Navigating vacation rental taxes in Costa Rica can be complex, especially with recent changes in 2025. At Osa Property Management, we understand the challenges property owners face when dealing with these financial obligations.

This guide will walk you through Costa Rica’s rental tax system, helping you calculate your tax liability and manage your finances efficiently. We’ll also share strategies to ensure compliance while maximizing your deductions legally.

Understanding Costa Rica’s Rental Tax System in 2025

Costa Rica’s rental tax system forms a critical part of property management that every landlord must comprehend. The year 2025 has introduced new complexities and opportunities for property owners in this beautiful Central American country.

Short-Term vs. Long-Term Rental Taxation

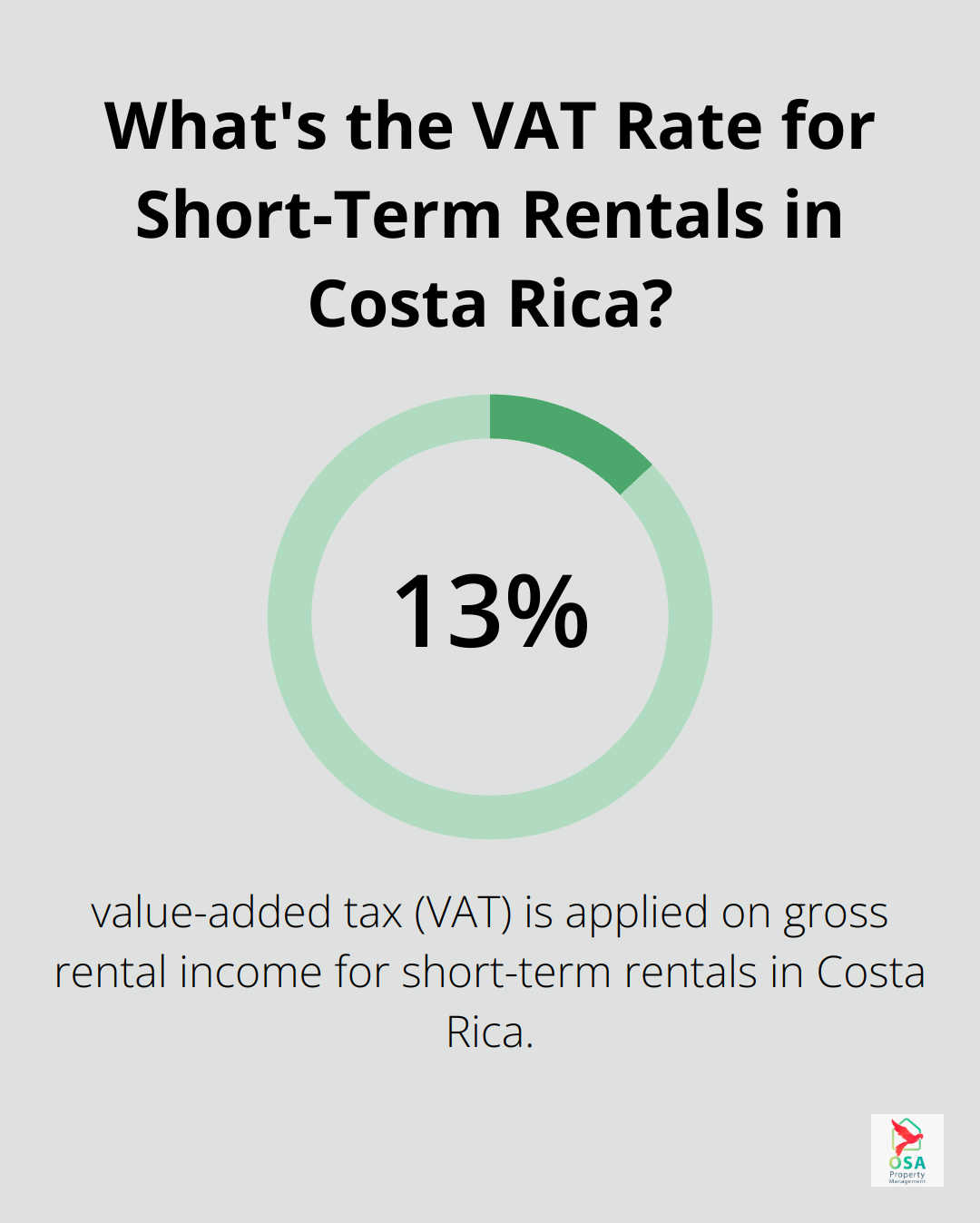

The Costa Rican government applies different tax rules to short-term and long-term rentals. Short-term rentals (typically under 30 days) incur a 13% value-added tax (VAT) on gross rental income. Property owners must collect this tax from tenants and remit it to tax authorities monthly.

Long-term rentals (exceeding 30 days) follow a progressive tax structure. As of 2025, the tax rates range from 10% for annual rental income up to 5 million colones (approximately $9,800 USD) to 25% for income exceeding 18 million colones (about $35,300 USD).

Key Changes in 2025

The year 2025 has ushered in significant changes to Costa Rica’s rental tax laws:

- Digital Reporting System: All property owners now must submit rental income and expense reports electronically through the Ministry of Finance’s online platform. This change aims to increase transparency and reduce tax evasion.

- Expanded Deductible Expenses: Property managers can now deduct a wider range of maintenance and improvement costs, including energy-efficient upgrades and security enhancements. This change encourages investment in rental properties, potentially increasing their value and appeal to tenants.

Compliance and Penalties

Non-compliance with Costa Rica’s rental tax laws can result in severe penalties. The tax authorities have intensified their scrutiny of rental properties, particularly in popular tourist areas. Fines for late payments or failure to report rental income can reach up to 50% of the unpaid taxes, plus interest.

Professional Property Management Services

To navigate this complex tax landscape effectively, many property owners opt for professional property management services. These experts stay current with the latest tax regulations and ensure full compliance while maximizing allowable deductions. Osa Property Management, with its 19 years of experience in Costa Rica, stands out as a top choice for property owners seeking expert guidance in this area.

As we move forward, let’s examine how to calculate your rental tax obligations in Costa Rica’s evolving tax environment.

How to Calculate Your Costa Rican Rental Tax

Determining Your Rental Income

The first step in calculating your rental tax involves an accurate determination of your total rental income. This includes all payments received from tenants for both short-term and long-term rentals. For short-term rentals, separate the 13% VAT from your gross income, as this is not part of your taxable rental income.

Maintain meticulous records of all rental payments (cash, check, or digital platforms). Costa Rican tax authorities now require electronic reporting, making digital record-keeping essential for compliance. Monthly declarations of gross income (Form D-125) are mandatory to avoid complications during annual returns.

Identifying Allowable Deductions

Costa Rica permits various deductions that can reduce your taxable rental income. As of 2025, these deductions include:

- Property maintenance and repairs

- Property management fees

- Utilities (if paid by the landlord)

- Property insurance premiums

- Mortgage interest

- Depreciation of the property and its contents

- Energy-efficient upgrades

- Security enhancements

Keep all receipts and invoices for these expenses. Costa Rican tax authorities may request documentation to verify your deductions.

Calculating Your Tax Liability

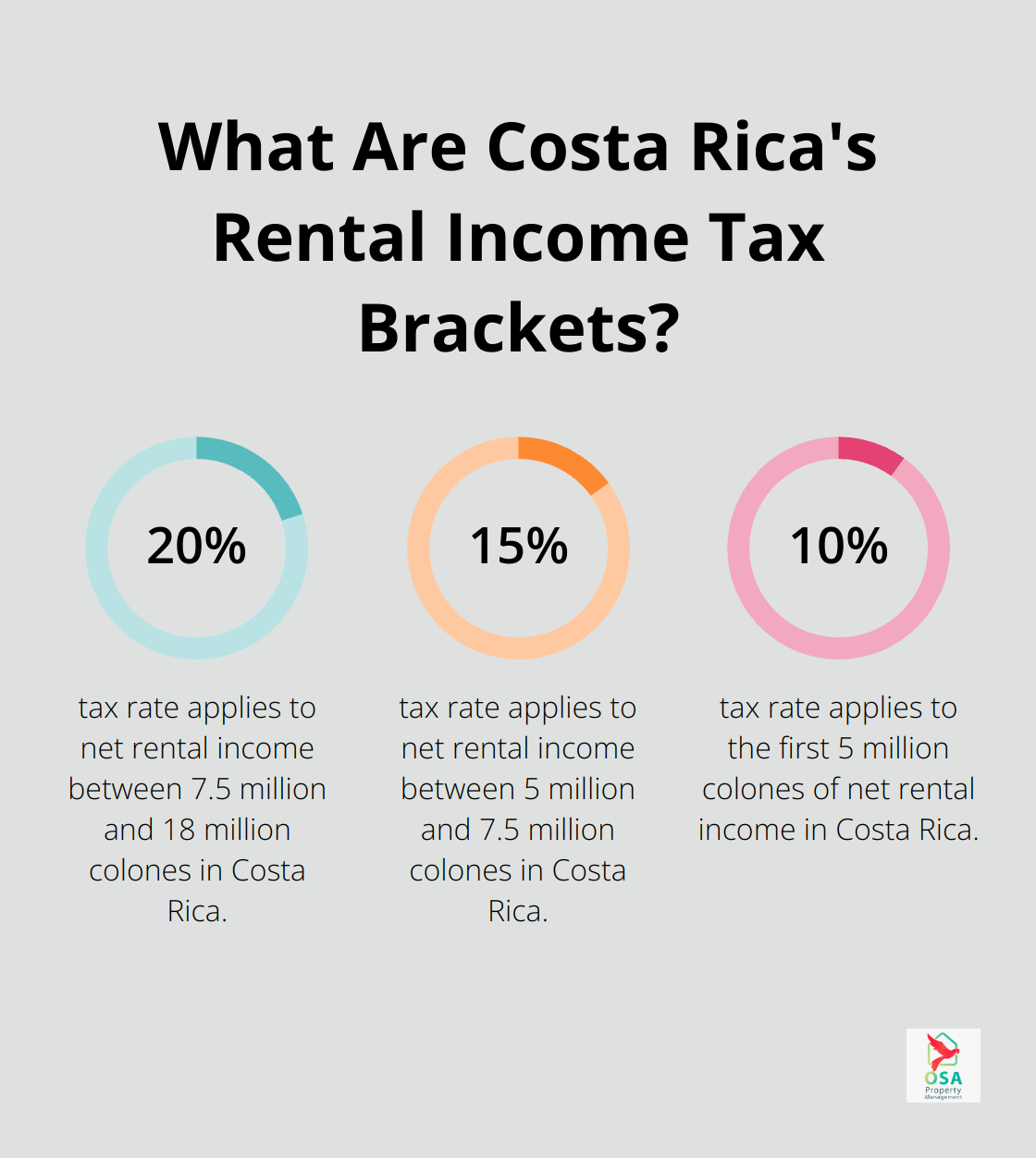

After determining your net rental income (gross income minus allowable deductions), calculate your tax liability. For long-term rentals, apply the progressive tax rates to your net income:

- 10% on the first 5 million colones

- 15% on income between 5 million and 7.5 million colones

- 20% on income between 7.5 million and 18 million colones

- 25% on income exceeding 18 million colones

For short-term rentals, collect and remit the 13% VAT to the tax authorities monthly.

Utilizing Tax Software and Professional Services

To ensure accuracy in your calculations, consider using tax software designed for Costa Rican rental properties or consult with a local tax professional. Many property owners find that expert guidance (such as that provided by Osa Property Management) proves invaluable in navigating these complex calculations and ensuring full compliance with Costa Rican tax laws.

Regular Review and Planning

Review your tax calculations throughout the year to avoid surprises and plan for your tax obligations effectively. This proactive approach holds particular importance given the increased scrutiny from Costa Rican tax authorities on rental properties.

As we move forward, let’s explore strategies for efficient tax management to optimize your rental property investments in Costa Rica.

Mastering Tax Efficiency for Costa Rica Rentals

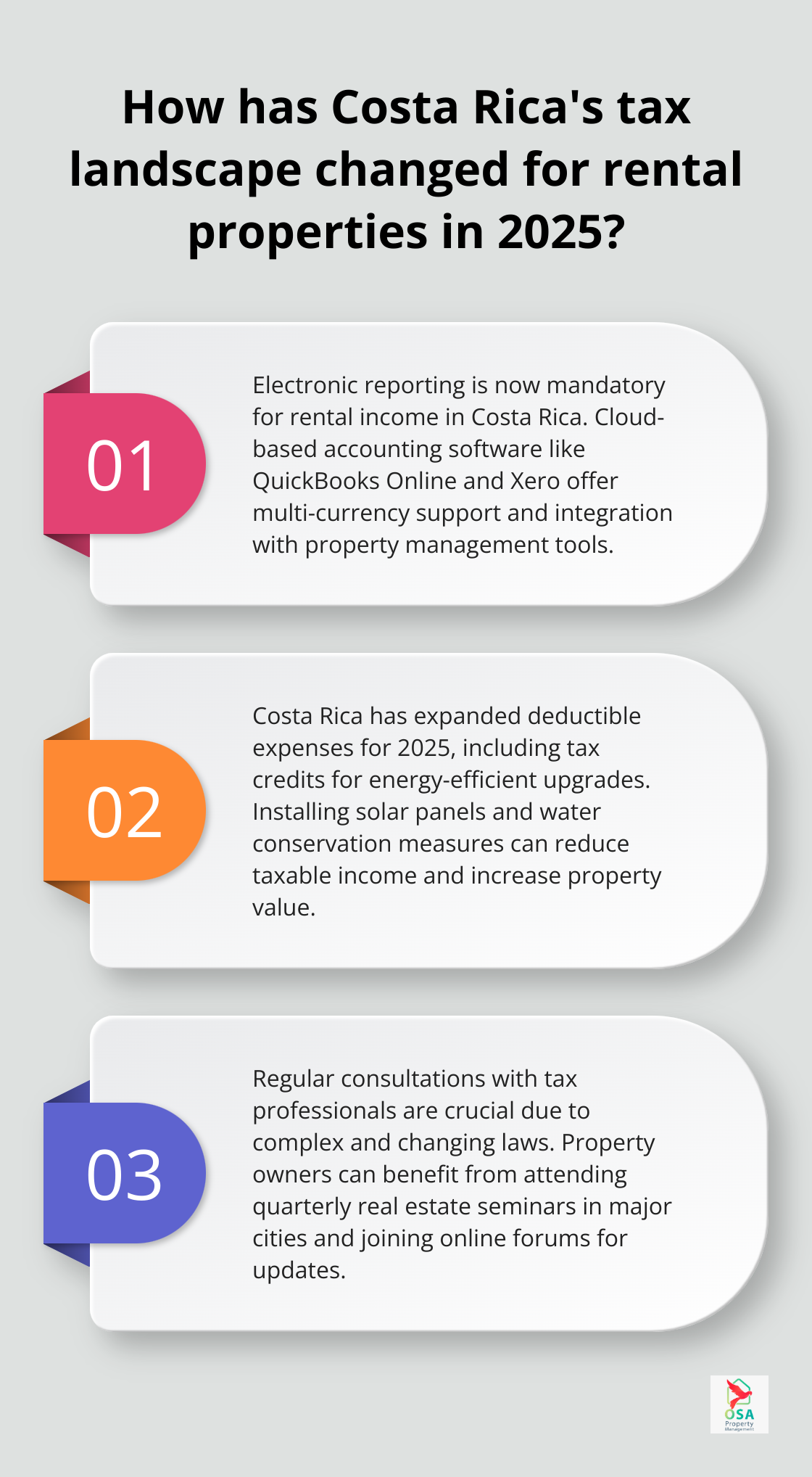

Embrace Digital Record-Keeping

Costa Rica’s tax authorities now require electronic reporting for rental income in 2025. Property owners should implement a robust digital record-keeping system to track all income and expenses. Cloud-based accounting software allows real-time updates and easy access for property owners and managers. This approach satisfies regulatory requirements and provides instant insights into a property’s financial performance.

QuickBooks Online and Xero (popular choices among property owners in Costa Rica) offer multi-currency support and can generate reports in both English and Spanish. These platforms integrate with property management software, which streamlines financial processes and reduces the risk of errors in tax calculations.

Leverage Professional Expertise

DIY tax management might seem cost-effective, but it often leads to costly mistakes. Professional property management services can prove invaluable. They stay updated on the latest tax laws and handle complex calculations, which ensures property owners don’t overpay or underpay their taxes.

Maximize Legal Deductions

Costa Rica’s expanded deductible expenses for 2025 offer new opportunities for tax savings. Property owners can qualify for tax credits by investing in energy-efficient upgrades. Installing solar panels, implementing water conservation measures, and other environmentally friendly improvements can provide dual benefits of tax savings and increased property value. These improvements can reduce taxable income while making properties more attractive to environmentally conscious renters.

Small deductions can add up significantly. Property owners should keep meticulous records of all property-related expenses, including cleaning supplies, marketing costs, and mileage for property visits. A comprehensive approach to deductions can substantially reduce tax liability.

Stay Informed and Seek Expert Advice

Costa Rica’s tax laws are complex and ever-changing. Regular consultations with tax professionals who specialize in rental properties can help property owners stay ahead of the curve and make informed decisions about their investments. These experts can provide tailored advice based on individual circumstances and the latest regulatory changes.

Property owners should attend local real estate seminars (often held quarterly in major cities) and join online forums dedicated to Costa Rican property management. These resources offer valuable insights into tax strategies and upcoming legislative changes that may impact rental property investments.

Final Thoughts

Costa Rica’s rental tax system demands diligence, knowledge, and strategic planning. The 2025 changes introduce new complexities and opportunities for property owners. Understanding different tax rates, leveraging expanded deductible expenses, and staying informed prove essential for financial success in Costa Rica’s rental market.

Compliance with tax laws represents a smart business practice, not just a legal obligation. Proper record-keeping, timely reporting, and accurate calculations help avoid penalties and maintain positive relationships with Costa Rican tax authorities. The shift towards digital reporting underscores the importance of technology in property management.

Vacation rental taxes in Costa Rica present unique challenges due to their structure and frequent regulatory updates. Osa Property Management offers comprehensive services to help property owners navigate this complex landscape effectively. Our team’s expertise ensures compliance with the latest regulations and maximizes legal deductions, allowing property owners to focus on enjoying their Costa Rican investments.