At Osa Property Management, we’ve seen a surge of interest in Costa Rica property flipping. This investment strategy has caught the attention of both local and international investors looking to capitalize on the country’s booming real estate market.

However, is property flipping truly profitable in Costa Rica? We’ll explore the factors that influence profitability, potential challenges, and key considerations for successful flipping ventures in this tropical paradise.

What Is Property Flipping in Costa Rica?

Property flipping in Costa Rica involves the purchase of undervalued real estate, its renovation, and subsequent sale for profit. This investment strategy has gained popularity in recent years, driven by the country’s thriving real estate market and increased foreign interest.

Costa Rica’s Real Estate Market Trends

Costa Rica’s property market demonstrates remarkable resilience and growth. The value of housing credit stock has decreased from 17.3% of GDP in 2020 to 14% in 2023. This trend reflects changes in the real estate market dynamics and economic conditions in the country.

The residential property market projects growth at a compound annual rate of 3.29% through 2029, with a potential value of USD 412.75 billion. This steady growth provides a favorable environment for property flippers who aim to capitalize on market appreciation.

High-Potential Locations for Flipping

Certain areas in Costa Rica offer promising opportunities for property flipping. The northern Pacific coast, including regions like Guanacaste, has experienced significant price increases.

Other high-potential areas include the southern corridor and the Central Valley. These regions benefit from ongoing infrastructure developments and increasing accessibility, factors that can boost property values over time.

Legal Considerations for Foreign Investors

Foreign investors enjoy the same property ownership rights as locals in Costa Rica, which makes it an accessible market for international flippers. However, navigation of the legal landscape requires careful attention to detail.

A comprehensive legal verification process for property takes about 30 days, which ensures the address of all ownership and title issues. This step prevents potential legal complications in the future.

Many foreign investors choose to purchase property through a corporation for enhanced commercial freedom and legal protections. This approach doesn’t require citizenship or residency, which offers flexibility for international flippers.

Market Research and Strategy

Successful property flipping in Costa Rica often depends on thorough market research, strategic location selection, and a solid understanding of local regulations. Investors should approach flipping with a well-informed strategy and realistic expectations.

The next chapter will explore the specific factors that affect profitability in Costa Rican property flipping, including renovation costs, labor market conditions, and market demand projections.

What Drives Profitability in Costa Rica’s Property Flipping Market?

Prime Locations for Flipping Success

The northern Pacific coast, particularly Guanacaste, stands out as a hotspot for property flipping. This region has experienced substantial price increases, with some areas seeing up to 16.35% year-over-year growth as of June 2024. The southern corridor and Central Valley also show promise due to ongoing infrastructure developments and increasing accessibility.

Coastal luxury properties, especially in areas like Tamarindo, Nosara, and Playas del Coco, consistently deliver returns between 7-10%. These locations attract affluent renters who value premium amenities and ocean views, making them ideal for high-end flipping projects.

Renovation Costs and Labor Markets

Renovation costs in Costa Rica vary widely, but understanding the local labor market is essential for accurate budgeting. The average construction cost for building a house from scratch is approximately $750 per square meter. However, renovation costs for existing properties can be lower, depending on the extent of work required.

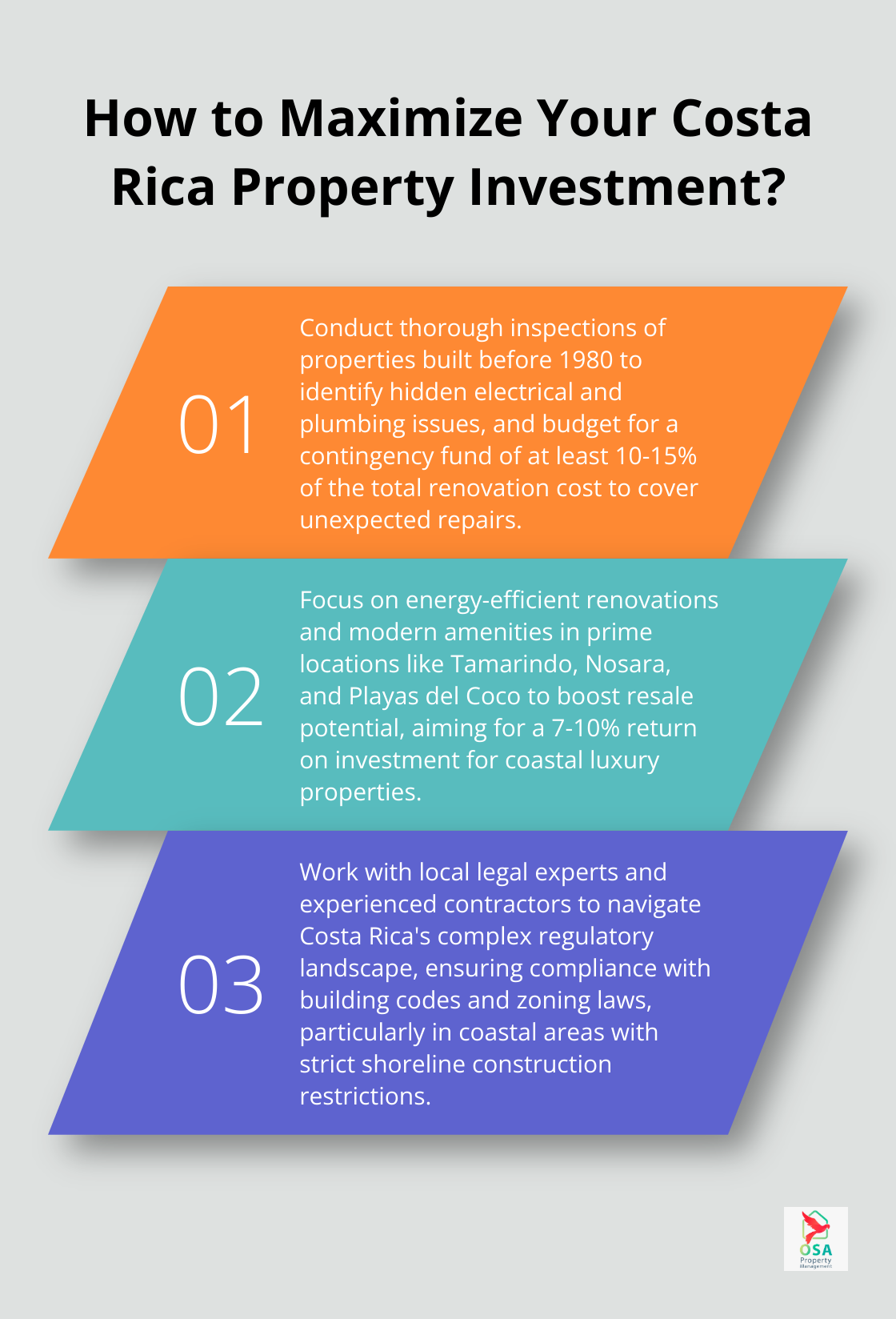

Properties built before 1980 may have hidden electrical and plumbing issues (which can significantly increase renovation costs). We recommend thorough inspections before purchase to avoid unexpected expenses.

Market Demand and Resale Value Projections

Costa Rica’s residential property market projects growth at a compound annual rate of 3.29% through 2029, potentially reaching a value of USD 412.75 billion. This growth trend suggests a favorable environment for property flippers who want to capitalize on market appreciation.

Vacation rentals in prime locations achieve average occupancy rates of 80%, with net returns averaging between 4% to 6% after expenses. This data indicates strong demand for well-renovated properties in tourist-friendly areas, which can translate to higher resale values for flipped properties.

Maximizing Profitability

To maximize profitability, investors should focus on properties that cater to current market trends. For instance, energy-efficient renovations and modern amenities are increasingly valued by buyers and can significantly boost resale potential.

Property flipping in Costa Rica offers promising returns, but each project requires a well-researched strategy and realistic expectations. Understanding these key factors can help investors navigate the market more effectively and increase their chances of success in this dynamic real estate landscape.

The next chapter will explore the challenges and risks associated with property flipping in Costa Rica, providing valuable insights for investors looking to enter this market.

What Are the Risks of Property Flipping in Costa Rica?

Complex Regulatory Landscape

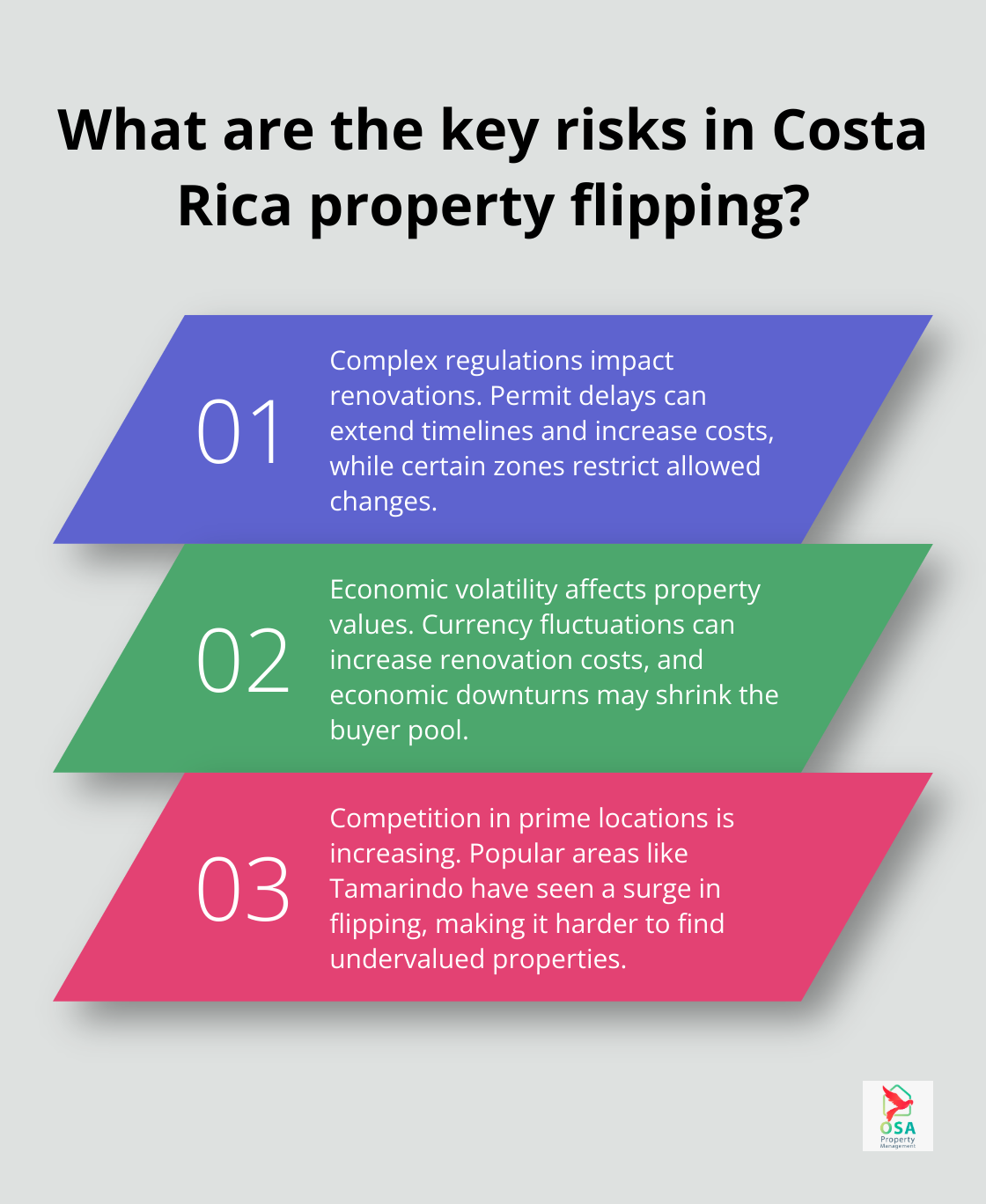

Property flipping in Costa Rica presents significant opportunities, but investors must navigate a complex regulatory environment. The process to obtain necessary permits for renovations can consume time and create complexity, especially for foreign investors unfamiliar with the system. Delays in permit approvals can extend project timelines, increase holding costs, and potentially erode profits.

Certain zones may restrict the types of allowed renovations. For example, coastal areas often enforce strict regulations about building within a specific distance from the shoreline. Non-compliance with these regulations can result in substantial fines or even forced demolition of unauthorized structures.

To mitigate these risks, investors should work with local legal experts and experienced contractors who understand the nuances of Costa Rican building codes and zoning laws. This approach can help avoid costly mistakes and ensure compliance throughout the renovation process.

Economic Volatility and Currency Risks

Costa Rica’s economy, while generally stable, can experience fluctuations that impact the real estate market. The value of the Costa Rican colón against major currencies (like the US dollar) can affect both renovation costs and property values. If the colón weakens significantly during a project, it could increase the cost of imported materials, potentially squeezing profit margins.

Economic shifts can also influence buyer demand. During economic downturns, the pool of potential buyers for flipped properties may shrink, extending the time a property sits on the market and increasing holding costs.

Investors should consider hedging strategies and maintain a financial buffer to account for potential currency fluctuations. It’s also wise to monitor economic indicators closely and adjust investment strategies accordingly.

Increasing Competition in Prime Locations

As Costa Rica’s real estate market gains international attention, competition among property flippers intensifies, especially in prime locations. This increased competition can drive up acquisition costs for potential flip properties and potentially saturate the market with renovated homes.

Popular areas like Tamarindo or Manuel Antonio have seen a surge in property flipping activities, making it challenging to find undervalued properties with high potential for appreciation. This competition can compress profit margins and require investors to be more strategic in their property selection and renovation plans.

To stand out in a competitive market, investors should focus on unique value propositions. This could mean targeting niche markets, such as eco-friendly renovations or properties catering to specific buyer demographics. Additionally, building strong local networks can provide access to off-market properties before they hit the competitive open market.

Hidden Property Issues

Older properties in Costa Rica (particularly those built before 1980) may harbor hidden electrical and plumbing issues. These problems can significantly increase renovation costs and timelines if not identified early. Thorough inspections before purchase are essential to avoid unexpected expenses and project delays.

Investors should budget for potential surprises and factor in a contingency fund for unforeseen repairs or upgrades. This approach can help maintain profitability even when faced with unexpected challenges during the renovation process.

Market Volatility and Resale Challenges

Costa Rica’s real estate market shows promising growth trends, with property values in Guanacaste jumping by 400% from 2020 to 2023. However, investors must be prepared for potential market fluctuations that could affect their ability to resell flipped properties at desired prices.

To mitigate this risk, investors should conduct thorough market research, understand local trends, and have flexible exit strategies. Diversifying investments across different types of properties or locations can also help spread risk and increase the chances of success in the Costa Rican property flipping market.

Final Thoughts

Costa Rica property flipping offers compelling opportunities for investors in the country’s thriving real estate market. Certain areas experience significant price appreciation and strong demand for renovated properties, making strategic location selection essential for success. Investors must navigate complex regulations, economic volatility, and increasing competition to maximize returns in this dynamic market.

Thorough research, efficient project management, and realistic expectations form the foundation of profitable flipping ventures in Costa Rica. Understanding local construction costs, conducting thorough inspections, and staying attuned to market trends help investors make informed decisions and mitigate risks. The residential property market’s projected growth (at a compound annual rate of 3.29% through 2029) indicates a favorable environment for flippers who meet buyer preferences.

For investors seeking expert assistance with property management in Costa Rica, Osa Property Management offers tailored services to meet diverse needs. With extensive experience in popular areas, Osa Property Management provides comprehensive support for property owners. As the Costa Rican real estate landscape evolves, property flipping remains an attractive option for investors willing to navigate its complexities and capitalize on the potential rewards in this tropical paradise.