Costa Rica’s tax treaties are reshaping the landscape for international investors and expatriates. These agreements aim to prevent double taxation and provide clarity on various tax-related issues.

At Osa Property Management, we understand the importance of staying informed about these treaties and their impact on property ownership. This post will explore the key points of Costa Rica’s tax treaties and how they affect foreign investors in the country.

Costa Rica’s Tax Treaty Network

Current Treaty Landscape

Costa Rica’s tax treaty network, though limited, plays a vital role in attracting foreign investment and providing clarity for expatriates. As of 2024, Costa Rica has signed tax treaties with a select group of countries, primarily in Europe and North America.

Key Treaty Partners

Spain, Germany, Mexico and the United Arab Emirates have double-taxation tax treaties with Costa Rica, lowering the withholding tax on dividends paid by Costa Rican companies. These agreements foster economic ties and provide tax certainty for businesses and individuals operating across borders.

Impact on Property Owners

These treaties can significantly affect property owners in Costa Rica. Consider a German national who owns a rental property in Jaco. The Costa Rica-Germany tax treaty may offer reduced withholding rates on rental income, potentially increasing net returns. However, property owners should consult with a tax professional to fully understand and leverage these benefits.

Expansion of Treaty Network

Costa Rica’s approach to investment is noteworthy. The Costa Rican government does not promote or incentivize outward investment, nor does it discourage or restrict domestic investors from investing abroad. This neutral stance may influence the expansion of its treaty network and the opportunities available for investors.

Importance for Investors

Understanding the nuances of these treaties helps investors make more informed decisions about their investments in Costa Rica. The reduced tax burdens and increased clarity on tax obligations make Costa Rica an attractive destination for foreign investment in real estate.

As we move forward, let’s examine the key provisions found in Costa Rica’s tax treaties and how they specifically impact foreign investors and property owners.

Key Provisions in Costa Rica’s Tax Treaties

Costa Rica’s tax treaties contain several important provisions that impact foreign investors and property owners. These agreements create a more favorable environment for cross-border business activities and investments.

Double Taxation Prevention

The primary goal of Costa Rica’s tax treaties is to prevent double taxation. This means that income taxed in Costa Rica won’t be taxed again in the investor’s home country. For example, if you’re a Spanish property owner renting out your Costa Rican vacation home, you may only need to pay taxes on that rental income in one country, not both. This provision can lead to substantial tax savings and simplify your tax obligations.

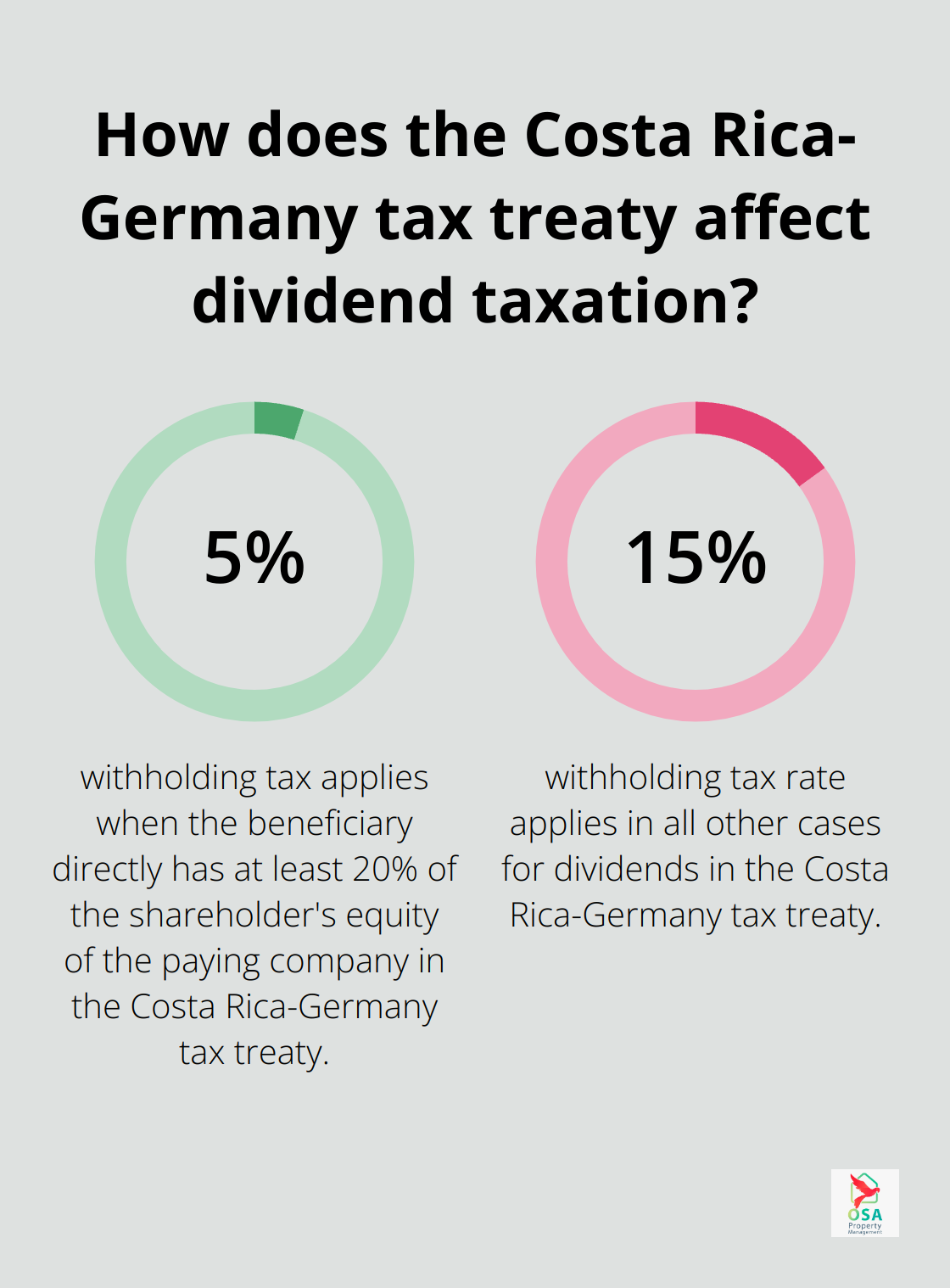

Reduced Withholding Tax Rates

Costa Rica’s tax treaties often include reduced withholding tax rates on dividends, interest, and royalties. For instance, the treaty with Germany lowers the withholding tax on dividends to either 5% or 15% (depending on the circumstances). The 5% withholding applies when the beneficiary directly has at least 20% of the shareholder’s equity of the paying company. In all other cases, the 15% rate applies. This reduction can be significant compared to the standard 15% rate for non-treaty countries. Property owners who receive rental income or dividends from Costa Rican investments should pay attention to these rates, as they can directly impact their bottom line.

Permanent Establishment Rules

The concept of permanent establishment determines when a foreign business becomes taxable in Costa Rica. Tax treaties typically define what constitutes a permanent establishment, providing clarity for investors. The Costa Rican tax system is based on the principle of territoriality, according to which, only income received from a source within Costa Rican territory is taxable. For property owners, this could be relevant if you run a business from your Costa Rican property. Understanding these rules can help you structure your activities to optimize your tax position.

Exchange of Information Clauses

Tax treaties include exchange of information clauses that allow tax authorities to share data, enhancing transparency and compliance. This means that accurate reporting of your Costa Rican property income in both countries is more critical than ever. These clauses ensure that tax authorities can verify the information provided by taxpayers and prevent tax evasion.

Dispute Resolution Mechanisms

Many tax treaties include provisions for resolving disputes between taxpayers and tax authorities. These mechanisms can provide a more efficient and fair process for addressing disagreements over tax matters. For property owners, this can offer additional protection and certainty in their tax dealings with Costa Rican authorities.

As Costa Rica continues to expand its treaty network, we anticipate more opportunities for foreign investors to benefit from these agreements. However, navigating the complexities of international tax law requires expert guidance. The next section will explore how these treaty provisions specifically impact foreign investors and expatriates in Costa Rica.

How Tax Treaties Benefit Foreign Investors in Costa Rica

Reduced Tax Burdens

Costa Rica’s tax treaties offer significant advantages for foreign investors, particularly in reducing tax burdens. The treaty with Spain, for instance, cuts the withholding tax on dividends to 5% or 10% (depending on the investor’s shareholding). This reduction from the standard 15% rate translates to substantial savings for Spanish investors in Costa Rican properties or businesses.

The treaty with Germany provides another example of tax benefits. It offers reduced rates on interest payments. Interest from loans lasting five years or more incurs a withholding tax of only 5%, while shorter-term loans are taxed at 10%. This provision proves especially beneficial for German investors who finance property purchases or development projects in Costa Rica.

Tax Residency and Income Sourcing Clarity

Tax treaties provide clear guidelines on determining tax residency and income sourcing, which is essential for expatriates and investors. Under most of Costa Rica’s treaties, an individual becomes a tax resident if they spend more than 183 days in the country within a tax year. This clarity prevents situations where an individual might be considered a tax resident in both countries.

For property owners, the treaties often specify the taxation of rental income. Typically, rental income from Costa Rican properties faces taxation in Costa Rica, but the treaties may provide mechanisms to avoid double taxation in the investor’s home country. This can result in significant tax savings and simplify compliance for property owners.

Dispute Resolution and Legal Certainty

Costa Rica’s tax treaties include provisions for resolving tax-related disputes, offering investors greater legal certainty. These mechanisms prove particularly valuable for property owners facing disagreements with tax authorities. If a dispute arises about the tax treatment of rental income, the treaty’s mutual agreement procedure provides a framework for resolution without resorting to lengthy and costly court proceedings.

Moreover, the exchange of information clauses in these treaties enhances transparency and helps prevent tax evasion. While this might appear as a drawback, it actually benefits compliant investors by creating a level playing field and reducing unfair competition from those attempting to evade taxes.

Real-World Benefits

The treaty provisions offer tangible benefits to investors. For example, a German property owner with a vacation rental in Jaco can take advantage of the reduced withholding rates on rental income, significantly increasing their net returns. However, to fully leverage these benefits, it’s important to work with experienced professionals who understand the nuances of these treaties.

Future Outlook

As Costa Rica continues to expand its treaty network, we anticipate even more opportunities for foreign investors in the coming years. The growing number of agreements will likely create an increasingly attractive investment environment, particularly in the real estate sector.

Final Thoughts

Costa Rica’s tax treaties shape the country’s investment landscape and offer significant benefits to foreign investors and property owners. These agreements prevent double taxation and provide clarity on tax-related issues, making Costa Rica an attractive destination for international investment. The Costa Rica tax treaties offer reduced withholding tax rates, clear guidelines on tax residency, and improved dispute resolution mechanisms.

Professional guidance proves invaluable for property owners who navigate the complexities of international taxation. Osa Property Management offers expert assistance with tax-related matters for property owners in Costa Rica. Our team’s extensive experience and deep understanding of local tax laws and international treaties ensure that our clients can maximize the benefits of these agreements while staying fully compliant.

As Costa Rica’s tax treaty landscape evolves, staying informed and seeking professional advice will impact your financial outcomes and overall investment experience. Whether you own property or consider investing in Costa Rica, understanding these tax treaties can significantly affect your investment strategy (and potential returns). Our comprehensive services cover key areas including Tarcoles, Jaco, Dominical, Manuel Antonio, Ojochal, and Uvita, providing peace of mind for property owners.