At Osa Property Management, we understand the complexities of Costa Rica expat taxes. Moving to this beautiful country can be exciting, but it’s crucial to navigate the tax landscape carefully.

Expats often face unexpected tax challenges that can lead to costly mistakes. This guide will help you avoid common pitfalls and optimize your tax strategy in Costa Rica.

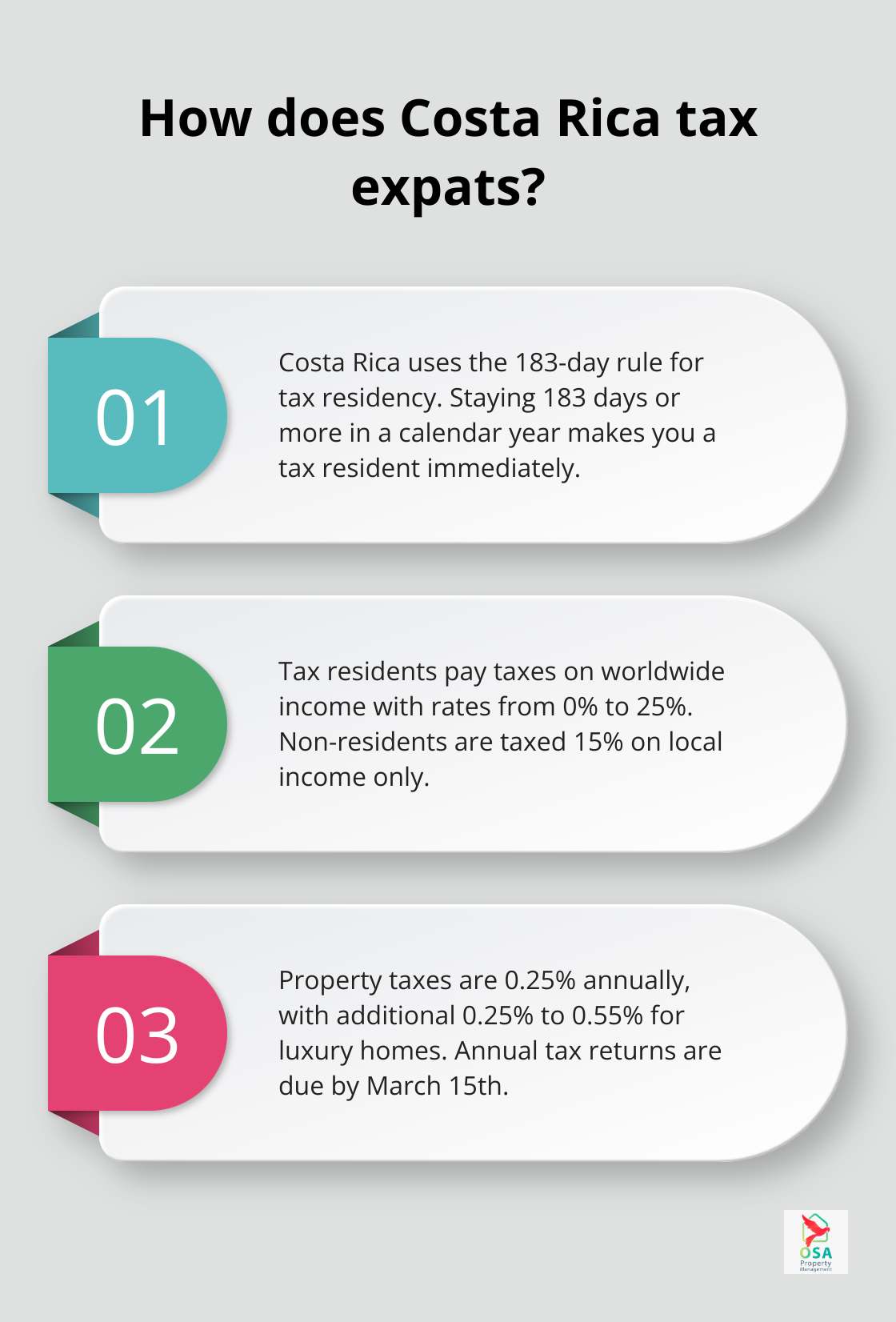

How Costa Rica Taxes Expats

Residency Rules and Their Impact

Costa Rica determines tax residency based on the 183-day rule. If you spend 183 days or more in the country within a calendar year, you become a tax resident. This status takes effect immediately, not just after a full year. Many expats cross this threshold unknowingly, which triggers unexpected tax obligations.

Worldwide Income Taxation for Residents

Tax residents in Costa Rica must pay taxes on their global income. This includes salaries, investments, and rental income from anywhere in the world. The tax rates progress from 0% to 25% (as of 2025). The thresholds are in colones, so currency fluctuations can affect your tax bracket.

Non-Resident Tax Obligations

Non-residents face different rules. Costa Rica only taxes their locally-sourced income. This typically includes rental income from Costa Rican properties or local business profits. The flat tax rate for non-residents usually stands at 15%, but it can vary based on income type.

Navigating Dual Tax Systems

Many expats (especially Americans) must manage both Costa Rican and home country tax obligations. The U.S., for example, taxes citizens on worldwide income regardless of residency. This can lead to double taxation if not managed properly.

To mitigate this, the U.S. offers the Foreign Earned Income Exclusion (FEIE), which allows expats to exclude up to $126,500 of foreign earnings from U.S. taxes in 2024. However, this doesn’t apply to passive income like rentals or investments.

Property Tax Considerations

Property taxes in Costa Rica are relatively low at 0.25% of the declared value annually. However, luxury homes face an additional tax ranging from 0.25% to 0.55%. Many expats underestimate this expense when budgeting for their Costa Rican dream home.

Costa Rica requires annual tax returns, due by March 15th each year. Late filing results in penalties and interest. Additionally, expats must keep detailed records of their worldwide income and time spent in the country to support their tax status claims.

The Costa Rican tax system presents unique challenges for expats. While you can navigate it successfully, it requires careful planning (and often professional guidance). The next section will explore common tax traps that expats often fall into and how to avoid them.

Hidden Tax Pitfalls for Costa Rica Expats

Unreported Foreign Income and Assets

Expats who move to Costa Rica often overlook the requirement to report their worldwide income. This oversight can lead to severe consequences. As a tax resident in Costa Rica, you must declare all income, regardless of its origin. The Costa Rican tax authority has intensified its efforts to detect unreported foreign income through international tax information exchange agreements.

To avoid penalties, maintain meticulous records of all income sources. Work with a tax professional who understands both Costa Rican and international tax laws to ensure full compliance.

The Double Taxation Dilemma

Costa Rica lacks tax treaties with numerous countries (including the United States). This absence can result in double taxation on certain types of income. For example, U.S. citizens living in Costa Rica might pay taxes on the same income to both countries.

While the U.S. offers mechanisms like the Foreign Earned Income Exclusion and Foreign Tax Credit, these don’t cover all income types. Passive income (such as rental income or capital gains) can prove particularly challenging.

To minimize your overall tax burden, understand the tax laws of both Costa Rica and your home country. Proper tax planning allows you to leverage available credits and exclusions effectively.

Local Property Taxes and Hidden Fees

Costa Rica’s property taxes appear low at first glance, but many expats underestimate the total cost of property ownership. Beyond the annual 0.25% property tax, consider these additional expenses:

- Luxury home tax: Properties valued over approximately $230,000 (as of 2025) incur an additional tax of 0.25% to 0.55%.

- Municipal fees: These include charges for garbage collection, street cleaning, and other local services.

- Corporation tax: Holding property through a Costa Rican corporation triggers an annual tax.

- Capital gains tax: Selling property may subject you to a capital gains tax of up to 15% on the profit.

Factor in all these costs when budgeting for property ownership in Costa Rica. Regular consultations with a local tax advisor help you stay informed about changes in property-related taxes and fees.

Misunderstanding Tax Residency Rules

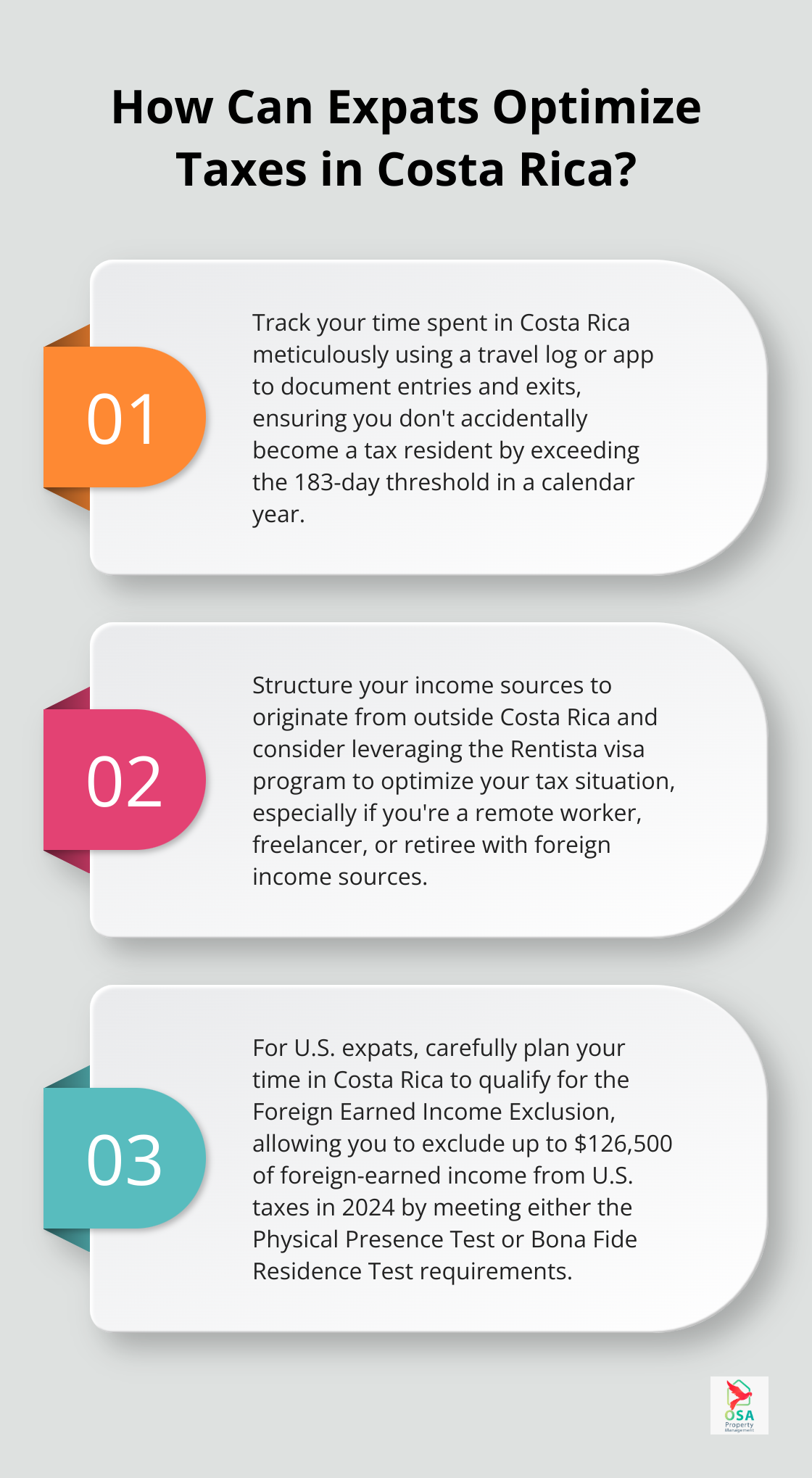

Costa Rica determines tax residency based on the 183-day rule. If you spend 183 days or more in the country within a calendar year, you become a tax resident immediately (not after a full year). Many expats cross this threshold unknowingly, which triggers unexpected tax obligations.

To avoid surprises, track your time spent in Costa Rica meticulously. Consider using a travel log or app to document your entries and exits. This practice proves invaluable if you need to demonstrate your residency status to tax authorities.

Neglecting U.S. Tax Obligations

For U.S. expats, the obligation to file U.S. tax returns continues even while living abroad. Many Americans mistakenly believe that living outside the U.S. exempts them from filing. This misconception can lead to severe penalties and interest charges.

U.S. citizens must report their worldwide income to the IRS annually, regardless of their residence. They may also need to file additional forms (such as the FBAR for foreign bank accounts). Failure to comply with these requirements can result in significant fines.

Navigating the Costa Rican tax system as an expat requires vigilance and expert guidance. These hidden tax pitfalls can significantly impact your financial well-being if left unaddressed. In the next section, we’ll explore effective strategies to minimize your tax liability and optimize your financial situation in Costa Rica.

How to Reduce Your Tax Burden in Costa Rica

At Osa Property Management, we understand the challenges expats face with tax obligations in Costa Rica. This chapter explores effective strategies to minimize your tax burden while maintaining compliance with local laws.

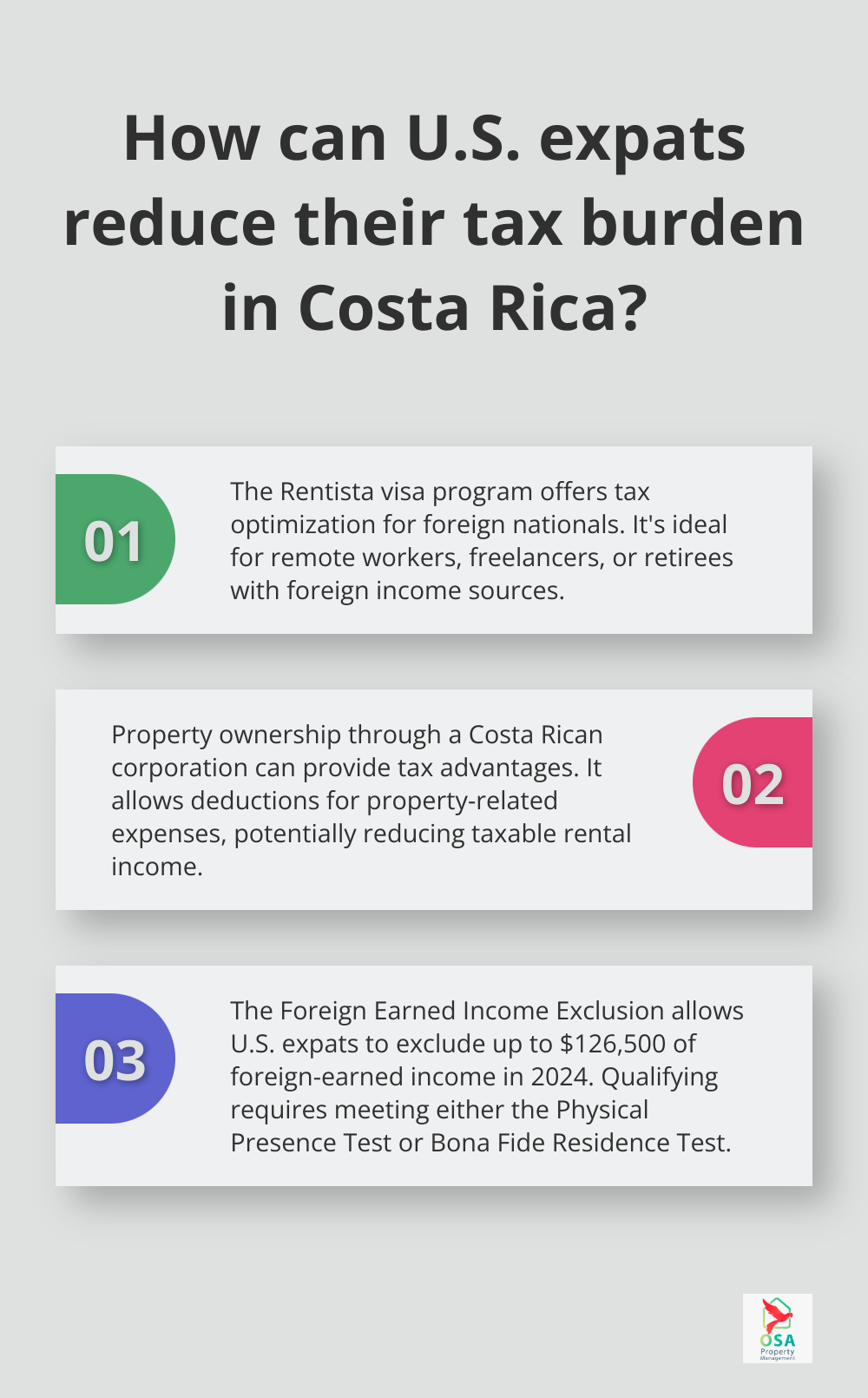

Leverage the Rentista Visa Program

The Rentista visa program offers a unique tax optimization opportunity. Costa Rica grants a temporary residency visa under this category to foreign nationals willing to immigrate to the country. This makes the Rentista visa an excellent choice for remote workers, freelancers, or retirees with foreign income sources.

To maximize this benefit, structure your income sources to originate from outside Costa Rica. For instance, if you work as a consultant, consider establishing your business entity in a tax-friendly jurisdiction and bill your clients through that entity.

Optimize Your Property Ownership Structure

Your property ownership structure in Costa Rica can significantly impact your tax liability. Many expats find benefits in owning property through a Costa Rican corporation. While this incurs an annual corporation tax, it can offer advantages such as easier property transfers and potential tax deductions for property-related expenses.

For example, if you use your property for rental income, corporate ownership allows you to deduct maintenance costs, property management fees, and even travel expenses related to property oversight. These deductions can substantially reduce your taxable rental income.

Utilize the Foreign Earned Income Exclusion

For U.S. expats, the Foreign Earned Income Exclusion (FEIE) serves as a powerful tool. In 2024, it allows you to exclude up to $126,500 of foreign-earned income from U.S. taxes. To qualify, you must pass either the Physical Presence Test or the Bona Fide Residence Test.

The Physical Presence Test requires you to be physically present in Costa Rica for at least 330 full days during a 12-month period. The Bona Fide Residence Test requires you to establish that Costa Rica is your true, fixed home for an uninterrupted period that includes an entire tax year.

Careful planning of your time in Costa Rica and the U.S. can help you meet these requirements and maximize your tax savings.

Seek Expert Guidance

Navigating the complexities of expat taxation requires specialized knowledge. Professional advice can save expats thousands of dollars in unnecessary taxes (as we’ve observed at Osa Property Management).

A local tax expert can help you structure your assets and income in the most tax-efficient manner. They can also ensure you take advantage of all available deductions and exemptions under Costa Rican law.

Costa Rica offers tax incentives for investments in certain sectors like tourism and renewable energy. A knowledgeable advisor can guide you towards these opportunities, potentially reducing your overall tax burden while contributing to the local economy.

Tax laws change frequently. What worked last year might not be the best strategy this year. Regular consultations with a tax professional can help you stay ahead of these changes and continuously optimize your tax position.

Final Thoughts

Costa Rica expat taxes require careful planning and attention to detail. Understanding residency rules, worldwide income taxation, and property-related expenses will lead to financial success in this beautiful country. The complexities of managing dual tax systems, especially for U.S. citizens, highlight the need for proactive strategies.

Compliance with Costa Rican tax laws forms the foundation of a stress-free expat life. Regular filing, accurate reporting of worldwide income, and meticulous record-keeping will help you avoid penalties and build a positive relationship with local tax authorities. Tax laws evolve, so what works today might not be ideal tomorrow.

Expert guidance proves invaluable when navigating complex scenarios and identifying opportunities for tax savings. At Osa Property Management, we can connect you with professionals versed in both Costa Rican and international tax laws. These experts will ensure full compliance and help you make informed decisions about property management and investments in Costa Rica.