At Osa Property Management, we understand the importance of maximizing tax benefits for rental property owners. One often overlooked strategy is leveraging the tax benefits of rental property depreciation.

This powerful tool can significantly reduce your taxable income and boost your overall returns. In this post, we’ll explore how to make the most of depreciation deductions and potentially save thousands on your taxes.

What Is Rental Property Depreciation?

The Power of Depreciation in Real Estate

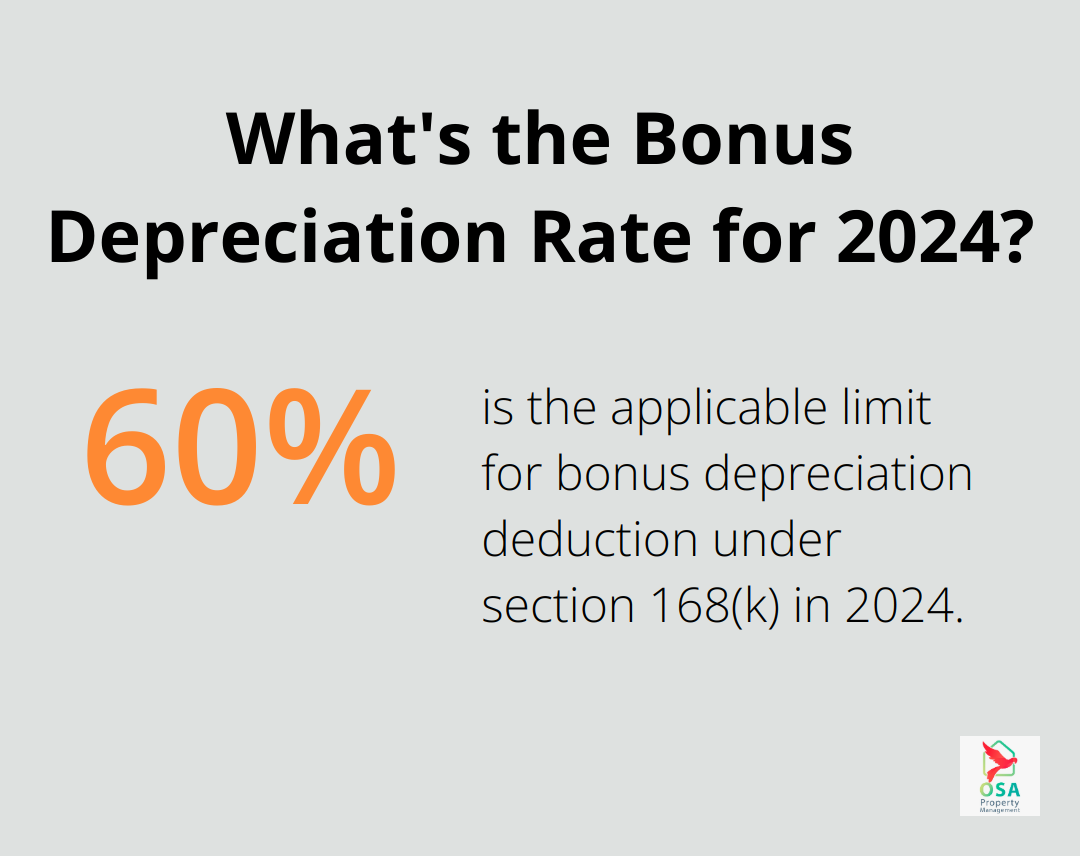

Rental property depreciation stands as a potent tax tool that many property owners underutilize. The bonus depreciation deduction under section 168(k) continues its phaseout in 2024 with a reduction of the applicable limit from 80% to 60%. This strategy allows you to deduct the cost of your rental property over its useful life, as defined by the IRS. It’s not merely an accounting technique; it’s a legitimate method to reduce your taxable income and enhance your overall returns.

Understanding the Depreciation Timeline

The IRS sets the depreciation period for residential rental properties at 27.5 years. This means using the straight line method over a recovery period of 27.5 years. For instance, if you acquire a rental property for $275,000, you could potentially deduct $10,000 annually from your taxable income (excluding land value).

The Financial Impact of Depreciation

Depreciation matters because it allows you to claim a tax deduction without actual yearly expenditure. This non-cash expense can substantially lower your tax bill, freeing up more of your rental income for other investments or expenses.

Eligibility Criteria for Depreciation

Not all properties qualify for depreciation. Your rental property must meet specific criteria:

- You must own the property

- It must generate income

- It must have a determinable useful life

- It must last more than one year

It’s important to note that land doesn’t depreciate. When calculating depreciation, you need to separate the value of the building from the land it occupies. This step often requires professional assistance to ensure accurate calculations and maximize potential tax savings.

Quantifying the Benefits

To illustrate the impact, consider this scenario: If you’re in the 24% tax bracket and can claim $10,000 in depreciation, that’s a potential tax saving of $2,400 per year. Over the full 27.5-year period, this could amount to $66,000 in tax savings (from depreciation alone).

As we move forward, we’ll explore the various methods to calculate depreciation and strategies to maximize these benefits, ensuring you make the most of this powerful tax tool.

How to Calculate Rental Property Depreciation

The Straight-Line Method: A Simple Approach

The IRS requires the use of the straight-line depreciation method for residential rental properties. This method distributes the cost of your property evenly over its useful life (27.5 years for residential rentals).

To calculate your annual depreciation deduction:

- Determine your property’s cost basis (purchase price plus improvements, minus land value)

- Divide the cost basis by 27.5

For example, if your property’s cost basis is $200,000, your annual depreciation deduction would be $7,272.73.

Determining Your Property’s Depreciable Basis

Your property’s depreciable basis includes more than just its purchase price. It encompasses:

- The purchase price

- Certain closing costs

- Improvements made before renting

- Any assumed mortgage debt

Subtract the value of the land, as it’s not depreciable. You can estimate land value using your property tax assessment or a professional appraisal.

Different Property Types, Different Timelines

While residential properties follow the 27.5-year timeline, other rental property types have different depreciation periods:

- Commercial properties: 39 years

- Land improvements (fencing or landscaping): 15 years

- Personal property within the rental (appliances, furniture): 5-7 years

Understanding these differences can significantly impact your tax strategy. Separating out personal property can accelerate your depreciation benefits.

The Mid-Month Convention: Timing Matters

The IRS applies a mid-month convention for residential rental properties. This means depreciation starts from the middle of the month you place the property in service, regardless of the actual date.

For example, if you start renting your property in April, you can claim 8.5 months of depreciation for that first year (not the full 12 months).

Improvements vs. Repairs: Know the Difference

It’s important to distinguish between improvements and repairs. Improvements that add value to your property or extend its life are depreciated over time. Repairs, on the other hand, are fully deductible in the year they’re made.

Keeping meticulous records of all expenses related to your rental property is essential. This practice ensures accurate depreciation calculations and maximizes your overall tax benefits.

These calculations might seem complex, but they’re a powerful tool for reducing your taxable income. Many property owners find value in consulting with a tax professional to ensure they leverage depreciation to its fullest potential while staying compliant with IRS regulations.

In the next section, we’ll explore advanced strategies to maximize your depreciation benefits and potentially save even more on your taxes.

Turbocharge Your Depreciation Benefits

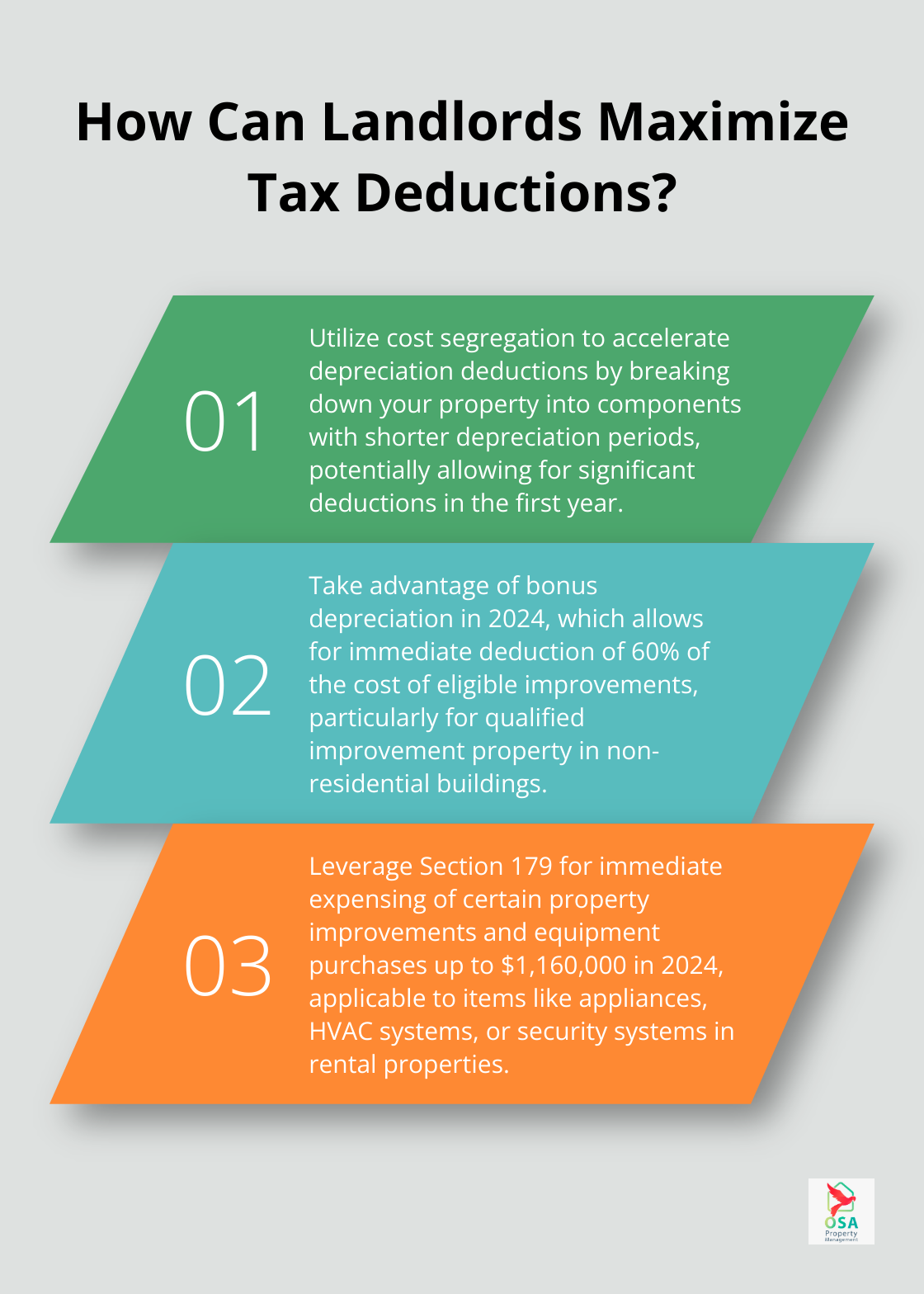

Cost Segregation: Accelerate Your Deductions

Cost segregation stands as a powerful strategy to front-load depreciation deductions. This approach breaks down your property into its component parts and depreciates each separately. While the building structure still depreciates over 27.5 years, many components can depreciate much faster.

Carpeting, appliances, and some electrical systems might qualify for 5-year depreciation. Parking lots and landscaping often fall into the 15-year category. A professional cost segregation study can identify these opportunities, potentially allowing you to deduct a significant portion of a property’s purchase price in the first year.

Cost Segregation studies typically aim to identify all property-related costs that can be depreciated over 5, 7 and 15 years.

Bonus Depreciation: A Limited-Time Opportunity

The Tax Cuts and Jobs Act introduced bonus depreciation, allowing investors to immediately deduct a large percentage of the cost of eligible improvements. For 2024, eligible assets acquired and placed in service are eligible for 60% bonus depreciation.

Qualified improvement property (QIP) includes interior improvements to non-residential buildings. While this doesn’t apply to residential rentals directly, it’s important for mixed-use properties or if you consider diversifying your portfolio.

The IRS defines QIP as improvements made to the interior of a non-residential building after the building was placed in service. This could include new flooring, lighting fixtures, or partition walls. Leveraging bonus depreciation on these improvements can significantly accelerate your deductions.

Section 179: Small-Scale but Mighty

Section 179, often associated with businesses, can also benefit savvy rental property owners. This provision allows for immediate expensing of certain property improvements and equipment purchases, up to $1,160,000 for the 2024 tax year.

For rental properties, this can apply to items like appliances, HVAC systems, or security systems. Instead of depreciating these over several years, you can potentially deduct the full cost in the year of purchase.

Section 179 has specific rules and limitations. It’s generally more beneficial for mixed-use properties or those who qualify as real estate professionals. Always consult with a tax professional to ensure you’re eligible and applying this strategy correctly.

Implementing these strategies requires careful planning and often professional assistance. We’ve observed clients save tens of thousands of dollars by optimizing their depreciation strategies. While we focus on providing top-notch property management services in Costa Rica, we always recommend working with a qualified tax professional to implement these advanced depreciation tactics effectively.

Final Thoughts

The tax benefits of rental property depreciation can significantly impact your bottom line as a property owner. You can potentially save thousands in taxes each year by understanding depreciation calculations and leveraging strategies like cost segregation. These strategies reduce your current tax liability and enhance your overall return on investment in the long run.

Navigating the complex world of tax regulations and depreciation strategies requires expertise. A qualified tax professional can help you identify opportunities specific to your property portfolio and financial situation (potentially uncovering deductions you might have otherwise missed). Working with an expert ensures you maximize your benefits while remaining compliant with IRS regulations.

At Osa Property Management, we understand the importance of maximizing returns for property owners in Costa Rica. We focus on providing top-notch property management services and recommend our clients work closely with tax professionals to optimize their investment strategies. You can truly unlock the full potential of your rental property investments through expert property management and savvy tax planning.