Costa Rica’s rental landscape is changing, and property owners need to be prepared. New regulations are set to reshape how rentals are managed, reported, and taxed in this popular destination.

At Osa Property Management, we’re committed to keeping our clients informed and compliant with these upcoming changes. This post will break down the latest rental regulations, their implications, and how property owners can navigate this new terrain.

What’s New in Costa Rica’s Rental Regulations?

Costa Rica’s rental market faces significant changes with the introduction of new regulations aimed at improving transparency and tax compliance. These changes will affect property owners across the country, particularly those involved in short-term rentals.

Key Changes in the Regulatory Framework

The most notable change is the implementation of a new registration system for rental properties. All property owners who rent out their properties (whether for short-term or long-term stays) will need to register with the Costa Rican Tourism Institute (ICT). This registration will include providing detailed information about the property, its amenities, and its rental history.

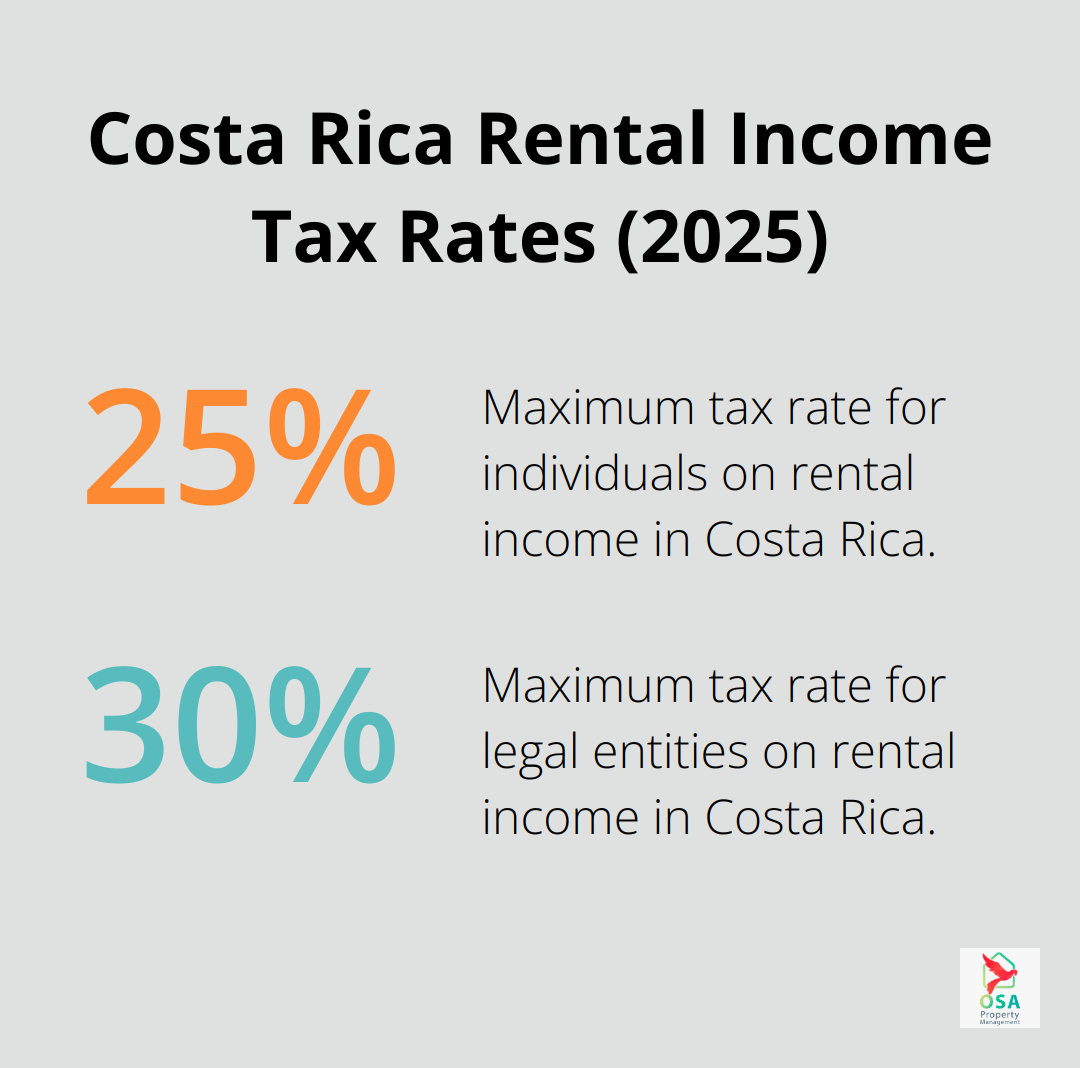

Another major shift occurs in tax reporting. The government has introduced a more stringent system for tracking rental income, especially from platforms like Airbnb. Property owners must now report all rental income, regardless of the platform used, and pay the appropriate taxes. The tax rate for rental income ranges from 0% to 25% for individuals and 5% to 30% for legal entities, depending on the total income.

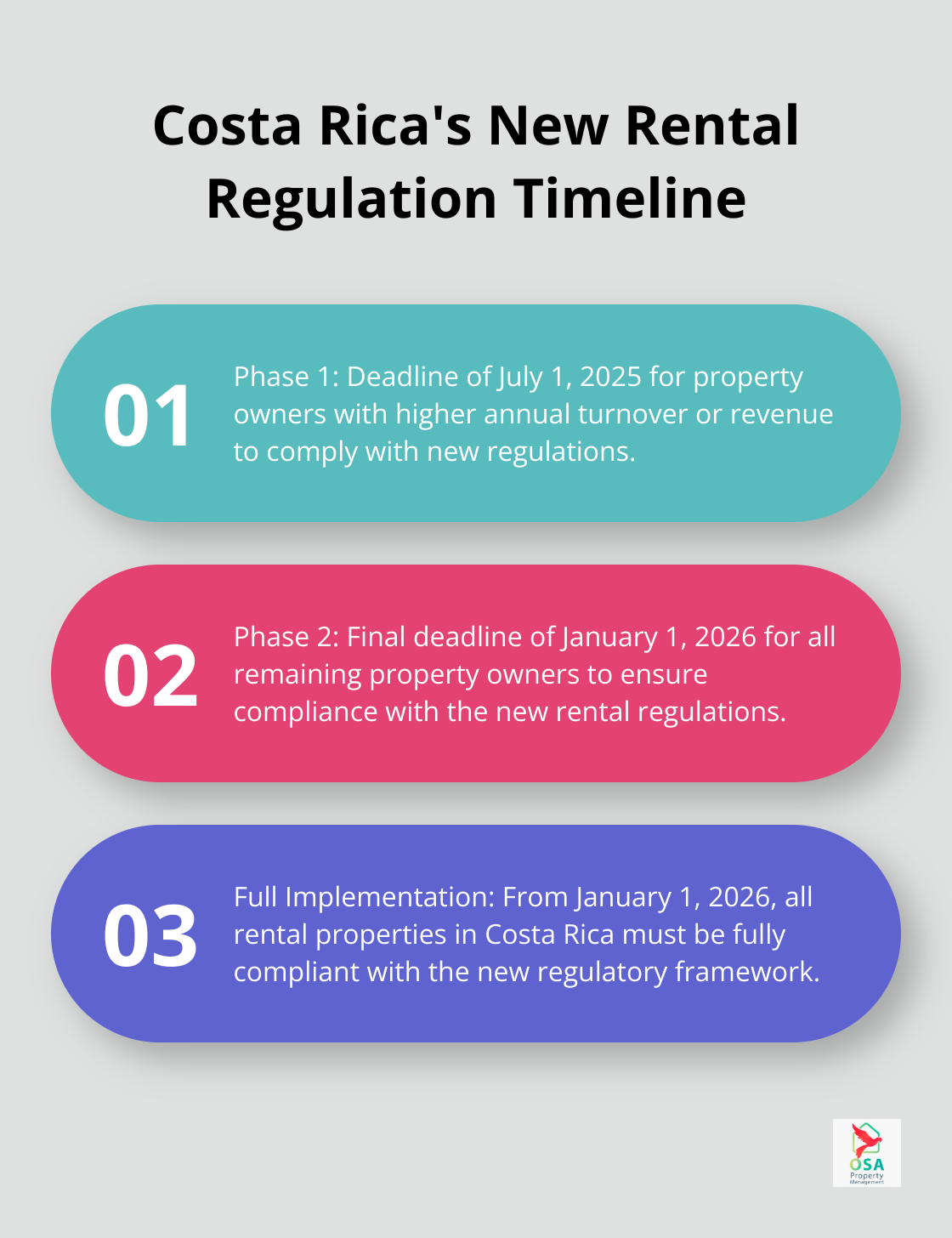

Implementation Timeline

These new regulations will take effect on January 1, 2026. However, the government has announced a phased implementation approach. The deadline is either July 1, 2025, or January 1, 2026, depending on annual turnover or revenue. This allows owners to familiarize themselves with the new system and ensure compliance before the mandatory deadline.

Affected Properties and Locations

The new regulations apply to all rental properties throughout Costa Rica, but they will have a particularly significant impact on popular tourist destinations. Areas like Guanacaste, Manuel Antonio, and the Central Valley (which have seen a boom in short-term rentals) will be under closer scrutiny.

Vacation rentals, defined as properties rented for less than 30 days, will face the most substantial changes. These properties (often listed on platforms like Airbnb and VRBO) will need to comply with additional requirements, including obtaining a special operating permit from the ICT.

Long-term rentals, while still affected, will see fewer changes. However, owners of these properties will still need to register and report their rental income accurately.

Impact on Property Management Services

The new regulations highlight the importance of professional property management services. Companies like Osa Property Management, with their extensive experience and local expertise, can help property owners navigate these complex changes. Their services (which include tax compliance and regulatory adherence) become even more valuable in light of these new requirements.

As we move forward, it’s clear that understanding and adapting to these new regulations will be essential for all property owners in Costa Rica. The next section will explore the specific implications these changes have for property owners and how they can prepare for the upcoming transition.

What Costa Rica’s New Rental Rules Mean for Property Owners

Mandatory Registration: A New Landscape

Costa Rica’s latest rental regulations introduce a mandatory registration requirement. All vacation rental properties must now register with the Costa Rican Institute of Tourism (ICT) for rentals between 24 hours and one year. This process involves more than simple paperwork; owners must provide detailed information about their property, including amenities and rental history. Vacation rental owners face an additional hurdle: obtaining a special operating permit from the ICT.

Tax Reporting: Increased Scrutiny

The new regulations usher in a more rigorous approach to tax reporting for rental income in Costa Rica. Informal rental arrangements are no longer acceptable. Property owners must report all rental income, regardless of the platform used (including popular sites like Airbnb and VRBO). As of 2025, rental income follows a progressive tax rate structure. The first 3.8 million colones are subject to different rates. Meticulous record-keeping of all rental transactions is now essential for accurate reporting.

Penalties for Non-Compliance: High Stakes

The consequences of failing to adhere to these new rules are severe. While the exact penalties aren’t specified in the regulations, they’re expected to be substantial. Potential repercussions include hefty fines, suspension of rental licenses, and in extreme cases, legal action. The Costa Rican government intends to enforce these regulations strictly, with penalties designed to ensure compliance.

Professional Management: A Valuable Asset

The complexity of these new rules highlights the value of professional property management services. Companies with local expertise (such as Osa Property Management) can navigate these regulations effectively, ensuring properties remain compliant and profitable. While independent management is possible, the time and effort required shouldn’t be underestimated.

Adapting to Change: The Path Forward

As Costa Rica’s rental landscape evolves, property owners must stay informed and adaptable. The new regulations present challenges, but they also offer opportunities for those who can navigate them effectively. Professional management services can provide invaluable support in this changing environment, helping property owners maintain compliance while maximizing their rental income.

The next chapter will explore how property owners can effectively navigate these new regulations, ensuring compliance while maintaining profitability in Costa Rica’s evolving rental market.

How Professional Property Management Simplifies New Rental Rules

Local Expertise: A Cornerstone of Compliance

Professional property management services offer invaluable local expertise in Costa Rica’s evolving rental landscape. Costa Rica’s rental tax compliance requirements have become more stringent in 2025, demanding meticulous attention from property owners. Companies with extensive experience in the region possess deep insights into the local market and regulatory environment. This knowledge allows them to anticipate changes and prepare property owners well in advance.

Property management teams stay current with the latest changes in Costa Rican rental regulations. They attend industry seminars, maintain relationships with local authorities, and consult with legal experts. This proactive approach equips them to guide property owners through complex regulatory changes effectively.

Streamlining the Registration Process

One of the most challenging aspects of the new regulations is the registration process. Professional property managers handle this entire process for their clients. They gather all necessary documentation, complete required forms, and communicate with the Costa Rican Tourism Institute (ICT) on behalf of property owners. This service not only saves time but also ensures accurate and complete submissions, reducing the risk of delays or rejections.

Ensuring Tax Compliance

Tax compliance is another area where professional expertise proves invaluable. Property owners must adhere to strict compliance and reporting requirements. Monthly declarations of gross income (Form D-125) are mandatory. Property management companies maintain detailed records of all rental transactions, providing property owners with accurate information for their tax returns. Many also assist with tax calculations and filings, simplifying this complex process for owners.

Benefits of Professional Management

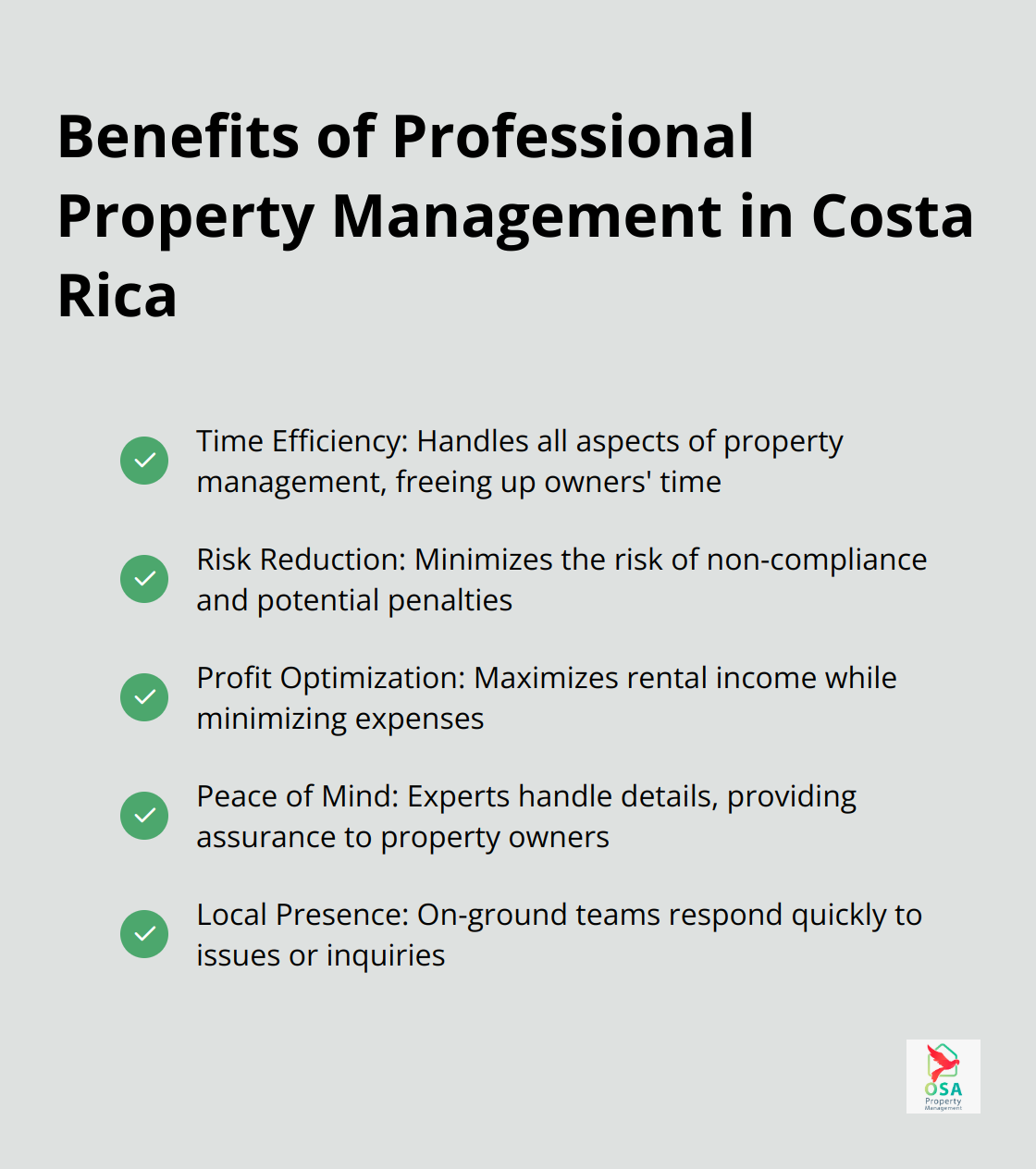

In light of these new regulations, the advantages of professional property management are clear:

Choosing the Right Property Management Company

When selecting a property management company, consider factors such as experience, local knowledge, and range of services offered. Companies like Osa Property Management (with over 19 years of experience in Costa Rica) offer comprehensive services tailored to navigate these new regulations effectively.

Look for companies that provide customized service packages, ensuring cost efficiency and peace of mind. A reliable property management company should handle marketing, concierge services, renter relationships, bill payments, accounting, and tax compliance. They should also oversee maintenance by trusted local companies.

The new rental regulations in Costa Rica underscore the importance of professional property management. With the right company, property owners can navigate these changes confidently, ensuring compliance while maximizing their investment potential.

Final Thoughts

Costa Rica’s new rental regulations will transform the property management landscape in 2026. These changes introduce mandatory registration requirements, stricter tax reporting, and potential penalties for non-compliance. Property owners must adapt to this evolving regulatory environment, especially those in popular tourist destinations.

The complexities of registration, tax reporting, and ongoing compliance highlight the value of professional property management services. These experts navigate the intricate regulatory landscape and ensure properties remain compliant while maximizing rental income. They handle everything from registration and tax compliance to marketing and maintenance.

Osa Property Management offers comprehensive services tailored to the new rental regulations. Our team provides peace of mind for property owners as Costa Rica’s rental market continues to evolve. We help property owners turn these challenges into opportunities for growth and success in Costa Rica’s vibrant rental market.