At Osa Property Management, we understand the importance of staying informed about your Costa Rica property’s value. Regular property valuation is key to making informed decisions about your investment.

Fluctuations in the Costa Rican real estate market can significantly impact your property’s worth. This blog post will guide you through the factors affecting property values and how often you should reassess your investment.

What Drives Costa Rica Property Values?

Economic Conditions and Market Trends

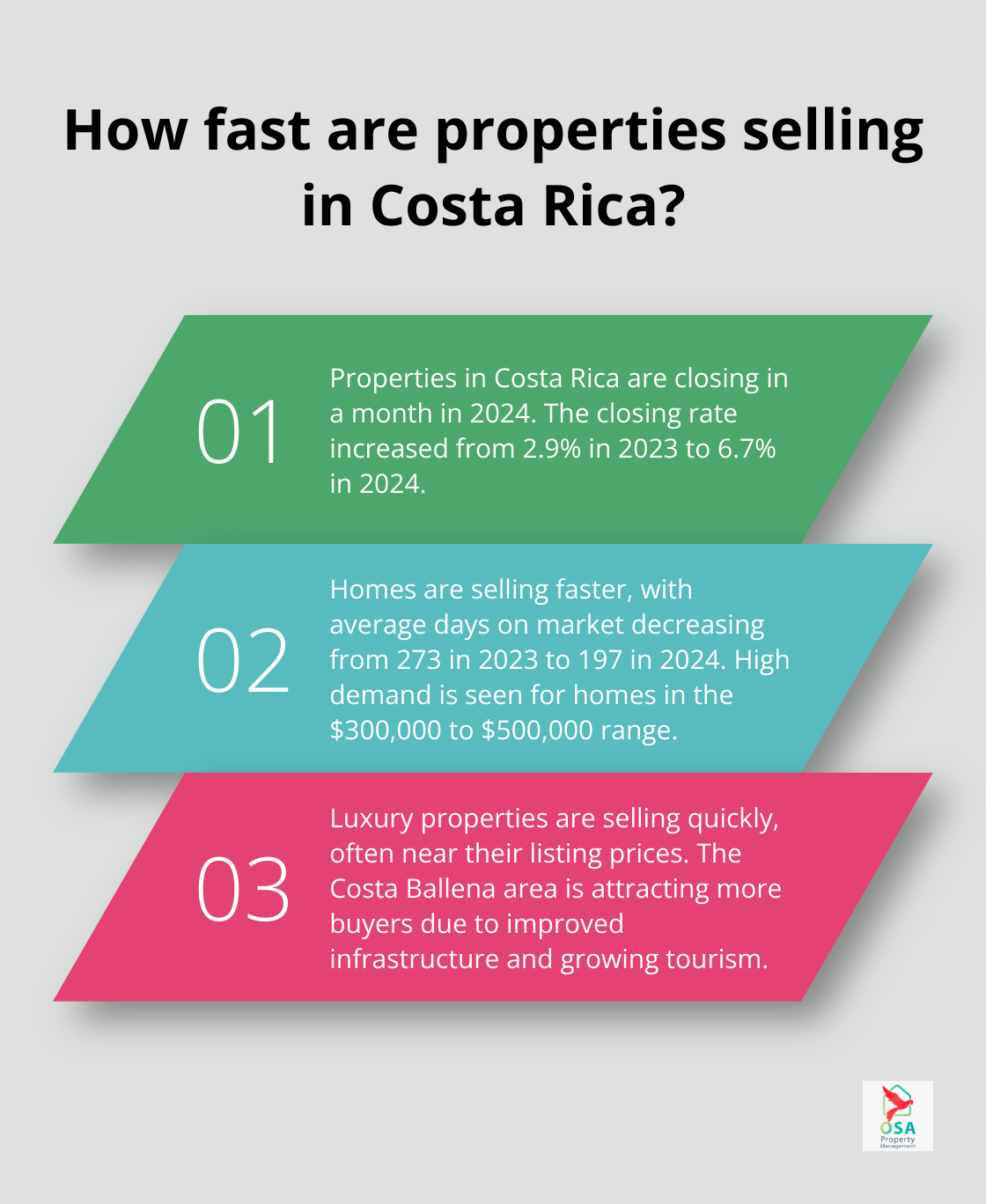

Costa Rica’s real estate market responds dynamically to various economic factors. In 2024, properties are closing in a month, up from 2.9% in 2023 to 6.7% in 2024. Homes are also selling faster, from 273 days in 2023 to 197 days in 2024. This surge indicates high demand, especially for homes in the $300,000 to $500,000 range. Luxury properties also sell quickly, often near their listing prices.

Global economic conditions influence the market significantly. The potential decrease in US mortgage rates could boost Costa Rica’s real estate sector by making property purchases more accessible to foreign buyers.

Local Development and Infrastructure

Infrastructure improvements enhance property values in specific regions. The Costa Ballena area, for example, attracts more buyers due to improved infrastructure, increasing tourism numbers, and growing interest in Costa Rica as a haven for relocation and investment. These developments improve quality of life and increase the appeal to potential buyers and renters.

Tourism Patterns

Costa Rica’s thriving tourism industry directly affects property values, particularly for short-term rentals and hospitality-related properties. The growth in tourism makes these investments increasingly profitable. Properties with ocean views or prime locations (often favored by tourists) command higher prices and sell quickly.

Environmental Factors

Costa Rica’s natural beauty attracts many property buyers. However, environmental events can impact property values both positively and negatively. Areas prone to flooding or landslides may see decreased values, while properties in well-preserved natural settings often appreciate. Property owners should stay informed about environmental risks and conservation efforts in their area.

Market Volatility and External Influences

The Costa Rican property market responds to international events and economic shifts. For instance, the ongoing US presidential elections impact investor attention and could slow down real estate activity until results finalize. Many investors reassess priorities during election years, which historically leads to market slowdowns in Costa Rica’s real estate sector.

Understanding these driving factors helps property owners make informed decisions about their investments. The next section will explore how often you should reassess your property’s value based on these dynamic market conditions.

How Often Should You Reassess Your Costa Rica Property?

Regular reassessment of your Costa Rica property’s value is essential for informed investment decisions. The frequency of these evaluations depends on several factors, which we’ll explore in this chapter.

Annual Reassessment for Investment Properties

Investment properties require annual reassessments. The Costa Rica real estate market changes rapidly, as shown by the 12.08% year-on-year increase in apartment prices in San José in June 2024, averaging at $2,343/sqm. This dynamic market demands frequent evaluations to maximize investment potential.

Biennial Evaluation for Vacation Homes

Vacation homes typically need less frequent reassessments. A biennial (every two years) evaluation often suffices for these properties. However, if your vacation home is in a high-demand area like Costa Ballena, where infrastructure improvements have increased appeal, you might consider annual reassessments.

Triggers for More Frequent Reassessments

Certain events or changes might necessitate more frequent property value reassessments:

- Major local developments: A new resort, shopping center, or infrastructure project near your property warrants a reassessment.

- Significant market shifts: Potential changes in mortgage rates could dramatically impact Costa Rica’s real estate market, requiring immediate property value reviews.

- Natural events: Costa Rica’s environment can affect property values. Significant environmental changes in your area should prompt a reassessment.

- Tourism trend changes: With short-term rentals becoming increasingly lucrative, shifts in tourism patterns should trigger a reassessment (especially for properties in prime locations).

Staying Informed About Local Market Conditions

To make timely decisions about reassessments, stay informed about local market conditions:

- Follow local real estate news and reports.

- Network with local real estate professionals. They often possess the most up-to-date information on market shifts.

- Monitor nearby property sales. If similar properties in your area sell quickly or at higher prices, it’s time for a reassessment.

- Keep an eye on local development plans. These can significantly impact property values.

Reassessing your property value isn’t just about potential price increases. It also protects your investment. If market conditions are unfavorable, knowing your property’s current value can help you make strategic decisions about holding, selling, or investing in improvements.

While these guidelines provide a general framework, every property is unique. Professional property management services can provide personalized advice on when and how to reassess your property value.

In the next chapter, we’ll explore various methods for reassessing your Costa Rica property value, including professional appraisals and comparative market analyses.

How to Accurately Value Your Costa Rica Property

Professional Appraisal Services

Certified appraisers provide the most reliable property value assessments. These professionals use standardized methods to evaluate properties, considering factors like location, size, condition, and recent comparable sales. In Costa Rica, appraisal fees typically range from $300 to $1,000, depending on the bank and how complete the appraisal is. This investment proves worthwhile for high-value properties or when accuracy is paramount (such as for legal proceedings or mortgage applications).

Comparative Market Analysis (CMA)

A CMA offers a less formal but effective valuation method. This approach compares your property to similar recently sold properties in the area in terms of size, location, and features. Real estate agents often provide this service for free or at a nominal cost. To conduct a basic CMA yourself:

- Research recent sales of properties similar to yours in size, location, and features

- Adjust for differences in amenities or condition

- Calculate an estimated value based on these comparisons

For example, if a comparable property sold for $300,000 but has an extra bedroom, you might subtract $20,000-$30,000 from that price for your valuation.

Online Valuation Tools

Online tools can provide quick property value estimates. However, these tools often lack accuracy in the Costa Rica market due to limited data and unique local factors. Use them as a starting point, but avoid relying on them for critical decisions. Some popular international platforms don’t operate in Costa Rica, so look for local alternatives. These tools might not account for recent infrastructure improvements or changes in tourism patterns that significantly impact property values in areas like Costa Ballena.

Consulting Local Real Estate Experts

Local real estate agents possess invaluable knowledge about market trends and property values in specific areas. They can provide insights that online tools or general appraisers might miss. For instance, an agent specializing in the Uvita area would know how recent tourism growth has affected property values there. When consulting an agent, ask about their experience in your specific area and request examples of recent sales they’ve handled.

Combining Methods for Accuracy

For the most accurate valuation, we recommend using a combination of these methods. Start with online research and a basic CMA. Then, consult a local real estate expert for their insights. If you plan to make a significant financial decision based on the valuation, consider investing in a professional appraisal for the most reliable results.

Property valuation in Costa Rica can present complexities due to factors like varying infrastructure quality, tourism trends, and environmental considerations. Regular reassessments using these methods will help you stay informed about your property’s changing value in this dynamic market.

Final Thoughts

Property valuation in Costa Rica requires regular reassessment due to the dynamic real estate market. Economic conditions, tourism trends, and local developments influence property values, making it essential for owners to monitor their investments. Accurate valuations enable strategic decisions about rental income optimization, potential sales, or property improvements.

Osa Property Management offers expert assistance with professional property valuations in Costa Rica. Our team leverages extensive knowledge of local market conditions and trends to provide accurate assessments. We take into account unique factors that influence prices in areas like Tarcoles, Jaco, Dominical, Manuel Antonio, Ojochal, and Uvita.

Property owners should act now to reassess their Costa Rica property value. Investors aiming to maximize returns and vacation home owners wanting to stay informed benefit from regular valuations. Contact property management professionals for accurate, up-to-date information about your property’s worth in this ever-changing market.