Buying property in Costa Rica as an American can be an exciting yet complex venture. At Osa Property Management, we’ve guided countless U.S. citizens through this process, helping them navigate the unique aspects of Costa Rica’s real estate market.

This comprehensive guide will walk you through the essential steps, from understanding local property laws to exploring financing options. We’ll also highlight popular regions and property types that appeal to American buyers, ensuring you’re well-equipped to make an informed decision.

Understanding Costa Rica’s Real Estate Landscape

Costa Rica’s property market presents a diverse array of opportunities for American buyers. The country’s stable political climate, stunning natural beauty, and foreigner-friendly ownership laws have transformed it into a popular destination for U.S. investors and retirees.

Prime Locations for American Buyers

Several areas in Costa Rica have become hotspots for American property seekers. The Guanacaste province, known for its pristine beaches and luxury resorts, has experienced significant development. Coastal towns like Tamarindo and Playas del Coco offer a mix of beachfront condos and upscale villas.

The Central Valley, including cities such as Escazú and Santa Ana, attracts those who prefer a more urban lifestyle with modern amenities. These areas provide easy access to San José’s international airport and high-quality healthcare facilities (ideal for retirees or remote workers).

Nature enthusiasts often gravitate towards the Southern Zone, which includes areas like Dominical, Uvita, and Ojochal. This region offers opportunities to own property near lush rainforests and secluded beaches, appealing to eco-conscious buyers seeking a tranquil lifestyle.

Property Types and Investment Options

Costa Rica’s real estate market caters to various preferences and budgets. Beachfront condos remain popular, especially in tourist-heavy areas. These properties often include amenities like pools and on-site management, making them attractive for both personal use and rental income potential.

Single-family homes, ranging from modest tico-style houses to luxurious villas, are available throughout the country. In recent years, gated communities have gained traction, offering enhanced security and shared facilities.

For those interested in long-term investment or development, raw land presents an intriguing option. However, it’s important to understand local zoning laws and building regulations before pursuing this route. Working with a reputable real estate agent and attorney is essential to navigate these complexities.

Market Trends and Considerations

The Costa Rican property market has shown resilience in recent years, with steady price appreciation in desirable areas. Costa Rica Frequently asked questions about procedures and legal considerations regarding Real Estate, finding, and purchasing a property in Costa Rica can provide valuable insights for potential buyers.

Market dynamics can vary significantly between regions. Urban areas like San José have experienced more modest growth, while emerging destinations in the Southern Zone have seen rapid appreciation as infrastructure improves.

American buyers should also consider the potential impact of currency fluctuations on their purchasing power. The Costa Rican colón has historically been relatively stable against the U.S. dollar, but it’s wise to consult with financial experts to understand the implications of exchange rates on your investment.

As we move forward to explore the legal considerations for American buyers, it’s important to note that understanding the local property laws and regulations will play a key role in ensuring a smooth and successful real estate transaction in Costa Rica.

Navigating Legal Aspects of Property Ownership in Costa Rica

Costa Rica’s Property Laws for Foreigners

Costa Rica offers straightforward property laws for foreign buyers. As an American, you will enjoy the same ownership rights as Costa Rican citizens when it comes to buying property. This means you can own property outright without the need for a local partner or residency status. This foreigner-friendly approach has made Costa Rica an attractive destination for U.S. investors and retirees.

The Importance of Title Searches

A thorough title search stands as one of the most important steps in purchasing property in Costa Rica. This process verifies the property’s legal status and ensures there are no liens, encumbrances, or ownership disputes. While the excitement of finding your dream property might tempt you to skip this step, it’s absolutely necessary.

Many buyers have faced legal issues later due to rushing into purchases without proper due diligence. To avoid such pitfalls, work with a reputable law firm that specializes in real estate transactions. These experts can perform a comprehensive title search through the National Registry, which maintains records of all property transactions in Costa Rica.

Engaging a Qualified Real Estate Attorney

Engaging a qualified real estate attorney is not just advisable; it’s highly recommended. Costa Rica’s legal system differs significantly from the U.S., and an expert can guide you through the legal process and ensure all documents are correctly handled.

A competent attorney will:

- Review and explain all legal documents in detail

- Ensure all necessary permits and licenses are in order

- Negotiate terms with the seller’s representatives

- Oversee the closing process and property transfer

It’s worth noting that in Costa Rica, attorneys also serve as notaries public. This dual role allows them to handle both the legal aspects and the official documentation of your property purchase.

Zoning and Building Regulations

Understanding zoning laws and building regulations that apply to the property is critical before finalizing any purchase. This becomes particularly important if you plan to buy land for construction or if you intend to renovate an existing structure.

Coastal properties, for instance, are subject to specific regulations. The Maritime Zone Law restricts construction within 200 meters of the high tide line. While ownership of property in the first 50 meters (public zone) is prohibited, you may obtain a concession for the next 150 meters (restricted zone), subject to certain conditions.

As we move forward to explore financing and payment options for your Costa Rican property purchase, keep in mind that a solid understanding of these legal aspects will serve as a strong foundation for a successful transaction.

Financing Your Costa Rican Property

Cash Purchases: A Popular Choice

Many American buyers prefer cash purchases when investing in Costa Rican real estate. This approach offers several advantages, including a smoother transaction process and potentially more negotiating power with sellers. Cash buyers often enjoy faster closing times and may secure better prices, as sellers appreciate the certainty and speed of a cash deal.

However, tying up a significant portion of assets in a property might not suit everyone’s financial strategy. It’s important to consult with a financial advisor to determine if a cash purchase aligns with your overall investment goals and liquidity needs.

Local Financing Options for Foreign Buyers

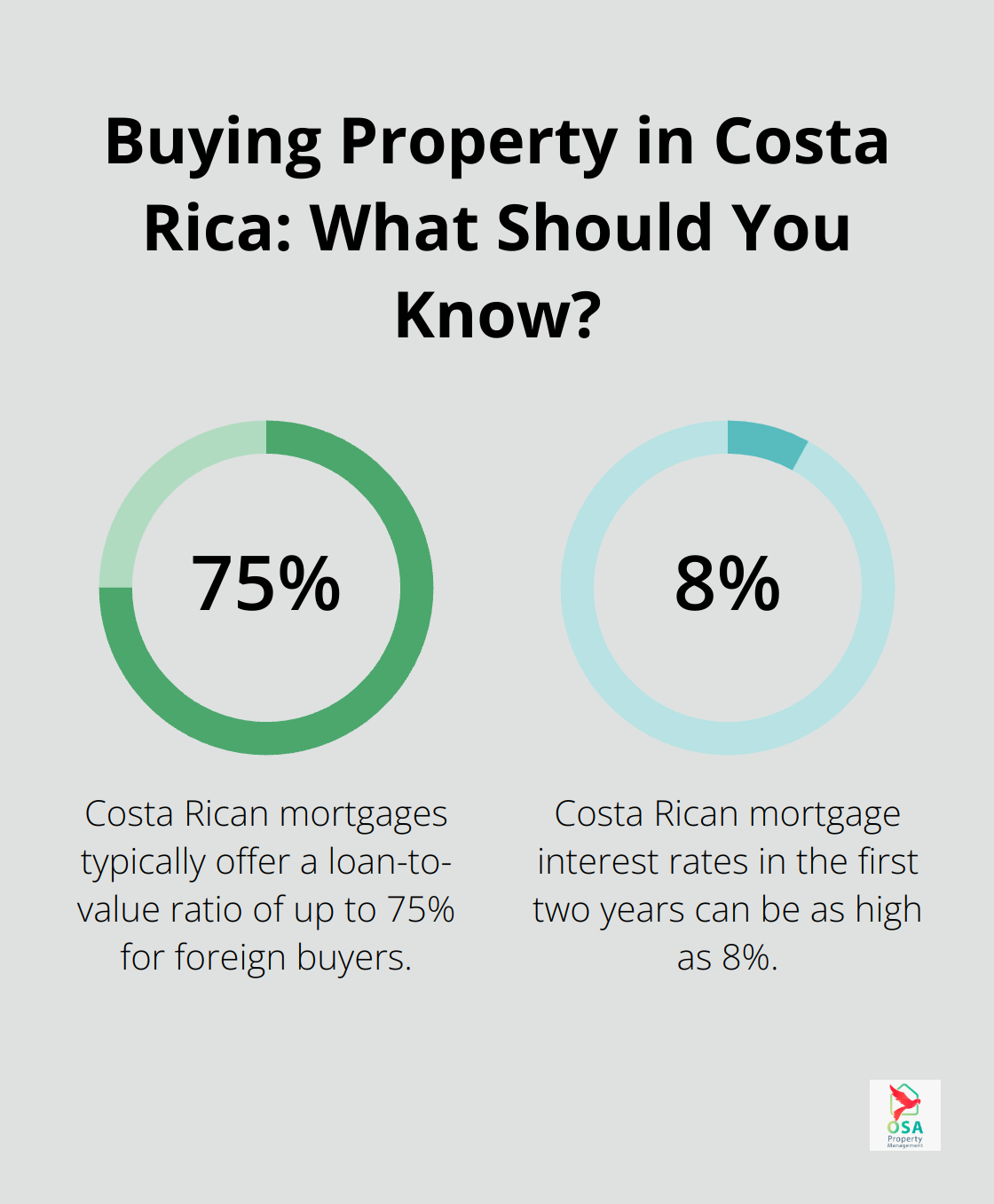

Obtaining a mortgage in Costa Rica is possible for foreign buyers, although the process differs from the United States. Costa Rican mortgages typically offer loans with terms up to 20 years, fully amortized, and are available to US, Canadian, and Costa Rican residents. The loan-to-value ratio is often up to 75% (25% down), with interest rates in the first two years ranging from 7.5% to 8%.

To qualify for a loan from a Costa Rican bank, you’ll need to provide extensive documentation (including proof of income, credit history, and sometimes even a life insurance policy).

Some Costa Rican banks have specific programs for foreign buyers. For instance, Banco Nacional and Scotiabank offer mortgage products tailored to non-residents. These programs often come with competitive rates and terms, making them worth exploring if you consider financing options.

International Money Transfers and Tax Considerations

When transferring funds to Costa Rica for your property purchase, you must consider both the method of transfer and the potential tax implications. Using a reputable international money transfer service can save you significant amounts on exchange rates and fees compared to traditional bank transfers.

Large transfers may trigger reporting requirements both in the U.S. and Costa Rica. The U.S. requires reporting of international transfers exceeding $10,000, while Costa Rica has its own regulations for monitoring large financial transactions.

From a tax perspective, American buyers should be mindful of potential reporting obligations to the IRS. While Costa Rica doesn’t tax foreign-sourced income, U.S. citizens must report their worldwide income, including rental income from Costa Rican properties.

Professional Guidance for Financial Decisions

Working with tax professionals who specialize in international real estate investments can prove beneficial. These experts can help you navigate the complexities of owning foreign property and ensure compliance with both U.S. and Costa Rican tax laws. As of May 17, 2024, expats owning property in Costa Rica must navigate several key tax areas.

Understanding your financing options and the associated financial implications plays a key role when investing in Costa Rican real estate. Careful consideration of these factors and seeking professional advice will enable you to make an informed decision that aligns with your investment goals and financial situation.

Final Thoughts

Buying property in Costa Rica as an American offers a unique opportunity to invest in a beautiful, stable country. The key to a successful property acquisition lies in thorough research, preparation, and understanding of local market trends. Costa Rica’s real estate market has something to offer for every preference and budget, from beachfront condos to secluded jungle retreats.

Navigating the legal aspects of property ownership in Costa Rica requires attention to detail. It’s important to conduct proper due diligence, including comprehensive title searches and adherence to zoning regulations. Engaging a qualified real estate attorney can ensure a smooth and legally sound transaction.

At Osa Property Management, we support you throughout your property ownership journey. Our extensive experience and comprehensive services help maintain and profit from your investment for years to come. With diligence and professional guidance, you can turn your dream of owning a piece of paradise into reality.