At Osa Property Management, we understand the importance of maximizing tax benefits for rental property owners. The mortgage interest tax deduction for rental properties is a valuable tool that can significantly reduce your tax liability.

This guide will walk you through the process of claiming this deduction, from understanding eligibility criteria to avoiding common filing mistakes. We’ll provide practical tips to help you navigate the complexities of mortgage interest tax deductions for rental properties and optimize your tax strategy.

What Is the Mortgage Interest Tax Deduction for Rentals?

Definition and Basics

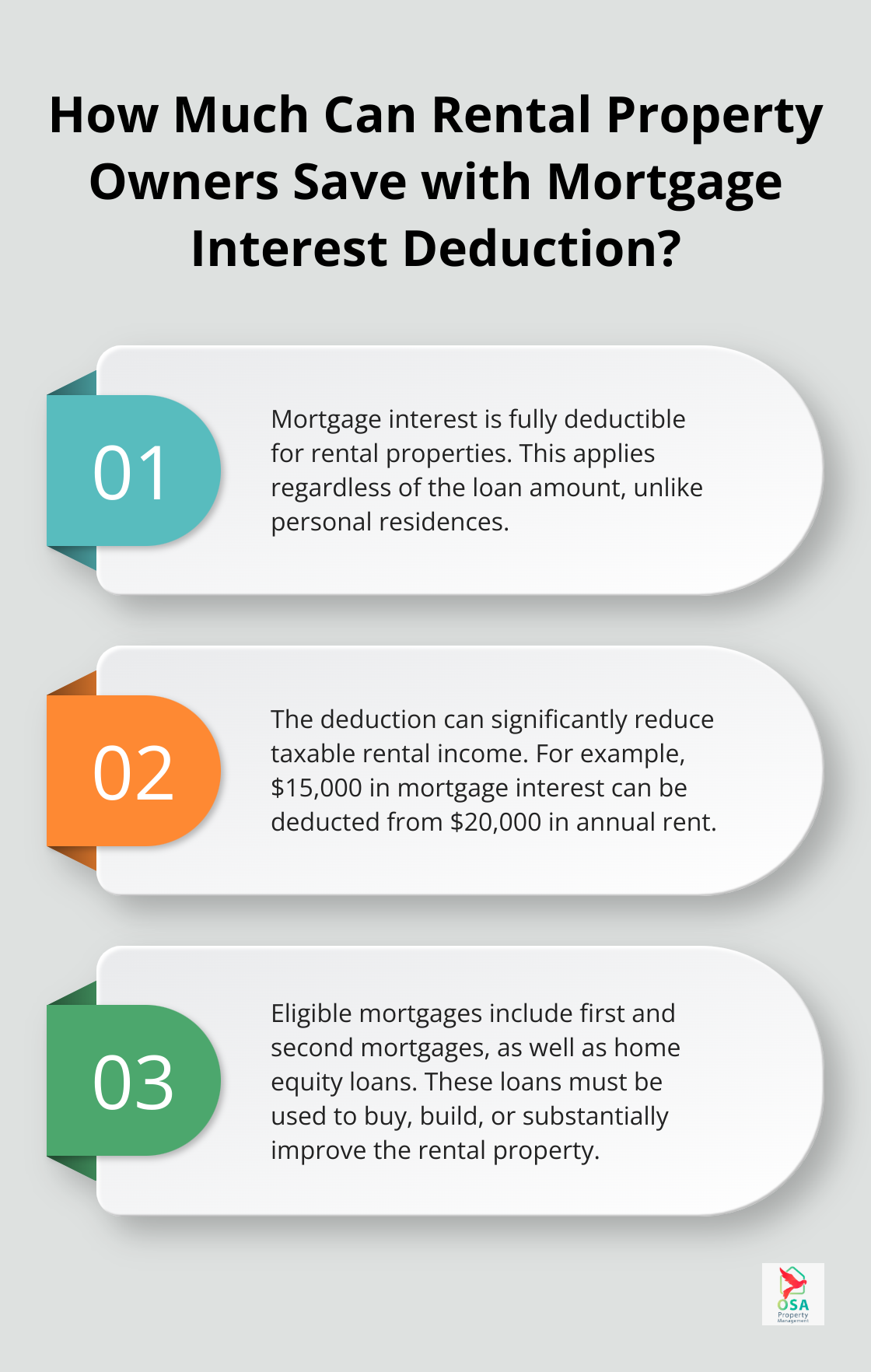

The mortgage interest tax deduction for rental properties allows property owners to subtract the interest paid on their mortgage from their rental income before calculating their tax liability. This deduction serves as a powerful financial tool that can significantly reduce taxable income for rental property owners.

How the Deduction Works

The IRS considers rental properties as businesses. This classification enables property owners to deduct mortgage interest as a business expense. For instance, if you collect $20,000 in annual rent and pay $15,000 in mortgage interest, you can deduct that $15,000 from your rental income. This leaves only $5,000 subject to taxation, resulting in substantial tax savings.

Eligibility Requirements

To claim this deduction, you must meet specific criteria:

- Legal Ownership: You must be the legal owner of the property and responsible for the mortgage.

- Rental Use: The property must function as a rental. (If you use the property for personal purposes for more than 14 days or 10% of the total days rented, whichever is greater, you may face limitations on your deductions.)

Qualifying Mortgages

Not all loans qualify for this deduction. Generally, eligible mortgages include:

- First mortgages

- Second mortgages

- Home equity loans or lines of credit (if used for the rental property)

These loans must be used to buy, build, or substantially improve your rental property. Personal loans or credit card debt used for property-related expenses don’t qualify, even if they were used for the rental property.

Impact of Tax Legislation

The Tax Cuts and Jobs Act of 2017 changed some rules regarding mortgage interest deductions for personal residences. However, these changes don’t apply to rental properties. For rental properties, you can still deduct the full amount of mortgage interest, regardless of the loan amount.

Proper record-keeping proves essential when leveraging this deduction. Maintain meticulous records of all mortgage interest paid, as this information will play a critical role when filing your taxes. As we move forward, we’ll explore how to calculate this deduction accurately and avoid common pitfalls in the process.

How to Calculate Your Mortgage Interest Tax Deduction

Determining Your Deductible Amount

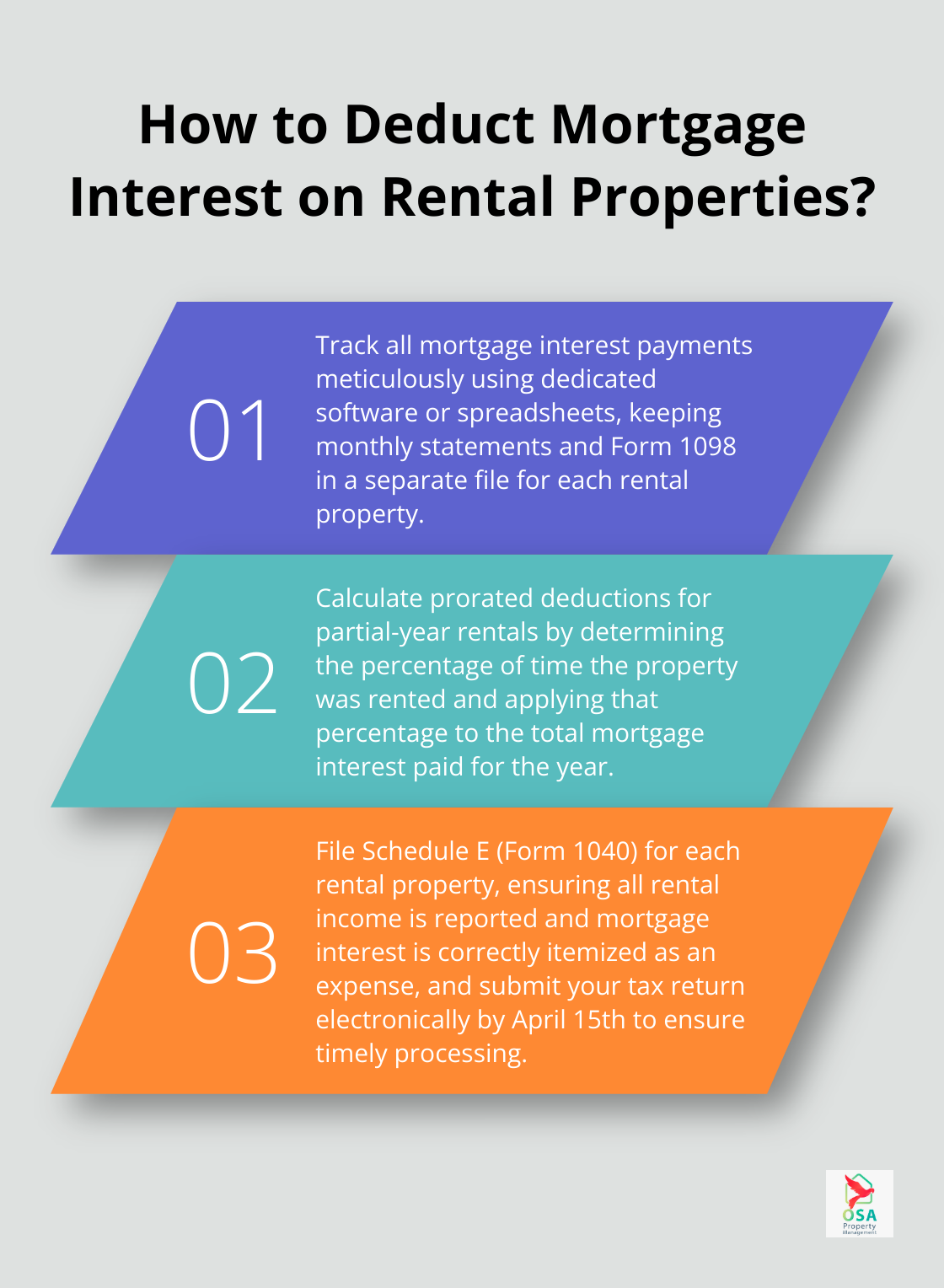

All rental income must be reported on your tax return, and in general, the associated expenses can be deducted from your rental income. This includes the mortgage interest paid on your rental property loan during the tax year. Your lender should provide this information on Form 1098 annually. However, you should verify this amount against your own records, as lenders can make mistakes.

For example, if you paid $15,000 in mortgage interest on your rental property in Jaco, Costa Rica, that entire amount would generally be deductible. Unlike primary residences, rental properties have no cap on the amount of interest you can deduct.

Proper Documentation and Record-Keeping

Maintaining meticulous records is essential when claiming mortgage interest deductions. Documentary evidence, such as receipts, canceled checks, or bills, is generally required to support your expenses. We recommend keeping a dedicated file for each rental property, including:

- Monthly mortgage statements

- Year-end Form 1098 from your lender

- Proof of payments (canceled checks, bank statements)

- Records of any additional home equity loans or lines of credit used for the property

If you manage multiple properties, consider using property management software to track expenses and income for each property separately. This practice will save you time and stress when tax season arrives.

Handling Partial-Year Rentals

Calculating deductions for partial-year rentals can be tricky. You can only deduct the mortgage interest for the period it was a rental if you only rented out your property for part of the year.

For instance, if you have a beachfront condo in Manuel Antonio that you rent out for 9 months and use personally for 3 months, you’d need to prorate your mortgage interest deduction. In this case, you could deduct 75% of the total mortgage interest paid for the year.

Mixed-Use Properties

For mixed-use properties, like a duplex where you live in one unit and rent out the other, you’ll need to allocate the mortgage interest based on the square footage used for rental purposes. If the rental unit comprises 60% of the total square footage, you can deduct 60% of the mortgage interest as a rental expense.

Complex Calculations

These calculations can become complex, especially for properties in unique markets like Costa Rica. Many property owners find value in comprehensive property management services (such as those offered by Osa Property Management), which include assistance with tax-related matters.

Accurate calculation of your mortgage interest tax deduction can significantly impact your overall tax liability. The process may seem daunting, but with proper record-keeping and attention to detail, you can maximize this valuable deduction for your rental property investments. In the next section, we’ll explore the filing process and common mistakes to avoid when claiming your mortgage interest tax deduction.

Navigating the Tax Filing Process for Rental Properties

Key Forms for Rental Property Taxes

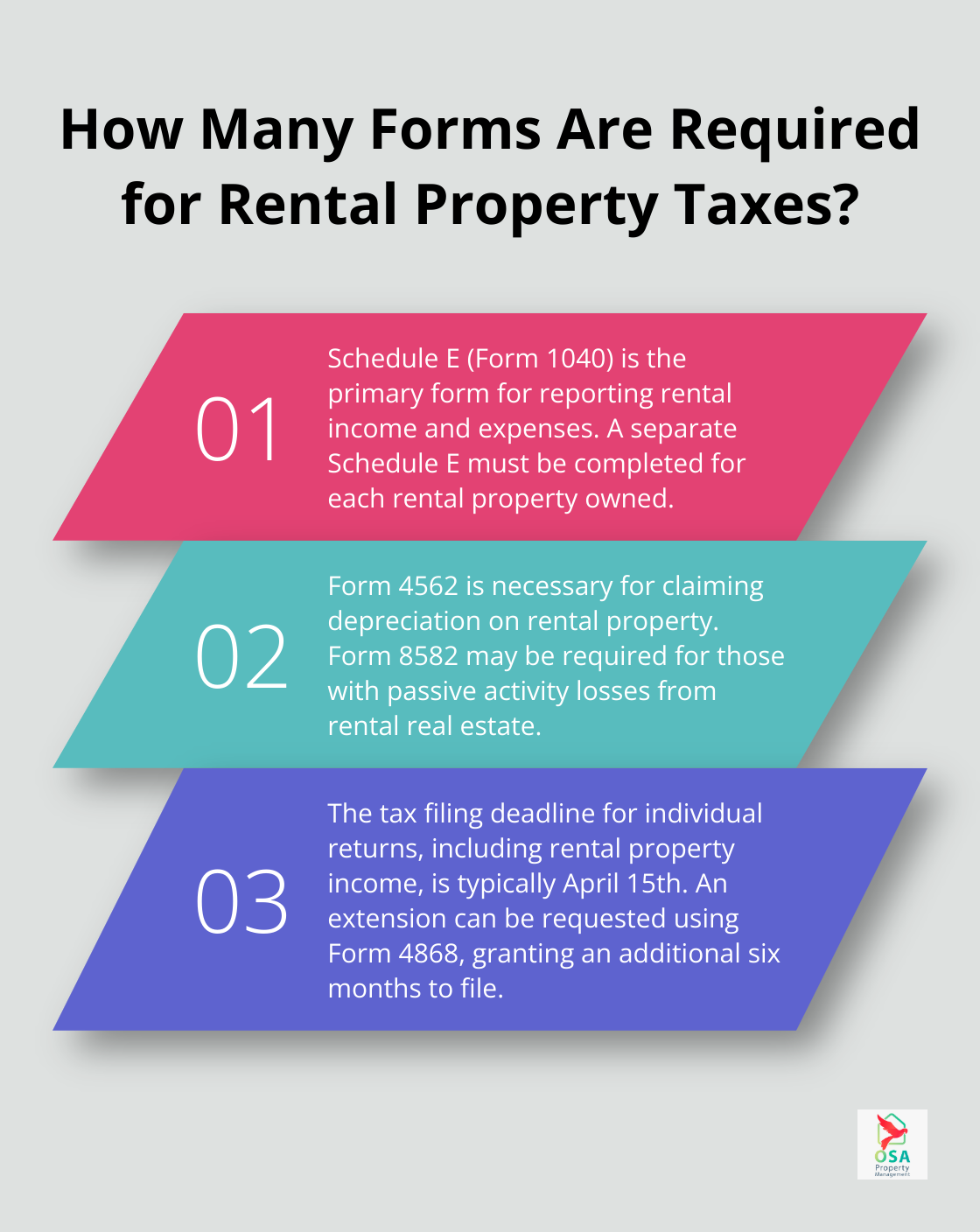

The primary form for reporting rental income and expenses is Schedule E (Form 1040). This form requires you to list your rental income and itemize your expenses, including mortgage interest. You must complete a separate Schedule E for each rental property you own. If you are an individual, report farm rental income or loss from Form 4835 on page 2, line 40.

If you claim depreciation on your rental property, you need to file Form 4562. This form reports depreciation and amortization of property used in your rental business.

For those with passive activity losses from rental real estate, Form 8582 may be necessary. This form must generally be filed by taxpayers who have an overall gain (including any prior year unallowed losses) from business or rental passive activities.

Important Deadlines and Submission Process

The deadline for filing individual tax returns, including those with rental property income, is typically April 15th. If you cannot file by this date, you can request an extension using Form 4868. This will give you an additional six months to file (but any taxes owed are still due by the original deadline).

We recommend you submit your tax return electronically. E-filing is faster, more secure, and provides confirmation that the IRS has received your return. If you prefer to mail your return, use certified mail with return receipt requested to ensure delivery and maintain proof of timely filing.

Common Errors in Mortgage Interest Deductions

One frequent mistake is the failure to report all rental income. The IRS requires you to report all rental income, even if you didn’t receive a 1099 form. This includes advance rent payments and any portion of a security deposit that you keep.

Another common error is the misclassification of improvements as repairs. While repairs are fully deductible in the year you make them, improvements must be depreciated over several years. (For example, fixing a broken window is a repair, but replacing all windows in the property is an improvement.)

Some property owners forget to prorate their mortgage interest deduction for mixed-use properties. If you use the property for personal use part of the year, you can only deduct the portion of interest that corresponds to the time it was rented out.

Lastly, don’t neglect to keep meticulous records. The IRS requires you to keep records that support your deductions for at least three years from the date you file your tax return. This includes mortgage statements, repair receipts, and records of any other expenses related to your rental property.

The Value of Professional Assistance

The complexities of rental property taxes lead many property owners to work with a tax professional or a property management company that offers tax assistance. These professionals can help you maximize your deductions while staying compliant with tax laws. (If you’re considering professional help, Osa Property Management offers comprehensive services that include assistance with tax-related matters.)

Final Thoughts

The mortgage interest tax deduction for rental properties can significantly reduce your tax liability. You must report all rental income and can only deduct interest on qualifying mortgages. Accurate calculations and prorating for partial-year or mixed-use properties ensure compliance with IRS regulations.

Proper documentation simplifies the tax filing process and provides support in case of an audit. You should keep meticulous records of all mortgage interest payments, rental income, and related expenses. Technology, such as property management software, can help you prepare for tax season.

Professional guidance can help you navigate complex tax laws and identify additional deductions. Osa Property Management offers comprehensive property management services that include assistance with tax-related matters for rental properties in Costa Rica. Our team’s experience in areas like Jaco, Manuel Antonio, and Uvita can provide insights into local tax regulations.