At Osa Property Management, we often get asked about how property managers make money. The answer isn’t as straightforward as you might think.

Property managers have various income streams, ranging from standard management fees to specialized services. In this post, we’ll break down the different ways property managers generate income and explore some emerging trends in the industry.

How Property Managers Structure Their Fees

At Osa Property Management, we understand the importance of transparent fee structures in property management. Let’s explore the most common fee types you’ll encounter in the industry.

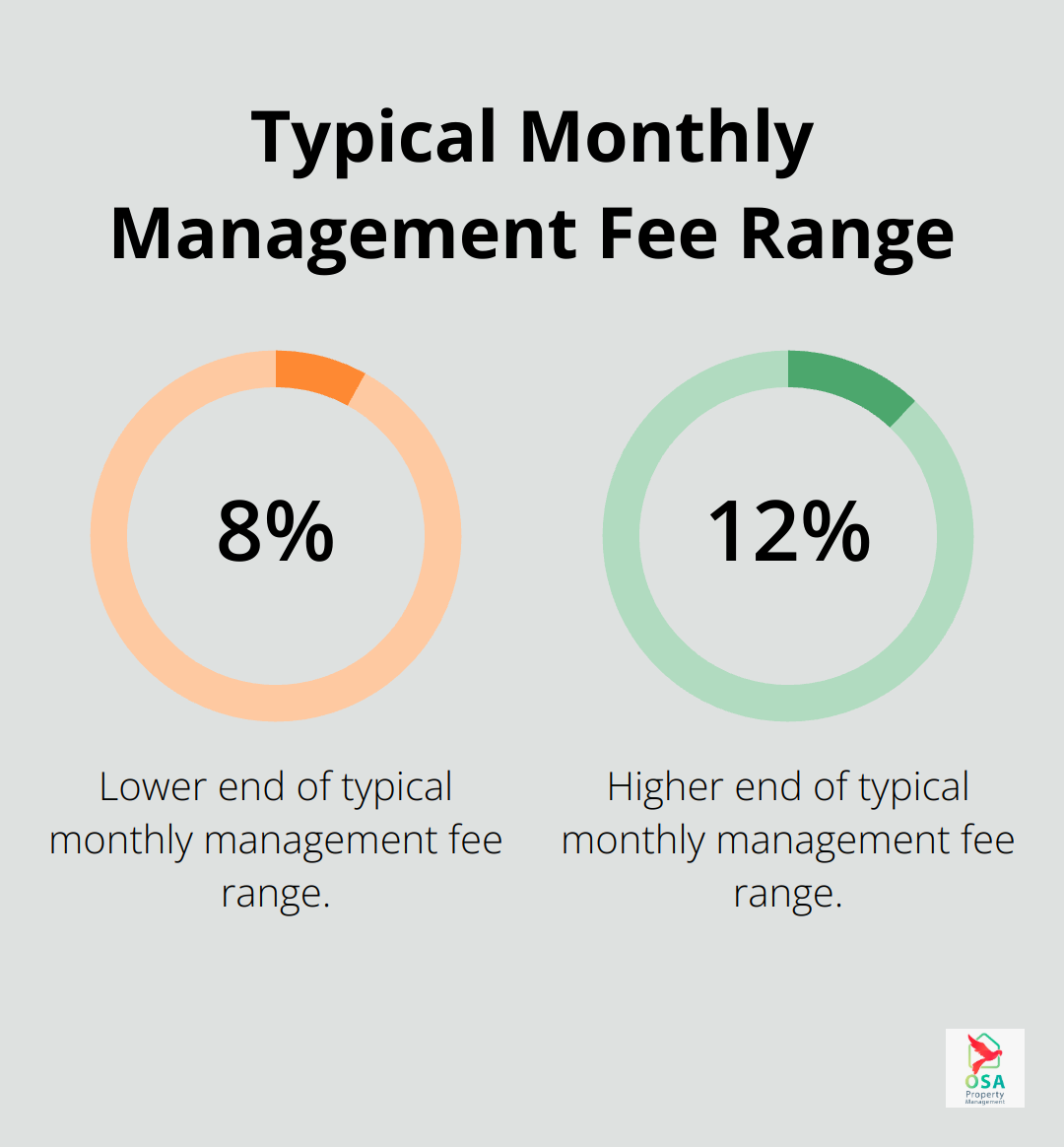

Monthly Management Fees

The cornerstone of property management income is the monthly management fee. This fee typically ranges from 8% to 12% of the monthly rent collected. For instance, a property renting at $1,500 might incur a management fee of $150 per month. These fees cover essential operations such as rent collection, tenant communication, and basic property oversight.

Leasing and Tenant Placement Fees

Finding and placing quality tenants is a valuable service that often comes with a separate fee. Leasing fees can vary, with some property managers charging between 6-8% of monthly rent for tenant placement. This fee covers property marketing, showings to potential tenants, applicant screening, and lease signing processes. Some managers opt for a flat fee for this service.

Maintenance and Repair Markups

Property managers often apply markups to maintenance and repair costs. These markups typically range from 10% to 20% on top of the actual cost of the work. For example, a plumbing repair costing $200 might result in a charge of $220 to $240 to the owner. This additional fee compensates for the time spent coordinating repairs and managing contractors.

Late Fee Collection

When tenants pay rent late, property managers usually retain a portion of the collected late fees. This portion can range from 25% to 50% of the late fee. For a $50 late fee, the property manager might keep $12.50 to $25. This practice incentivizes timely rent collection and offsets the extra work involved in pursuing late payments.

Additional Service Fees

Many property management companies offer additional services for extra fees. These may include:

- Property inspections (annual or bi-annual)

- Eviction management

- Lease renewal processing

- Bill payment and accounting services

It’s crucial to note that while these fees are standard in the industry, they can vary based on location, property type, and specific services offered. Always review management agreements carefully and ask questions about fee structures. A clear and transparent fee policy is a hallmark of reputable property management companies.

As we move forward, let’s examine additional income streams that property managers use to diversify their revenue and provide comprehensive services to property owners.

Expanding Revenue Streams in Property Management

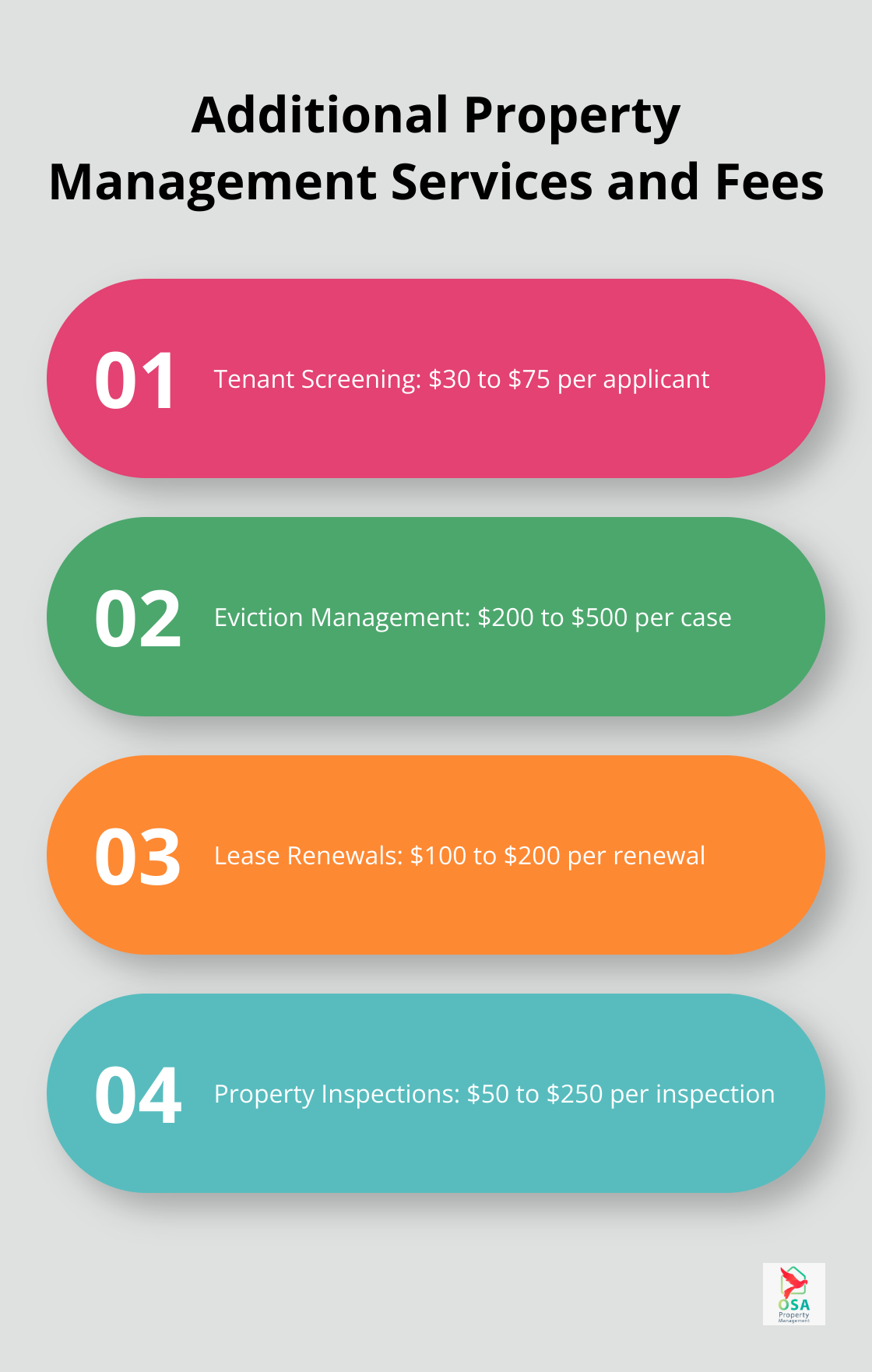

Tenant Screening and Application Fees

Property managers often charge fees for tenant screening and application processing. These fees typically range from $30 to $75 per applicant and cover the costs of background checks, credit reports, and application review time. While some jurisdictions limit these charges, they remain a standard practice in many areas. Thorough screening processes help owners secure reliable tenants, which can reduce future issues and costs associated with problematic renters.

Eviction Management Services

Evictions sometimes become necessary, and property managers may charge additional fees for handling this complex and time-consuming process. These fees often range from $200 to $500 (depending on case complexity and local regulations). This service proves particularly valuable for out-of-state property owners who might find it challenging to navigate local eviction laws and procedures.

Lease Renewal and Administrative Fees

Many property management companies charge fees for lease renewals, typically ranging from $100 to $200. These fees compensate for the time spent negotiating new terms, updating paperwork, and ensuring compliance with current regulations. Some managers also charge administrative fees for tasks like annual tax preparation or monthly statement generation (usually between $20 to $50 per month).

Property Inspection Services

Regular property inspections maintain the value of a rental property and ensure tenant compliance with lease terms. Property managers often offer inspection services, charging anywhere from $50 to $250 per inspection (depending on property size and inspection frequency). These inspections can identify maintenance issues early, potentially saving owners money on major repairs in the future.

Specialized Management Services

Property managers can further diversify their income by offering specialized services. These might include vacation rental management, short-term rental oversight, or commercial property management. The typical range of property management fees for vacation rentals is anywhere between 10% and 50% of the monthly rental income. Each of these niches requires specific expertise and can command higher fees due to the additional complexities involved.

As the property management industry evolves, managers who offer a wide range of services position themselves as valuable partners to property owners. The next section will explore how property managers can leverage technology and marketing strategies to enhance their service offerings and increase profitability.

Expanding Your Property Management Offerings

At Osa Property Management, we understand the importance of diversifying services to boost income for property managers. Let’s explore some specialized services and add-ons that can set you apart in the competitive property management landscape.

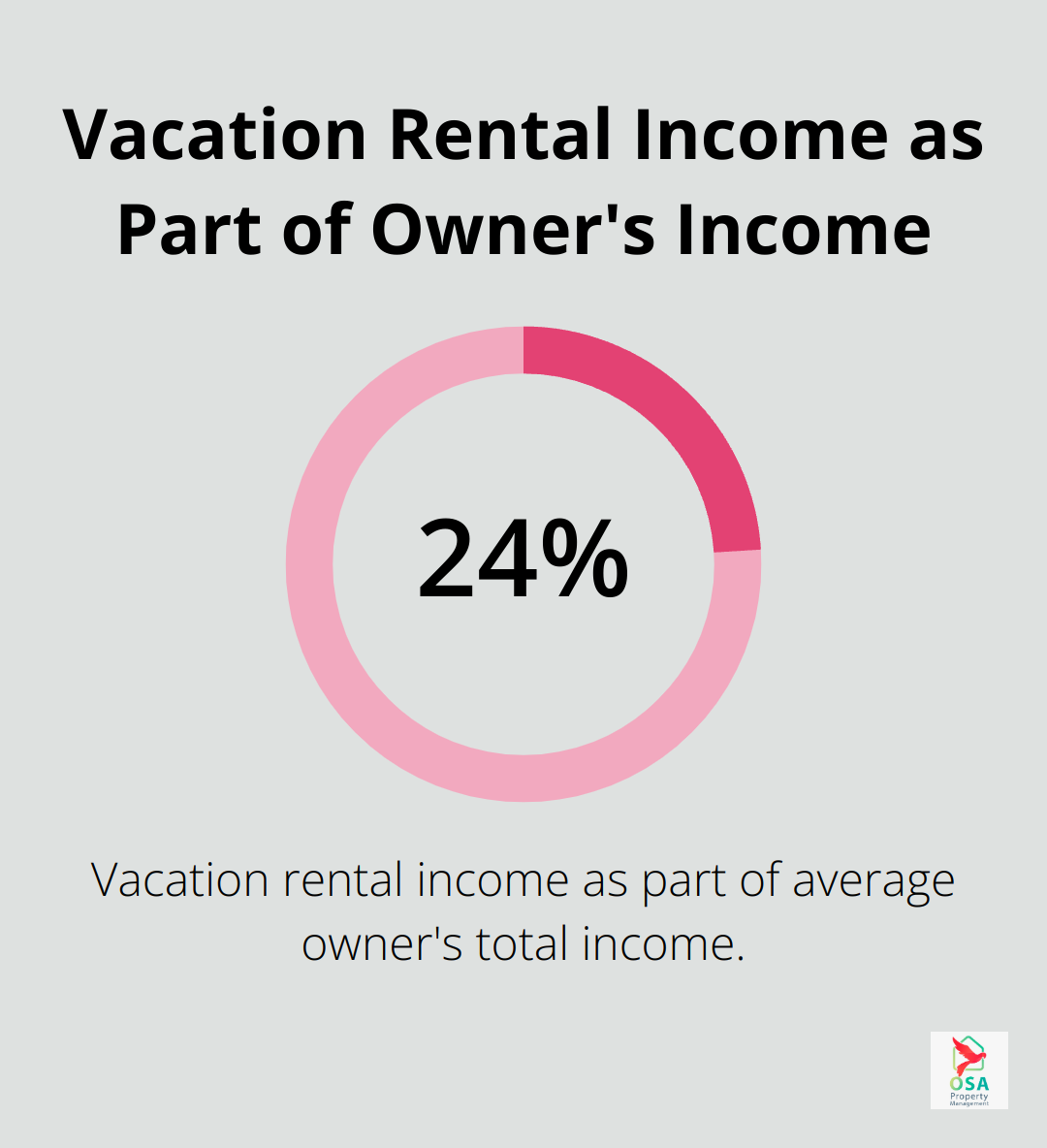

Vacation Rental Management

Vacation rental management represents a lucrative niche, especially in tourist hotspots. This service can significantly contribute to a property owner’s income, with vacation rental income comprising about 24% of the average owner’s income. Managers handle everything from dynamic pricing strategies to guest communications and turnover cleaning. Success in this area often depends on understanding local tourism trends and using technology for efficient bookings and operations.

Short-term Rental Management

The popularity of platforms like Airbnb has created a demand for short-term rental management services. This niche requires a hands-on approach, with managers often charging between 15% to 30% of rental income. Key responsibilities include frequent turnovers, responding to guest inquiries, and navigating local short-term rental regulations. Managers who excel in this area often develop relationships with cleaning services and implement smart home technology to streamline operations.

Comprehensive Financial Services

Offering advanced financial services can significantly improve a property manager’s value proposition. This extends beyond basic rent collection to include detailed financial reporting, tax preparation, and strategic financial planning for property owners. Some managers charge an additional 2-5% for these services (or a flat monthly fee). The key is to provide clear, actionable financial insights that help owners make informed decisions about their investments.

Marketing and Advertising Services

Property managers can offer specialized marketing and advertising services to help owners attract high-quality tenants or guests. This might include professional photography, virtual tours, social media management, and targeted online advertising campaigns. Managers can charge a flat fee or a percentage of the first month’s rent for these enhanced marketing efforts.

Maintenance and Renovation Coordination

Some property managers expand their offerings to include comprehensive maintenance and renovation coordination. This service involves overseeing larger projects, such as kitchen remodels or bathroom upgrades, which can significantly increase a property’s value and rental potential. Managers typically charge a percentage of the total project cost (often 10-15%) for this specialized service.

Final Thoughts

Property management encompasses diverse income streams, from monthly fees to specialized services. Managers generate revenue through management fees, leasing charges, maintenance markups, and late fee collections. They also offer additional services like tenant screening, eviction management, and property inspections to increase their value proposition and boost income.

The future of property management income lies in specialization and adaptation to market trends. Vacation rental management, short-term rental oversight, and comprehensive financial services will become increasingly important. Technology will play a key role in shaping future trends, allowing property managers to handle larger portfolios more efficiently.

Osa Property Management stays ahead of these trends, offering a wide range of services tailored to property owners in Costa Rica. Our expertise in areas like Tarcoles, Jaco, and Uvita (among others) ensures we maximize value for our clients while diversifying our own income streams. Property managers who adapt, innovate, and provide comprehensive solutions will thrive in this dynamic industry.