At Osa Property Management, we understand the challenges of property management debt collections. Unpaid rent can significantly impact a property’s financial health and overall operations.

This blog post explores effective strategies for preventing and managing tenant debt, from robust screening processes to legal considerations in debt collection.

We’ll guide you through practical techniques to maintain a healthy cash flow while preserving positive tenant relationships.

How to Prevent Debt in Property Management?

At Osa Property Management, we know that debt prevention trumps debt collection. Our 19 years of experience have taught us valuable strategies to minimize tenant debt risk.

Rigorous Tenant Screening

The first defense against potential debt is a thorough tenant screening process. We recommend you begin by approaching one of the established tenant screening services, often the same ones landlords use, and request a personal report. Verify employment, contact previous landlords, and analyze income-to-rent ratios. Try to select tenants with income at least three times the monthly rent. This extra effort upfront can save you countless headaches down the line.

Airtight Lease Agreements

Your lease agreement is your most powerful tool in preventing debt. Make sure it clearly outlines all payment terms, due dates, and late fees. We’ve found that specifying a grace period (typically 3-5 days) and then implementing a substantial late fee (often 5-10% of the rent) encourages prompt payments. Also, consider including an early termination clause to protect yourself if a tenant needs to break the lease.

Proactive Communication

Regular, friendly communication with tenants can prevent many payment issues. Send rent reminders a few days before the due date. If a tenant is late, reach out immediately. Often, a simple phone call can resolve the issue before it escalates. Most tenants appreciate these reminders and view them as good customer service rather than harassment.

Diverse Payment Options

The easier you make it for tenants to pay, the more likely they are to do so on time. Offer multiple payment methods such as online transfers, credit card payments, or even automatic withdrawals. Online rent payments can reduce the risk of late fees for tenants, as automated reminders help avoid late payments and associated fees. Consider incentivizing certain payment methods by offering a small discount for tenants who set up automatic payments.

These strategies create a system that naturally encourages timely payments and reduces the likelihood of debt. However, even with the best prevention methods, some tenants may still fall behind on payments. In the next section, we’ll explore effective debt collection techniques to address these situations.

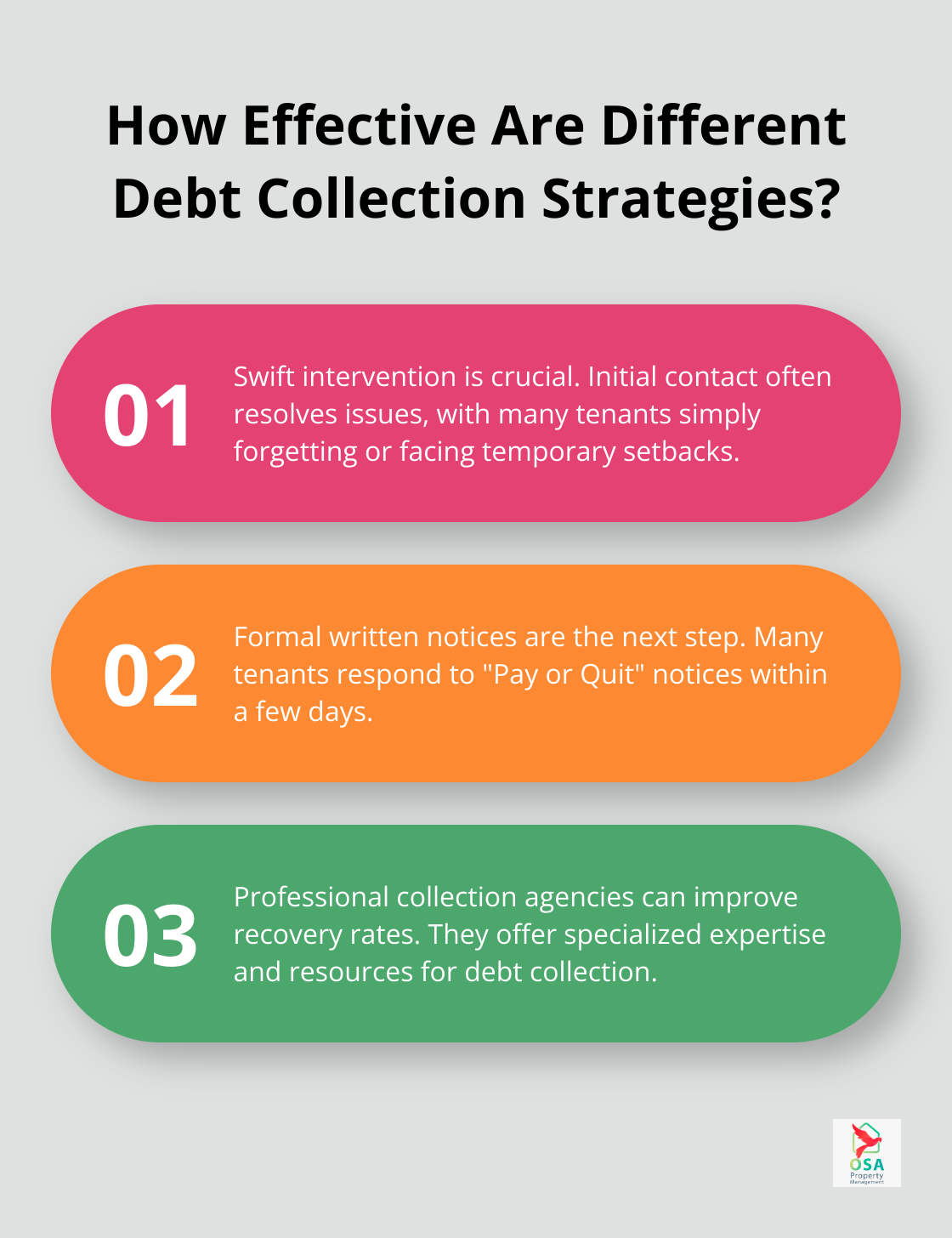

Effective Debt Collection Strategies

When prevention fails, property managers must act swiftly and decisively to recover unpaid rent. Our approach maximizes recovery while maintaining positive tenant relationships.

Swift Intervention

The moment a tenant misses a payment, take action. Contact the tenant immediately. A friendly phone call or text message often resolves the issue. Many tenants simply forgot or encountered a temporary setback. Offer to set up a payment plan if needed. Tenants who agree to payment plans tend to follow through more often than those who don’t.

Formal Written Notices

If initial contact doesn’t yield results, escalate to formal written notices. Send a “Pay or Quit” notice, which clearly states the amount owed, due date, and consequences of non-payment. Follow up with certified mail to create a paper trail. Many tenants respond to formal notices within a few days.

Professional Collection Agencies

When internal efforts fall short, consider professional debt collection agencies. These specialists have resources and expertise that can significantly improve recovery rates. Professional collection agencies should be able to provide a recovery rate or rate of success in recovering past due rent. It’s important to inquire about the agency’s debt collections process before hiring them.

Legal Action as Last Resort

If all else fails, legal action may become necessary. This typically involves filing for eviction and seeking a judgment for unpaid rent. While effective, it’s costly and time-consuming. Evictions typically cost $2,540 due to vacancy, based on an average 2-3 month eviction process.

Maintaining Professionalism

Throughout the debt collection process, maintain professionalism and comply with local laws. The goal is to recover funds while preserving your property’s reputation. Each step should be taken with care and consideration.

As we move forward, it’s essential to understand the legal considerations that govern debt collection practices in property management. Let’s explore these crucial aspects to ensure compliance and protect your interests.

Legal Considerations in Property Management Debt Collection

At Osa Property Management, we understand that navigating the legal landscape of debt collection is as important as the collection process itself. The Fair Debt Collection Practices Act (FDCPA) forms the foundation of debt collection law in the United States. It applies to any person who regularly collects or attempts to collect debts for another.

Understanding Legal Boundaries

The FDCPA prohibits deceptive, unfair, and abusive practices. You cannot misrepresent the amount owed, threaten actions you don’t intend to take, or contact tenants at inconvenient times. For instance, calls before 8 a.m. or after 9 p.m. are off-limits unless the tenant agrees otherwise.

A common misconception is that collecting your own debt exempts you from all regulations. This isn’t always true. Many states have enacted laws that mirror the FDCPA and apply them to landlords. In California, for example, the Rosenthal Fair Debt Collection Practices Act clarifies that, when collecting rent from their tenants, landlords must abide by the Act’s prohibition against deceptive, unfair, and abusive practices.

Importance of Documentation

Meticulous record-keeping serves as your best defense against potential legal challenges. You should log every communication with the tenant, including date, time, method of contact, and a summary of the conversation. For email or text messages, keep copies. For phone calls, take detailed notes immediately after the call.

This documentation serves two purposes: it helps you track the progress of your collection efforts and provides evidence of your compliance with debt collection laws if a tenant ever disputes your practices.

Adapting to Local Laws

While federal laws provide a baseline, local and state laws often add additional layers of regulation. For example, in New York City, landlords must provide written notice to tenants before initiating any legal action for unpaid rent. This notice must follow a specific format and give the tenant at least 14 days to pay.

In Seattle, landlords must offer payment plans to tenants who fall behind on rent before considering eviction. Failure to comply with these local ordinances can result in your debt collection efforts being nullified, even if you followed federal guidelines to the letter.

Seeking Professional Guidance

To stay compliant, we recommend consulting with a local attorney specializing in landlord-tenant law. They can provide up-to-date information on your specific jurisdiction’s requirements. This step can help protect you legally and maintain your reputation as a fair and professional property manager.

The goal is not just to collect the debt, but to do so in a way that protects you legally (and ethically). Understanding and adhering to these legal considerations will equip you to handle debt collection effectively.

Final Thoughts

Property management debt collections require a proactive and balanced approach. Robust prevention strategies can significantly reduce the likelihood of tenant debt, but when debt occurs, swift and professional action becomes necessary. A comprehensive debt collection strategy should include early intervention, clear communication, and a thorough understanding of legal requirements.

Osa Property Management has refined its approach to debt collection through years of experience in Costa Rica’s property management landscape. We understand the delicate balance between firm collections and maintaining positive tenant relations. Our strategy focuses on prevention first, followed by a graduated response to unpaid rent that respects both the property owner’s financial interests and the tenant’s rights.

Professional property management services can make a significant difference, especially when managing multiple properties or operating in an unfamiliar market. Osa Property Management offers expert services tailored to the unique needs of property owners in Costa Rica, handling everything from marketing and tenant screening to rent collection and maintenance (including debt collections).