At Osa Property Management, we understand the importance of maximizing rental property tax depreciation for our clients. This powerful tax strategy can significantly reduce your taxable income and boost your overall returns on investment.

In this post, we’ll explore practical methods to optimize your rental property depreciation benefits. We’ll cover everything from understanding the basics to implementing advanced strategies that can save you thousands in taxes.

What Is Rental Property Depreciation?

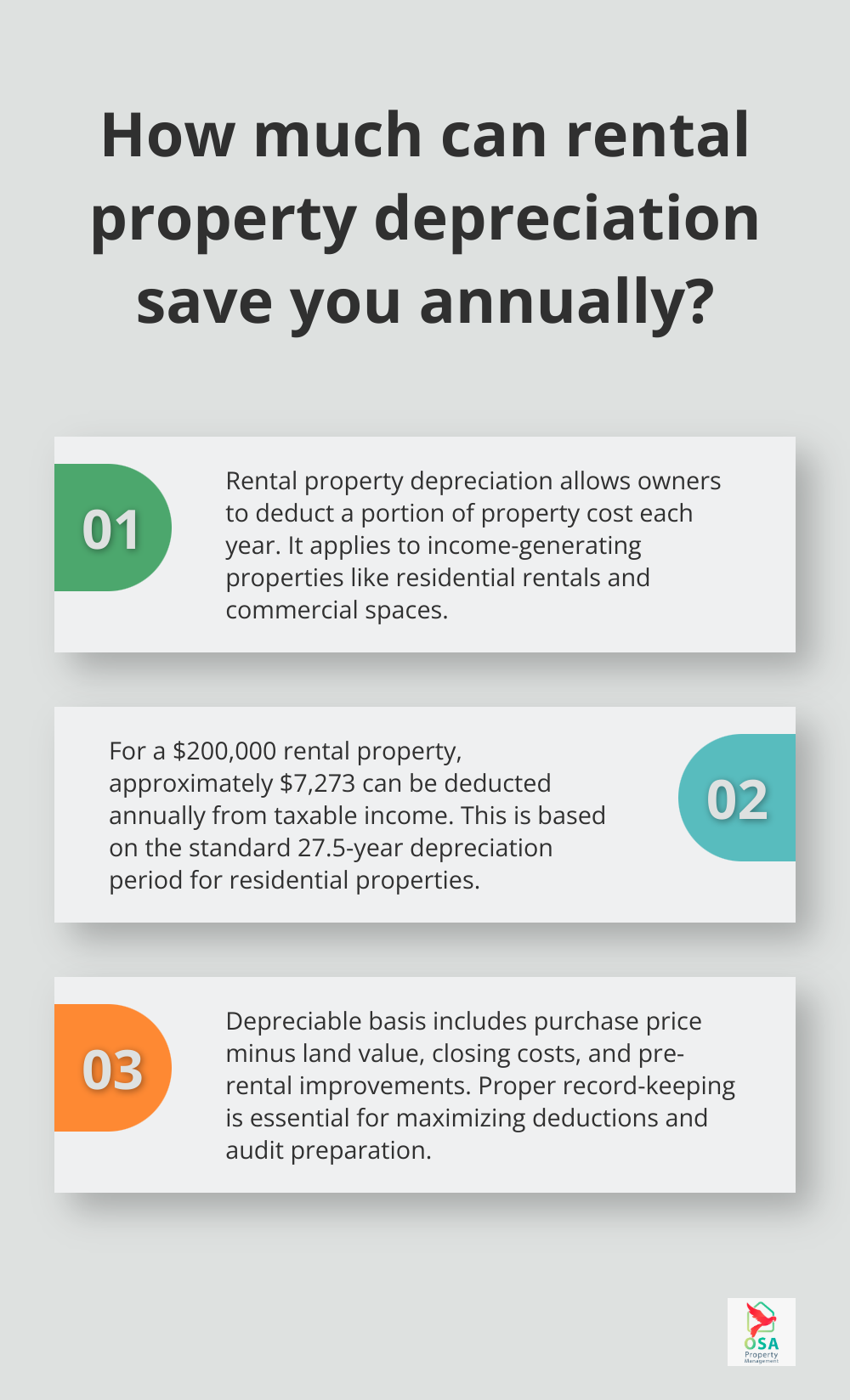

Definition and Eligibility

Rental property depreciation serves as a powerful tax tool for property owners to reduce their taxable income. This concept recognizes that buildings and assets deteriorate over time, allowing owners to deduct a portion of the property’s cost each year. To qualify for depreciation, a property must generate income, such as a rental. Eligible properties include residential rentals (single-family homes, apartments, condos) and commercial properties (office buildings, retail spaces). It’s important to note that land does not depreciate; only the structure and its components qualify for this deduction.

Impact on Taxable Income

Rental property depreciation is a basic accounting principle that allows you to deduct the cost of a rental property over a set period of time. This can substantially lower your taxable income from rental properties. For instance, if you own a rental property valued at $200,000 (excluding land value) and apply the standard 27.5-year depreciation period for residential properties, you could deduct approximately $7,273 annually from your taxable rental income. This deduction often leads to significant tax savings, particularly for high-income earners in higher tax brackets.

Determining Depreciable Basis

To optimize your depreciation benefits, you must accurately determine your property’s depreciable basis. This includes:

- Purchase price of the property (minus land value)

- Closing costs

- Improvements made before renting out the property

To calculate depreciation, the value of the building is divided by 27.5 years. The resulting depreciation expense is deducted from the pre-tax net income. Maintaining detailed records of all expenses related to your rental property is essential for maximizing your deductions. (This practice will prove invaluable during tax season and potential audits.)

Real-World Application

In Costa Rica, property owners have successfully implemented depreciation strategies to their advantage. For example, a client in Jaco reduced their taxable rental income by over $10,000 annually through careful depreciation planning and meticulous record-keeping. (This case demonstrates the potential for substantial tax savings through proper depreciation management.)

Professional Guidance

Depreciation offers significant tax advantages, but it involves complex tax laws. Working with a qualified tax professional or property management company experienced in Costa Rican tax regulations will help ensure you maximize your benefits while complying with local laws. Osa Property Management, with its extensive experience in Costa Rican property management, can provide valuable insights into optimizing your rental property depreciation.

As we move forward, we’ll explore the specific methods used to calculate depreciation for rental properties, including the Modified Accelerated Cost Recovery System (MACRS) and how to determine recovery periods for different property types.

How to Calculate Rental Property Depreciation

Understanding the Modified Accelerated Cost Recovery System (MACRS)

The IRS requires the use of the Modified Accelerated Cost Recovery System (MACRS) for most rental properties acquired after 1986. This system provides a standardized method to calculate depreciation over time. Under MACRS, residential rental properties typically depreciate over 27.5 years, while commercial properties depreciate over 39 years.

To calculate your annual depreciation deduction using MACRS, divide your property’s depreciable basis by the appropriate recovery period. For example, if your residential rental property has a depreciable basis of $200,000, your annual depreciation deduction would equal approximately $7,273 ($200,000 ÷ 27.5 years).

Determining Your Property’s Depreciable Basis

Your property’s depreciable basis plays a key role in calculating depreciation. It includes the purchase price of the property, plus certain closing costs and improvements, minus the value of the land. Here’s how to determine your depreciable basis:

- Start with the purchase price of your property.

- Add eligible closing costs (e.g., legal fees, recording fees, transfer taxes).

- Include the cost of any improvements made before renting the property.

- Subtract the value of the land, as land does not depreciate.

For instance, if you purchased a rental property for $300,000, incurred $5,000 in closing costs, made $20,000 in improvements, and the land is valued at $75,000, your depreciable basis would equal $250,000 ($300,000 + $5,000 + $20,000 – $75,000).

Applying Recovery Periods to Different Property Types

Different types of rental property assets have varying recovery periods under MACRS. Here’s a quick overview:

- Residential rental properties: 27.5 years

- Commercial properties: 39 years

- Appliances and carpeting: 5 years

- Office furniture and equipment: 7 years

- Fences and roads: 15 years

These recovery periods can significantly impact your annual depreciation deductions. While your building structure depreciates over 27.5 or 39 years, you can depreciate appliances much faster, potentially leading to larger deductions in the early years of ownership.

Considering Local Tax Laws

In Costa Rica, local tax laws may have specific provisions for depreciation. Always consult with a local tax expert to ensure compliance with Costa Rican regulations while maximizing your depreciation benefits. (Osa Property Management, with its extensive experience in Costa Rican property management, can provide valuable insights into optimizing your rental property depreciation.)

Accurate depreciation calculations can lead to substantial tax savings over time. (One property owner in Jaco reduced their taxable rental income by over $15,000 annually through proper depreciation strategies, significantly lowering their overall tax burden.)

Now that we understand how to calculate depreciation, let’s explore strategies to maximize these benefits and optimize your rental property’s tax efficiency.

Maximizing Depreciation Benefits for Rental Properties

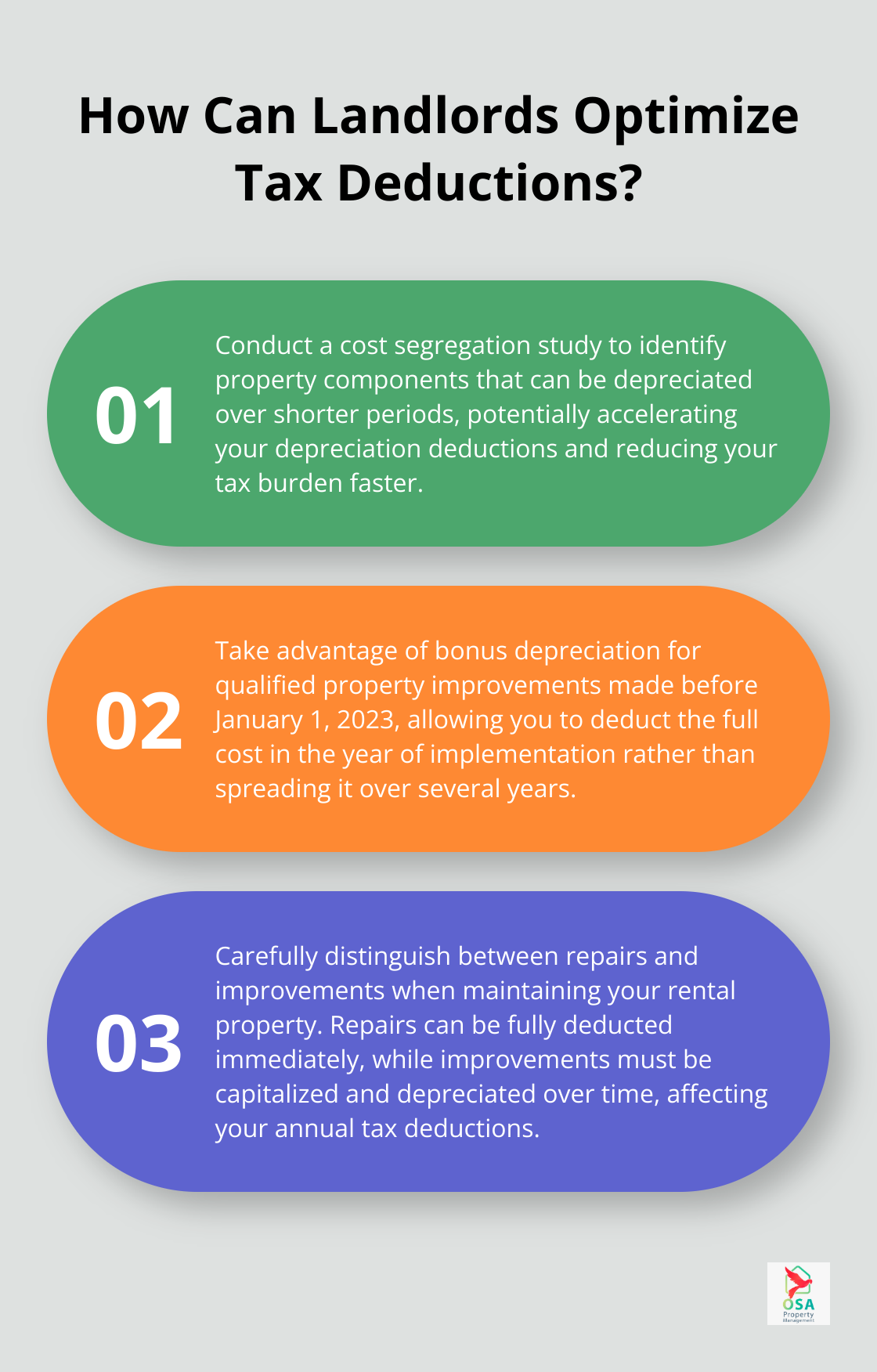

Cost Segregation Studies

Property owners can use cost segregation studies to optimize their depreciation benefits. These detailed analyses of a property’s components allow owners to accelerate depreciation deductions and reduce their tax burden. While residential rental property typically depreciates over 27.5 years, a cost segregation study can identify components that depreciate over shorter periods.

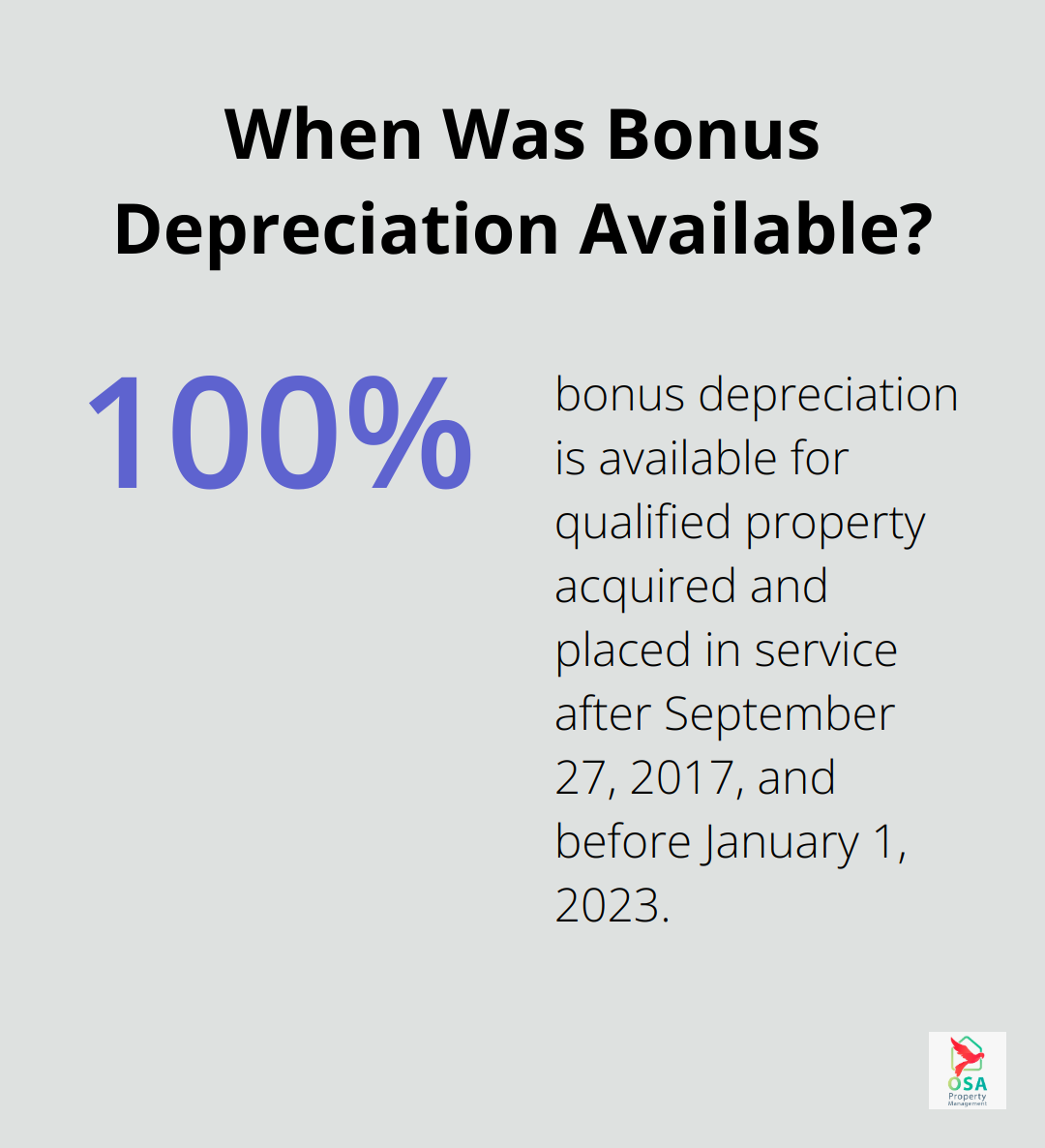

Bonus Depreciation

The Tax Cuts and Jobs Act introduced 100% bonus depreciation for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. This allows property owners to deduct the full cost of eligible improvements in the year they’re made, rather than spreading the deduction over several years.

Property owners can take advantage of bonus depreciation when installing new systems or making significant improvements to their rental properties. This can provide immediate tax relief and improve cash flow.

Section 179 Deductions

Section 179 of the Internal Revenue Code allows businesses to deduct the full purchase price of qualifying equipment or software purchased or financed during the tax year. This benefits rental property owners who need to purchase items like appliances or office equipment.

Improvement vs. Repair Considerations

Understanding the difference between improvements and repairs is essential for maximizing depreciation benefits. Repairs can be fully deducted in the year they’re made, while improvements must be capitalized and depreciated over time.

For example, fixing a leaky roof would be considered a repair and can be fully deducted immediately. However, replacing the entire roof would be an improvement, subject to depreciation over several years.

Professional Guidance

Implementing these strategies requires careful planning and expert knowledge of tax laws. Property owners should work with professionals who understand both U.S. and Costa Rican tax regulations to ensure they maximize their depreciation benefits while staying compliant with local laws. Osa Property Management, with 19 years of experience in Costa Rican property management, can provide valuable insights into optimizing rental property depreciation strategies.

Final Thoughts

Rental property tax depreciation offers property owners a powerful strategy to reduce taxable income and boost investment returns. Property owners must understand depreciation calculations, determine accurate depreciable basis, and leverage advanced strategies like cost segregation studies. Meticulous record-keeping and staying informed about current tax laws will maximize available deductions and ensure compliance with regulations.

Navigating the complex landscape of rental property tax depreciation requires expertise in both U.S. and Costa Rican tax laws. A tailored depreciation strategy aligned with specific investment goals can improve cash flow, increase profitability, and enhance the value of an investment portfolio. (Consistent implementation of these strategies over time can build substantial wealth through real estate investments.)

Osa Property Management offers expert guidance and comprehensive property management services for property owners in Costa Rica. Our team can help you navigate local tax regulations, implement effective depreciation strategies, and ensure your rental property investment reaches its full potential. We combine smart depreciation practices with effective property management to create robust, profitable rental property portfolios.