At Osa Property Management, we understand the importance of navigating Costa Rica’s property laws for successful ownership. This guide will walk you through the essential legal aspects every property owner should know.

From ownership rights to zoning regulations and tax considerations, we’ll cover the key areas that impact your real estate investment in Costa Rica.

What Are Costa Rica’s Property Ownership Rights?

Costa Rica’s property ownership system offers a unique blend of opportunities and regulations for local and foreign investors. The country recognizes two primary types of property ownership: fee simple and concession.

Fee Simple Ownership

Fee simple ownership is the most common type in Costa Rica. It grants full rights to the property, including the ability to sell, lease, or modify the land within legal limits. This type of ownership is available to both Costa Ricans and foreigners, with no restrictions based on nationality.

Concession Properties

Concession properties are leased from the government, typically for 20-year periods. These are often found in coastal areas and are subject to specific regulations. Foreign investors can only own up to 49% of a concession property, with the remaining 51% required to be held by Costa Rican citizens or residents.

Maritime Zone Regulations

The Maritime Zone Law in Costa Rica impacts coastal property ownership significantly. This law establishes a 200-meter zone from the high tide line, which defines the boundary of the maritime zone.

- The first 50 meters are public property and cannot be privately owned or developed.

- The next 150 meters can be leased from the government as concession property, subject to strict development regulations.

Some areas, like Jaco Beach, are exceptions to these rules (properties can be fully titled up to the high tide line). However, these exceptions are rare and require thorough verification before any purchase.

Foreign Ownership Rights and Restrictions

Foreign investors face some restrictions in Costa Rica’s property market. The principal problem is that no private ownership of beachfront property is allowed. The Costa Rican government owns the first 200 meters of the beach front. Additionally, foreigners face restrictions in certain zones:

- Within 50 kilometers of international borders

- In specific protected areas and national parks

- In the Maritime Zone, as mentioned earlier

Due Diligence: A Necessity

Thorough due diligence is essential for all property transactions (regardless of the type or buyer’s nationality). This process typically takes 30 to 45 days and should include:

- A complete title search at the National Registry

- Verification of property boundaries through recent surveys

- Checking for any liens or encumbrances on the property

- Reviewing zoning regulations and environmental restrictions

Understanding these fundamental aspects of property ownership in Costa Rica is essential for any investor. While the system offers many opportunities, it also presents unique challenges that require careful navigation and expert guidance. As we move forward, let’s explore the intricacies of zoning and land use regulations, which play a significant role in shaping property development in Costa Rica.

Navigating Costa Rica’s Zoning and Construction Laws

Costa Rica’s zoning and land use regulations shape property development and protect the country’s natural resources. These laws impact property owners and developers significantly. Let’s explore the key aspects you need to know.

Zoning Categories and Their Impact

Costa Rica divides land into several zoning categories, each with specific permitted uses and development restrictions. The most common categories include:

- Residential

- Commercial

- Industrial

- Agricultural

Zoning designations can vary significantly between municipalities. In popular tourist areas like Manuel Antonio, zoning laws are particularly strict to preserve the natural environment. Building height restrictions often limit structures to three stories or less, ensuring development doesn’t overshadow the lush landscape.

Urban areas like San José have more lenient zoning laws, allowing for higher-density development. However, even these areas have restrictions on building height and land use to maintain the city’s character.

The Building Permit Process

Obtaining a building permit in Costa Rica involves several steps:

- Submit architectural plans to the local municipality

- Obtain approval from the Health Ministry

- Get clearance from the National Institute of Housing and Urban Development (INVU)

- Secure final approval from the College of Engineers and Architects

This process can take 3 to 6 months, depending on the project’s complexity and the local authorities’ efficiency. Working with experienced local architects and lawyers who understand each municipality’s requirements is essential.

Environmental Protection’s Influence on Development

Costa Rica’s commitment to environmental conservation significantly impacts property development. The Environmental Law (No. 7554) requires all development projects to undergo an environmental impact assessment before approval.

Your first step is to complete the Environmental Evaluation form (D-1 or D-2) and submit the form to SETENA. Once they evaluate the information, they will determine if further environmental studies are required.

This law is particularly stringent in areas near protected zones or water sources. Properties within 50 meters of a river or stream are subject to additional restrictions and may require special permits for any development.

In coastal areas, the Maritime Zone Law imposes strict regulations on development within 200 meters of the high tide line. This law aims to preserve Costa Rica’s beaches and coastal ecosystems while allowing for sustainable tourism development.

Violating these environmental laws can result in hefty fines and even demolition orders. Therefore, property owners must research and comply with all relevant environmental regulations before starting any development project.

Understanding these zoning and land use regulations is just one aspect of property ownership in Costa Rica. The next chapter will focus on the financial considerations, including taxation, that every property owner should know about.

What Are the Tax Implications for Property Owners in Costa Rica?

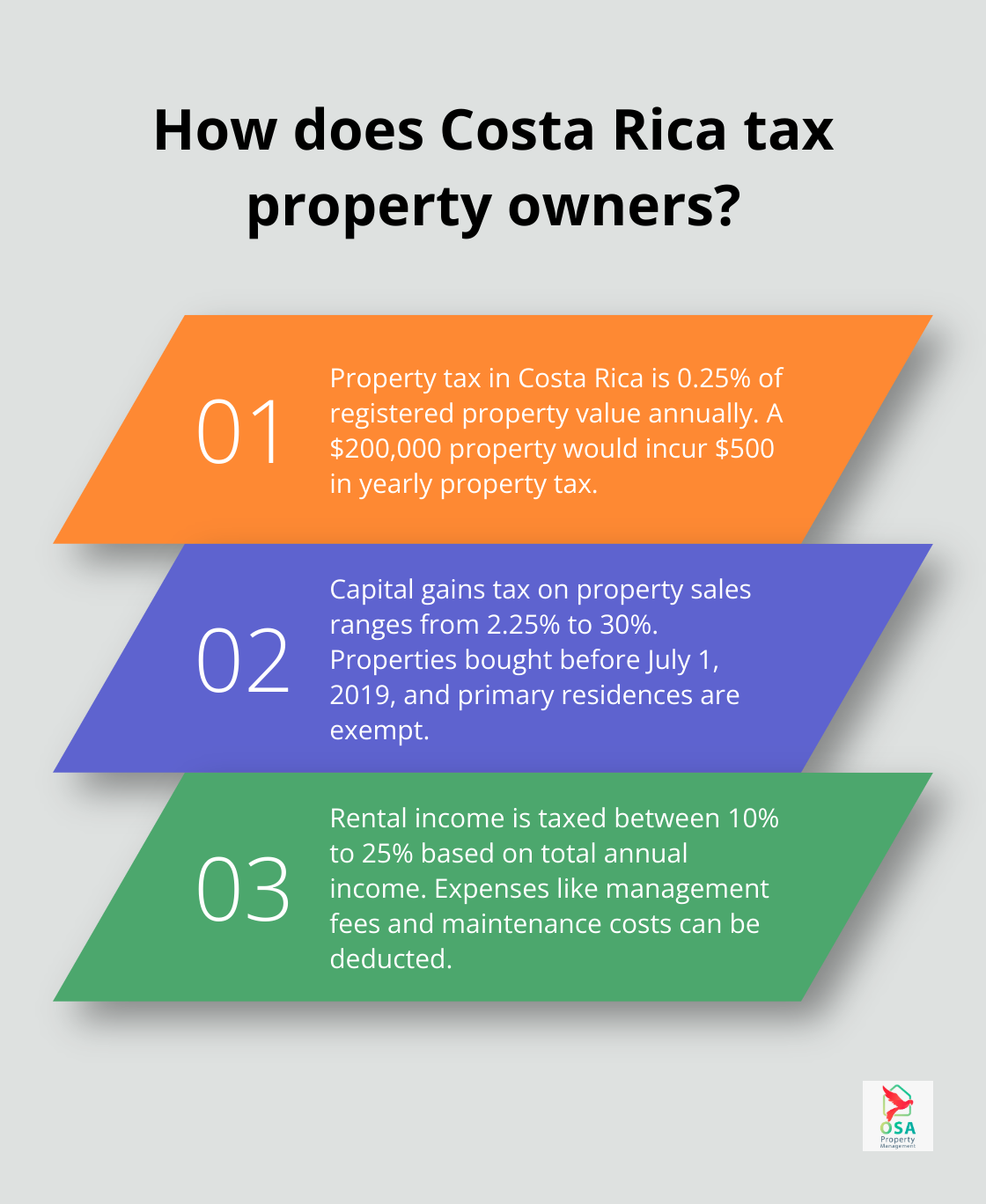

Costa Rica’s tax system for property owners is relatively straightforward, but it’s important to understand the nuances to avoid surprises. The tax landscape includes property taxes, capital gains taxes, and rental income taxes.

Property Tax: A Low Annual Expense

The annual property tax in Costa Rica is notably low compared to many other countries. Property owners pay 0.25% of the registered property value per year. Local municipalities collect this tax where the property is located.

For instance, a property valued at $200,000 would incur an annual property tax of $500. Property values for tax purposes are often lower than market values, which can further reduce the tax burden.

Luxury homes valued over $214,000 are subject to an additional solidarity tax. This tax is progressive, starting at 0.25% and capping at about 0.55% for the highest-valued properties.

Capital Gains: A New Addition to the Tax Landscape

Costa Rica introduced a capital gains tax on property sales in 2019. The tax rate can range from 2.25% of the sales price to 15% or 30% of capital gains, depending on various factors. However, there are important exemptions:

- Properties purchased before July 1, 2019, are exempt from this tax.

- Primary residences where the owner has lived for at least two years are also exempt.

For properties subject to this tax, it’s important to keep detailed records of all improvements and renovations. These costs can be deducted from the profit, potentially reducing the tax liability.

Rental Income: Tax Obligations for Landlords

Property owners who rent out their properties must pay income tax on their rental earnings. The tax rate depends on the total annual income and ranges from 10% to 25%.

Certain expenses can be deducted from rental income before calculating the tax. These deductions include property management fees, maintenance costs, and property taxes.

For foreign property owners, setting up a Costa Rican corporation to manage rental properties can be advantageous. This approach can simplify tax reporting and potentially offer additional benefits.

Navigating the Tax Landscape

Understanding these tax implications is key for making informed decisions about property ownership in Costa Rica. While the tax burden is generally lower than in many other countries (particularly for property taxes), proper planning and compliance are essential to maximize an investment’s potential.

Property owners should consult with local tax experts or property management companies (such as Osa Property Management) to ensure they fully understand and comply with all tax obligations. This approach can help avoid potential penalties and optimize the financial aspects of property ownership in Costa Rica.

Final Thoughts

Property laws in Costa Rica shape the landscape of real estate ownership. Owners must understand fee simple and concession properties, Maritime Zone Law, zoning regulations, and tax implications. Professional legal counsel proves essential to navigate these complex laws and prevent costly mistakes.

Local property law knowledge empowers owners to make better investment decisions and plan for future developments. It also ensures compliance with tax obligations and helps protect property rights. Osa Property Management offers comprehensive services for property owners in Costa Rica, assisting with local regulations and rental management.

Staying informed about Costa Rica’s property laws minimizes risks for real estate owners. It allows them to fully enjoy the benefits of owning property in this tropical paradise. Professional support can help maximize returns on investments in Costa Rican real estate.