At Osa Property Management, we understand the importance of maximizing tax benefits for rental property owners. Navigating the complex world of rental property and tax deductions can be challenging, but it’s crucial for optimizing your investment returns.

This guide will walk you through the essential tax deductions available to rental property owners, helping you reduce your tax liability and increase your profits.

Maximizing Mortgage Interest and Property Tax Deductions

Mortgage Interest Deductions: A Powerful Tax Benefit

Rental property owners can significantly reduce their tax liability through mortgage interest deductions. The IRS permits the deduction of interest paid on loans used to acquire, construct, or improve rental properties. This applies to primary mortgages and home equity loans or lines of credit used for rental property purposes.

For each year of coverage, you can deduct only the part of the premium payment that applies to that year. Interest expense is also deductible for mortgage interest paid on rental properties.

Accurate record-keeping is essential. Your lender should provide Form 1098 at year-end, detailing the total interest paid. Always compare this form with your personal records to ensure accuracy.

Property Tax Deductions: Lowering Your Taxable Income

Property taxes represent another major deductible expense for rental property owners. The full amount of property taxes paid on your rental property each year is deductible. This includes taxes paid to local and state governments.

Note that only taxes assessed for the period you owned the property are deductible. If you purchased a rental property mid-year, you can only deduct taxes from the purchase date to year-end.

Important Considerations and Limitations

While these deductions offer powerful tools for reducing your tax burden, keep these key points in mind:

- The Tax Cuts and Jobs Act of 2017 imposed a $10,000 cap on state and local tax (SALT) deductions for personal residences. However, this cap doesn’t apply to rental properties. You can still deduct the full amount of property taxes paid on your rental properties.

- If you use your rental property for personal use for more than 14 days or 10% of the total days rented (whichever is greater), you must prorate your deductions based on the percentage of time the property served as a rental.

- Maintain meticulous records of all rental property expenses. In case of an audit, you’ll need to provide documentation for all claimed deductions.

Working with a qualified tax professional who specializes in real estate investments can help ensure you maximize your deductions while staying compliant with tax laws.

As we move forward, let’s explore another critical area of tax deductions for rental property owners: operating expenses and maintenance costs. These deductions can further reduce your taxable income and increase your overall profitability.

How to Maximize Deductions for Operating Expenses

Utility Expenses During Vacancies

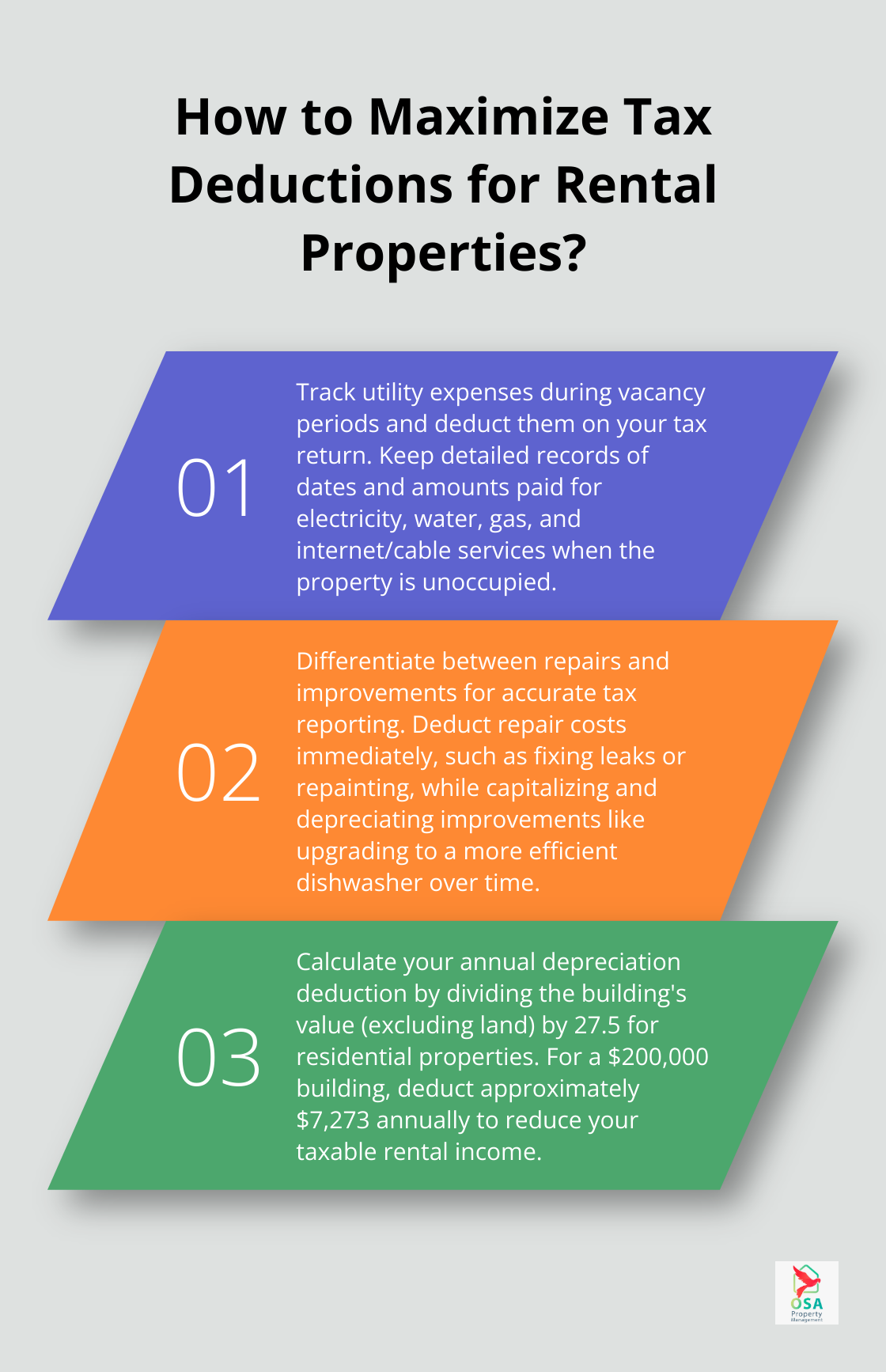

Property owners often overlook utility expenses during vacancy periods as a deductible item. When your rental property sits unoccupied, you become responsible for utility bills. These costs are fully deductible. This includes electricity, water, gas, and even internet or cable if you provide these services. Track these expenses meticulously, noting the dates of vacancy periods for accurate reporting.

Repairs and Maintenance: The Key to Profitability

Regular repairs and maintenance keep your rental property in top condition and attract quality tenants. The IRS allows you to deduct the cost of repairs that maintain your property in good working condition. This includes painting, fixing leaks, replacing broken windows, and repairing appliances.

It’s essential to differentiate between repairs and improvements. Repairs are immediately deductible, while improvements that add value to the property must be capitalized and depreciated over time. For example, fixing a broken dishwasher counts as a repair, but upgrading to a new, more efficient model qualifies as an improvement.

Insurance and Property Management Fees

You can deduct the costs of certain materials, supplies, repairs, and maintenance that you make to your rental property to keep your property in good operating condition. This includes landlord insurance policies that cover property damage, liability, and loss of rental income. If you pay your insurance annually, you can deduct the full amount in the year you pay it.

Property management fees represent another significant deduction. If you use a professional property management company, the fees you pay for their services are tax-deductible. This includes costs for tenant screening, rent collection, maintenance coordination, and other management tasks. (Osa Property Management offers comprehensive services in this area, ensuring you maximize these deductions.)

Record-Keeping for Operating Expenses

Proper documentation is vital in case of an IRS audit. You generally must have documentary evidence, such as receipts, canceled checks or bills, to support your expenses. Keep track of any travel expenses related to your rental property as well. Consider using property management software or working with a professional property manager to help track these expenses accurately. (This is where Osa Property Management’s expertise can prove invaluable.)

The Impact of Operating Expense Deductions

Maximizing these deductions can significantly reduce your tax liability and improve your rental property’s profitability. The next section will explore how depreciation and capital improvements can further impact your tax situation, providing you with a comprehensive understanding of rental property tax benefits.

Unlocking Rental Property Depreciation and Capital Improvements

Understanding Depreciation for Rental Properties

Depreciation serves as a powerful tax tool for rental property owners. The IRS allows you to deduct a specific amount from your taxable income every full year you own and rent a property. This reflects the gradual wear and tear of your property over time. Understanding these rules can significantly impact your tax strategy.

For residential rental properties, the IRS allows depreciation over 27.5 years. This means you can deduct a portion of your property’s value each year for nearly three decades. Commercial properties have a longer depreciation period of 39 years.

Only the building itself can be depreciated, not the land it sits on. To calculate your annual depreciation deduction, you must determine the value of the building separate from the land. This often requires a property appraisal or assessment.

Calculating Your Depreciation Deduction

To calculate your annual depreciation deduction, divide the value of the building by 27.5 (for residential properties). For example, if your rental property’s building is valued at $200,000, your annual depreciation deduction would be approximately $7,273.

This deduction can significantly reduce your taxable rental income. However, you must keep accurate records of your property’s original cost, improvements, and the date it was placed in service as a rental.

Distinguishing Capital Improvements from Repairs

Repairs are necessary to maintain the property’s condition, while improvements add value or extend the useful life of the property. Understanding this difference is essential for maximizing your tax benefits.

For example, fixing a leaky roof is a repair, while replacing the entire roof is a capital improvement. Painting a room is typically a repair, but adding a new room is a capital improvement.

Maximizing Tax Benefits through Proper Classification

Proper classification of expenses as either repairs or capital improvements can significantly impact your tax liability. Repairs offer immediate tax benefits, while capital improvements provide long-term advantages through depreciation.

Try to maintain detailed records of all property-related expenses, including receipts, invoices, and descriptions of work performed. This documentation will prove invaluable in case of an audit and help ensure you claim the correct deductions.

Seeking Professional Guidance

Depreciation and capital improvements represent complex areas of tax law. Working with a qualified tax professional who understands rental property taxation is important for maximizing your benefits and avoiding potential pitfalls. A knowledgeable property management company can also provide valuable insights into local tax implications and help you navigate these complexities.

Final Thoughts

Rental property and tax deductions require careful navigation to optimize your investment returns. Proper record-keeping proves essential for maximizing tax benefits and providing evidence in case of an audit. We recommend consulting with a qualified tax professional who specializes in real estate investments to navigate complex scenarios and stay compliant with current regulations.

Osa Property Management understands the intricacies of rental property management in Costa Rica. Our team can assist you in maintaining accurate records, managing your property efficiently, and connecting you with local tax professionals. We cover areas from Tarcoles to Uvita, ensuring your rental property investment receives comprehensive management.

Effective tax planning demands ongoing attention and accurate record-keeping throughout the year. Work with professionals who can guide you through the complexities of rental property taxation. This approach will position you to maximize your deductions and optimize the financial performance of your rental property investment.