At Osa Property Management, we know how vital it is to stay on top of tax deadlines in Costa Rica. Owning property here comes with responsibilities, and understanding the local tax system is key to avoiding penalties.

This guide will walk you through the essential property tax deadlines for 2025, ensuring you’re well-prepared to meet your obligations. We’ll also share practical tips to help you manage your payments effectively and stay compliant with Costa Rican tax laws.

How Costa Rica’s Property Tax System Works

Types of Property Taxes in Costa Rica

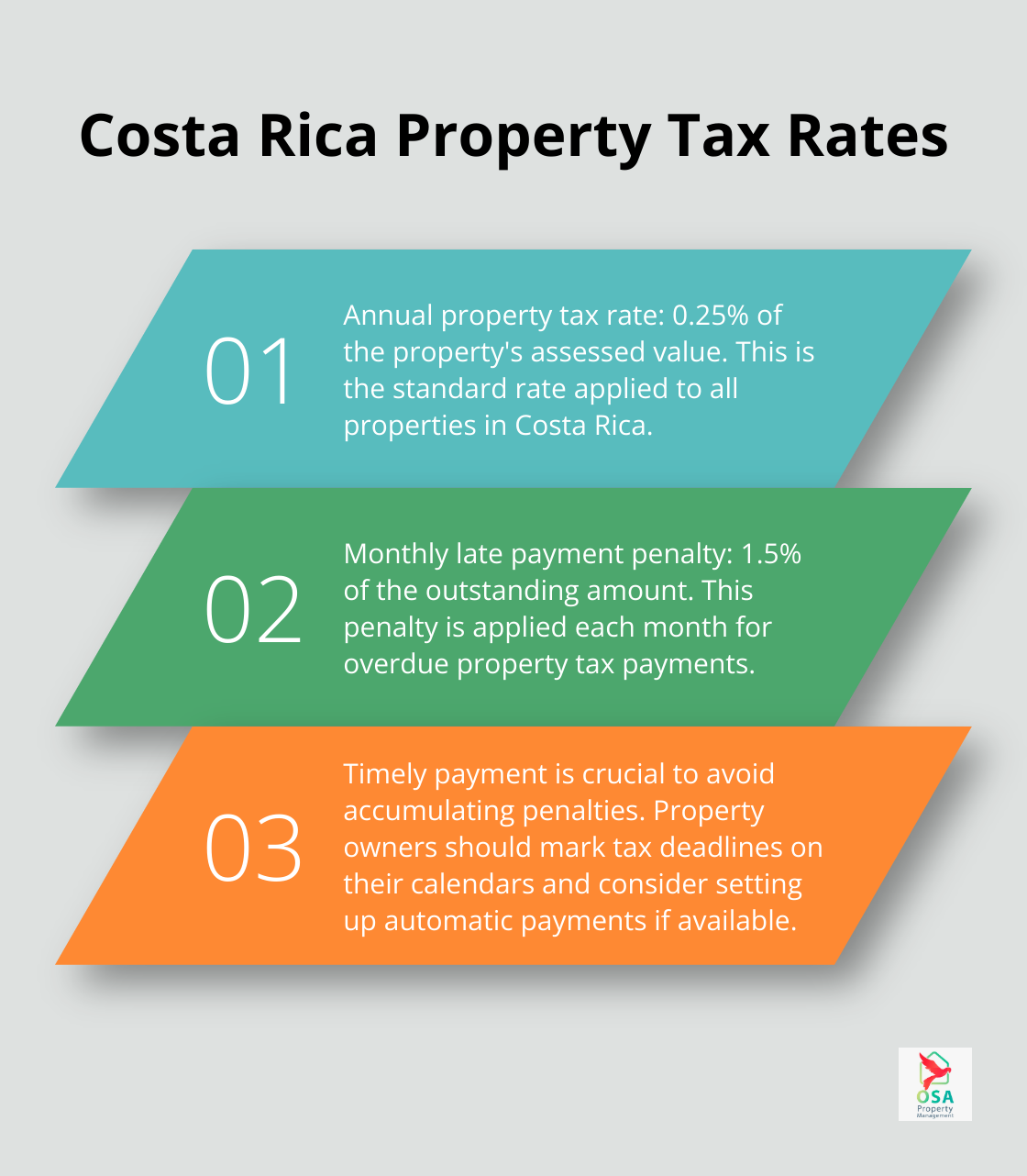

Costa Rica’s property tax system is straightforward but demands vigilance from property owners. The system centers on an annual tax based on the registered value of your property. The standard rate is 0.25% of the property’s assessed value (typically lower than the market value).

The primary property tax is the “Impuesto sobre Bienes Inmuebles” (IBI), or real estate tax. This is the 0.25% annual tax mentioned earlier. Another tax to consider is the luxury home tax for properties valued over approximately $230,000, which uses a progressive tax system.

Corporation tax applies to properties owned by legal entities. As of 2025, this tax stands at approximately $300 per year for active corporations and $150 for inactive ones. These figures may change, so it’s essential to verify current rates with local authorities or a property management company.

The Importance of Timely Tax Payments

Paying your property taxes on time is not just a legal obligation; it’s a financial necessity. Late payments in Costa Rica incur a penalty of 1.5% per month on the outstanding amount. This can quickly add up, transforming a manageable tax bill into a significant financial burden.

Consistent on-time payments help maintain a good standing with local municipalities. This can benefit you when dealing with other property-related matters or seeking local permits and approvals.

Consequences of Missing Deadlines

Failure to pay property taxes in Costa Rica can lead to severe consequences. Beyond the monthly penalties, prolonged non-payment can result in legal action by the municipality. In extreme cases, this could lead to property liens or even forced sale of the property to recover the owed taxes.

Tax delinquency can complicate future property transactions. When selling a property, you’ll need to provide proof of tax compliance. Outstanding taxes can delay or even derail a sale, potentially costing you a valuable opportunity.

Proper tax management can save property owners from headaches and unexpected costs. Staying updated on local tax regulations and deadlines ensures that properties remain in good standing year-round.

Understanding Costa Rica’s property tax system is the first step in responsible property ownership. Staying informed and proactive helps you avoid penalties and enjoy your Costa Rican property with peace of mind. Now, let’s explore the key property tax deadlines you need to mark on your 2025 calendar.

When Are Costa Rica’s Property Tax Deadlines in 2025?

Costa Rica’s property tax system operates on a specific schedule. Property owners must pay attention to several key dates in 2025 to ensure compliance and avoid penalties.

Quarterly Property Tax Due Dates

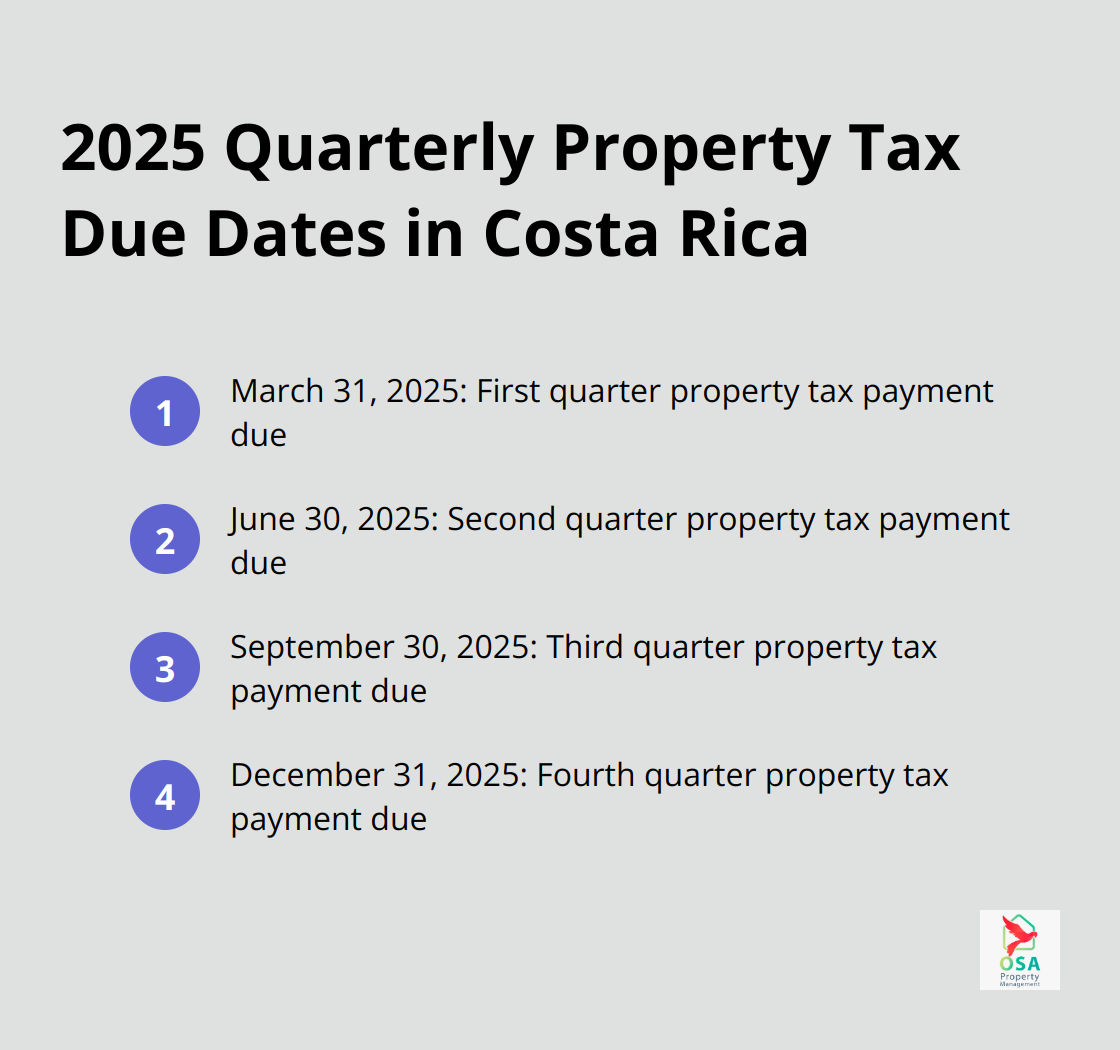

Costa Rica’s property tax, known as Impuesto sobre Bienes Inmuebles (IBI), requires payment in quarterly installments. Costa Rica sets its property tax at a standard rate of 0.25% annually, based on the property’s value or purchase price. For 2025, the due dates are:

- March 31, 2025

- June 30, 2025

- September 30, 2025

- December 31, 2025

Mark these dates on your calendar now. Payment before or on these dates will help you avoid the 1.5% monthly penalty on late payments. Some municipalities offer a discount for paying the full year’s tax in advance (usually in January). Check with your local tax office for potential savings.

Luxury Home Tax Deadline

If your property value exceeds 133 million colones (approximately $230,000 as of 2025), you may need to pay the luxury home tax. This tax follows a progressive rate system and requires annual payment. In 2025, the deadline for this tax falls on January 15th. Missing this deadline can result in significant penalties, so prepare well in advance.

Corporation Tax Payment Schedule

Properties owned by legal entities must pay corporation tax. As of 2025, active corporations owe about $300 annually, while inactive ones pay around $150. This tax typically requires payment by January 31st each year. However, newly formed corporations may have different deadlines based on their registration date.

Setting Reminders and Preparing for Payments

To avoid unnecessary stress and financial strain, set up reminders at least a month before each due date. This will ensure you have ample time to prepare your payments. Consider working with a local property management company to handle these tax obligations, especially if you don’t reside in Costa Rica year-round.

Staying Informed About Tax Changes

Tax rates and deadlines can change. Always verify current information with local authorities or a trusted property management service to stay compliant with Costa Rican tax laws. This proactive approach will help you navigate the property tax landscape with confidence and ease.

Now that you understand the key tax deadlines for 2025, let’s explore some practical tips for managing your property tax payments in Costa Rica.

How to Streamline Your Costa Rica Property Tax Payments

Leverage Technology for Automatic Payments

Key tax deadlines for Costa Rica property owners in 2024 include the annual property tax, luxury home tax, and corporation tax. Many Costa Rican municipalities now offer online payment systems. You can take advantage of these platforms to set up automatic payments for your property taxes. This approach eliminates the risk of forgetting due dates and incurring late fees. Check with your local tax office to see if they offer similar services.

Partner with a Reliable Property Management Company

If you’re an absentee owner or prefer hands-off management, you should consider working with a reputable property management company. These professionals can handle all aspects of tax compliance on your behalf. Osa Property Management, with its 19 years of experience in Costa Rica, offers comprehensive tax handling services. They ensure timely payments, keep track of changing regulations, and liaise with local authorities on your behalf.

Implement a Robust Record-Keeping System

Maintaining organized records is essential for smooth tax management. You should create a digital filing system for all property-related documents, including tax receipts, property valuations, and correspondence with tax authorities. Use cloud storage solutions (like Dropbox or Google Drive) to ensure you can access these documents from anywhere. This system will prove invaluable during tax season and in case of any discrepancies or audits.

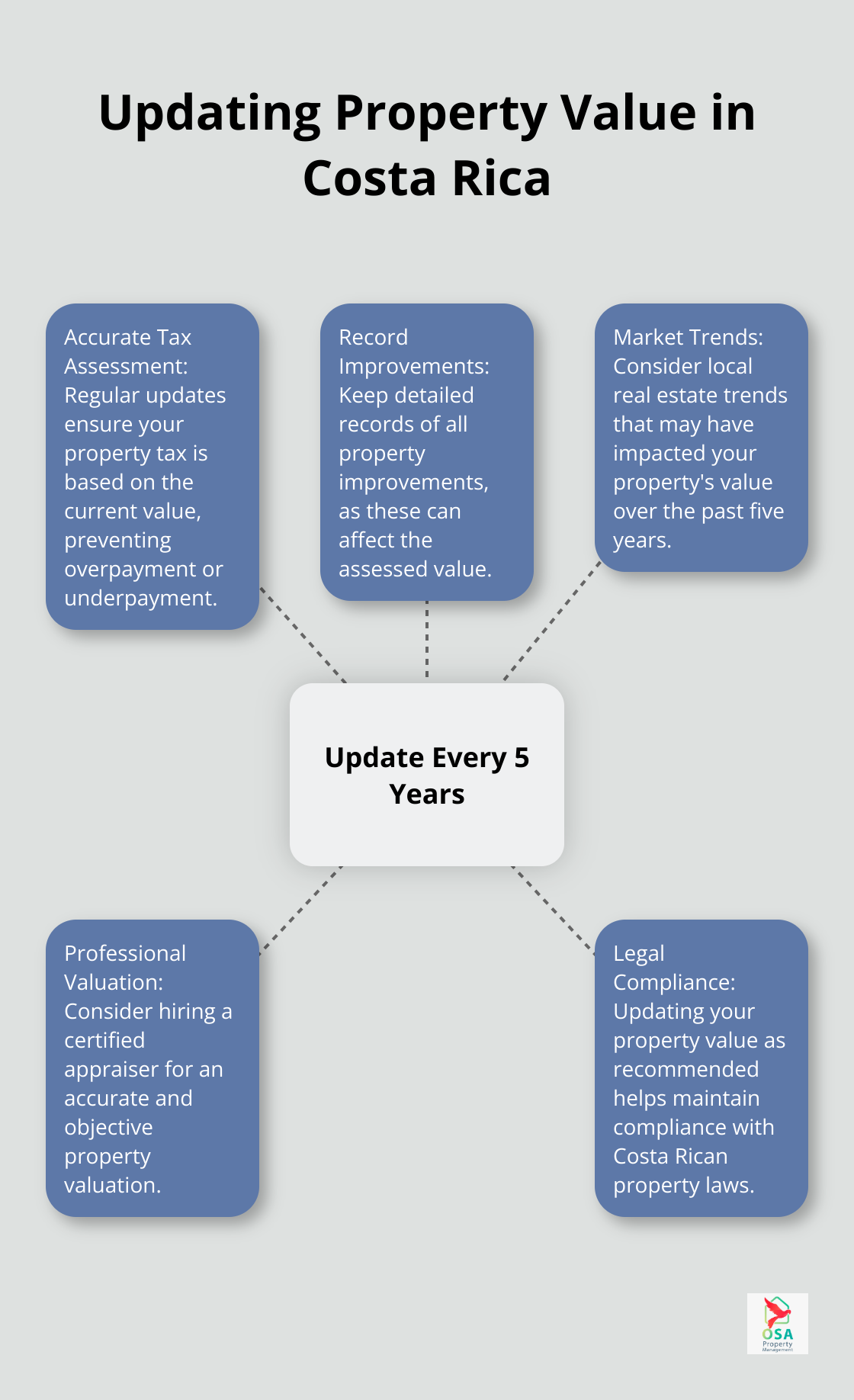

Keep Track of Property Improvements

You must keep records of property improvements as well. These can affect your property’s value and, consequently, your tax obligations. The National Registry of Costa Rica recommends updating your property value every five years, so having a detailed record of improvements can help ensure accurate assessments.

Stay Informed About Local Tax Regulations

Tax laws and regulations can change. You should make an effort to stay informed about any updates or modifications to Costa Rica’s property tax system. Subscribe to official government newsletters or follow reputable local news sources for the most up-to-date information. This proactive approach will help you adapt your tax management strategy as needed and avoid any surprises.

Final Thoughts

Tax deadlines form a critical part of property ownership in Costa Rica. Property owners must pay quarterly taxes on March 31, June 30, September 30, and December 31, 2025. Luxury homeowners face a January 15 deadline for their annual tax, while corporation tax typically falls due on January 31.

Timely tax payments help property owners avoid penalties and maintain positive relationships with local authorities. This compliance ensures smooth property transactions and provides peace of mind for owners. Professional assistance can make a significant difference in managing these obligations, especially for those who don’t reside in Costa Rica year-round.

Osa Property Management offers expert services to help property owners navigate Costa Rica’s tax system. Their team (with over 19 years of experience) handles all aspects of tax compliance, from payments to keeping up with changing regulations. This comprehensive service allows property owners to focus on enjoying their Costa Rican investment without the stress of tax management.