At Osa Property Management, we often encounter questions about the legal responsibilities of property managers. One common query is: Do property managers owe fiduciary duties to tenants?

This blog post will explore the complex relationship between property managers, owners, and tenants. We’ll clarify the legal obligations and ethical considerations that shape our industry.

What Are Fiduciary Duties in Property Management?

The Essence of Fiduciary Responsibilities

Fiduciary duties form the cornerstone of property management relationships. These legal obligations require property managers to act in the best interest of their clients (typically property owners). At its core, a fiduciary duty demands loyalty, confidentiality, and full disclosure.

Property managers must prioritize their clients’ interests above their own. This means they should present all rental offers to owners, even if some options might be less convenient for the manager to process. Such transparency (a hallmark of fiduciary duty) builds trust and ensures ethical business practices.

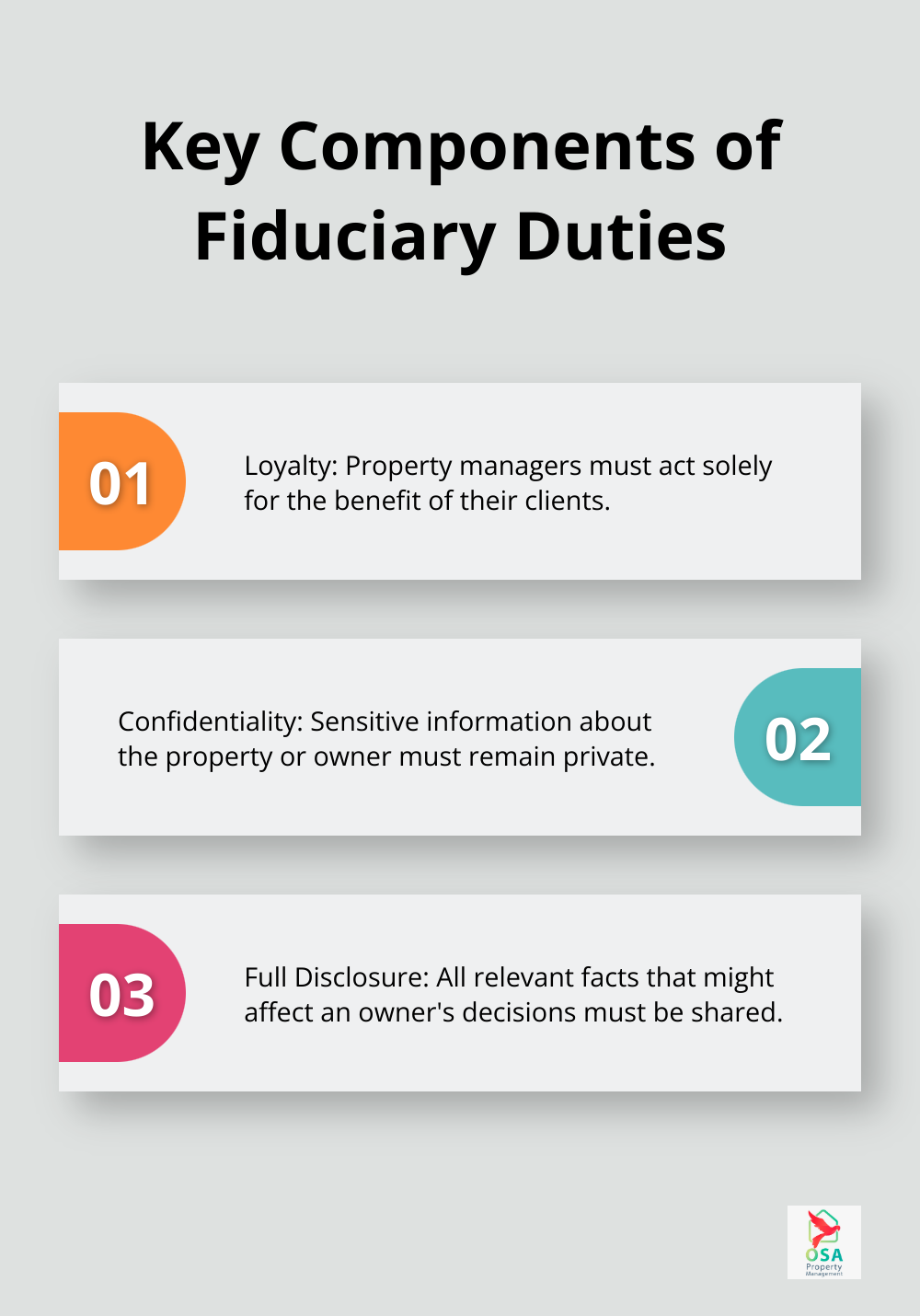

Key Components of Fiduciary Duties

- Loyalty: Property managers must act solely for the benefit of their clients.

- Confidentiality: Sensitive information about the property or owner must remain private.

- Full Disclosure: All relevant facts that might affect an owner’s decisions must be shared.

Fiduciary vs. Non-Fiduciary Responsibilities

It’s important to distinguish between fiduciary and non-fiduciary responsibilities. Property managers owe fiduciary duties to property owners but generally have non-fiduciary responsibilities to tenants. This means they must treat tenants fairly and legally, but without the same level of obligation as to the property owner.

Legal Implications and Accountability

The California Department of Real Estate considers property managers as fiduciaries under state law. This designation carries significant weight, as managers can face legal consequences (including license suspension or revocation) for breaching these duties.

Practical Applications of Fiduciary Duties

In practice, fiduciary duties manifest in various ways:

- Financial Management: Property managers must maintain separate trust accounts for each property they manage. Commingling funds or using them for personal purposes constitutes a serious breach of fiduciary duty.

- Due Diligence: Managers must exercise care in all aspects of property management, including thorough tenant screening, prompt maintenance responses, and accurate financial reporting.

- Transparency: All actions taken on behalf of the property owner should be documented and communicated clearly.

As we move forward, let’s explore how these fiduciary duties specifically apply to property managers’ relationships with property owners.

How Property Managers Serve Owners

At Osa Property Management, we recognize that property owners entrust us with their valuable assets. This responsibility extends beyond simple maintenance and rent collection. It involves a complex web of duties that demand expertise, integrity, and dedication.

Loyalty and Transparency

Property managers must always act in the best interest of property owners. This duty of loyalty requires members to act in the best interests of the LLC and avoid conflicts of interest. Members must refrain from engaging in activities that could harm the LLC or benefit themselves at the expense of the LLC.

Transparency is equally important. Property managers should provide regular, detailed reports on the property’s performance, including occupancy rates, maintenance costs, and rental income.

Financial Management

Proper handling of finances is a cornerstone of property management. This includes:

- Maintaining separate trust accounts for each property

- Promptly depositing rent payments

- Accurately tracking all income and expenses

Specific regulations and laws are in place to protect clients’ funds in property management. For example, Article 8 of the National Association of REALTORS® Code of Ethics requires that all money received by a REALTOR® in a real estate transaction be maintained in a separate escrow account.

Property managers should also proactively suggest ways to improve the property’s financial performance. This might involve recommending energy-efficient upgrades to reduce utility costs or identifying opportunities to increase rental income through amenity additions or strategic renovations.

Proactive Property Maintenance

Effective property maintenance goes beyond fixing issues as they arise. It involves regular inspections, preventative maintenance, and strategic upgrades to preserve and enhance the property’s value.

Many property management companies develop comprehensive maintenance checklists that cover everything from HVAC system checks to roof inspections. This proactive approach helps prevent small issues from becoming costly problems and ensures the property remains attractive to high-quality tenants.

Property managers should also have a network of reliable, licensed contractors to handle repairs promptly and cost-effectively. This network can be invaluable during emergencies or when specialized work is required.

Tenant Relations

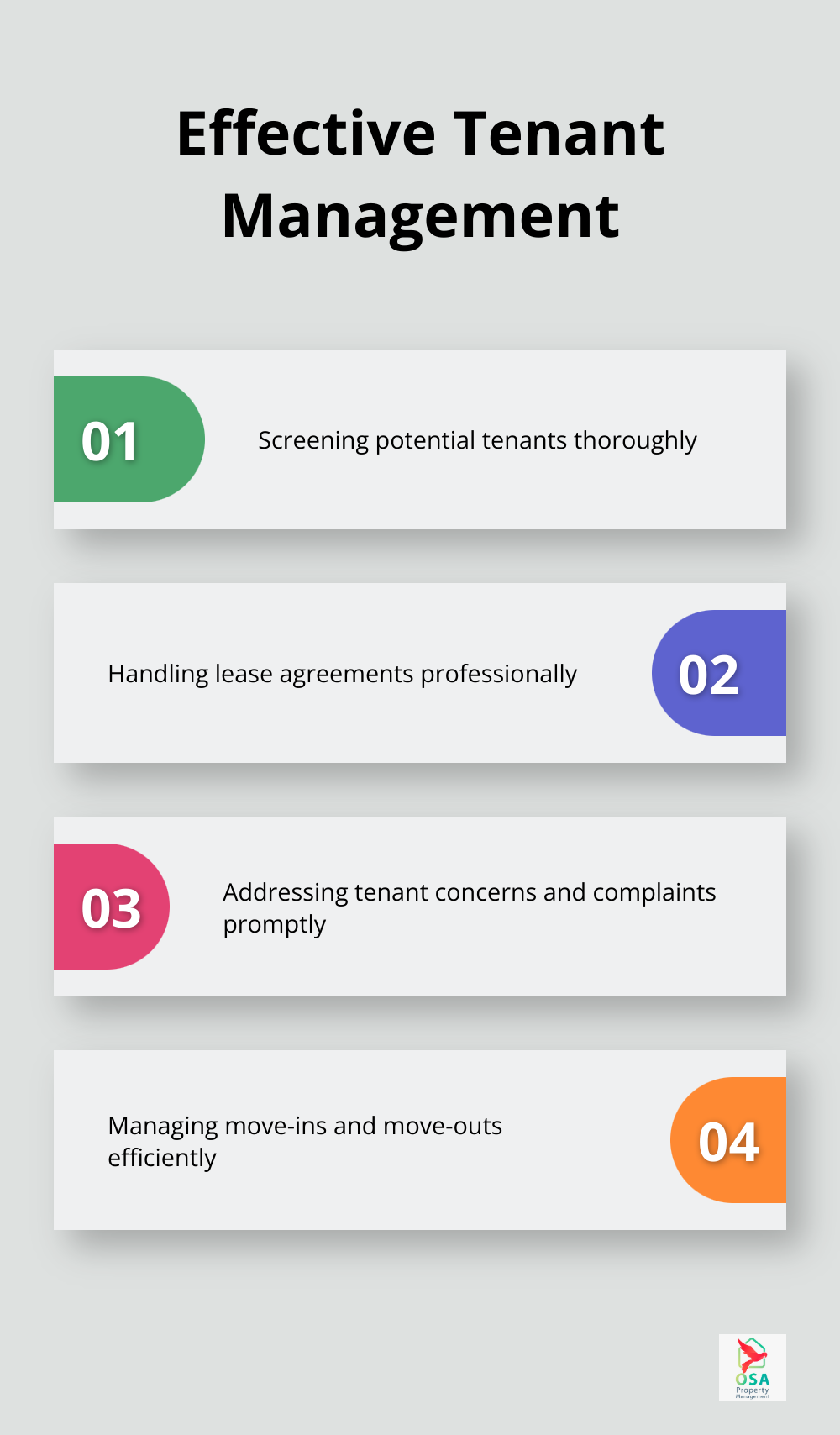

While property managers primarily serve owners, they also play a critical role in tenant relations. This includes:

- Screening potential tenants

- Handling lease agreements

- Addressing tenant concerns and complaints

- Managing move-ins and move-outs

Effective tenant management (which includes prompt communication and fair treatment) can lead to higher tenant satisfaction, longer lease terms, and reduced vacancy rates. These factors directly impact the property’s profitability and value for the owner.

As we shift our focus to the responsibilities property managers have towards tenants, it’s important to understand how these duties differ from the fiduciary obligations owed to property owners.

How Property Managers Protect Tenant Rights

At Osa Property Management, we recognize our significant responsibilities to tenants, which extend beyond our primary fiduciary duty to property owners. These responsibilities form legal obligations that shape the landlord-tenant relationship.

Fair Housing Practices

Property managers must uphold fair housing laws. The Fair Housing Act prohibits discrimination in public housing and other housing-related areas. We implement this by:

- Using consistent screening criteria for all applicants

- Avoiding steering tenants to specific units or neighborhoods

- Making reasonable accommodations for tenants with disabilities

Safe and Habitable Living Conditions

Property managers must ensure rental properties meet basic health and safety standards. This includes:

- Addressing maintenance issues promptly

- Conducting regular property inspections

- Ensuring compliance with local building codes

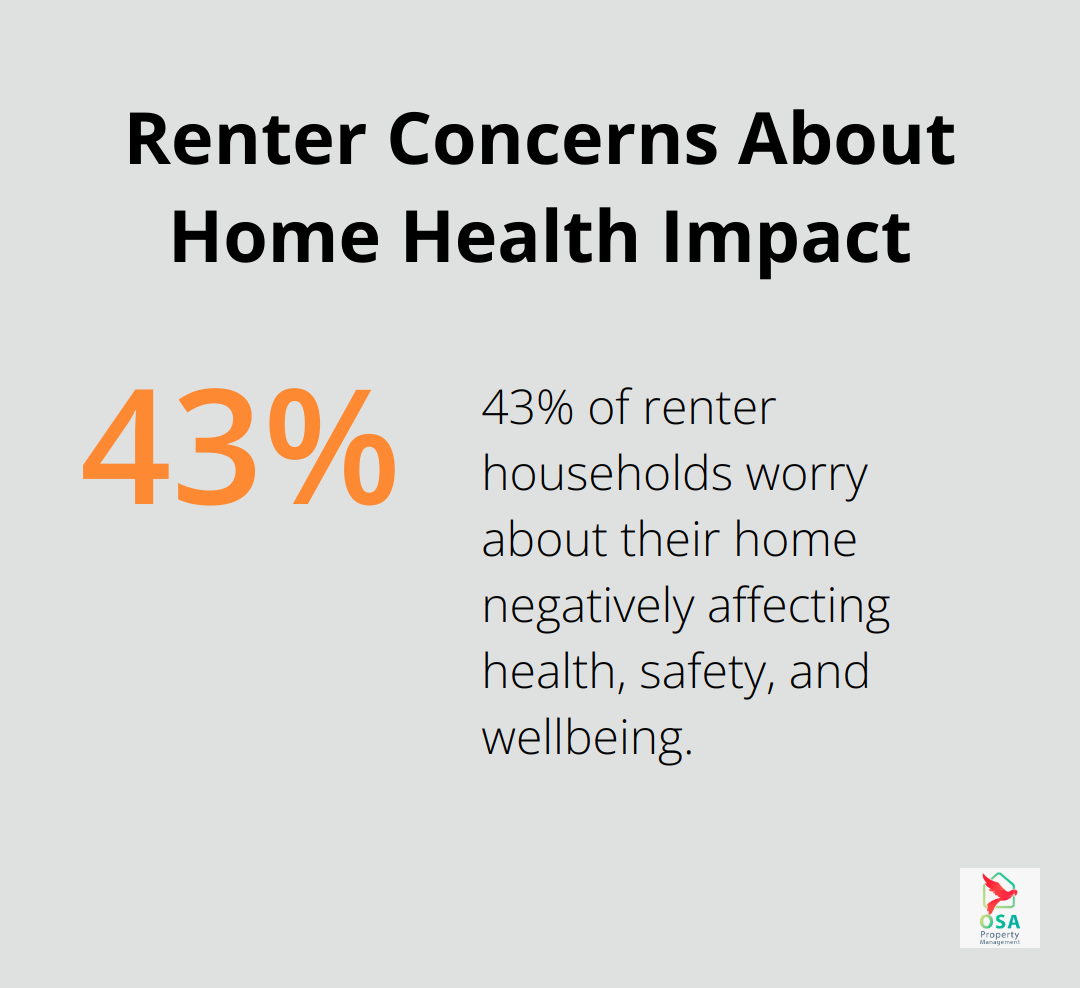

A recent survey found that 43 percent of renter households worry about their home negatively affecting their or another occupant’s health, safety, and wellbeing. Property managers play a vital role in addressing these concerns through diligent maintenance of safe living conditions.

Security Deposit Management

Security deposits often cause disputes between landlords and tenants. Property managers must:

- Follow state laws regarding deposit limits and return timelines

- Provide itemized lists of deductions when returning deposits

- Keep security deposits in separate, interest-bearing accounts (where required by law)

Clear communication and proper handling of deposits can alleviate concerns and build trust with tenants.

Tenant Concern Resolution

Effective communication forms the key to successful property management. This includes:

- Providing multiple channels for tenants to report issues (phone, email, online portals)

- Setting and meeting response time standards for different types of concerns

- Keeping tenants informed about the status of their requests

While property managers’ primary duty remains to property owners, maintaining positive relationships with tenants proves crucial for the long-term success of any rental property. Balancing the needs of both owners and tenants creates win-win situations that benefit all parties involved.

Final Thoughts

Property managers do not owe fiduciary duties to tenants, but they must uphold fair housing laws and maintain safe living conditions. They navigate a complex landscape of responsibilities, balancing their fiduciary duties to property owners with legal and ethical obligations to tenants. Professional property management services offer expertise in legal complexities, efficient property maintenance, and skillful tenant relations.

Osa Property Management leverages extensive experience in Costa Rica’s property market to deliver tailored solutions. Our team understands local regulations and market dynamics, which allows us to maximize property value while ensuring compliance with all legal requirements. We strive to create a harmonious environment that benefits all parties involved in the property management process.

The question “Do property managers owe fiduciary duties to tenants?” highlights the nuanced nature of property management. Successful management requires a balanced approach that respects and protects the rights of all parties involved. Property owners can navigate these complexities with confidence by partnering with experienced professionals who understand the intricacies of property management.