At Osa Property Management, we know that owning rental property can be a lucrative investment. However, many landlords overlook the substantial tax breaks for owning rental property that can significantly boost their bottom line.

In this post, we’ll explore how to maximize these tax benefits, from common deductions to lesser-known credits. We’ll also share practical strategies to help you keep more of your hard-earned rental income in your pocket.

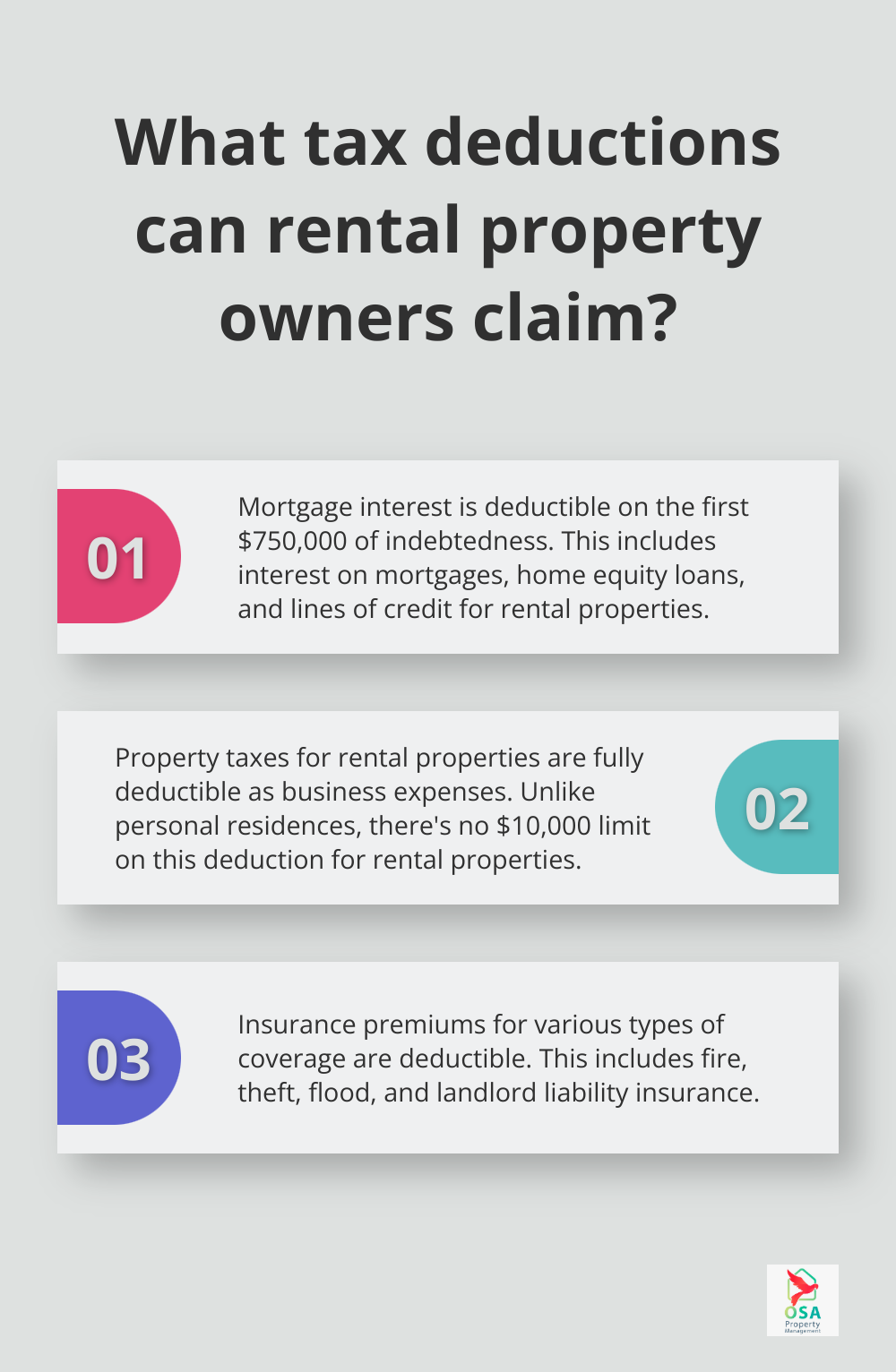

What Tax Deductions Can Rental Property Owners Claim?

Rental property owners have access to numerous tax deductions that can significantly reduce their tax liability. Proper utilization of these deductions can boost property owners’ bottom lines.

Mortgage Interest: A Major Deduction

Mortgage interest represents one of the largest deductions available to rental property owners. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. This includes interest on mortgages, home equity loans, and lines of credit used for rental property purposes.

Property Taxes: Fully Deductible

Property taxes for rental properties are fully deductible as business expenses when incurred. Unlike personal residences, there’s no $10,000 limit on this deduction for rental properties. This can result in substantial savings, especially in areas with high property tax rates.

Insurance Premiums: Often Overlooked

Don’t overlook insurance premiums. You can deduct premiums for various types of coverage, including fire, theft, flood, and landlord liability insurance. These costs can add up quickly, so make sure you track and deduct them.

Depreciation: A Valuable Long-Term Deduction

Depreciation is one of the most valuable deductions available for rental property owners. It allows you to deduct the cost of your rental property over time – 27.5 years for residential properties. This non-cash expense can significantly reduce your taxable income. For example, if you purchased a residential rental property for $275,000, you could potentially deduct $10,000 per year in depreciation.

Repairs vs. Improvements: Know the Difference

Understanding the distinction between repairs and improvements is essential for maximizing your deductions. Repairs can be fully deducted in the year they’re made, while improvements must be depreciated over time. For instance, fixing a leaky pipe is a repair, while installing a new HVAC system is an improvement.

The IRS defines repairs as expenses that keep your property in good operating condition but don’t materially add value or prolong its life. On the other hand, improvements are expenses that add value to the property, prolong its useful life, or adapt it to new uses.

Careful categorization of your expenses can maximize your immediate deductions while still benefiting from long-term depreciation on improvements. Proper documentation is key to supporting your deductions in case of an audit.

Now that we’ve covered the main tax deductions for rental property owners, let’s explore some valuable tax credits that can further reduce your tax liability.

Tax Credits for Rental Property Owners

Low-Income Housing Tax Credit (LIHTC)

The LIHTC program subsidizes the acquisition, construction, and rehabilitation of affordable rental housing for low- and moderate-income tenants. This federal initiative, managed by state housing agencies, provides tax credits for investors who buy, renovate, or build rental housing for lower-income tenants.

To qualify, property owners must restrict rents and occupy a certain percentage of units with individuals earning below the area median income. The credit spans a 10-year period and can reach up to 70% of the building’s qualified basis present value.

For instance, a $1 million qualifying project could yield $700,000 in tax credits over a decade (a significant reduction in tax liability while promoting affordable housing investment).

Residential Energy Efficient Property Credit

Property owners can slash their tax bills through energy efficiency improvements. The Residential Renewable Energy Tax Credit allows claims for qualified energy-efficient upgrades to rental properties.

Eligible improvements include:

- Solar panels

- Solar water heaters

- Geothermal heat pumps

- Small wind turbines

As of 2023, if you make qualified energy-efficient improvements to your home, you may qualify for a tax credit up to $3,200.

Rehabilitation Tax Credit

The Rehabilitation Tax Credit (also known as the Historic Tax Credit) encourages the preservation and renovation of historic buildings. This credit proves particularly valuable for rental property owners with older properties in historic districts.

Property owners can claim 20% of qualified rehabilitation expenditures for a certified historic structure. To qualify, the building must either:

- Be listed in the National Register of Historic Places

- Be located in a registered historic district and certified as historically significant

A $500,000 investment in qualifying rehabilitation expenses for a historic rental property could translate to a $100,000 tax credit. This not only reduces tax liability but also preserves architectural heritage and potentially increases property value.

These tax credits offer powerful tools for rental property owners to minimize their tax burden while investing in socially beneficial projects. The next section will explore strategies to maximize these and other tax benefits, ensuring property owners make the most of available incentives.

How to Maximize Tax Benefits for Rental Property Owners

Keep Meticulous Records

Effective tax management starts with thorough record-keeping. Document every expense, no matter how small. This includes receipts for repairs, utility bills, insurance premiums, and mileage for property-related travel. Use digital tools to scan and organize receipts, which simplifies expense categorization during tax season. Property owners who maintain detailed records often save up to 15% more on taxes compared to those with poor documentation (according to a study by the National Association of Residential Property Managers).

Conduct a Cost Segregation Study

A cost segregation study is a powerful tool that may help boost your cash flow and decrease your tax liability. This engineering-based analysis identifies and reclassifies personal property assets to shorten their depreciation time for tax purposes. While residential rental property typically depreciates over 27.5 years, certain components (like carpeting, appliances, and some electrical installations) can depreciate over 5, 7, or 15 years.

Use 1031 Exchanges Strategically

The 1031 exchange offers a powerful tool to defer capital gains taxes when selling a rental property. Reinvest the proceeds into a like-kind property to postpone paying taxes on your gains (potentially indefinitely). The 1031 exchange rules timeline breaks down into three events: the sale of your property, the identification period, and the exchange period. Investors who use 1031 exchanges tend to accumulate more wealth over time compared to those who sell properties outright and pay taxes with each transaction (according to a study by the National Association of Realtors).

Hire Professional Property Management

Engaging a professional property management company can lead to substantial tax savings. Property managers handle day-to-day operations, maintain detailed financial records, identify deductible expenses you might overlook, and stay updated on tax law changes. Their expertise helps navigate complex tax situations, ensuring you claim every eligible deduction. Properties under professional management report 20% higher tax deductions on average compared to self-managed properties (based on a survey by the Institute of Real Estate Management).

Separate Personal and Business Expenses

Maintain clear boundaries between personal and rental property expenses. Open separate bank accounts and credit cards for your rental business. This separation simplifies accounting, reduces the risk of overlooking deductible expenses, and strengthens your position in case of an audit. (Tax professionals recommend this practice as a cornerstone of effective rental property financial management.)

Final Thoughts

Tax breaks for owning rental property offer numerous opportunities to reduce tax liability. Property owners can benefit from deductions on mortgage interest, property taxes, insurance premiums, and depreciation. Tax credits like the Low-Income Housing Tax Credit and Residential Energy Efficient Property Credit provide additional savings while promoting social and environmental benefits.

Effective tax management requires meticulous record-keeping and strategic planning. Property owners should separate personal and business expenses, conduct cost segregation studies, and utilize 1031 exchanges to enhance their tax position. Professional property management can provide expertise in navigating complex tax situations and identifying often-overlooked deductions.

Osa Property Management can help you navigate the complexities of property management in Costa Rica, including tax compliance and accounting. Our team of experts will handle day-to-day operations while you focus on growing your investment (and maximizing your tax benefits). Regular review of IRS guidelines and consultation with tax professionals will help you adapt strategies and uncover new opportunities for tax savings.