At Osa Property Management, we often field questions about the potential of Costa Rica’s real estate market. Is buying property in Costa Rica a good investment? This question has gained traction as more investors seek opportunities in tropical paradises.

Our comprehensive guide explores the benefits, risks, and key considerations for those eyeing Costa Rica’s property market.

Costa Rica’s Real Estate Landscape: A Market in Bloom

Market Trends and Statistics

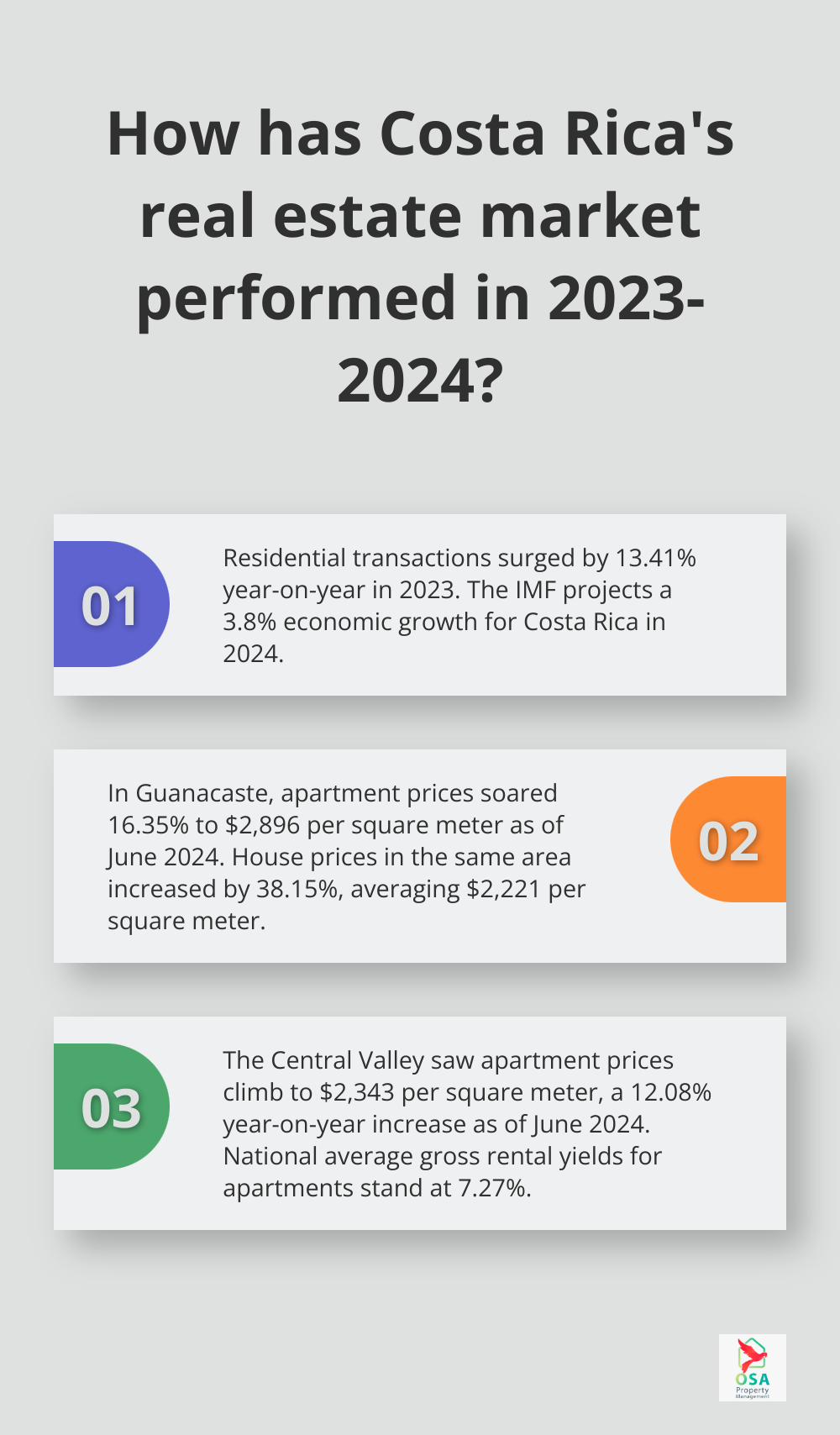

Costa Rica’s real estate market exhibits robust growth and stability, attracting investors worldwide. The International Monetary Fund projects a 3.8% economic growth for Costa Rica in 2024, laying a solid foundation for real estate investments. This economic vigor reflects in the property market, with residential transactions surging by 13.41% year-on-year in 2023 (Gutiérrez & Gallardo).

Property prices have appreciated significantly, especially in sought-after regions. Guanacaste province stands out, with apartment prices soaring 16.35% year-on-year to $2,896 per square meter as of June 2024 (encuentra24.com). House prices in the same area skyrocketed by 38.15%, averaging $2,221 per square meter.

Investment Hotspots

Costa Rica offers diverse investment opportunities, but certain areas shine brighter. The Central Valley, including San José, remains a prime urban investment location. Apartment prices here have climbed to $2,343 per square meter, marking a 12.08% year-on-year increase as of June 2024.

Coastal areas continue to captivate investors. Guanacaste, with its stunning beaches and expanding infrastructure, attracts luxury and vacation property seekers. The new Flamingo Marina development further boosts the region’s appeal. Other coastal gems like Jacó, Manuel Antonio, and the Southern Zone (where Osa Property Management operates) also draw increasing investor interest, thanks to their natural beauty and tourism potential.

Property Types and Investment Opportunities

Costa Rica’s real estate market presents a wide array of investment options. Beachfront properties and homes in gated communities top the demand list, especially in the Central Valley and along the Pacific Coast. These properties often yield strong rental returns, with national average gross rental yields for apartments at 7.27% (Global Property Guide).

For budget-conscious investors, provinces like Limón offer more affordable options, with average house prices at $971 per square meter. This diversity allows investors to find properties that align with their financial goals and investment strategies.

The vacation rental market thrives, fueled by Costa Rica’s booming tourism sector. International visitor numbers jumped 12.2% in the first half of 2024 compared to the previous year (Costa Rican Tourism Institute). This trend bolsters the demand for short-term rentals, particularly in popular tourist destinations.

Eco-friendly and wellness-focused properties gain traction, aligning with Costa Rica’s commitment to sustainability. Investors looking to capitalize on this trend might consider properties with green technologies or those in eco-conscious developments.

As we move forward, it’s essential to understand the benefits and potential risks associated with investing in Costa Rica’s property market. Let’s explore these aspects in detail to provide a comprehensive picture for potential investors.

Why Costa Rica Property Attracts Savvy Investors

Economic Resilience and Political Stability

Costa Rica’s real estate market offers compelling advantages for investors seeking lucrative opportunities in a tropical paradise. The country’s unique blend of economic stability, natural beauty, and investor-friendly policies creates an attractive environment for property investment.

Costa Rica is known for its political stability, which is a crucial factor for any real estate investment. A stable country provides a secure environment for long-term investments. This stability stems from Costa Rica’s decision to abolish its military in 1948, redirecting resources towards education and social programs.

The economic outlook for Costa Rica remains positive. Over the next five years, long-term projections suggest Costa Rica’s economy will grow by 15.9%, averaging 3.2% growth annually. This economic resilience provides a solid foundation for property value appreciation and rental income potential.

Tourism Boom Fuels Rental Market

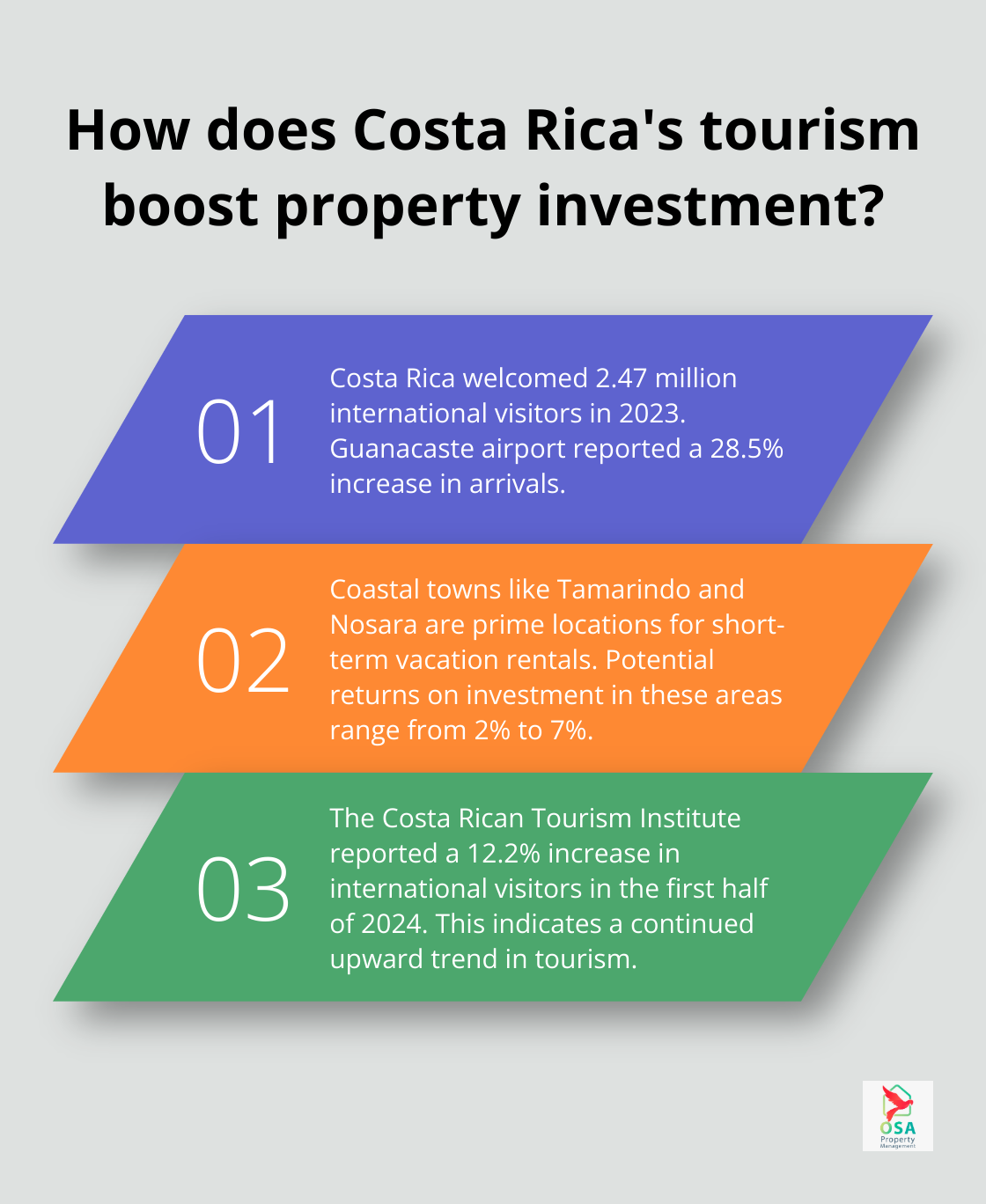

Costa Rica’s thriving tourism industry significantly drives property demand, creating lucrative opportunities for rental income. In 2023, Costa Rica welcomed 2.47 million international visitors (with Guanacaste airport reporting a 28.5% increase in arrivals). This influx of tourists translates directly into high demand for vacation rentals.

Coastal towns like Tamarindo and Nosara have become prime locations for short-term vacation rentals. Investors in these areas can capitalize on the booming tourism sector, with potential returns on investment ranging from 2% to 7%. The Costa Rican Tourism Institute reported a 12.2% increase in international visitors in the first half of 2024 compared to the previous year, indicating a continued upward trend in tourism.

Attractive Rental Yields and Affordability

Costa Rica offers impressive rental yields, making it an appealing market for property investors. According to Numbeo, rental yields in Costa Rica range between 5.3% and 8.0%. San José, the capital, boasts the highest rental yield for apartments, averaging 8.25% as reported by the Global Property Guide.

Compared to other tropical destinations, Costa Rica offers relatively affordable property prices. For instance, in Limón province, the average asking price for houses is $971 per square meter, presenting a more budget-friendly option for investors. This affordability, combined with strong rental yields, creates an opportunity for investors to enter the market with lower initial capital and still achieve attractive returns.

Tax Benefits for Foreign Investors

Costa Rica’s tax environment is particularly favorable for foreign property investors. The country imposes one of the lowest property tax rates in the Caribbean (with an effective rate of approximately 0.25% of the property’s registered value annually). This low tax burden enhances the overall return on investment for property owners.

Additionally, Costa Rica offers tax incentives and exemptions for certain types of real estate developments, particularly those aligned with the country’s sustainability goals. Investors developing eco-friendly properties or contributing to sustainable tourism initiatives may qualify for additional tax benefits, further boosting their investment returns.

While Costa Rica’s property market presents numerous advantages, it’s essential for investors to conduct thorough due diligence and seek professional guidance. The potential of Costa Rica’s real estate market is evident, but like any investment, it comes with its own set of challenges and risks. In the next section, we’ll explore these potential hurdles and how investors can navigate them effectively.

Navigating the Challenges of Costa Rica Real Estate

Costa Rica’s property market offers rewards, but investors must address several challenges. Understanding these potential obstacles will help you make informed decisions and maximize your investment potential.

Foreign Ownership Laws

Costa Rica’s legal framework for foreign property ownership is generally welcoming. While foreigners can readily buy property in Costa Rica, a non-citizen can only own up to 49% of Maritime Zone land. This restriction applies to areas within 200 meters of the high tide line, where only concessions or leases are allowed.

To avoid legal complications, you should work with a reputable local attorney who specializes in real estate. They can help you navigate the complexities of property titles, especially in coastal areas where concession rights may apply instead of outright ownership.

Property Management Challenges

Absentee ownership presents unique challenges. Without proper management, your property could face neglect, leading to decreased value and potential legal issues. Regular maintenance, prompt repairs, and adherence to local regulations are essential.

Professional property management becomes invaluable in these situations. Companies offer comprehensive services, handling everything from marketing and renter relationships to bill payments and maintenance oversight. With extensive experience in various areas, they ensure properties remain well-maintained and compliant with local laws, even when owners are thousands of miles away.

Economic Factors and Currency Risks

While Costa Rica’s economy is relatively stable, it’s not immune to global economic shifts. The exchange rate between the Costa Rican colón and your home currency can impact your investment returns. In recent years, the colón has shown stability against major currencies, but fluctuations can occur.

To mitigate currency risks, you should consider diversifying your investments. Some investors choose to hold both colón and dollar-denominated assets. Additionally, working with a local financial advisor can help you navigate Costa Rica’s banking system and develop strategies to protect your investment against currency fluctuations.

Environmental Considerations and Building Restrictions

Costa Rica’s commitment to environmental preservation is admirable but can pose challenges for property development. Strict building codes and environmental regulations (especially in coastal and protected areas) can limit what you can do with your property.

Before purchasing, you should thoroughly research local zoning laws and building restrictions. Some areas have height limitations or require specific environmental impact studies before construction. Working with local experts who understand these regulations can save you time, money, and potential legal headaches down the line.

Final Thoughts

Investing in Costa Rica property offers a unique opportunity to diversify portfolios in a tropical paradise. The country’s stable political climate, growing tourism sector, and attractive rental yields make it an appealing destination for real estate investors. Costa Rica’s relatively affordable property prices and favorable tax conditions for foreign investors present significant potential for capital appreciation and rental income.

Investors must approach the Costa Rican real estate market with caution and thorough research. Foreign ownership laws, property management challenges, currency fluctuations, and environmental regulations require careful consideration. These factors highlight the need for due diligence and professional guidance when navigating the Costa Rican property market.

Osa Property Management understands the intricacies of Costa Rica’s property market and helps investors maximize returns while minimizing risks. Our team ensures that your investment in Costa Rica property becomes a rewarding reality. Is buying property in Costa Rica a good investment? The answer depends on individual circumstances, investment goals, and risk tolerance.