Are you unknowingly breaking Costa Rica’s rental laws? Many property owners operate short-term rentals without realizing they’re violating local regulations.

At Osa Property Management, we’ve seen the consequences of non-compliance firsthand. This post will guide you through the key legal requirements, common violations, and how to stay on the right side of the law.

What Are Costa Rica’s Short-Term Rental Laws?

Costa Rica’s short-term rental laws present a complex landscape for property owners. In 2019, Law No. 9742 established a framework for non-traditional accommodations, applying to rentals under one year and regulating the vacation rental market.

Licensing and Registration Requirements

Property owners must obtain proper licenses to operate legally. The Costa Rican Tourism Institute (ICT) mandates all short-term rental properties to register and secure a tourism license. This process requires owners to fill out an electronic form (in Spanish only) available at www.ict.go.cr and include information such as the property details.

Local municipality registration is also necessary. Each area may have specific requirements and fees. Popular tourist destinations like Jaco or Manuel Antonio often require special licenses for short-term rentals. Non-compliance can result in substantial fines or property closure.

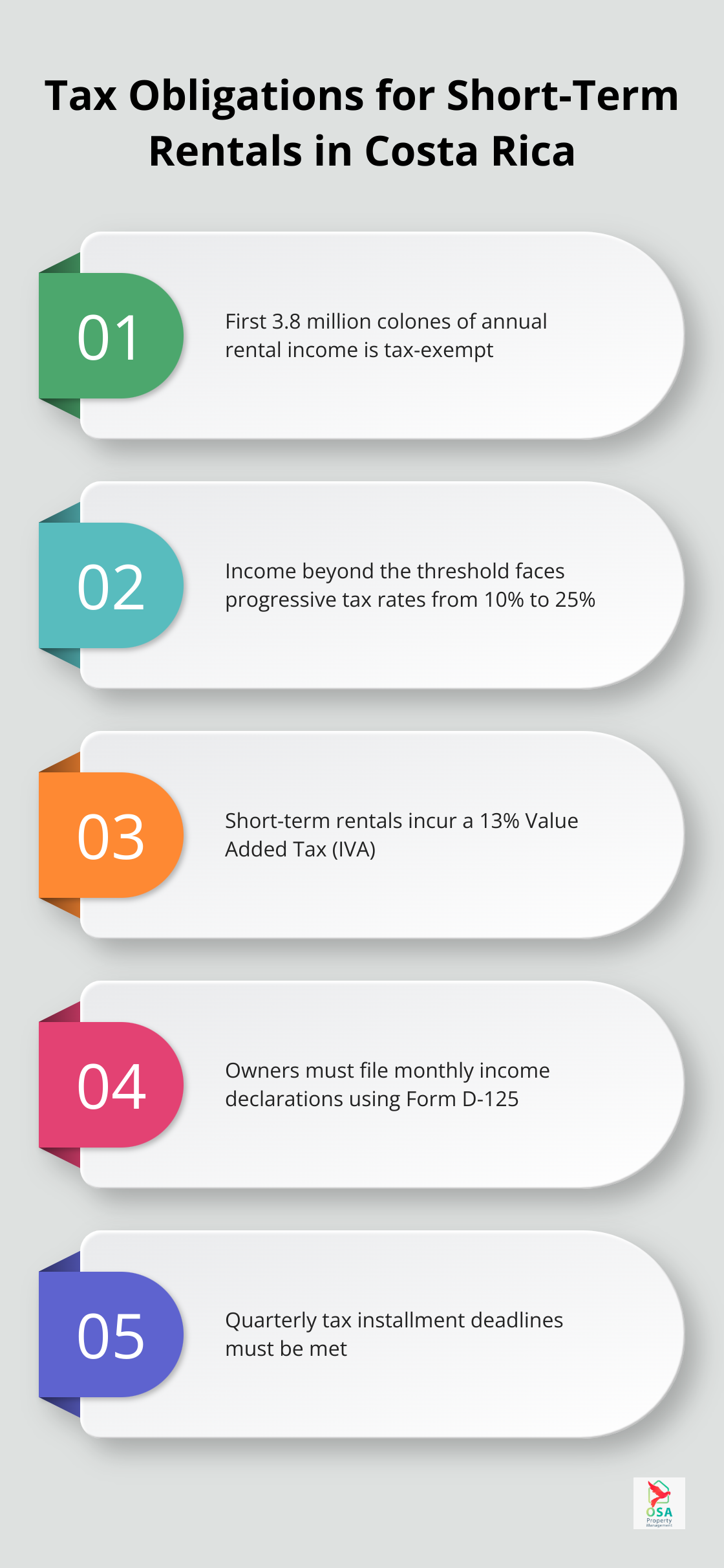

Tax Obligations for Short-Term Rentals

Tax compliance is essential for short-term rental owners. As of 2025, the first 3.8 million colones (about $7,600 USD) of annual rental income is tax-exempt. Income beyond this threshold faces progressive tax rates from 10% to 25%.

Short-term rentals (less than one month) now incur the standard 13% Value Added Tax (IVA), while long-term residential rentals remain exempt. Owners must file monthly income declarations (Form D-125) and meet quarterly tax installment deadlines. Neglecting these obligations can lead to severe penalties and legal issues.

Zoning and Property Use Restrictions

Zoning laws significantly impact short-term rental operations. Properties in Costa Rica typically fall under residential or commercial zoning. Residential zones often impose stricter limitations on short-term rentals, while commercial zones offer more flexibility.

Some areas, particularly in tourist hotspots, have specific zones for vacation rentals. Property owners should check with local authorities about zoning restrictions before starting a short-term rental business. Operating in a non-approved zone can result in fines and forced property closure.

Understanding and complying with these laws allows property owners to operate successful and legal short-term rentals in Costa Rica’s thriving tourism market. However, the complexity of these regulations often leads to unintentional violations. Let’s explore some common mistakes property owners make and their potential consequences.

Common Rental Law Violations in Costa Rica

Costa Rica’s rental laws present a complex landscape, and many property owners unknowingly violate them. These violations can lead to severe consequences, impacting both business operations and legal standing. Let’s explore some of the most frequent infractions and their potential repercussions.

Unlicensed Operations

One of the most common violations involves operating without proper licenses. The Costa Rican Tourism Institute (ICT) requires all short-term rental properties to register and obtain a tourism license. Additionally, local municipalities often have their own registration requirements. Failure to secure these licenses can result in hefty fines and even forced closure of properties.

In popular tourist areas like Jaco or Manuel Antonio, operating without a special short-term rental license can lead to penalties of up to 10 times the cost of the license itself. Properties have been shut down during peak tourist seasons, resulting in significant financial losses for owners.

Unreported Rental Income

Another frequent violation involves the failure to report rental income accurately. As of 2025, the first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt. Many property owners, especially those new to the market, neglect to file monthly income declarations using Form D-125 or miss quarterly tax installment deadlines.

The Costa Rican tax authority (Dirección General de Tributación) has increased its scrutiny of short-term rentals. In a recent crackdown, they identified over 500 properties with unreported income, resulting in back taxes and penalties totaling millions of colones.

Health and Safety Violations

Ignoring health and safety standards not only endangers guests but can also lead to severe legal consequences. Costa Rica’s Ministry of Health conducts regular inspections, especially in tourist-heavy areas. Common violations include lack of fire safety equipment, inadequate sanitation facilities, and failure to maintain proper waste management systems.

A recent case in Guanacaste saw a property owner face fines of over $5,000 USD and a temporary closure order for multiple safety violations, including non-functional smoke detectors and inadequate emergency exits.

Zoning Infractions

Operating a short-term rental in a non-approved zone constitutes a serious violation that often goes unnoticed until it’s too late. Some residential areas prohibit or severely restrict short-term rentals. For instance, certain parts of San José only allow short-term rentals in buildings specifically zoned for such use.

Violating zoning laws can result in daily fines, forced eviction of guests, and even legal action from neighbors or homeowners’ associations. In extreme cases, property owners may need to convert their property back to residential use, incurring significant costs.

The consequences of these violations can be severe and long-lasting. Fines can range from a few hundred dollars to tens of thousands, depending on the nature and duration of the violation. Repeat offenders may face criminal charges and permanent bans from operating rental properties.

Moreover, violations can damage reputations in the rental market. Many booking platforms now require proof of legal compliance, and negative reviews from guests who discover they’re staying in an illegal rental can devastate a business.

Navigating these complex regulations challenges many property owners, especially those unfamiliar with Costa Rican law. This complexity underscores the value of partnering with professional property management companies that stay up-to-date with changing regulations and ensure full compliance. Such partnerships allow property owners to focus on growing their rental business without legal worries, setting the stage for our next discussion on how professional management can safeguard your investment.

How Professional Management Ensures Legal Compliance

At Osa Property Management, we have developed a comprehensive approach to navigate Costa Rica’s complex rental laws. Our 19 years of experience have taught us that compliance isn’t just about avoiding fines-it’s about building a sustainable, profitable rental business.

Navigating the Licensing Process

Securing the right licenses is essential, but it often confuses property owners. We have streamlined this process by maintaining strong relationships with local municipalities and the Costa Rican Tourism Institute (ICT). Our established channels help property owners reduce license acquisition time significantly.

We don’t just file paperwork-we anticipate potential issues. When stricter zoning regulations are introduced, we proactively adjust our clients’ rental strategies to prevent disruptions to their income streams.

Mastering Tax Compliance

Tax laws for short-term rentals in Costa Rica present numerous challenges. We use a system that tracks rental income in real-time, which ensures accurate monthly declarations. This approach helps our clients avoid potential fines and stay compliant with tax regulations.

We also stay ahead of tax law changes. When new taxes (such as the Value Added Tax) apply to short-term rentals, we immediately adjust pricing strategies. This helps our clients maintain profitability without violating new regulations.

Prioritizing Guest Safety and Property Maintenance

Regular property inspections fulfill legal requirements and are essential for guest satisfaction and long-term profitability. Our team conducts monthly inspections and addresses potential issues before they become costly problems.

We partner with local safety experts to ensure all properties meet the latest standards. This approach helps our clients achieve high pass rates on health and safety inspections (often exceeding regional averages).

Staying Informed on Regulatory Changes

Costa Rica’s rental laws evolve constantly. We dedicate resources to monitor these changes and understand their implications for property owners. This proactive approach allows us to implement necessary adjustments quickly, keeping our clients’ properties compliant and profitable.

Professional property management isn’t just about convenience-it’s a strategic investment in your rental business’s long-term success and legal compliance. By maintaining high standards and staying ahead of regulatory changes, we allow property owners to focus on providing exceptional experiences for their guests and maximizing their returns.

Final Thoughts

Costa Rica’s rental laws present challenges for property owners, but compliance protects investments and enhances guest experiences. Professional property management companies offer expertise in navigating these complex regulations, saving time and reducing stress. These experts handle licensing, registration, tax compliance, and ensure properties meet health and safety standards.

Osa Property Management brings 19 years of experience in Costa Rica’s rental market. Our team understands local regulations and helps optimize property performance while maintaining compliance. We provide comprehensive services tailored to specific needs, from marketing to maintenance and financial management.

Successful property management in Costa Rica balances profitability with legal compliance and community respect. The right partner (like Osa Property Management) can help achieve this balance and maximize your Costa Rican property investment. Our expertise in areas such as Tarcoles, Jaco, Dominical, Manuel Antonio, Ojochal, and Uvita ensures capable handling of your property, regardless of location.