At Osa Property Management, we know that navigating rental property repair tax deductions can be tricky for landlords. Understanding which repairs qualify and how to claim them correctly is crucial for maximizing your tax benefits.

This guide will walk you through the process of claiming rental property repair tax deductions, helping you save money and stay compliant with tax regulations.

What Counts as a Rental Property Repair?

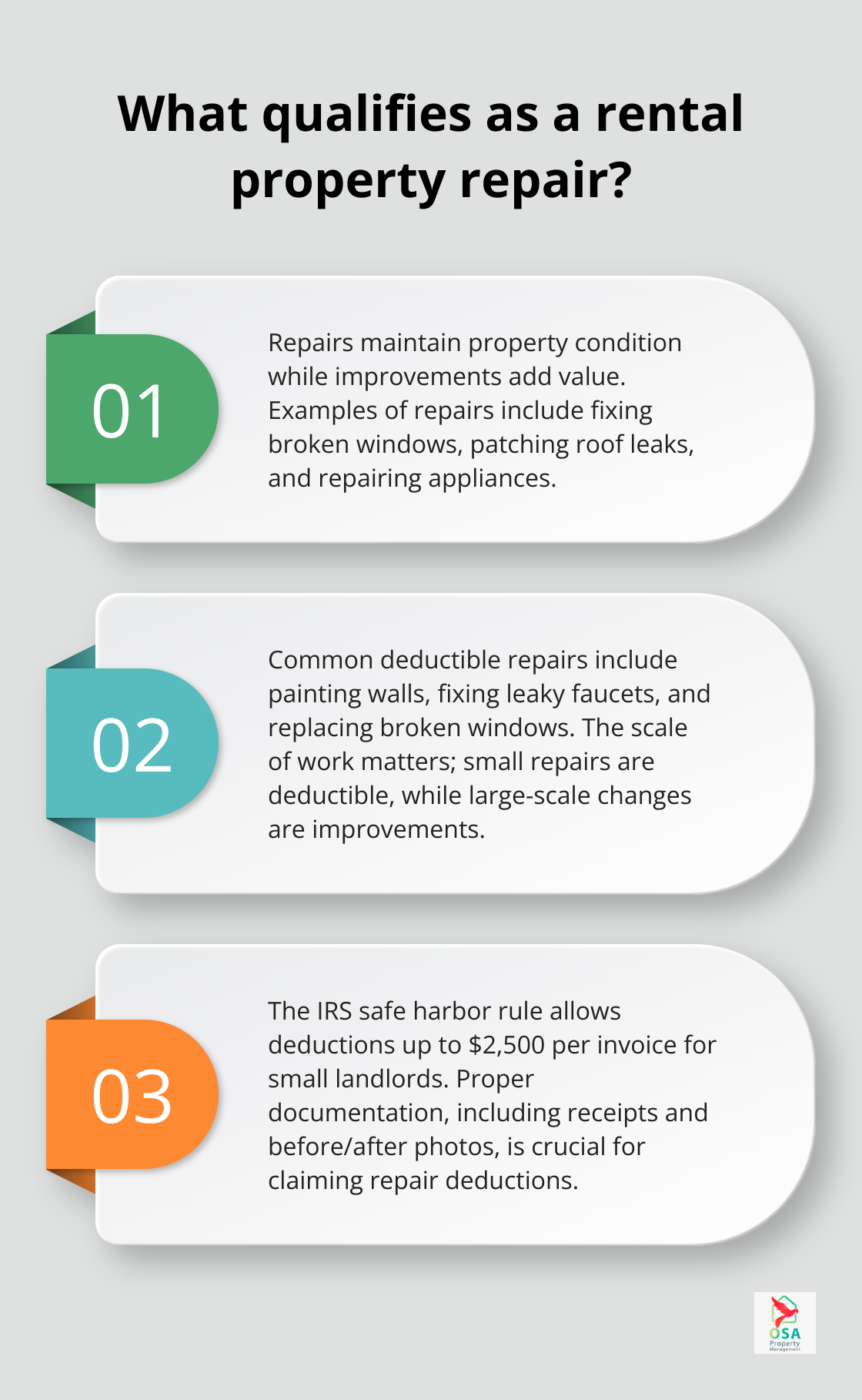

Repairs vs. Improvements: A Critical Distinction

The difference between repairs and improvements is key for landlords who want to maximize their tax deductions. Repairs are necessary to maintain the property’s condition, while improvements add value or extend the useful life of the property. Examples of repairs include fixing broken windows, patching roof leaks, or repairing appliances. These expenses are typically deductible in the year you incur them.

Improvements, however, add value to your property or extend its useful life. Adding a new room, upgrading to a more efficient HVAC system, or completely remodeling a kitchen are examples of improvements. You must capitalize these costs and depreciate them over time (usually 27.5 years for residential rental properties).

Common Deductible Repairs

Several repairs qualify for immediate tax deductions:

- Painting walls or touching up exterior paint

- Fixing leaky faucets or toilets

- Replacing broken windows or doors

- Repairing electrical outlets or switches

- Patching small areas of damaged flooring

The scale of the work matters. While patching a small area of damaged flooring is a repair, replacing all the flooring in a room is likely an improvement.

Proper Documentation: Your Shield Against Audits

Proper documentation is essential when you claim repair deductions. The IRS may request proof of your expenses during an audit. Keep detailed records including:

- Receipts for all materials and labor

- Before and after photos of the repair work

- Written descriptions of the repairs performed

- Copies of any contracts or agreements with service providers

Property management software can simplify this process. These tools often allow you to upload receipts, track expenses, and generate reports for tax purposes.

The Safe Harbor Rule: A Potential Game-Changer

The IRS provides a safe harbor rule for small landlords, allowing them to deduct amounts up to $2,500 per invoice or item if they don’t have an applicable financial statement (AFS). This can simplify record-keeping and potentially increase your deductions.

However, you should consult with a tax professional to ensure you apply this rule correctly and maximize your benefits within the bounds of tax law.

Understanding these distinctions and maintaining proper documentation can significantly impact your tax liability as a landlord. These principles apply broadly to rental properties in many jurisdictions (including Costa Rica, where Osa Property Management operates). In the next section, we’ll explore how to report these deductions on your tax return effectively.

How to Report Rental Property Repairs on Your Tax Return

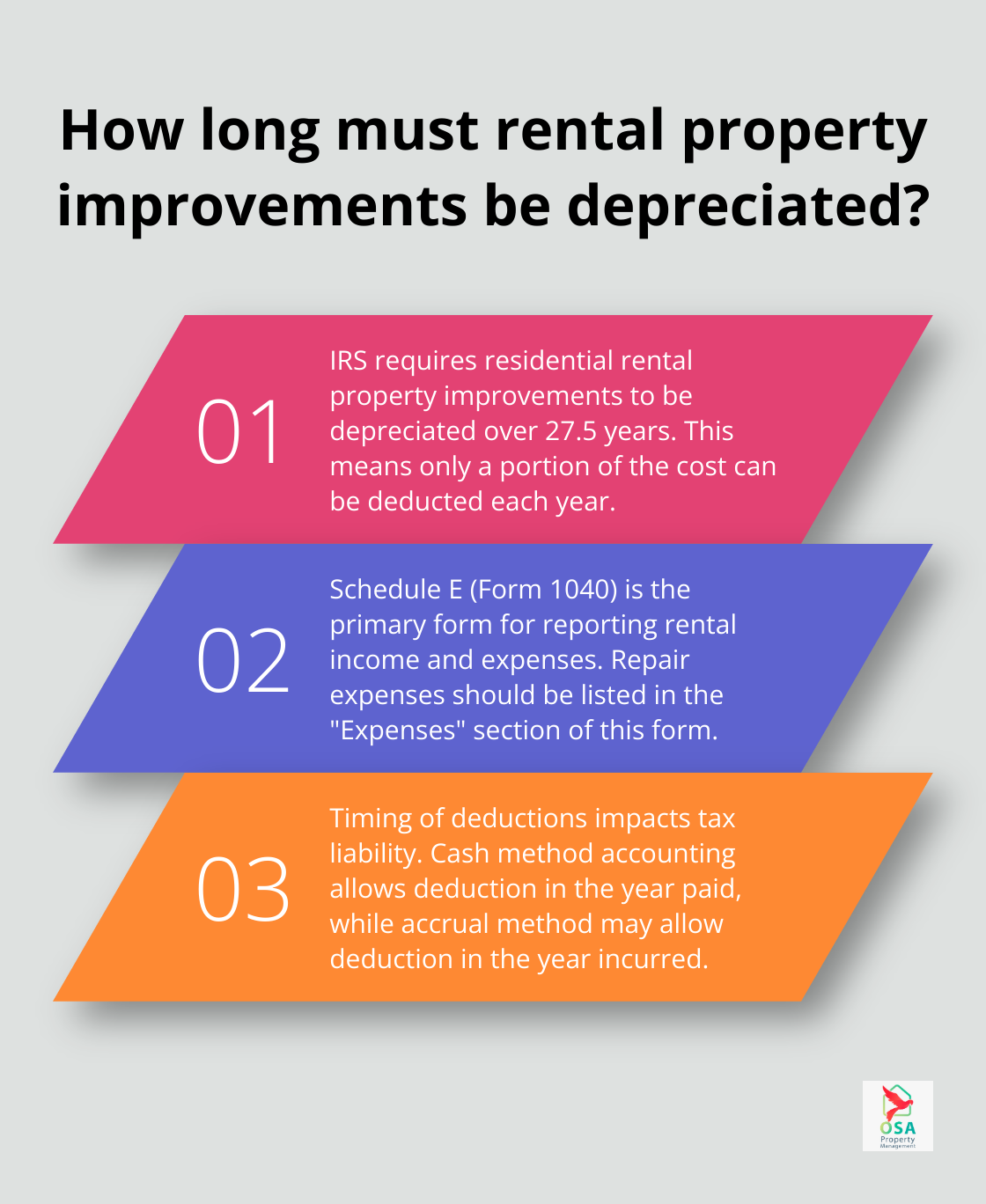

Understanding Schedule E

Schedule E (Form 1040) serves as the primary form for reporting rental income and expenses. When you complete this form, list your rental property repairs in the “Expenses” section. Accuracy and specificity are paramount. For example, if you spend $500 on plumbing repairs, enter this amount on the “Repairs” line of Schedule E.

Strategic Timing of Deductions

The timing of your deductions can significantly impact your tax liability. You should deduct repair expenses in the year you pay for them if you use the cash method of accounting. However, if you use the accrual method, you might deduct the expense in the year you incur it, even if you haven’t paid for it yet.

For larger repairs that qualify as capital improvements, you must depreciate these costs over several years. The IRS typically requires residential rental property improvements to be depreciated over 27.5 years. This means you’ll only deduct a portion of the cost each year (spreading the tax benefit over time).

Avoiding Common Mistakes

Misclassification of Improvements

A frequent error is the misclassification of improvements as repairs. While it might seem advantageous to classify all work as repairs for immediate deduction, this can lead to issues with the IRS. Always exercise caution and consult with a tax professional if you’re uncertain about how to classify an expense.

Inadequate Record-Keeping

The IRS may require you to substantiate your deductions. Maintain detailed records of all repair expenses, including receipts, invoices, and descriptions of the work performed. This documentation will prove invaluable in case of an audit.

Failure to Report All Income

Don’t forget to report all rental income, even if it’s offset by your expenses. Failing to report income is a red flag for audits and can result in penalties. (It’s always better to be thorough and transparent in your reporting.)

Leveraging Professional Assistance

Tax laws can be complex and change frequently. While this guide provides general information, it’s advisable to seek personalized advice tailored to your specific situation. A qualified tax professional can help you navigate the intricacies of rental property tax reporting and ensure you maximize your deductions within legal boundaries.

As we move forward, let’s explore strategies to maximize your rental property repair deductions and streamline your expense tracking process.

Maximizing Rental Property Repair Deductions

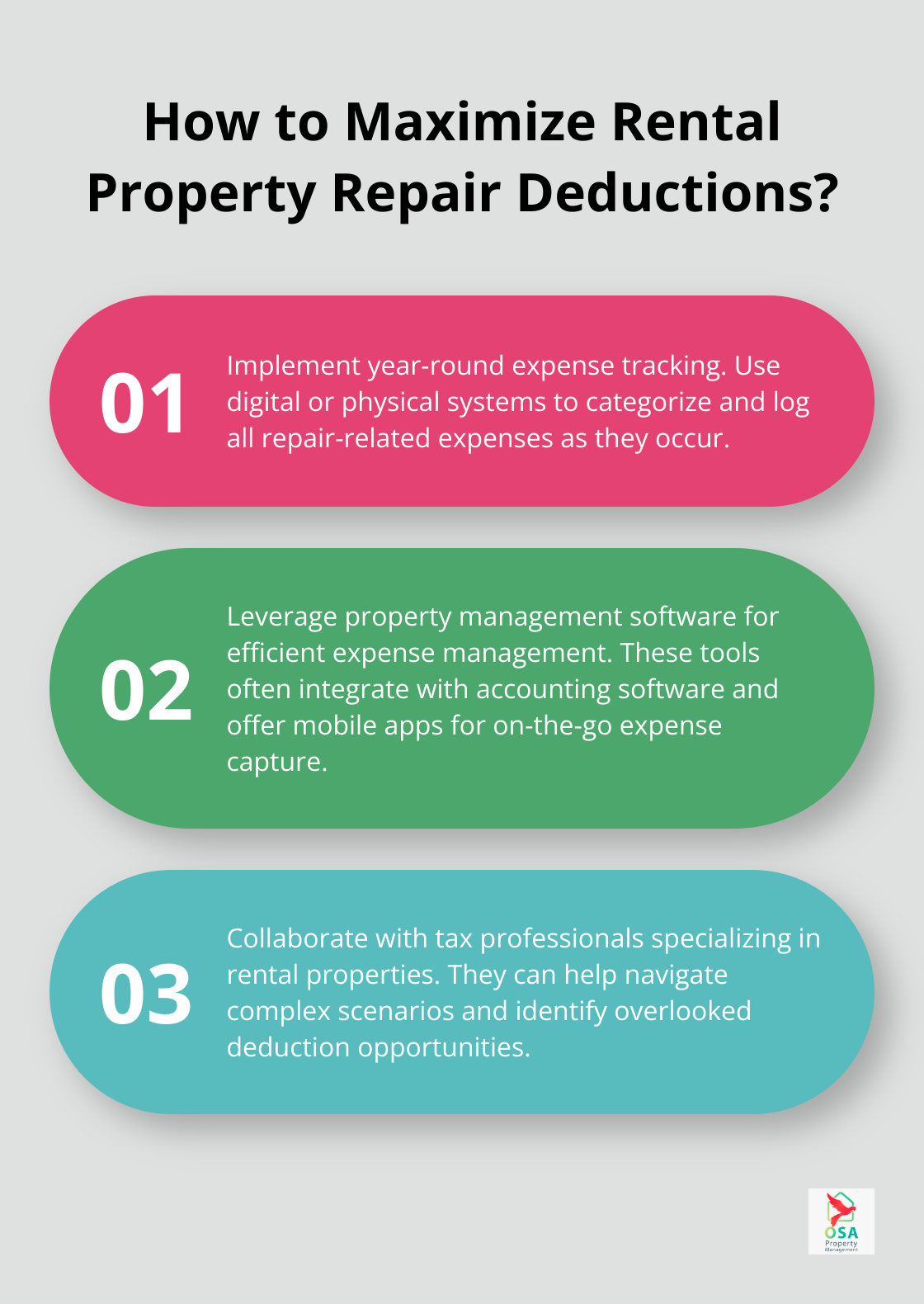

Implement a Year-Round Expense Tracking System

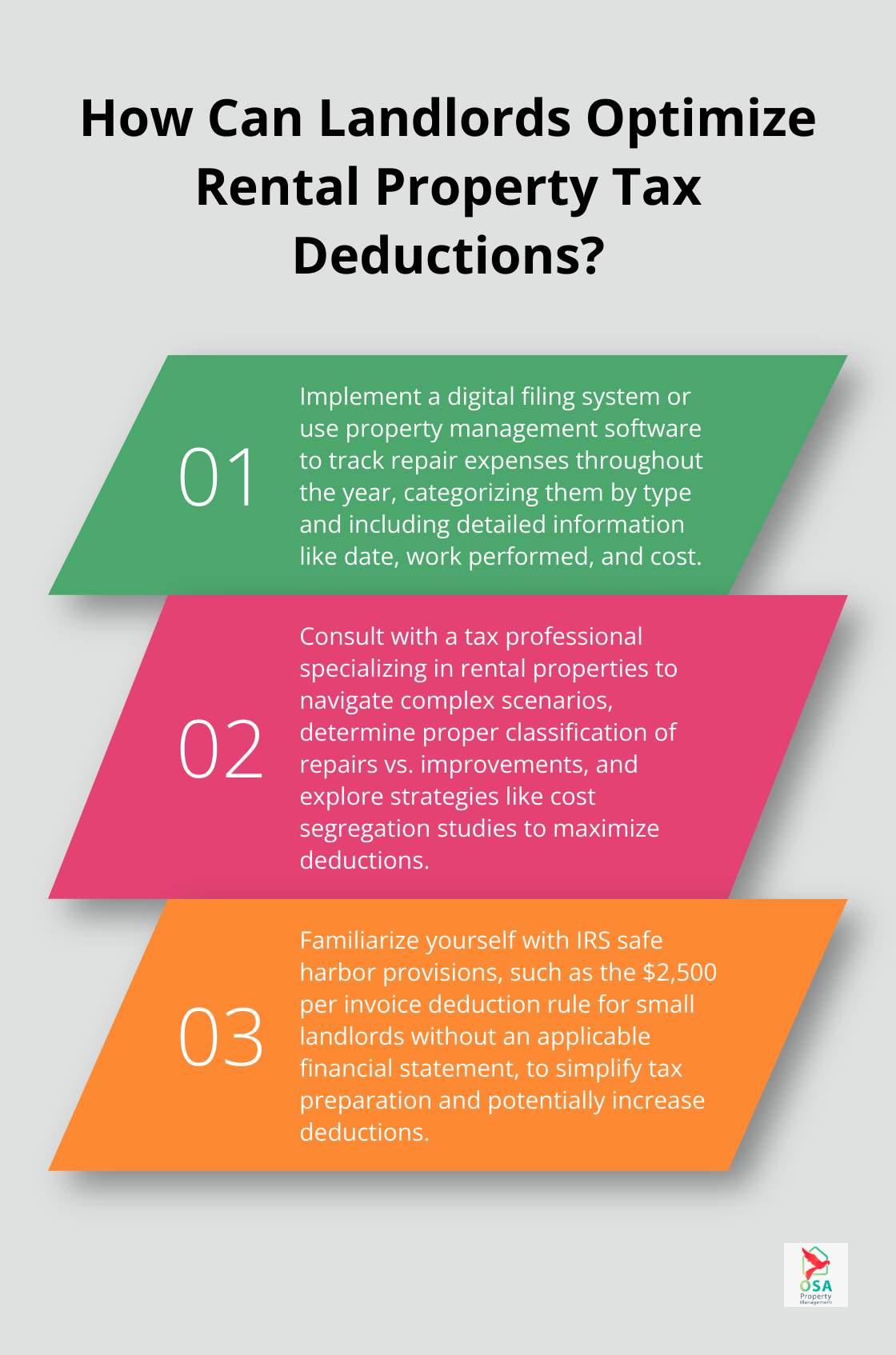

Accurate record-keeping throughout the year is essential for maximizing your rental property repair deductions. Create a dedicated system to log all repair-related expenses as they occur. This approach prevents the year-end scramble to gather receipts and ensures you don’t overlook any deductible expenses.

Use a digital filing system or a physical folder for each property. Categorize expenses by type (e.g., plumbing, electrical, general maintenance) to simplify tax preparation. Include detailed information such as the date of the repair, the specific work performed, and the cost. This level of detail aids in accurate reporting and provides valuable support in case of an IRS audit.

Leverage Technology for Efficient Expense Management

Property management software can transform your expense tracking process. These tools often include features specifically designed for rental property owners, such as the ability to categorize expenses, store digital receipts, and generate financial reports.

Many property management platforms integrate with accounting software, which streamlines the tax preparation process. Some systems can automatically categorize expenses based on predefined rules, reducing the risk of misclassification.

Mobile apps associated with these platforms allow you to capture and categorize expenses on the go. This immediate recording ensures no repair costs slip through the cracks, even for small, easily forgettable expenses (like a replacement doorknob or a can of paint).

Collaborate with Tax Professionals for Optimal Results

While diligent record-keeping is essential, partnering with a tax professional who specializes in rental properties can enhance your deduction strategy. These experts stay current with ever-changing tax laws and can identify deduction opportunities you might overlook.

A tax professional can help you navigate complex scenarios, such as determining whether a substantial repair qualifies as an improvement for tax purposes. They can also advise on strategies like cost segregation studies, which can accelerate depreciation deductions for certain property components.

Regular consultations with your tax advisor throughout the year can help you make informed decisions about the timing of repairs and improvements. This proactive approach allows you to strategically plan expenses to maximize tax benefits in a given year.

Utilize Safe Harbor Provisions

The IRS provides safe harbor provisions that can simplify the process of deducting certain expenses. For information about repairs and improvements, and depreciation of most rental property, refer to Publication 527, Residential Rental Property.

Try to familiarize yourself with these provisions and discuss their applicability with your tax professional. Proper use of safe harbor rules can significantly streamline your tax preparation process and potentially increase your deductions.

Stay Informed About Tax Law Changes

Tax laws and regulations related to rental properties can change frequently. The IRS Revenue Ruling 2023-25 has brought significant changes to the taxation rules for rental income. These changes are important for landlords and property owners to understand. Stay informed about these changes to ensure you’re taking advantage of all available deductions and following current guidelines. Subscribe to reputable tax news sources, attend landlord seminars, or join local real estate investment groups to stay up-to-date on relevant tax information.

Final Thoughts

Rental property repair tax deductions can significantly impact your investment returns. You must understand the difference between repairs and improvements, keep detailed records, and use technology for expense tracking. Tax laws change frequently, so you should educate yourself or consult professionals to optimize your tax strategy.

Osa Property Management offers comprehensive property management services in Costa Rica, including assistance with tax compliance. Our team can help streamline your property management processes and position you to maximize available tax benefits. We recommend maintaining accurate records throughout the year to save time and stress during tax season.

Effective management of rental property repair tax deductions builds a sustainable, profitable real estate investment strategy. You should implement the strategies discussed in this guide and stay vigilant about your rental property expenses. This approach will equip you to maximize your deductions and minimize your tax liability.