At Osa Property Management, we often field questions about the typical cost for property management services. Understanding these expenses is crucial for property owners considering professional management.

Property management fees can vary widely based on several factors, including location, property type, and the scope of services required. In this post, we’ll break down the common fee structures and additional costs associated with property management, helping you make an informed decision for your investment.

Common Property Management Fee Structures

Percentage-Based Fees

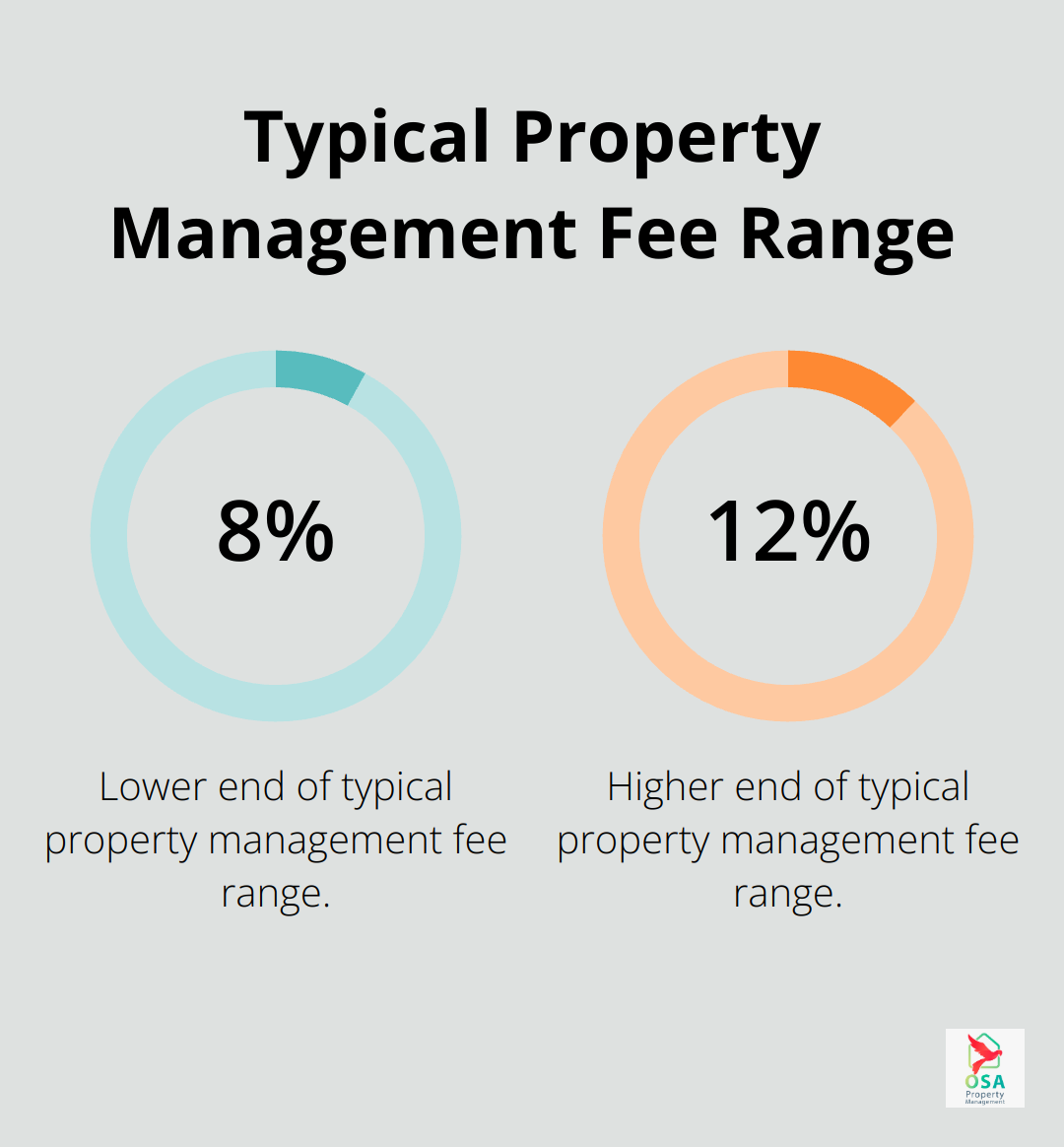

The most prevalent fee structure in property management is the percentage-based model. Property managers typically charge between 8% to 12% of the monthly rent collected. This model aligns the property manager’s interests with yours – they earn more when your property generates higher rent. Rates can vary significantly based on location and property type. In high-cost areas like San Francisco or New York City, rates may reach up to 10% due to complex local regulations and higher operational costs.

Flat Rate Fees

Some property management companies prefer a flat rate fee structure. This approach offers simplicity and predictability. Fixed fees for single-family homes typically average around $100 to $200 per month, though this varies widely depending on the market and services provided.

Flat rate fees can benefit properties with higher rental incomes, as the fee doesn’t increase proportionally with the rent. However, for lower-rent properties, this structure might represent a higher percentage of the income.

À La Carte Services

An increasingly popular option is the à la carte model, where property owners select specific services they need. This can include tenant placement, rent collection, maintenance coordination, or financial reporting. While this approach offers flexibility, costs can add up quickly if you require multiple services.

Tenant placement fees often range from 50% to 100% of one month’s rent (covering marketing, screening, and lease preparation). Maintenance coordination might involve a markup on vendor invoices.

Factors Influencing Costs

Several factors affect the cost of property management services:

- Property type and size: Managing a multi-unit apartment building is typically more complex than overseeing a single-family home.

- Property condition and location: Older properties or those in areas with strict rental regulations often require more intensive management.

- Market competition: In areas with many property management companies, you might find more competitive rates. Conversely, in regions with fewer options, prices may be higher.

Transparency in fee structures builds trust with property owners. We recommend discussing all potential fees upfront, including any additional charges for services like inspections, evictions, or lease renewals. This approach allows property owners to accurately budget for management costs and avoid unexpected expenses.

As you consider these fee structures, it’s important to also understand the additional costs that may come with property management. Let’s explore these in the next section.

What Are the Hidden Costs of Property Management?

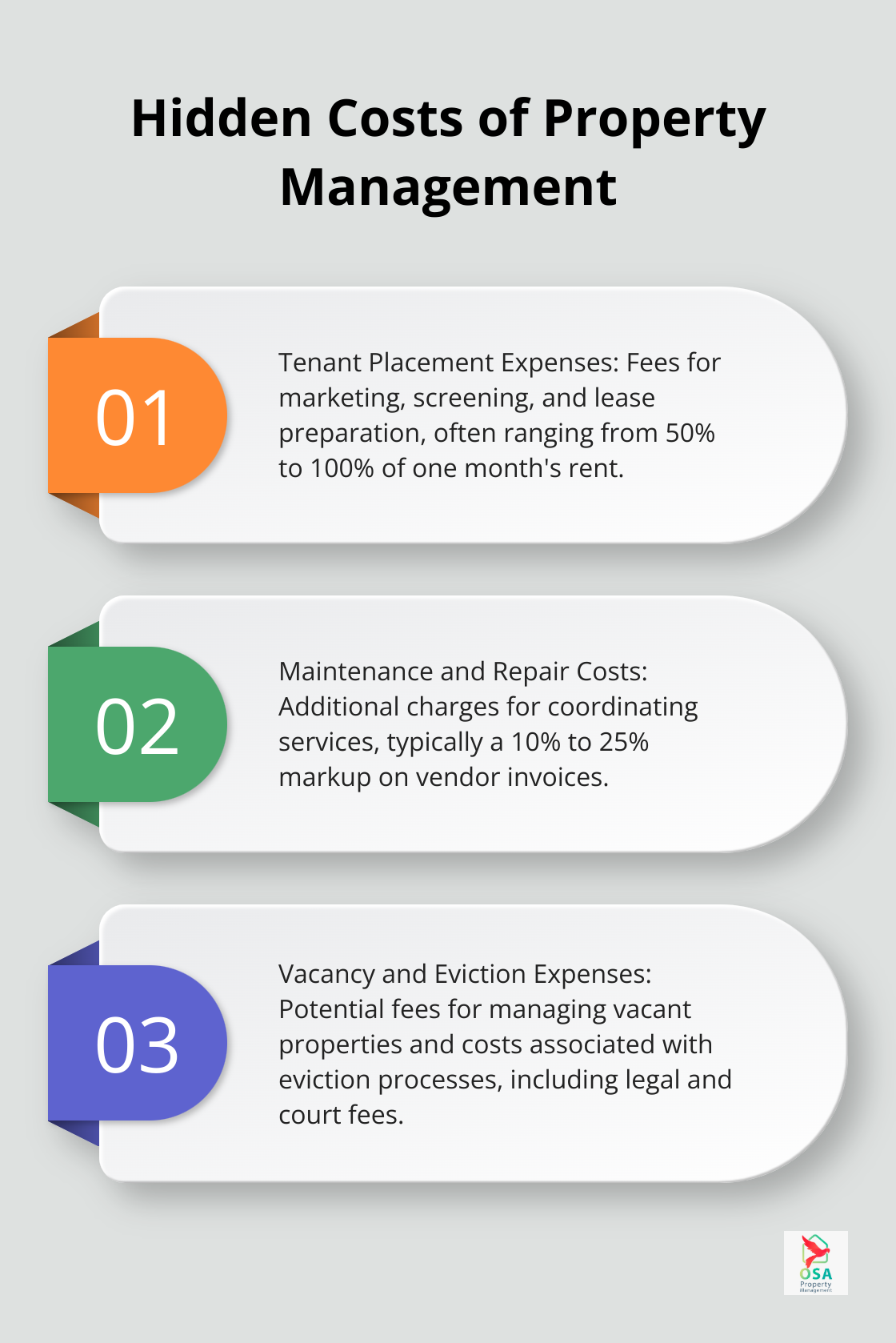

Property management involves more than just basic fees. We want to highlight some additional costs that property owners might encounter.

Tenant Placement Expenses

Finding quality tenants is key for rental property success. Many management companies charge a tenant placement fee. Generally, property management companies charge between $100 and $200 per month. It’s common for them to get paid by percentage of the monthly rent price, or by a flat fee. This fee covers property marketing, tenant screening, and lease preparation. While it may seem high, the value of a reliable tenant who pays on time and cares for your property often outweighs the cost.

Maintenance and Repair Costs

Regular maintenance preserves property value and keeps tenants happy. While routine maintenance might be included in your management fee, larger repairs often incur extra costs. Property managers usually add a 10% to 25% markup on vendor invoices for coordinating these services. This markup compensates for the time spent finding reliable contractors and overseeing the work.

Vacancy and Eviction Expenses

Vacancies can drain resources, and some management companies charge a vacancy fee to cover extra work during these periods (such as more frequent property inspections). Eviction costs for landlords can include legal fees, court filing fees and expenses for repairing or cleaning the property after a tenant leaves. It’s important to discuss how these situations are handled and what fees apply before signing a management contract.

Marketing and Advertising Costs

Effective marketing minimizes vacancy periods. While basic listing services might be included in your management fee, premium advertising options often come at an additional cost. These might include professional photography, virtual tours, or targeted social media campaigns. The investment in high-quality marketing can result in faster tenant placement and potentially higher rental rates, which may offset the initial expense.

Lease Renewal Fees

Some property management companies charge a fee when existing tenants renew their leases. This fee covers the administrative work involved in updating lease agreements and potentially negotiating new terms. While not all companies charge this fee, it’s worth asking about during your initial discussions.

Understanding these additional costs helps you budget more accurately for property management services. Clear, upfront information about all potential expenses ensures you can make informed decisions about your investment properties. As we move forward, let’s examine how these costs stack up against the benefits of professional property management.

Is Hiring a Property Manager Worth the Cost?

Time Savings: A Valuable Asset

Property management demands significant time investment. The National Association of Residential Property Managers (NARPM) reports that landlords dedicate an average of 20 hours per month to manage a single property. For busy professionals or those with multiple properties, this commitment can become overwhelming.

Professional property managers handle everything from tenant screening to maintenance calls. This frees up your time for other pursuits. The time savings prove particularly valuable for out-of-state investors or those with full-time careers outside of real estate.

Maximizing Rental Income

Professional property managers possess the expertise and market knowledge to optimize your rental income. They conduct comprehensive market analyses to set competitive rental rates, which can increase your property’s profitability.

Property management statistics reveal insights into the largest companies, management fees, services provided, and the number of properties managed. Property managers also reduce vacancy periods through effective marketing and quick turnarounds between tenants, further boosting your bottom line.

Navigating Legal Complexities

The legal landscape of property management presents complex challenges. Property managers stay current with local, state, and federal regulations, which helps you avoid costly legal mistakes. Their expertise covers fair housing laws, eviction procedures, and other critical areas.

Fair housing violations can result in civil penalties of up to $23,011 for a first violation, increasing to $115,054 for third violations in cases tried before a HUD Administrative Law Judge. Property managers’ knowledge in this area can save you from such expensive pitfalls. Their familiarity with local ordinances and state laws (which often change) ensures your property remains compliant, protecting your investment and reputation.

The Value of Professional Tenant Management

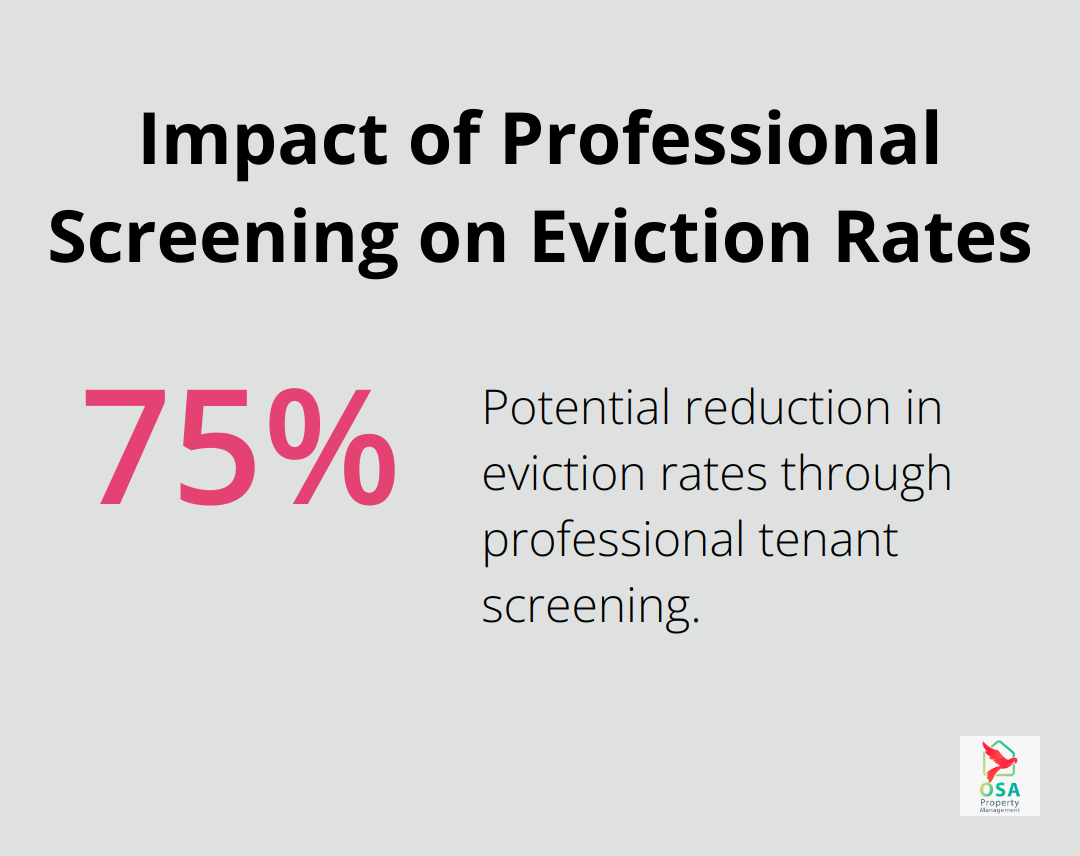

Finding and retaining quality tenants plays a key role in the success of your rental property. Professional property managers employ refined screening processes that extend beyond basic credit checks. They verify employment, check references, and conduct thorough background checks to secure reliable tenants.

Property managers also handle all aspects of tenant relations, from move-in to move-out. This professional buffer can prove invaluable in maintaining positive landlord-tenant relationships while enforcing lease terms. According to a report by TransUnion, professional screening can reduce eviction rates by up to 75%, saving you the stress and expense of the eviction process.

Cost-Benefit Analysis

While property management services come with costs, the benefits often outweigh the expenses for many property owners. The time saved, potential for increased rental income, reduced legal risks, and professional tenant management can result in a more profitable and stress-free investment experience.

Final Thoughts

The typical cost for property management ranges from 8% to 12% of monthly rent for percentage-based fees, or $100 to $200 per month for flat-rate structures. Additional expenses such as tenant placement fees, maintenance costs, and potential vacancy charges should factor into your budget. Professional property management often provides value beyond these numbers through time savings, increased rental income potential, and reduced legal risks.

We recommend thorough research and comparison when selecting a property management company. Look for companies with a proven track record, positive client testimonials, and transparent fee structures. Ask detailed questions about their services, communication practices, and how they handle various scenarios like maintenance emergencies or tenant disputes.

Osa Property Management offers customized service packages tailored to your specific needs in Costa Rica. Our comprehensive services cover marketing, tenant relations, bill payment, and tax compliance. Our insured team of professionals manages all aspects of property management to maximize your investment’s potential and provide peace of mind.