Owning property in Costa Rica comes with unique responsibilities, including maintaining essential documentation. At Osa Property Management, we understand the importance of proper record-keeping for property owners in this beautiful country.

This guide will walk you through the crucial property documentation you need to keep organized and up-to-date. From ownership papers to tax records and legal compliance documents, we’ll cover everything you need to know to protect your investment and enjoy peace of mind.

Key Property Ownership Documents in Costa Rica

The Escritura: Your Property’s Legal Identity

The Escritura (Property Deed) stands as the most critical document for property owners in Costa Rica. This legal instrument, drafted by a notary public, contains essential information about your property. It details the exact location, boundaries, and your rights as the owner. We recommend keeping the original Escritura in a secure location and having several certified copies available for various transactions.

Plano Catastrado: Mapping Your Property’s Boundaries

The Plano Catastrado (Cadastral Plan) provides a detailed survey map of your property. This document plays a vital role in preventing boundary disputes and ensures you know the exact dimensions of your land. It can also identify any encroachments or disputes over the property’s boundaries, which can help to avoid potential legal issues in the future. We advise updating your Plano Catastrado regularly, especially if you make any changes to your property’s boundaries.

Personería Jurídica: Proving Legal Entity Status

For property owners who hold their assets through a Costa Rican corporation (a common practice for foreign investors), the Personería Jurídica becomes an indispensable document. This Legal Entity Certificate indicates if a person or legal entity owns or does not own goods and chattels or real estate registered in their name. It typically remains valid for 15 days from the date of issue, necessitating a new certificate for each major transaction or legal process involving your property.

The Importance of Document Organization

Maintaining these documents in order is not just a legal requirement; it’s a practical necessity for smooth property management in Costa Rica. Having these documents readily available can save property owners time, money, and stress. Whether you’re dealing with local authorities, selling your property, or simply proving ownership, these three documents will serve as your most valuable assets.

As we move forward, let’s explore the tax and financial documents that Costa Rica property owners must keep in order. These records play a crucial role in maintaining compliance with local regulations and ensuring smooth financial operations for your property.

Managing Tax and Financial Records for Costa Rica Properties

Property Tax Receipts: Proof of Compliance

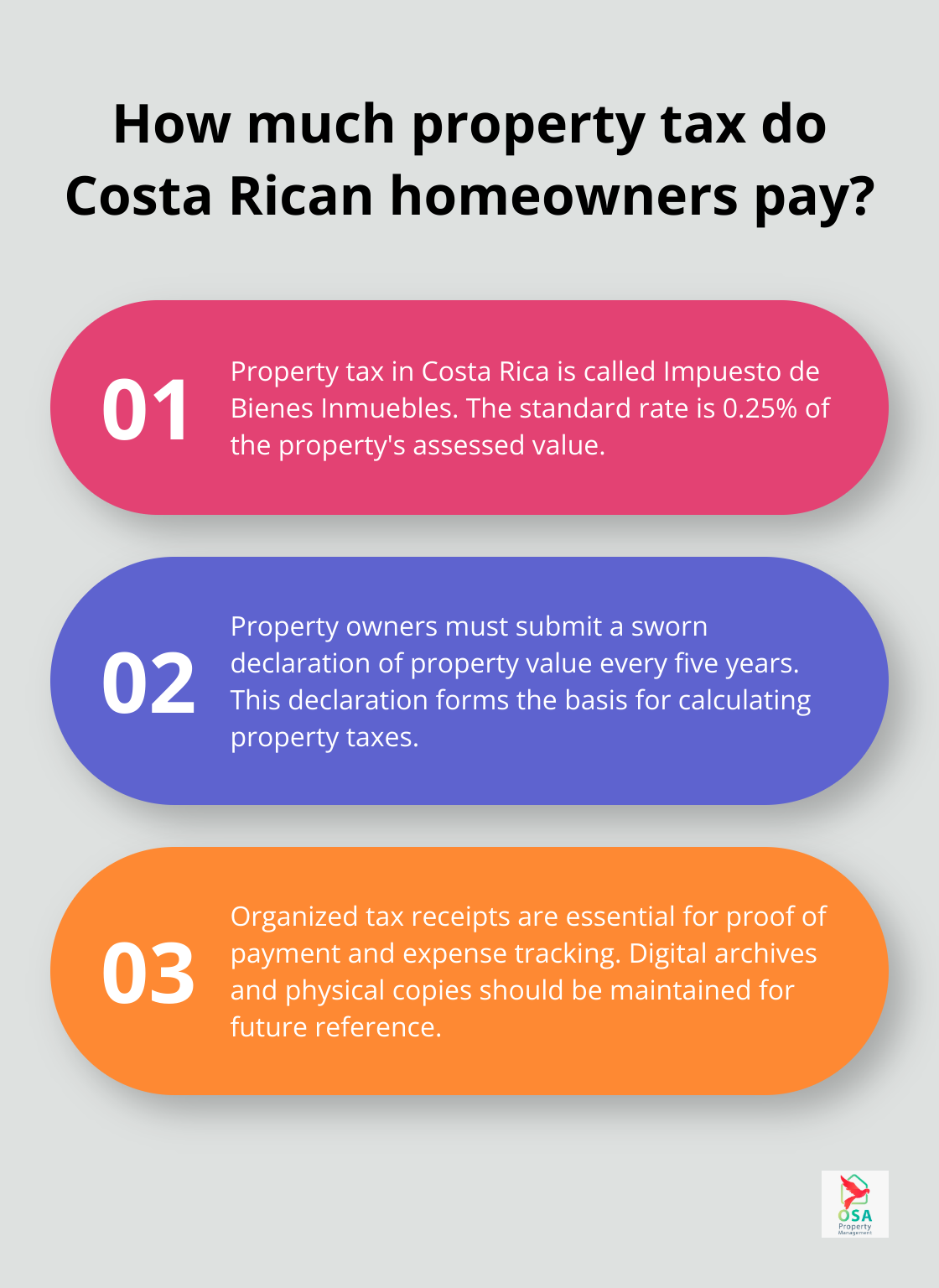

The Impuesto de Bienes Inmuebles (property tax) is an annual obligation for all property owners in Costa Rica. The standard property tax rate is 0.25% of the property’s assessed value, applied uniformly across the country. Organized tax receipts are essential for several reasons. They provide proof of payment, which authorities may require during property transactions. Additionally, these receipts help track expenses for tax purposes, especially for rental properties.

Property owners should create a digital archive of their receipts and keep physical copies in a secure location. This practice can prevent complications during property sales and save time in the future.

Sworn Declaration of Real Estate: Valuing Your Property

The Declaración Jurada de Bienes Inmuebles is a sworn statement of property value. Property owners submit this document to the local municipality every five years. It forms the basis for calculating property taxes.

Accurate valuation is important. Undervaluing a property might reduce tax liability but can lead to problems during a sale. Overvaluing can result in unnecessarily high tax payments. Professional assistance in preparing this declaration ensures accuracy and compliance.

Utility Bills and Payment Records: Beyond Basic Receipts

Utility bills serve as proof of occupancy and can be critical when addressing tenant issues or proving a property’s habitability. These documents (which include electricity, water, and internet bills) play a significant role in property management.

Tracking utility payments aids in budgeting and identifies potential issues like water leaks or electrical problems. For rental properties, these records are invaluable for accurate expense reporting and tax preparation.

Financial Document Organization: A Key to Success

Meticulous maintenance of financial documents not only ensures compliance with local regulations but also protects your investment. Proper organization sets the foundation for smooth property management in Costa Rica.

An efficient system to track and organize utility bills ensures that no payment is missed and all records are easily accessible when needed. This level of organization can make a significant difference in the ease of managing a property in Costa Rica.

As we move forward, let’s explore the legal and compliance documents that Costa Rica property owners must maintain. These records are essential for ensuring your property remains in good standing with local authorities and regulations.

Legal Compliance for Costa Rica Property Owners

Construction Permit: Your Building’s Legal Foundation

The Permiso de Construcción is a mandatory document for any construction or significant renovation project in Costa Rica. This permit, issued by the local municipality, ensures that your building plans comply with local zoning laws, building codes, and safety regulations.

Below is a detailed step-by-step guide, including the necessary documents, associated costs, and possible special permits. The process can take several weeks to several months (depending on the project’s complexity and the local municipality’s efficiency).

Keep your Construction Permit on file even after the project’s completion. This document proves that your property was built or modified legally, which becomes invaluable during property transactions or inspections.

Land Use Certificate: Defining Your Property’s Purpose

The Uso de Suelo, or Land Use Certificate, specifies the permitted uses for your property based on its location and zoning regulations. This document is essential for understanding what activities are allowed on your land (whether it’s residential, commercial, or mixed-use).

It’s important to understand everything there is to know about the zoning or uso de suelo of the property before you make a purchase. Interpreting the certificate can be complex, as it often contains technical jargon and references to specific zoning laws.

Property owners should review their Land Use Certificate carefully before making any significant changes to their property or starting a new business venture. Violations of the permitted uses can result in fines or legal complications.

Property Registry Certificate: Your Ownership Proof

The Certificación Literal, issued by the National Registry of Costa Rica, is the official document that confirms your ownership of the property. This certificate provides a comprehensive history of the property, including past owners, mortgages, liens, and any other legal encumbrances.

Regular updates of your Certificación Literal are important for property owners. It helps detect any unauthorized changes to your property’s legal status and provides peace of mind knowing your ownership is officially recognized.

The National Registry updates this document frequently, so try to obtain a new certificate before any major property transaction or at least once a year. This practice helps catch any discrepancies early and prevents potential legal issues down the line.

Managing these legal and compliance documents is an essential part of responsible property ownership in Costa Rica. Stay organized and up-to-date with these key documents to protect your investment and ensure smooth sailing in your property management journey.

Final Thoughts

Property documentation forms the foundation of successful property ownership in Costa Rica. Accurate and up-to-date records protect your investment and ensure smooth operations. Each document, from property deeds to tax receipts and compliance certificates, plays a vital role in safeguarding your rights and facilitating seamless transactions.

Organized record-keeping simplifies interactions with local authorities and streamlines property transactions. It equips you to handle unexpected situations, respond to legal inquiries, and make informed decisions about your property. Professional assistance can make a significant difference, especially for foreign investors unfamiliar with Costa Rica’s legal landscape.

Osa Property Management offers expert services to help property owners navigate the intricacies of Costa Rican real estate. Our team specializes in comprehensive property management, including document organization, tax compliance, and maintenance oversight (with over 19 years of experience). We provide customized service packages to meet your specific needs, offering cost-efficient solutions for your property ownership journey in Costa Rica.