At Osa Property Management, we know that owning property in Costa Rica can be a rewarding investment. However, many property owners overlook valuable tax deductions that could significantly reduce their tax burden.

In this blog post, we’ll explore hidden tax deductions for Costa Rica property owners and show you how to maximize your savings. From maintenance expenses to depreciation, we’ll cover the key deductions you might be missing out on.

How Costa Rica’s Property Tax System Works

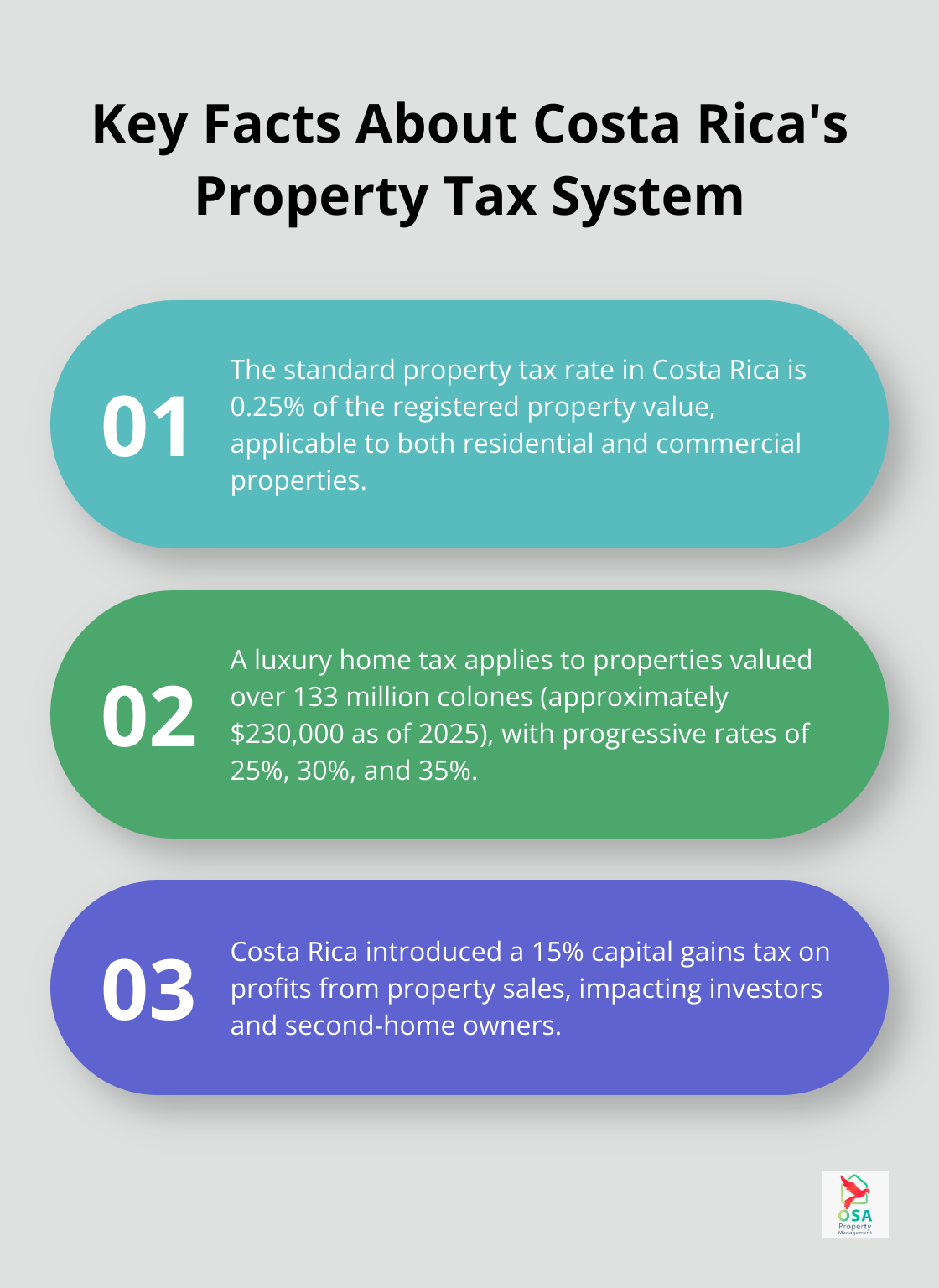

Standard Property Tax Rate

Costa Rica’s property tax system presents unique challenges for foreign investors. The standard property tax rate stands at 0.25% of the registered property value. This value often falls below the market value. Both residential and commercial properties adhere to this rate, which simplifies the process for property owners.

Luxury Home Tax Explained

High-value properties face an additional tax burden. The luxury home tax applies to properties valued over 133 million colones (approximately $230,000 as of 2025). This tax follows a progressive rate structure, with tax rates of 25%, 30% and 35% respectively, which is applied according to the entity’s accumulated taxable income. Owners of high-end properties must factor in this additional tax when calculating their overall expenses.

Recent Tax Law Changes

Costa Rica introduced a significant change to its property tax laws. A 15% capital gains tax now applies to profits from property sales. This tax is defined as an equity increase derived from the disposition of assets. However, investors and second-home owners must consider this factor when planning their property strategies.

Rental Property Tax Implications

Owners of rental properties face additional tax considerations. While rental income is subject to taxation, Costa Rica allows various deductions that can reduce tax liability. These deductions include maintenance expenses, property management fees, and even travel costs related to property management.

Importance of Local Tax Expertise

The complexities of Costa Rica’s property tax system underscore the importance of working with local tax professionals. These experts can help property owners navigate the nuances of the tax code, identify all available deductions, and ensure compliance with Costa Rica’s evolving tax laws. Their knowledge proves invaluable in maximizing savings and avoiding potential pitfalls.

Understanding Costa Rica’s property tax system forms the foundation for effective tax planning. With this knowledge in hand, let’s explore the often-overlooked tax deductions that can significantly reduce your tax burden as a property owner in Costa Rica.

Maximizing Your Tax Savings: Hidden Deductions for Costa Rica Property Owners

Maintenance and Repair Expenses

Property owners often overlook deductions for maintenance and repair costs. You can deduct expenses for routine upkeep, such as painting, plumbing repairs, electrical work, and general upkeep. Keeping detailed records and receipts for all maintenance work is essential for claiming these deductions.

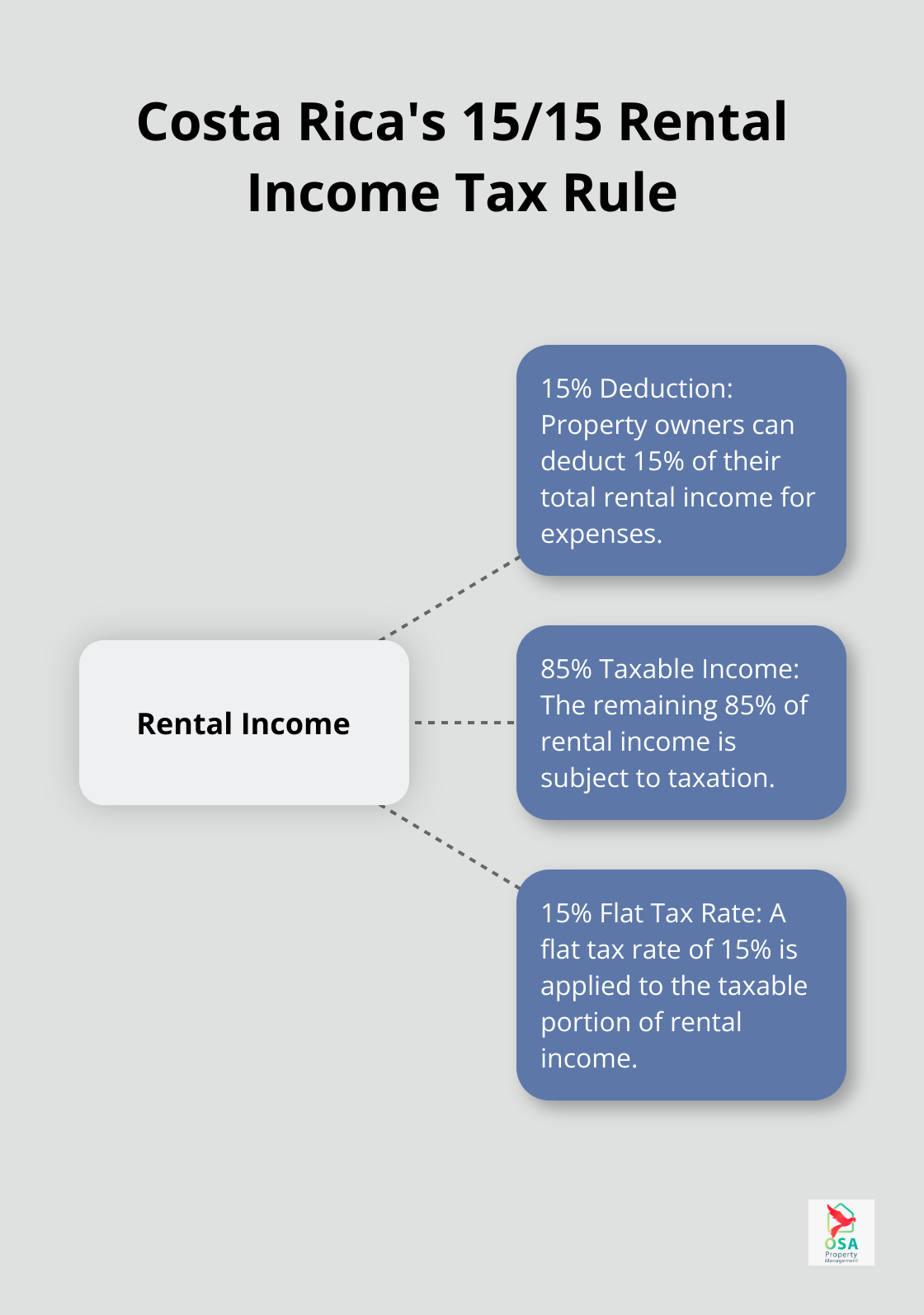

Property Management Fees

The fees you pay to property management companies are fully tax-deductible. This includes costs for tenant screening, rent collection, and property inspections. The remaining 85% of rental income is taxed at a flat rate of 15%. Some call this the 15/15 tax because you deduct 15% of rental income and pay 15% on the rest.

Utility Costs and Insurance Premiums

You can deduct utility costs for periods when your property is vacant or between tenants. This includes electricity, water, and internet bills. Insurance premiums for your property are also fully deductible.

Mortgage Interest Deductions

Mortgage interest payments on Costa Rica properties are deductible, potentially leading to significant tax savings. This deduction can substantially lower your taxable rental income.

Record-Keeping and Professional Assistance

To maximize these deductions, meticulous record-keeping is vital. Use digital tools or property management software to track all expenses throughout the year. This simplifies tax preparation and ensures you don’t miss any potential deductions.

Tax laws can change, and individual circumstances vary. While these deductions can lead to significant savings, working with a local tax professional or a knowledgeable property management company is important for optimizing your tax strategy in Costa Rica.

As we move forward, let’s explore how rental property owners can further maximize their deductions through depreciation, travel expenses, and other often-overlooked areas.

Rental Property Tax Savings Strategies

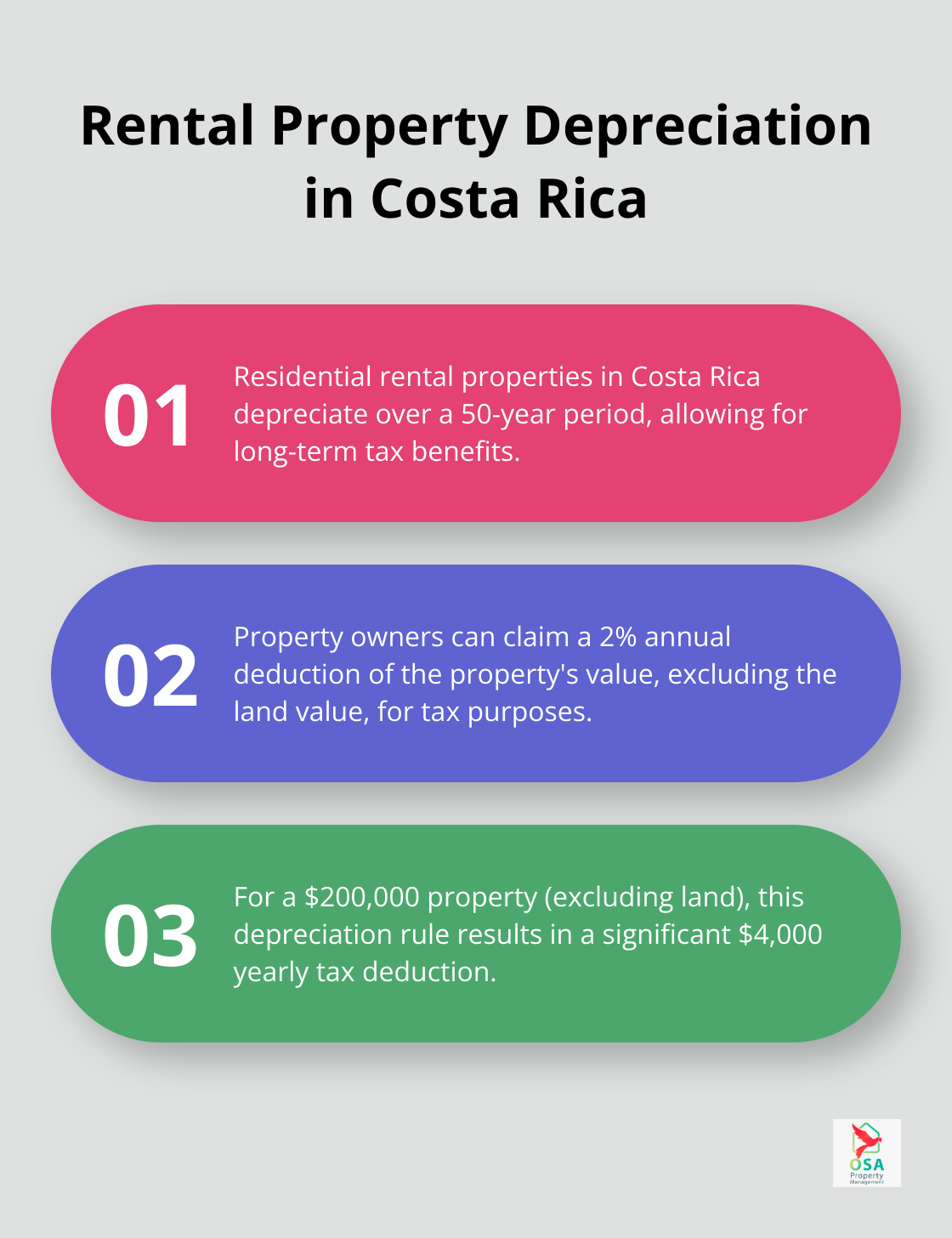

Leveraging Depreciation

Costa Rica’s tax system allows property owners to reduce their taxable income through depreciation. Residential rental properties depreciate over 50 years, enabling a 2% annual deduction of the property’s value (excluding land). For a $200,000 property (excluding land), this results in a $4,000 yearly deduction.

Furnishings and appliances in rental properties depreciate faster (typically 5-7 years). A $10,000 investment in furniture could yield an additional $1,400-$2,000 in annual deductions. Detailed records of all purchases and improvements will maximize these benefits.

Deducting Travel Expenses

Property owners can deduct travel expenses related to managing their rentals. Flights, car rentals, and accommodations for property inspections or maintenance visits qualify as deductible expenses. The primary purpose of the trip must be property-related.

For instance, if you spend seven days in Costa Rica and dedicate four days to property management activities, you can deduct 4/7 of your travel expenses. A detailed itinerary and all receipts will support your claims.

Maximizing Professional Fee Deductions

Legal and professional fees associated with your rental property are fully deductible. This includes costs for property management services, legal consultations, tax preparation, and accounting services. Smaller professional expenses also count. Fees for property inspections, energy audits, or consultations with interior designers for rental upgrades are all potentially deductible.

Strategic Marketing Investments

Marketing costs for rental properties are fully deductible. This includes expenses for professional photography, virtual tour creation, and listing fees on popular rental platforms. The cost of maintaining a website for your rental property is also deductible.

Allocate a portion of your rental income to marketing. A well-marketed property can command higher rates and achieve better occupancy, potentially offsetting the tax implications of increased income through strategic deductions.

Costa Rica’s tax laws are complex and subject to change. Work with experienced professionals (such as Osa Property Management) to maximize your deductions while remaining compliant with local regulations. A knowledgeable team will stay updated on the latest tax laws, helping you navigate the intricacies of Costa Rican property taxation effectively.

Final Thoughts

Costa Rica property owners can benefit from numerous tax deductions to maximize their investment returns. Savvy investors who take advantage of these deductions will reduce their tax burden and improve their overall investment performance. Proper documentation and meticulous record-keeping prove essential for claiming these tax deductions effectively.

The complexity of Costa Rica’s tax laws necessitates expert guidance, especially for foreign investors. Local tax professionals or property management companies offer invaluable assistance in optimizing tax strategies and identifying often-overlooked deductions. These experts stay current with the latest tax regulations to ensure full compliance while maximizing savings.

Osa Property Management specializes in helping property owners navigate these complexities. We offer comprehensive services covering marketing, maintenance, tax compliance, and accounting. Our team strives to help you make the most of available tax deductions while maintaining full compliance with local regulations.