At Osa Property Management, we understand the importance of maximizing your rental property investments. One often overlooked aspect is the rental property depreciation tax deduction, which can significantly impact your bottom line.

This guide will walk you through the process of calculating depreciation deductions for your rental properties, helping you optimize your tax strategy and boost your returns.

What is Rental Property Depreciation?

Definition and Importance

Rental property depreciation serves as a powerful tax tool for property investors. It represents the gradual decrease in a property’s value over time due to wear and tear. The Internal Revenue Service (IRS) allows property owners to deduct this theoretical decline in value from their taxable income, even if the property’s market value increases.

Financial Impact on Investors

Depreciation can significantly reduce taxable income for property investors. The IRS stipulates that residential rental properties depreciate over 27.5 years, while commercial properties depreciate over 39 years. This annual deduction of a portion of your property’s value from your taxes can potentially save thousands of dollars (a benefit that savvy investors should not overlook).

Eligibility Criteria

Not all properties qualify for depreciation deductions. To be eligible, a property must meet specific criteria:

- You must own the property

- You must use the property for income-producing activity

- The property must have a determinable useful life

- The property must last more than one year

It’s crucial to note that land does not depreciate. Only the value of buildings and improvements can be depreciated, a distinction that plays a vital role in calculating your depreciation deductions.

Maximizing Depreciation Benefits

To optimize depreciation, you must accurately determine your property’s basis – the amount you can depreciate. This includes the purchase price of the property (excluding land value), certain closing costs, and the cost of improvements made before renting the property.

A cost segregation study can prove invaluable for maximizing depreciation benefits. This engineering-based analysis identifies and reclassifies personal property assets to shorten the depreciation time for taxation purposes, which can increase cash flow.

While understanding depreciation can significantly impact your bottom line, it’s always advisable to consult with a qualified tax professional. They can ensure you take full advantage of all available depreciation deductions for your rental properties and navigate the complexities of tax law. As we move forward, let’s explore the step-by-step process of calculating rental property depreciation.

How to Calculate Rental Property Depreciation

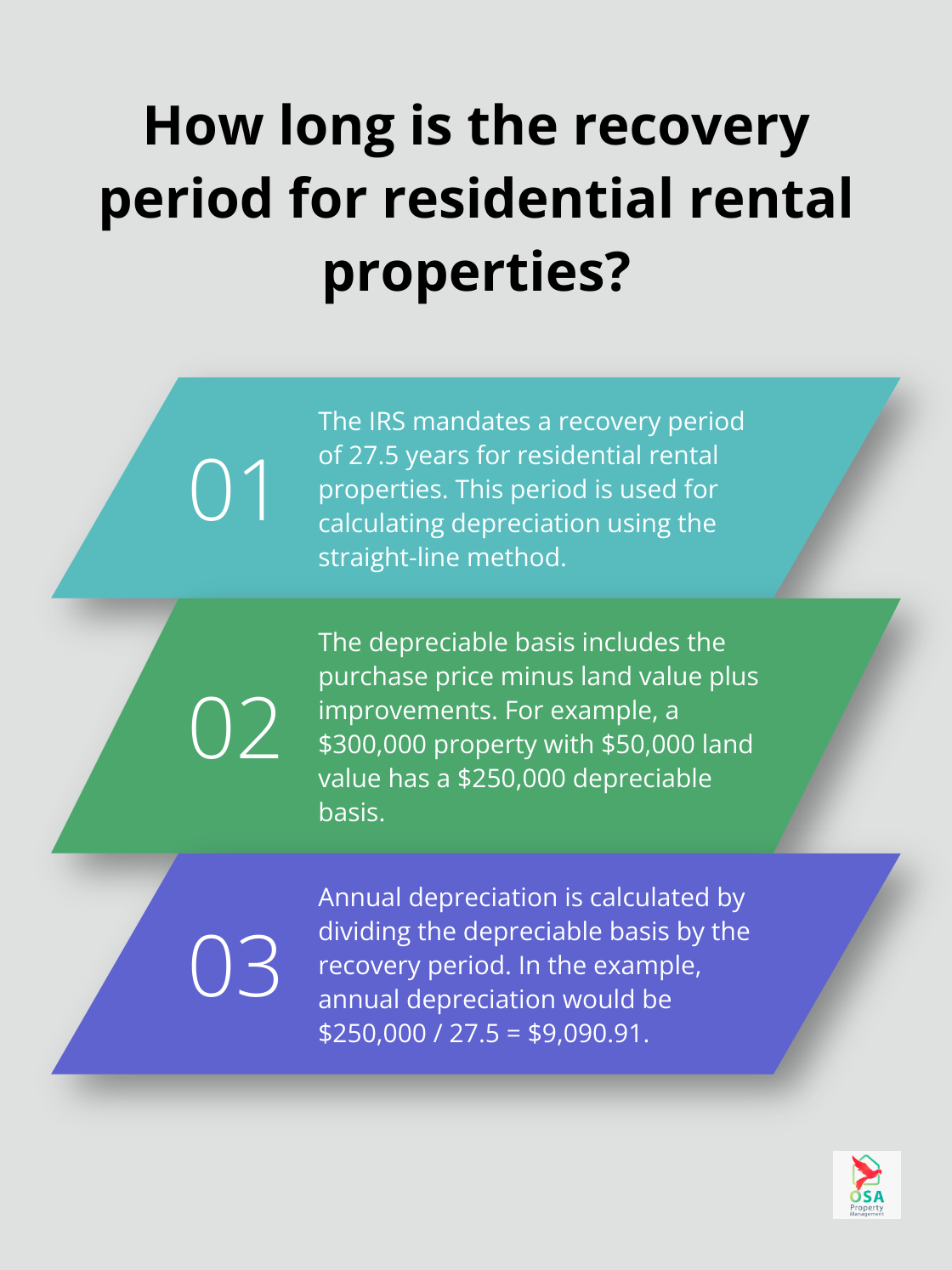

Determining Your Property’s Depreciable Basis

The first step in calculating depreciation requires you to determine your property’s depreciable basis. This represents the total amount you can depreciate over time. It includes the purchase price of the property (minus the land value) plus any improvements made before renting. For example, if you purchased a property for $300,000, and the land is valued at $50,000, your depreciable basis would be $250,000.

Understanding the Recovery Period

The IRS explains how you can recover the cost of business or income-producing property through deductions for depreciation. This publication provides guidance on the specific recovery periods for different types of rental properties.

Applying the Straight-Line Depreciation Method

For residential rental properties, the IRS mandates the use of the straight-line depreciation method. This approach evenly distributes the depreciation over the recovery period. To calculate your annual depreciation, simply divide your depreciable basis by the recovery period.

Using our previous example, if your depreciable basis is $250,000, your annual depreciation would equal $250,000 / 27.5 = $9,090.91.

Prorating for Partial Years

If you didn’t own the property for a full year when you started renting it out, you must prorate your depreciation. The IRS employs a mid-month convention, assuming you placed the property in service in the middle of the month you started renting it.

For instance, if you began renting your property in March, you’d claim 9.5 months of depreciation in the first year. Your first-year depreciation would calculate as ($9,090.91 / 12) * 9.5 = $7,197.18.

Seeking Professional Guidance

While these calculations may appear straightforward, tax laws often present complexities and undergo frequent changes. A great real estate CPA can help you improve cash flow, minimize tax liabilities, and grow your portfolio. This step proves particularly important for investors with multiple properties or those dealing with unique situations.

As we move forward, let’s explore strategies to maximize your depreciation deductions and optimize your rental property investments.

Maximizing Your Rental Property Depreciation

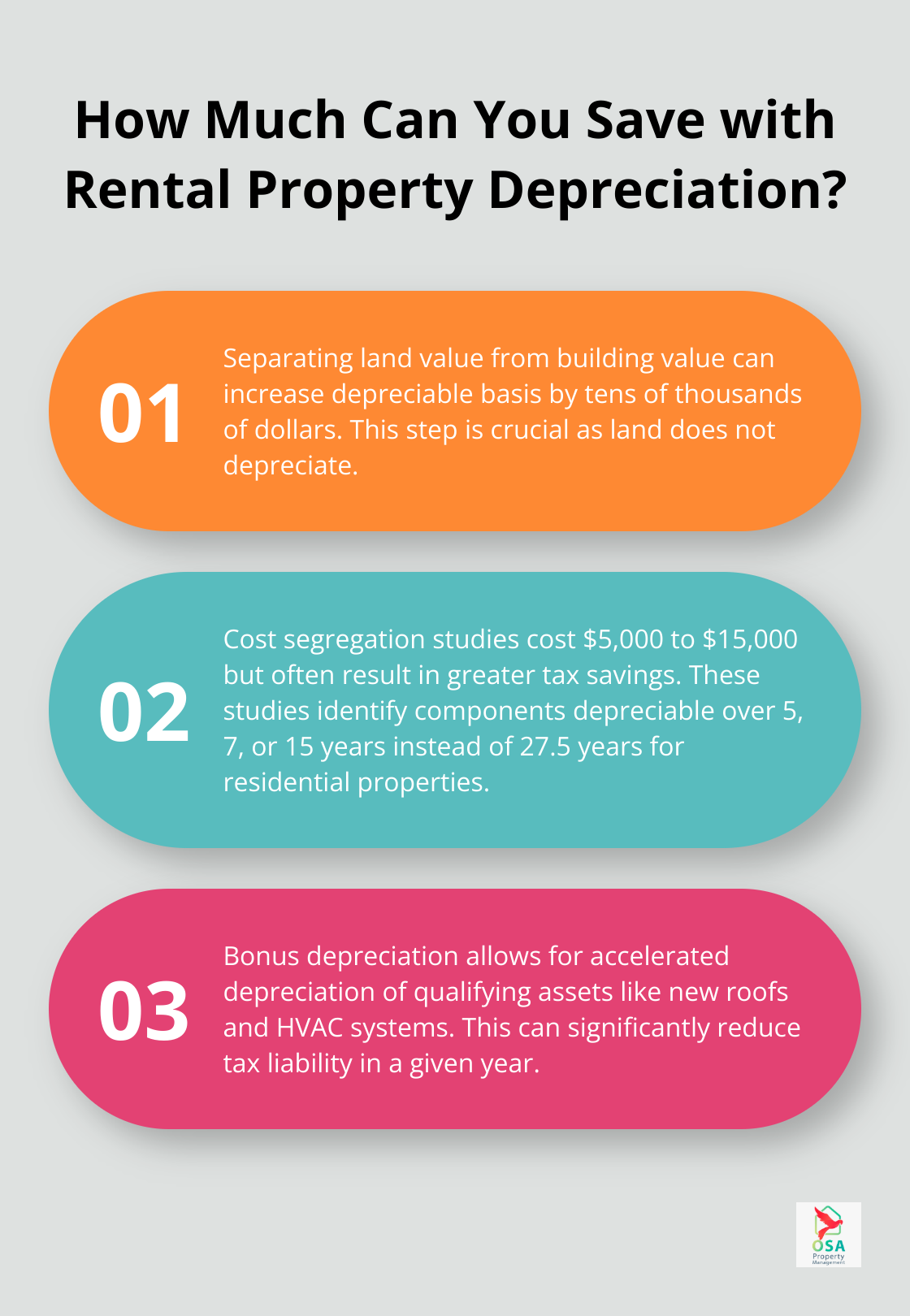

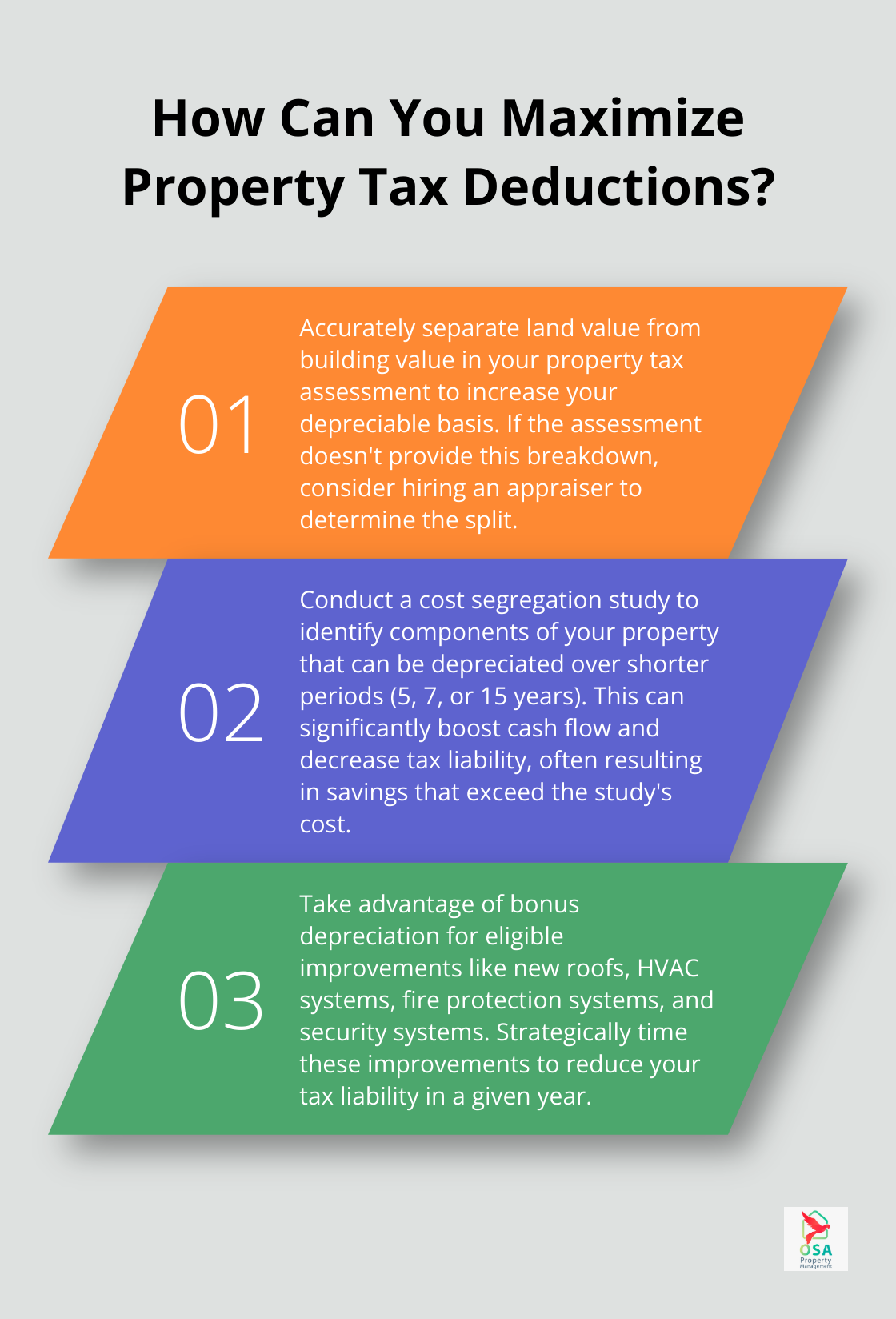

Separate Land from Building Value

One of the most important steps in maximizing depreciation involves the accurate separation of land value from building value. Land does not depreciate. If you fail to separate these values, you miss out on potential tax savings.

To effectively separate these values, review your property tax assessment. This document often breaks down the value between land and improvements. If it doesn’t provide this breakdown, consider hiring an appraiser to determine the split. This step alone can increase your depreciable basis by tens of thousands of dollars.

Leverage Cost Segregation Studies

Cost segregation studies are a powerful tool that may help boost your cash flow and decrease your tax liability. These studies identify components of your property that you can depreciate over shorter periods – 5, 7, or 15 years instead of 27.5 years for residential properties.

A cost segregation study might classify certain electrical systems, carpeting, or landscaping as personal property or land improvements, allowing for faster depreciation. While these studies can cost between $5,000 to $15,000, they often result in tax savings that far exceed the initial investment.

Take Advantage of Bonus Depreciation

Bonus depreciation is a tax incentive designed to stimulate business investment by allowing companies to accelerate the depreciation of qualifying assets. This allows you to deduct a larger portion of eligible improvements in the year you place them in service, rather than depreciating them over time.

Eligible improvements include new roofs, HVAC systems, fire protection systems, and security systems. Strategic timing of these improvements can significantly reduce your tax liability in a given year.

Keep Meticulous Records

Accurate record-keeping proves essential for maximizing depreciation deductions. Maintain detailed records of all property improvements, including receipts, contracts, and before-and-after photos. This documentation not only supports your depreciation claims but also helps identify opportunities for accelerated depreciation.

Try using property management software to track expenses and improvements. Advanced software solutions (like those used by top property management companies) ensure that records remain audit-ready at all times.

Implementing these strategies can dramatically increase your depreciation deductions, potentially saving you thousands in taxes each year. However, tax laws remain complex and ever-changing. While property management experts strive to provide valuable insights, always consult with a qualified tax professional to ensure you maximize your deductions within the bounds of current tax law.

Final Thoughts

Rental property depreciation tax deductions can significantly boost your investment’s profitability. You must accurately determine your property’s depreciable basis, apply the correct recovery period, and use the straight-line depreciation method to maximize tax benefits. Separating land value from building value and leveraging cost segregation studies can further enhance your tax savings (and improve cash flow).

Navigating the complexities of tax law requires expertise. We at Osa Property Management recommend consulting with qualified tax professionals to ensure you maximize your deductions within legal boundaries. Our team can connect you with trusted experts who understand the nuances of rental property taxation in Costa Rica.

Proper management is key to maximizing returns on your rental property investments. Osa Property Management offers comprehensive services to help you navigate the Costa Rican real estate market. We handle day-to-day operations and ensure you take full advantage of available tax benefits, allowing you to focus on growing your investment portfolio.