At Osa Property Management, we understand the importance of staying informed about your property’s value in Costa Rica. The real estate market here is dynamic, influenced by various factors that can impact property valuation.

Regular reassessment of your property’s worth is essential for making informed decisions about investments, renovations, or potential sales. This blog post will guide you through the process of reassessing your Costa Rica property value and help you determine how often you should do it.

What Drives Costa Rica Property Values?

Costa Rica’s real estate market responds to various factors that impact property values. Property owners must understand these drivers to make informed decisions about their investments.

Economic Conditions and Market Trends

The Costa Rican economy demonstrates resilience, with a growing GDP and increased foreign investment. This economic stability affects property values, especially in popular areas. Recent market reports show that apartment prices in San José rose 12.08% year-on-year, averaging $2,343 per square meter as of June 2024.

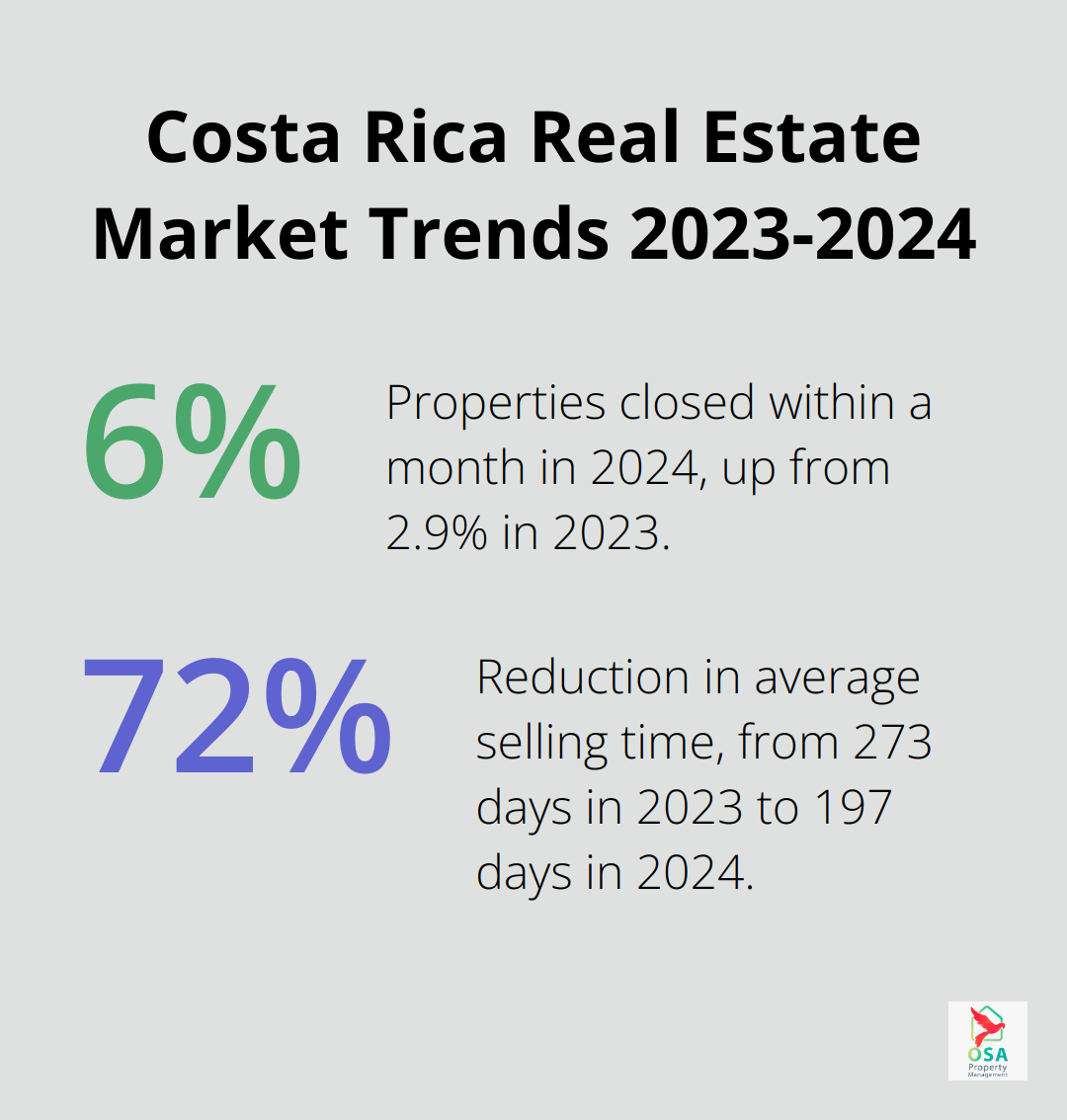

Real estate demand has surged, with properties closed in a month increasing from 2.9% in 2023 to 6.7% in 2024. This heightened demand results in faster sales, as the average time for homes to sell decreased from 273 days in 2023 to 197 days in 2024. These trends indicate a robust market that favors property value appreciation.

Infrastructure and Local Development

Infrastructure improvements and local developments significantly boost property values. The recent upgrades in Costa Ballena serve as a prime example, enhancing the area’s appeal to tourists and property investors alike. Such developments often lead to increased property demand and, consequently, higher values.

Property owners should stay informed about upcoming infrastructure projects in their area. These might include new roads, improved water systems, or enhanced telecommunications networks. Properties in areas with recent infrastructure upgrades often experience a notable increase in value.

Tourism Patterns and Their Impact

Costa Rica’s tourism industry directly affects property values, particularly for short-term rentals and hospitality-related properties. The country’s commitment to sustainable tourism attracts a steady stream of visitors, creating demand for vacation rentals and second homes.

Properties with ocean views or in prime tourist-favored locations typically command higher prices and sell more rapidly. Luxury properties in popular tourist destinations often sell at or near their listing prices, reflecting the strong demand in these areas.

Environmental Factors and Natural Events

Costa Rica’s diverse environment influences property values both positively and negatively. Properties in areas prone to environmental risks (such as flooding) may see decreased values, while those in eco-friendly or protected zones often appreciate due to their unique appeal.

Property owners must stay informed about environmental changes and potential risks in their area. This knowledge helps in accurately assessing property value and making informed decisions about property improvements or risk mitigation strategies.

Understanding these factors and their interplay proves key to accurately assessing your Costa Rica property value. Regular reassessments (ideally every 2-3 years or more frequently in rapidly changing markets) will help you stay ahead of market trends. Now, let’s explore how often you should reassess your property value to maximize your investment potential.

How Often Should You Reassess Your Costa Rica Property?

At Osa Property Management, we understand the importance of regular property value reassessments in Costa Rica’s dynamic real estate market. The frequency of these reassessments can significantly impact your investment strategy and financial planning.

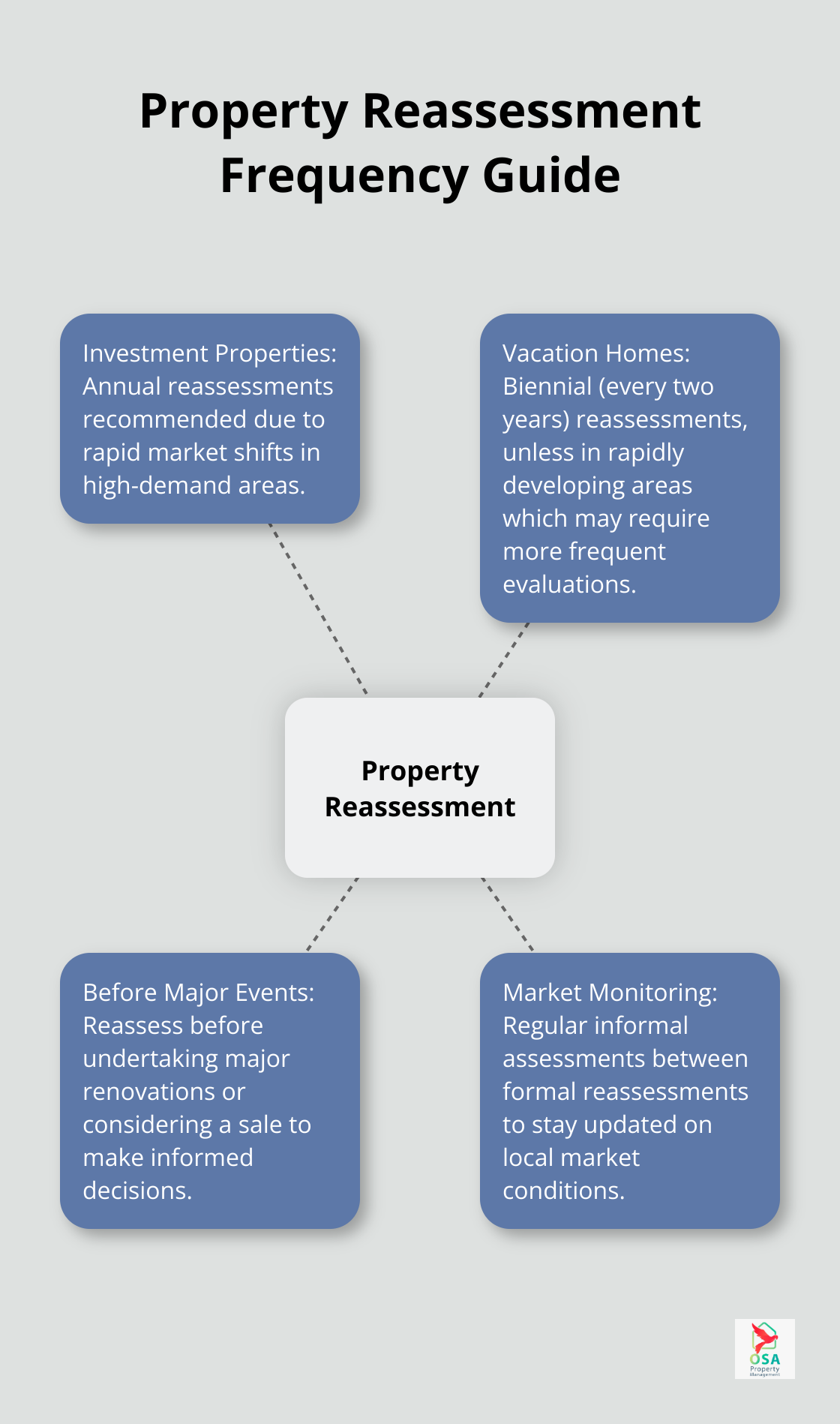

Annual Reassessments for Investment Properties

For investment properties, we strongly recommend annual reassessments. The Costa Rican real estate market can shift rapidly, especially in high-demand areas. This increased market activity makes yearly evaluations essential to capitalize on potential value increases or address any market downturns promptly.

Biennial Approach for Vacation Homes

Vacation homes often benefit from a biennial (every two years) reassessment strategy. These properties typically experience less frequent use and may be less affected by short-term market fluctuations. However, in rapidly developing areas like Costa Ballena (where recent infrastructure upgrades have significantly impacted property values), more frequent assessments might prove beneficial.

Reassess Before Major Events

It’s wise to reassess your property value before undertaking major renovations or considering a sale. A pre-renovation assessment provides a baseline for understanding how your improvements impact the property’s worth. Properties with ocean views in Costa Rica often command premium prices. Knowing your property’s current value can help you make informed decisions about which renovations will yield the best return on investment.

Before listing your property for sale, a fresh assessment is crucial. The Costa Rican luxury property market, in particular, moves quickly. With limited luxury supply and a rapidly growing population, Dubai’s prime real estate market will see growth in 2025, which could indicate similar trends for luxury markets in Costa Rica. An accurate and current valuation can help you price your property competitively and potentially accelerate the sale process.

Monitor Local Market Conditions

Regular monitoring of local market conditions is vital between formal reassessments. Keep an eye on factors like new infrastructure projects, changes in tourism patterns, or environmental developments. For example, the 12.08% year-on-year increase in San José apartment prices as of June 2024 indicates a trend that property owners in urban areas should closely watch.

Networking with local real estate professionals and staying updated on market reports can provide valuable insights. These informal assessments can help you identify the right moment for a more formal property valuation, ensuring you’re always one step ahead in managing your Costa Rica real estate investment.

Now that we’ve explored the frequency of property reassessments, let’s examine the various methods you can use to accurately assess your Costa Rica property’s value.

How to Accurately Value Your Costa Rica Property

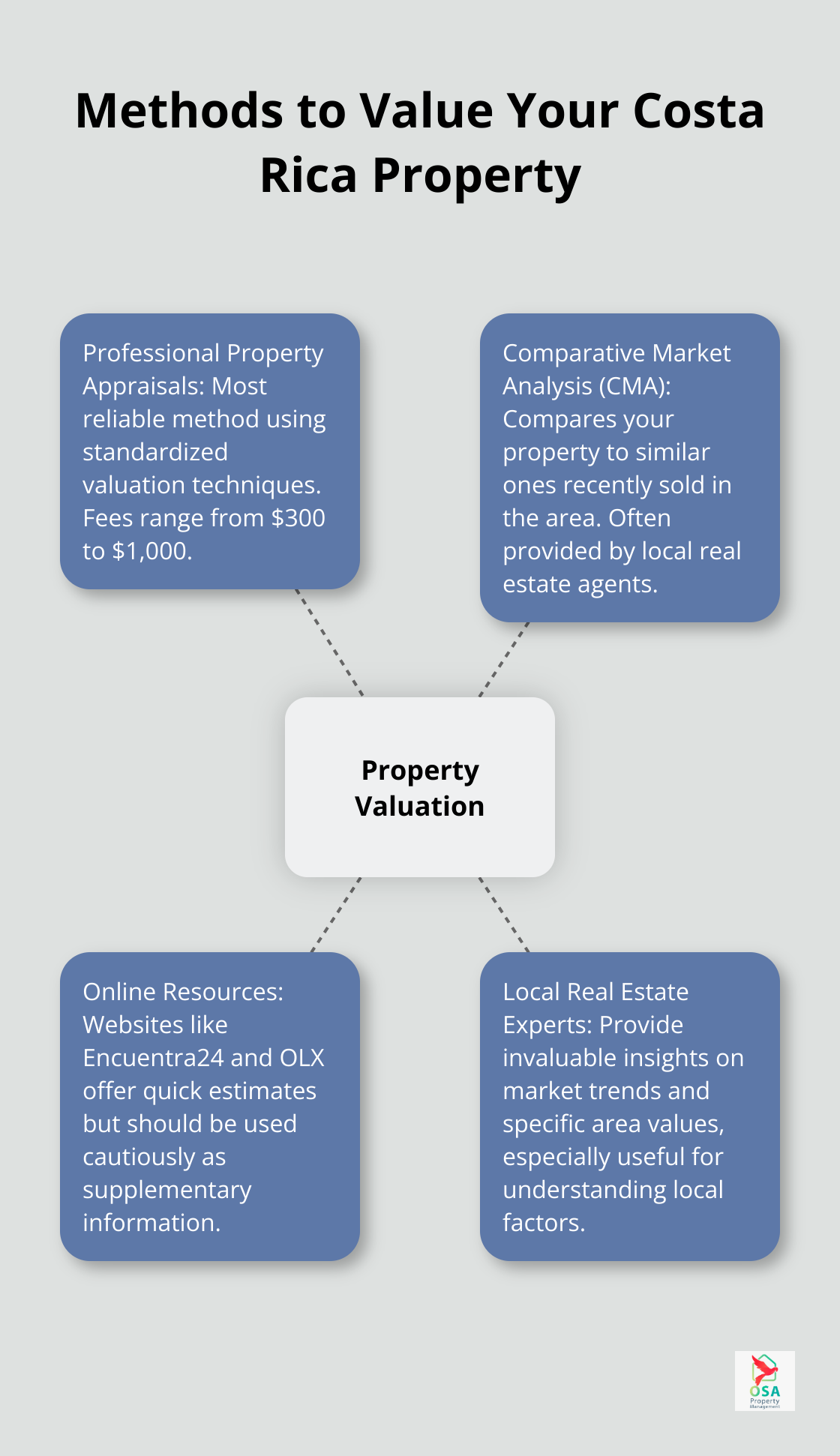

Professional Property Appraisals

Hiring a certified appraiser provides the most reliable method for valuing your Costa Rica property. These professionals use standardized valuation methods, including evaluating property conditions, location desirability, and potential rental income. In Costa Rica, appraisal fees typically range from $300 to $1,000 (depending on the property’s size and complexity).

Professional appraisers consider factors like recent infrastructure improvements, which can significantly impact property values. For instance, the recent upgrades in Costa Ballena have enhanced property values in the area. An appraiser will take such developments into account, providing you with an up-to-date and accurate valuation.

Comparative Market Analysis

A Comparative Market Analysis (CMA) offers another effective tool for property valuation. This method involves comparing your property to similar ones that have recently sold in the area. Local real estate agents often provide this service, leveraging their knowledge of the market and access to recent sales data.

When conducting a CMA, focus on properties with similar features to yours. For example, if you own a beachfront property in Manuel Antonio, compare it to other beachfront properties in the area that have sold recently. This approach will give you a more accurate picture of your property’s current market value.

Online Resources

Online valuation tools can provide a quick estimate of your property’s worth. Websites like Encuentra24 and OLX offer property listings that can give you an idea of current market prices in your area.

However, use these tools with caution. Online estimates don’t always account for unique features of your property or recent local developments that could affect its value. They work best as a starting point or to supplement other valuation methods.

Local Real Estate Experts

Local real estate experts possess invaluable knowledge about market trends and property values in specific areas of Costa Rica. Their insights can prove particularly useful in understanding how factors like tourism patterns or new infrastructure projects might impact your property’s value.

For instance, a local expert in Jaco or Uvita would know how recent changes in tourism patterns have affected short-term rental demand and property values in these areas. This kind of localized knowledge can prove essential in accurately assessing your property’s worth.

Combining Methods for Accuracy

To gain a comprehensive understanding of your Costa Rica property’s value, try to combine these methods. The real estate market in Costa Rica can change rapidly, so regular reassessments using these techniques will help you stay informed and make smart decisions about your investment.

Final Thoughts

Regular property valuation stands as a key element for successful real estate investment in Costa Rica. The dynamic nature of Costa Rica’s real estate market, influenced by economic conditions, infrastructure developments, and tourism patterns, highlights the need for frequent valuations. Accurate property valuation enables you to make informed choices about renovations, sales, or further investments.

Osa Property Management understands the intricacies of Costa Rica’s real estate market. Our team of experts can assist you with professional property valuations, using our extensive experience and local market knowledge. We offer customized services tailored to your specific needs, whether you own a vacation home, an investment property, or consider a new purchase.

Our comprehensive approach to property management includes regular market analysis and property value assessments. We monitor local developments, tourism trends, and economic indicators that might impact your property’s worth. This proactive stance equips you with the most current and accurate information about your investment.