At Osa Property Management, we understand the importance of maximizing tax benefits for property owners. Navigating the complexities of rental property loan interest tax deductions can be challenging, but it’s a crucial aspect of smart financial management for landlords.

This guide will walk you through the process of claiming these deductions, helping you reduce your tax burden and increase your rental property’s profitability. We’ll cover everything from understanding eligible loans to proper documentation practices, ensuring you’re well-equipped to take advantage of this valuable tax benefit.

What Are Rental Property Loan Interest Deductions?

Definition and Importance

Rental property loan interest deductions allow property owners to subtract the interest paid on loans used for rental properties from their gross rental income. This tax benefit can significantly reduce taxable income for landlords.

Types of Eligible Loans

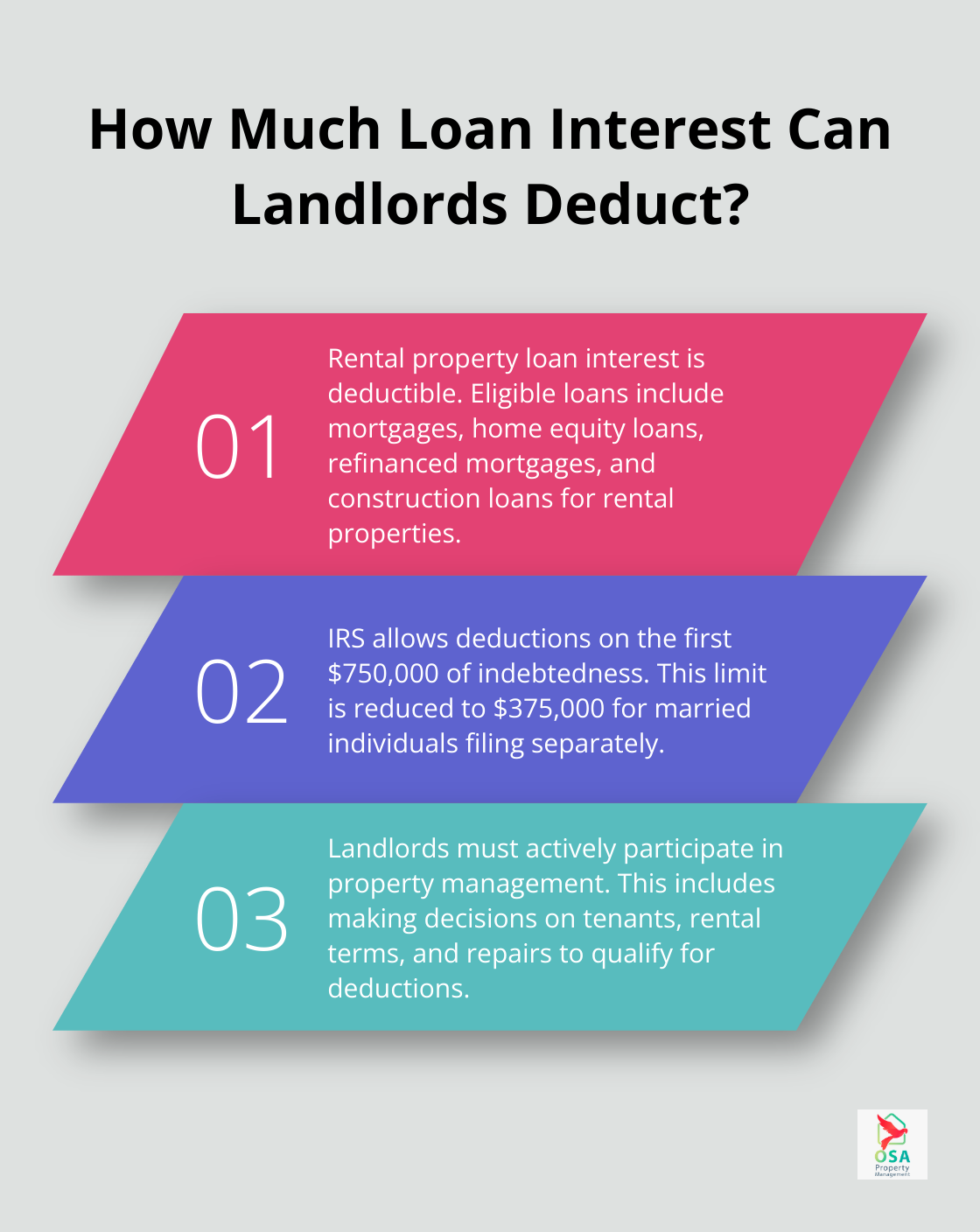

The IRS permits deductions on several loan types related to rental properties:

- Mortgage loans for rental property purchases

- Home equity loans or lines of credit for property improvements

- Refinanced mortgages on rental properties

- Construction loans for building rental units

Personal loans not secured by the property itself typically do not qualify for these deductions.

IRS Guidelines and Limitations

The IRS sets specific rules for rental property loan interest deductions:

- Deduction limits: You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness

- Active participation requirement: Landlords must make management decisions (e.g., approving tenants, setting rental terms, authorizing repairs) to claim these deductions

Maximizing Deductions

To optimize these deductions:

- Maintain detailed records of all loan-related documents (mortgage statements, receipts for loan-related expenses)

- Use property management software for accurate expense tracking

- Consult with a tax professional to ensure compliance with IRS guidelines and maximize potential savings

The next chapter will explain how to calculate the deductible loan interest for your rental properties, including special considerations for mixed-use properties.

How to Calculate Deductible Loan Interest for Rental Properties

Identifying Total Interest Paid

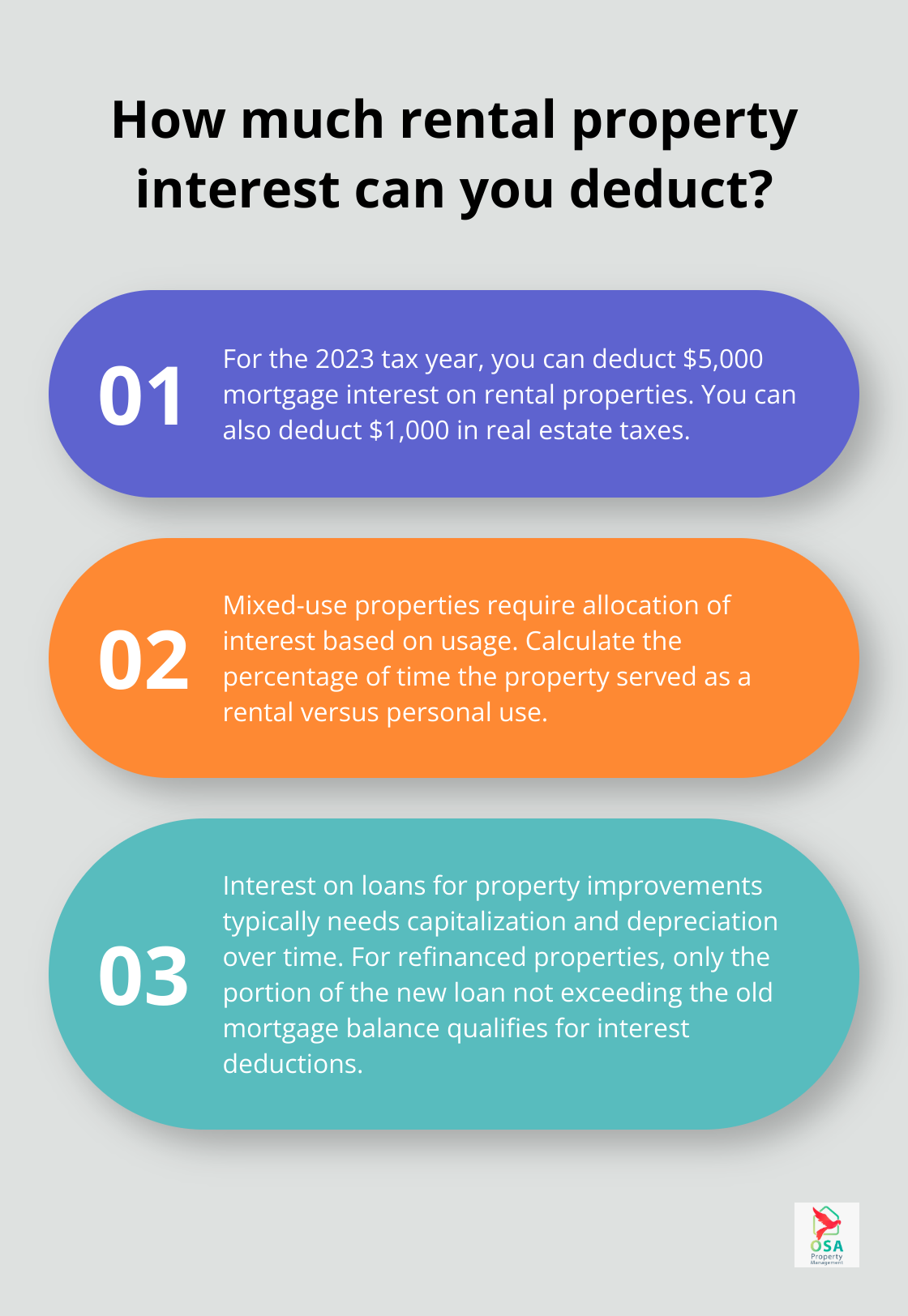

The first step in calculating deductible loan interest involves determining the total interest paid on your rental property loans. You’ll find this information on your annual mortgage statement or Form 1098 from your lender. For the 2023 tax year, you can deduct $5,000 mortgage interest and $1,000 real estate taxes on rental properties (subject to other IRS rules and your specific tax situation).

Allocating Interest for Mixed-Use Properties

Properties used as both rentals and personal residences require careful allocation of interest based on usage. The IRS mandates calculation of the percentage of time the property served as a rental versus personal use.

Consider this example:

You rent out your beach house for 300 days and use it personally for 65 days.

Calculation: 300 / (300 + 65) = 82.2%

This result means you can deduct 82.2% of the mortgage interest paid on this property as a rental expense.

Handling Property Improvements and Refinancing

Interest on loans for property improvements or major repairs requires different treatment. These costs typically need capitalization and depreciation over time rather than deduction as interest expenses.

For refinanced rental properties, only the portion of the new loan that doesn’t exceed the balance of the old mortgage qualifies for interest deductions. Any additional borrowed amount may fall under different rules.

Considering Tax Law Changes

The Tax Cuts and Jobs Act of 2017 introduced changes for some taxpayers. A transition rule in the TCJA allows taxpayers to elect to expense 50% of the cost of eligible business property rather than the full 100% for certain situations.

Accurate Record-Keeping

Proper documentation proves essential for claiming these deductions. You should maintain detailed records of all loan-related documents (mortgage statements, receipts for loan-related expenses). Many property owners find that using property management software helps ensure accurate expense tracking.

As you navigate the complexities of rental property loan interest deductions, you’ll need to focus on proper documentation and record-keeping. The next section will explore the essential documents and best practices for maintaining accurate records to support your deductions.

How to Document Rental Property Loan Interest

Essential Documents for Deductions

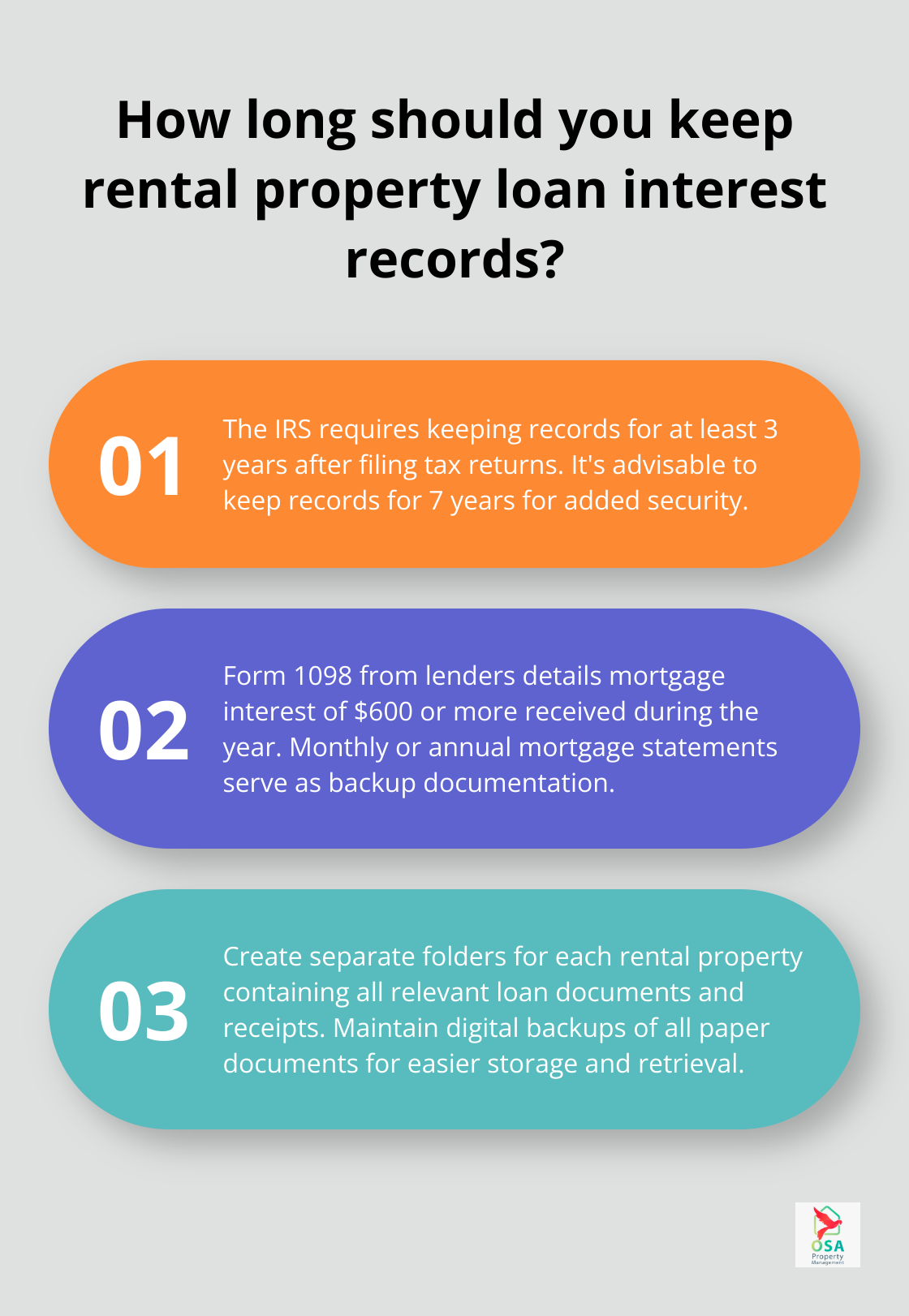

The IRS requires specific documentation to support your rental property loan interest deductions. These include:

- Form 1098: Your lender provides this form, which details mortgage interest of $600 or more received by you during the year in the course of your trade or business.

- Mortgage statements: Monthly or annual statements from your lender serve as backup documentation for the interest amounts reported on Form 1098.

- HUD-1 Settlement Statement: For newly purchased properties, this document outlines closing costs (including any prepaid interest).

- Receipts for property improvements: Keep all related receipts to justify interest deductions on loans for significant upgrades.

- Rental income and expense ledger: A comprehensive record of all rental-related transactions (including interest payments).

Organizing Financial Records

Effective organization of your financial records is important. We recommend:

- Create separate folders for each rental property, containing all relevant loan documents and receipts.

- Maintain a digital backup of all paper documents. The IRS accepts digital records, and they’re easier to store and retrieve.

- Update your records regularly, ideally monthly, to avoid a year-end scramble.

- Keep records for at least three years after filing your tax return, as per IRS guidelines. However, we advise keeping them for seven years for added security.

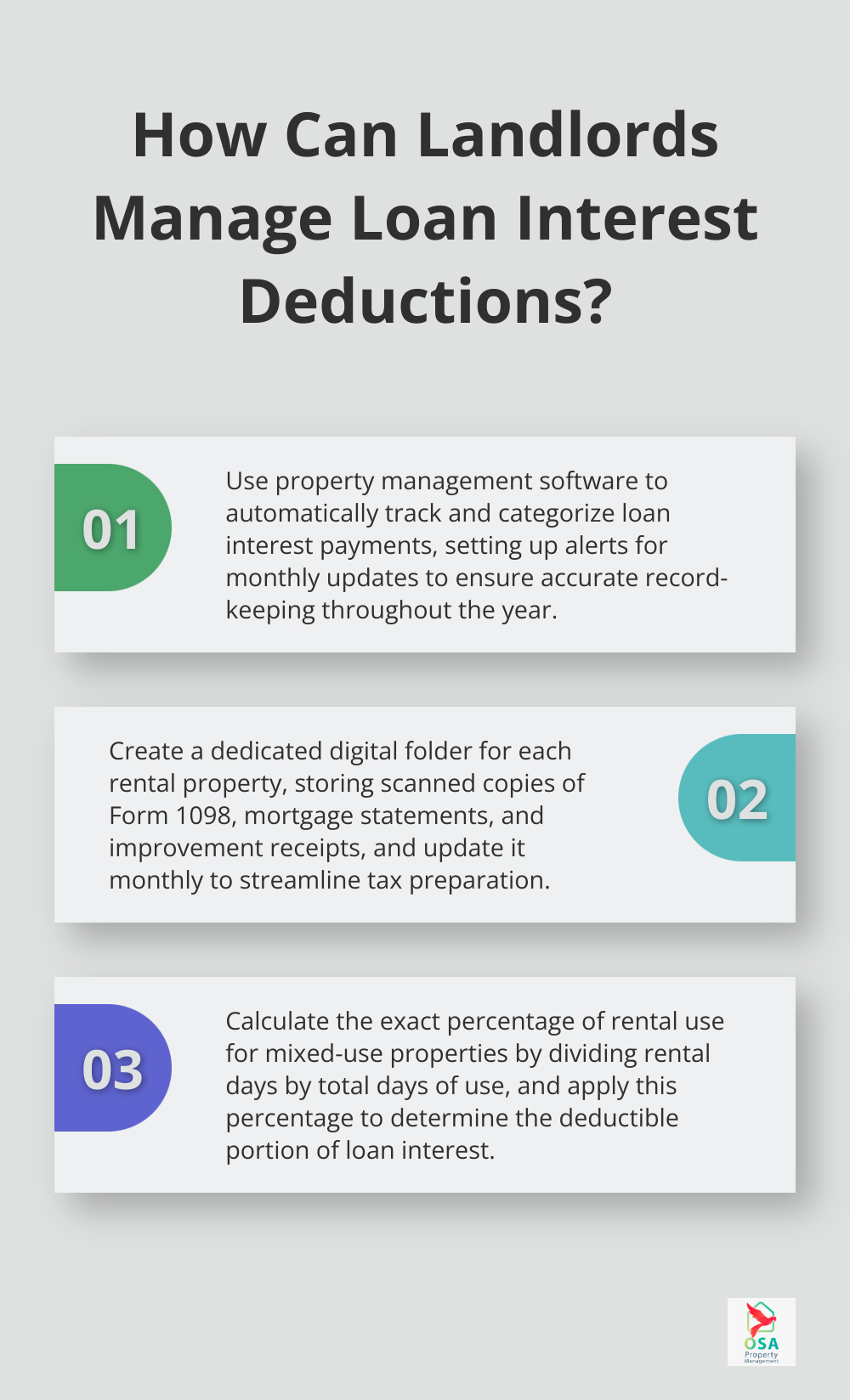

Leveraging Technology for Accuracy

Property management software can streamline your record-keeping process. These tools offer:

- Automated expense tracking, including loan interest payments.

- Digital storage for receipts and important documents.

- Generation of financial reports for tax preparation.

- Integration with accounting software for seamless data transfer.

Best Practices for Documentation

To ensure accurate and comprehensive documentation:

- Establish a consistent system for organizing and labeling documents.

- Set reminders for regular record updates and backups.

- Use a dedicated business bank account for rental property transactions.

- Consult with a tax professional to understand specific documentation requirements for your situation.

Handling Mixed-Use Properties

For properties used as both rentals and personal residences:

- Track the number of days the property is rented versus used personally.

- Calculate the percentage of rental use to determine the deductible portion of loan interest.

- Maintain separate records for rental-related expenses versus personal expenses.

Final Thoughts

Rental property loan interest tax deductions can significantly impact your bottom line as a property owner. You must understand eligible loans, calculate deductible interest accurately, and maintain meticulous records to maximize your tax benefits. Proper documentation (including mortgage statements, Form 1098, and receipts for property improvements) forms the cornerstone of successful tax deductions.

We recommend you consult with a tax professional who specializes in real estate investments to make the most of your rental property loan interest tax deductions. They can provide personalized advice tailored to your specific situation and ensure you take advantage of all available tax benefits. Accurate calculation of deductible interest is essential, especially for mixed-use properties.

At Osa Property Management, we understand the complexities of managing rental properties in Costa Rica. Our team can help you navigate the local tax landscape, manage your property efficiently, and maximize your investment returns. We cover areas from Tarcoles to Uvita, ensuring your property is well-maintained and your financial obligations are met.