At Osa Property Management, we understand that property owners often wonder: How much does it cost for property management?

The answer isn’t always straightforward, as fees can vary widely based on several factors.

In this post, we’ll break down the different types of property management costs, explain what services are typically included, and highlight some hidden expenses you should be aware of.

What Are Property Management Fee Structures?

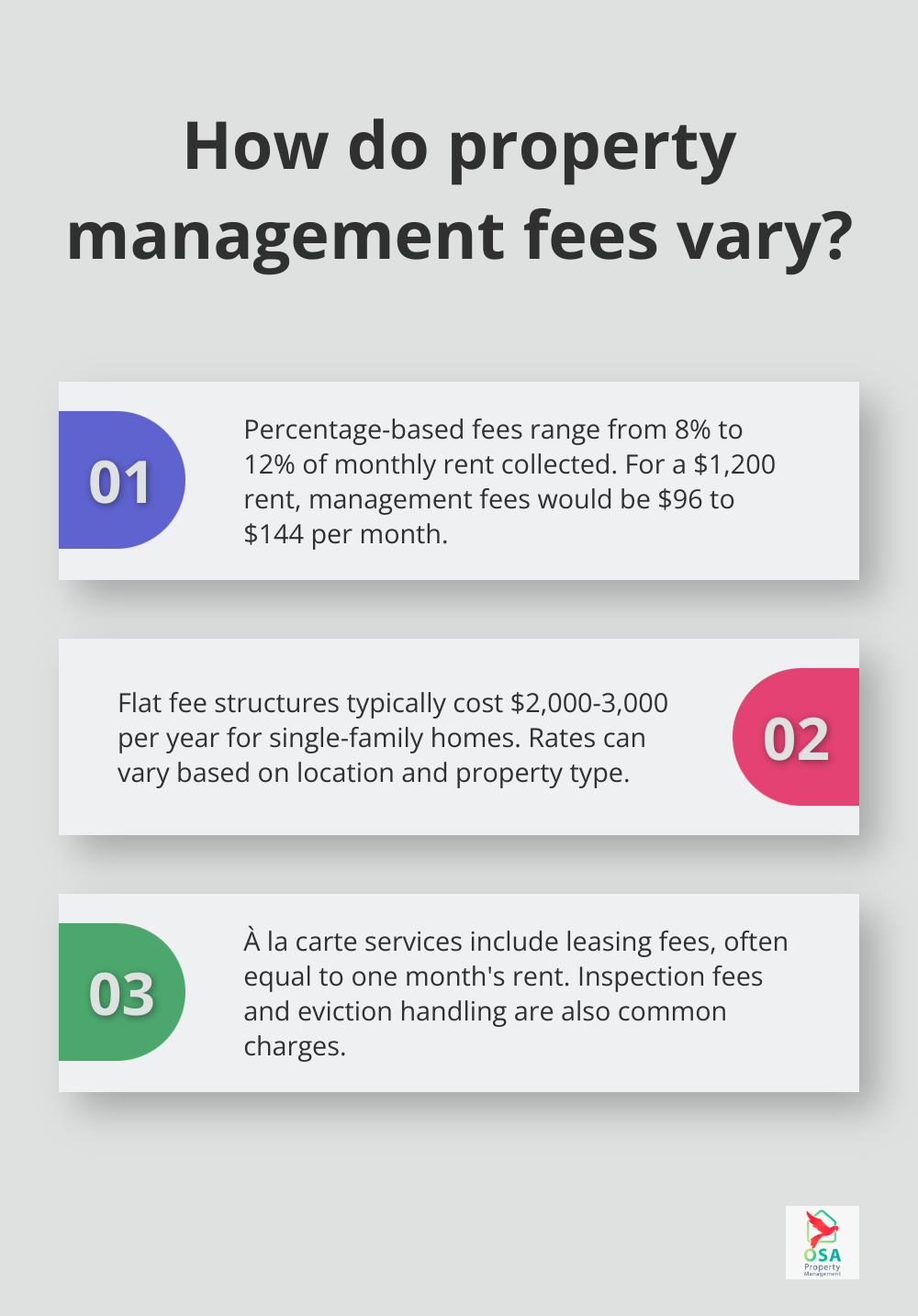

Percentage-Based Fees

Property management companies often use percentage-based fees as their primary pricing model. Most property management companies charge a monthly fee of between 8% – 12% of the monthly rent collected. For example, if the rent on your home is $1,200 per month, the management fee would range from $96 to $144. This structure aligns the property manager’s interests with the owner’s, as they earn more when the property generates higher rent.

Flat Fee Structure

Some companies prefer a flat fee model. This approach can benefit high-value properties but may prove less cost-effective for lower-rent units. Flat fees for single-family homes typically cost about $2,000-3,000 per year per property. However, these rates can vary significantly based on location and property type (urban areas often command higher fees than rural locations).

À La Carte Services

The à la carte model allows property owners to pay for specific services as needed. While this may appear cost-effective initially, fees can accumulate quickly. Common à la carte charges include:

- Leasing fees (often equivalent to one month’s rent)

- Inspection fees

- Eviction handling

Factors Influencing Management Costs

Several factors impact property management fees:

- Property Type: Single-family homes typically incur lower fees compared to multi-unit properties or commercial real estate. The complexity of managing multiple units or dealing with commercial tenants justifies higher fees.

- Location: Urban areas with higher property values and rents often see higher management fees. For instance, managing a property in San José, Costa Rica, might cost more than in a smaller town like Uvita.

- Scope of Services: Full-service management (including marketing, maintenance coordination, and financial reporting) commands higher fees than basic rent collection services.

- Property Condition: Older properties or those requiring frequent maintenance may incur higher management fees due to the increased workload.

When selecting a property management company, property owners should look beyond the base fee. They should consider the value provided, the company’s track record, and their local market knowledge. While some companies might offer lower rates, experienced firms (such as Osa Property Management with its 19 years of experience in Costa Rica) often provide superior value and peace of mind for property owners.

Property owners should also factor in potential savings from professional management. Effective tenant screening, timely maintenance, and expert marketing can lead to higher occupancy rates and rental income, potentially offsetting management costs.

As we move forward, let’s examine the specific services included in property management fees and how they contribute to the overall cost structure.

What Services Do Property Managers Provide?

At Osa Property Management, we offer a comprehensive suite of services designed to make property ownership as stress-free as possible. Let’s explore the core services that property managers typically provide and how they contribute to the overall cost of management.

Tenant Screening and Placement

Finding the right tenants is essential for the success of your rental property. Property managers use rigorous screening processes to evaluate potential tenants, including credit checks, employment verification, and rental history reviews. A study by TransUnion indicates that the majority of property management companies have been affected by fraud. This service often comes with a separate fee, typically ranging from 50% to 100% of the first month’s rent.

Rent Collection and Financial Reporting

Consistent rent collection forms the foundation of your rental property investment. Property managers handle this task efficiently, often using online payment systems that make it easy for tenants to pay on time. They also provide detailed financial reports, giving you a clear picture of your property’s performance. Professional management can help with upkeep, taking tenant calls, collecting rent, and enforcing leases.

Maintenance and Repairs

Maintaining your property in top condition is vital for tenant satisfaction and long-term property value. Property managers coordinate routine maintenance and handle emergency repairs, often leveraging relationships with trusted contractors to secure competitive rates. On average, professionally managed properties spend 20% less on maintenance costs due to preventative measures and bulk discounting from service providers.

Legal Compliance and Eviction Handling

Navigating the complex landscape of landlord-tenant laws can challenge many property owners. Property managers stay up-to-date with local regulations, ensuring your property remains compliant. In the unfortunate event of an eviction, they handle the process professionally and legally. The cost for eviction services can range from $500 to $3,000 (depending on the complexity of the case and local laws).

Marketing and Advertising

Effective marketing is key to minimizing vacancy periods and attracting quality tenants. Property managers employ various strategies to showcase your property, including professional photography, virtual tours, and targeted online listings. These efforts often result in faster tenant placement and potentially higher rental rates.

While the services provided by property managers offer significant value, it’s important to understand that additional costs may arise beyond the standard management fee. In the next section, we’ll explore some of these hidden costs and additional expenses that property owners should consider when budgeting for professional management services.

The Hidden Costs of Property Management

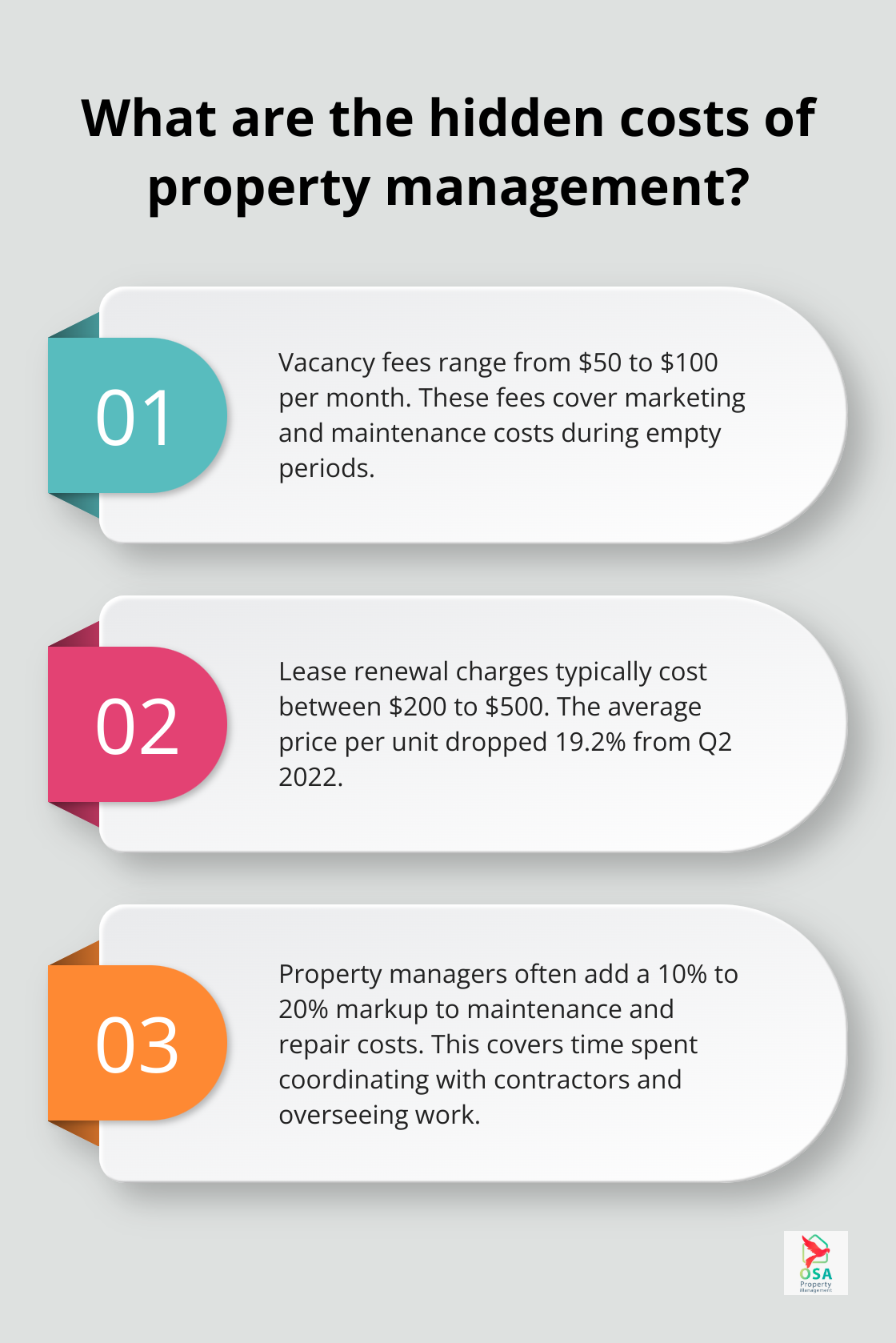

Vacancy Fees

Some management companies charge vacancy fees when your property remains unoccupied. These fees (typically $50 to $100 per month) cover marketing and maintenance costs during empty periods. To reduce this expense, select a management company with a strong record of swift tenant placement.

Lease Renewal Charges

Many property managers impose a lease renewal fee when tenants extend their stay. This fee (often $200 to $500) compensates for time spent on negotiations and paperwork. While it may seem unnecessary, it proves more cost-effective than finding new tenants. The average price per unit dropped 19.2% from Q2 2022.

Maintenance Markup

Property management companies commonly add a 10% to 20% markup to maintenance and repair costs. This covers the time spent coordinating with contractors and overseeing work. Although this increases maintenance expenses, professional management often results in more efficient and cost-effective repairs long-term.

Marketing and Advertising Expenses

While basic marketing often falls under the standard fee, premium advertising options may incur additional costs. These might include professional photography, virtual tours, or targeted online ads. High-quality marketing can significantly impact property value and rental potential.

Inspection Fees

Some management companies charge for routine property inspections. These inspections (usually conducted quarterly or bi-annually) help identify maintenance issues early and ensure tenants comply with lease terms. Fees for this service can range from $50 to $250 per inspection. Regular inspections play a vital role in maintaining the condition and value of any rental property.

Final Thoughts

Property management costs vary, but typically range from 8% to 12% of monthly rent. Additional charges for services like tenant placement and maintenance coordination reflect the comprehensive nature of professional management. Property owners must look beyond the base fee to understand the true value provided by experienced managers.

The cost of property management often leads to higher occupancy rates and better tenant quality. Transparency in fee structures, a proven track record, and comprehensive service offerings are key factors to consider when selecting a management company. Property owners should inquire about tenant screening processes, maintenance procedures, and financial reporting capabilities.

Osa Property Management understands the unique challenges of managing properties in Costa Rica. With 19 years of experience in areas like Tarcoles, Jaco, Dominical, Manuel Antonio, Ojochal, and Uvita, we offer tailored solutions to meet each property owner’s needs. Our expertise ensures your property receives capable management, providing peace of mind and potential for increased returns.