At Osa Property Management, we often hear the question: “How much are rental management fees?” It’s a crucial consideration for property owners looking to maximize their investment returns.

In this post, we’ll break down the factors that influence these costs and provide insights into average fee ranges across different property types.

What Are Rental Management Fees?

Fee Structures in Property Management

Rental management fees represent the costs property owners pay to professional companies for overseeing their rental properties. The industry employs various fee structures to accommodate different owner needs and property types.

Percentage-Based Fees

The most common structure involves percentage-based fees. Property managers charge 4% to 12% of the monthly rent collected, with 10% being common. For instance, a property renting for $1,200 per month might incur management fees of $48 to $144.

Flat Fee Structure

Flat fee structures offer predictability with a set monthly rate, regardless of rental income. These fees often range from $100 to $300 per month (depending on property size and included services).

Hybrid Models

Some companies offer hybrid models that combine aspects of both structures to provide flexibility and value to property owners.

Services Included in Management Fees

Standard management fees typically cover a range of essential services:

- Rent collection and processing

- Tenant screening and placement

- Regular property inspections

- Coordination of routine maintenance

- Financial reporting and record-keeping

Additional Costs to Consider

While base management fees cover many services, property owners should be aware of potential additional charges:

- Leasing fees: Often one-half to one month’s rent for securing a new tenant

- Maintenance fees: Some companies charge extra for coordinating repairs

- Eviction fees: These can average around $500 (plus legal costs if needed)

Understanding these fee structures and included services plays a key role when selecting a property management company. Transparency and tailored services should be priorities for property owners seeking management solutions.

The next chapter will explore the various factors that influence the cost of rental management fees, providing a deeper understanding of what determines these expenses.

What Drives Rental Management Costs?

Property Complexity and Size

Property complexity and size significantly impact management costs. The type of property and its size are key factors affecting rental property management costs. Larger properties or those with unique features require more time and resources to manage effectively.

Market Location Matters

Location plays a critical role in determining management fees. Properties in high-demand urban areas often command higher fees. Urban properties may have additional costs such as higher property taxes, management fees, and maintenance expenses compared to suburban properties.

Managing a vacation rental in Manuel Antonio, Costa Rica (where tourism thrives) may cost more than managing a long-term rental in a less touristy area like Tarcoles. The higher turnover rate and need for more frequent cleaning and maintenance in tourist hotspots contribute to these increased costs.

Service Level and Customization

The level of service required by property owners impacts fees. Basic management packages typically cover essentials like rent collection and maintenance coordination. However, more comprehensive services such as marketing, financial reporting, and 24/7 emergency response often come at a premium.

Customized service packages can lead to cost savings for property owners. Tailoring services to specific needs allows owners to avoid paying for unnecessary features while ensuring their properties receive the attention they require.

Occupancy Rates and Income

Occupancy rates and rental income influence management fees, especially when percentage-based fee structures apply. Properties with higher occupancy rates and rental incomes may result in larger management fees in absolute terms, but they often represent a better value due to the increased revenue generated.

Some property management companies offer tiered fee structures based on occupancy rates or rental income. This approach can incentivize managers to maximize property performance while providing potential cost savings for owners during periods of lower occupancy.

These factors shape the landscape of rental management fees. Property owners who consider these elements and discuss them openly with potential management companies can find a service that offers the best value for their specific property and circumstances. In the next section, we’ll explore the average rental management fee ranges across different property types to provide a clearer picture of what owners can expect.

What Are Typical Rental Management Fee Ranges?

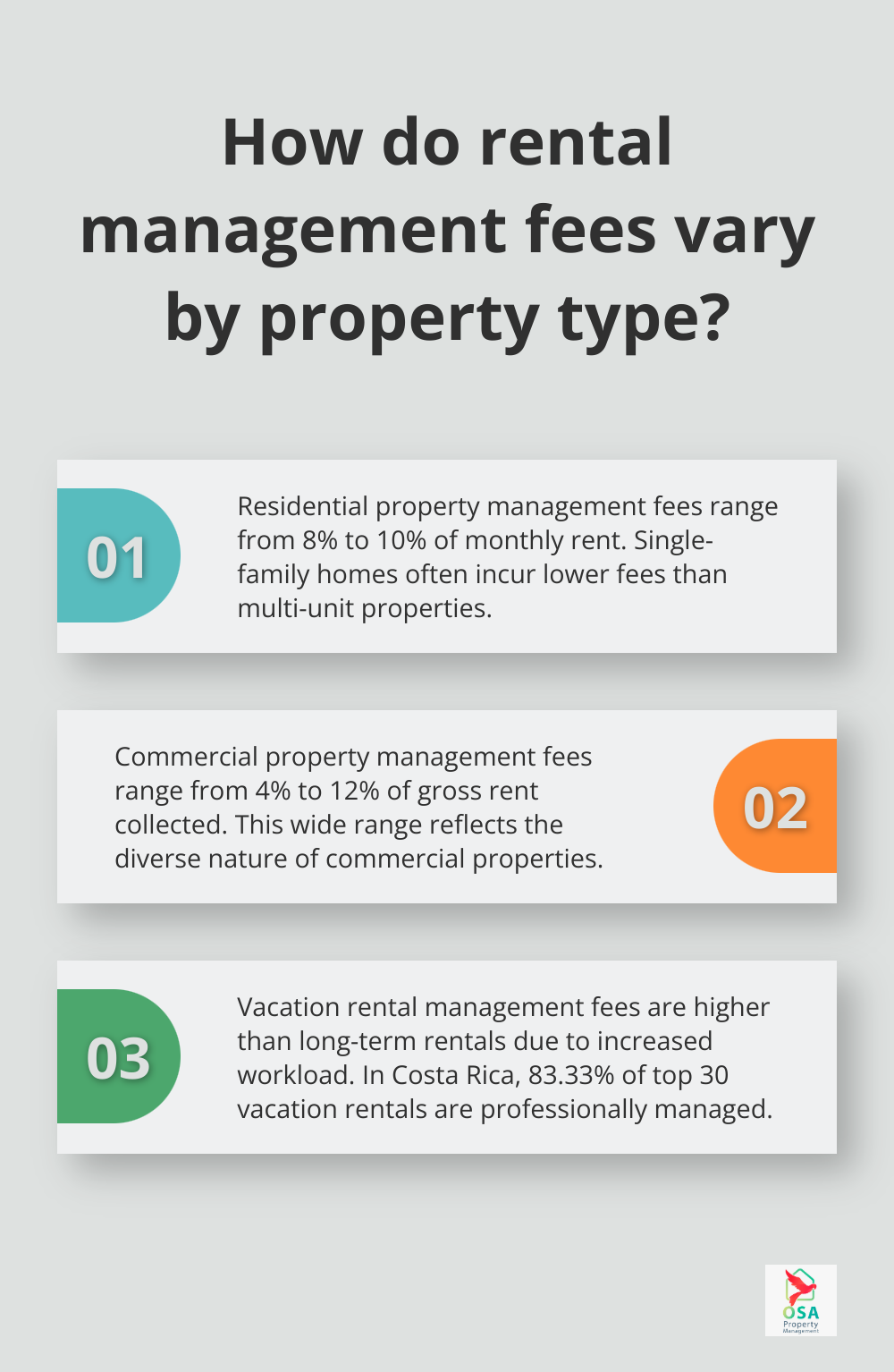

Residential Property Management Fees

Residential property management fees typically range from 8% to 10% of the monthly rent collected. This range varies based on location and property type. Single-family homes often fall on the lower end, while multi-unit properties might incur higher fees due to increased complexity. For instance, a single-family home renting for $1,000 per month might have a management fee of $80 to $100.

Commercial Property Management Fees

Commercial properties command higher management fees due to their complexity. Fees for these properties often range from 4% to 12% of the gross rent collected. This wide range reflects the diverse nature of commercial properties (from small retail spaces to large office buildings). A small retail space generating $3,000 in monthly rent might incur a management fee of $120 to $360. Larger properties or those requiring more intensive management could see fees at the higher end of the spectrum.

Vacation Rental Management Fees

Vacation rental management fees exceed those for long-term rentals, reflecting the increased workload associated with frequent turnovers and guest services. In Costa Rica, 83.33% of the top 30 vacation rentals are managed by professional property management companies or hosts who oversee multiple properties. This high percentage indicates the prevalence and importance of professional management in the vacation rental market.

Additional Fees to Consider

While the base management fee covers many services, property owners should know about potential additional charges:

- Leasing or tenant placement fees: Often equivalent to 50-100% of one month’s rent.

- Maintenance fees: Some companies charge a markup on maintenance costs (typically 10-20%).

- Vacancy fees: A flat fee during periods when the property remains unoccupied, usually ranging from $50 to $100 per month.

- Eviction fees: Can range from $500 to $1,000, not including legal costs.

- Renewal fees: Some managers charge for lease renewals, often 25-50% of one month’s rent.

Property owners should discuss these potential additional fees with their property manager upfront. Companies like Osa Property Management believe in transparency and work to create customized packages that align with their clients’ needs and budgets.

Final Thoughts

Rental management fees vary based on property type, location, and service level. Residential properties typically incur fees between 8% to 10% of monthly rent, while commercial properties range from 4% to 12%. Vacation rentals often command higher fees due to increased management demands. Additional charges like leasing fees, maintenance markups, and vacancy fees can impact overall costs.

The question “How much are rental management fees?” requires more than a simple comparison of numbers. Property owners must evaluate the services provided against the costs. A higher fee might offer better value if it includes comprehensive services that save time and maximize property performance. Conversely, a lower fee could lead to hidden costs or subpar management.

Choosing the right property management company involves experience, local market knowledge, and a track record of success. Osa Property Management offers tailored solutions for property owners in Costa Rica. Transparency in fee structures and willingness to customize services are also key factors to consider when selecting a management partner.