Owning property in Costa Rica is a dream for many, but it comes with unique challenges. Property insurance is a critical aspect of protecting your investment in this tropical paradise.

At Osa Property Management, we’ve seen firsthand how proper insurance can safeguard property owners from unexpected disasters and financial losses. This guide will help you understand the ins and outs of property insurance in Costa Rica and ensure your piece of paradise is adequately protected.

What Property Insurance Do You Need in Costa Rica?

Types of Property Insurance Available

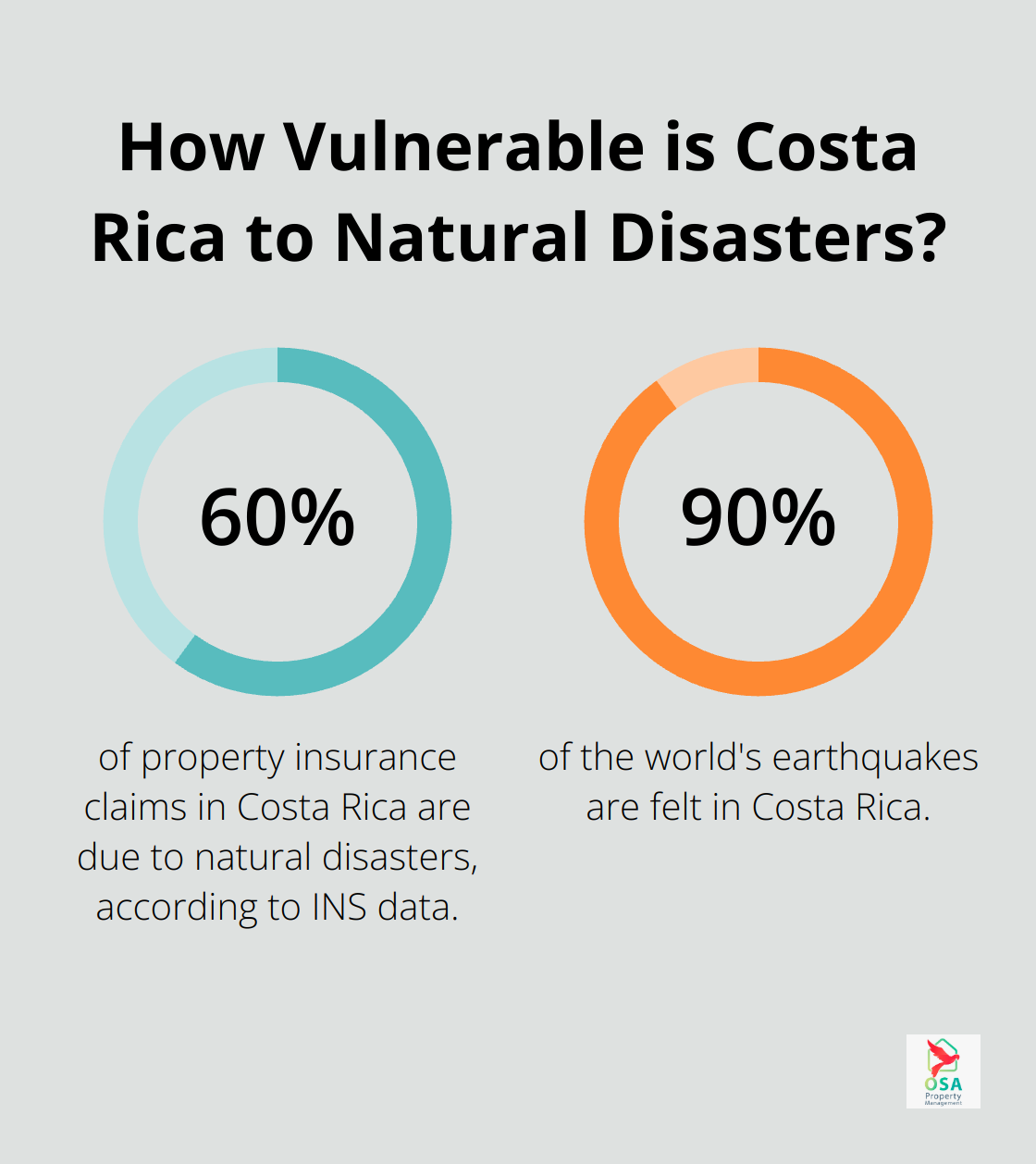

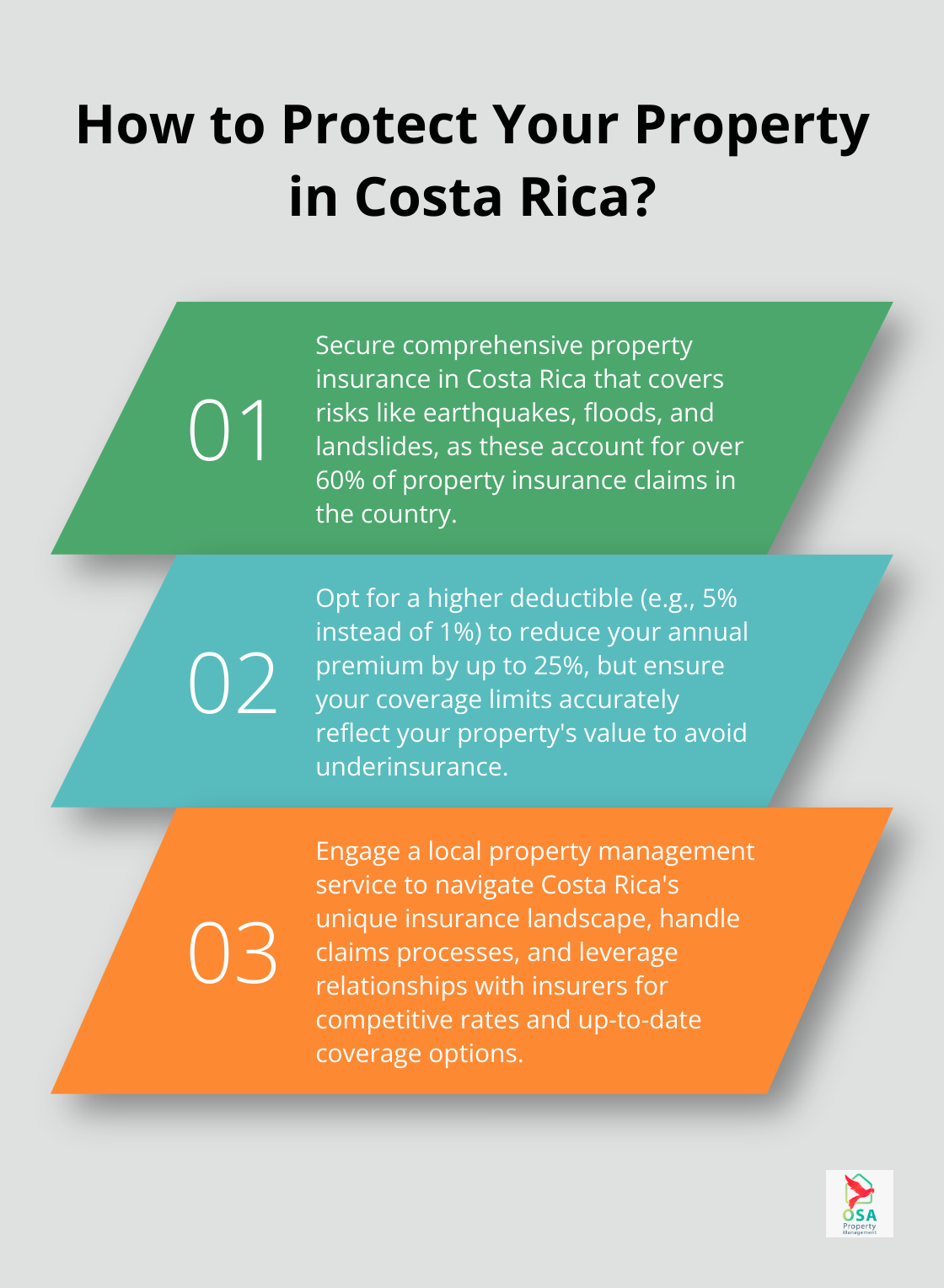

Costa Rica’s unique climate and geographical features necessitate tailored insurance solutions for property owners. The Instituto Nacional de Seguros (INS) offers comprehensive policies that cover risks such as fire, theft, and natural disasters (including earthquakes, floods, and landslides). These natural disasters account for over 60% of property insurance claims in Costa Rica, according to INS data.

Since the end of the insurance monopoly in 2008, private insurers like Oceanica, Lafise, and Mapfre have entered the market. These companies provide competitive rates and specialized coverage options, often with more flexible terms than traditional policies.

Importance of Insurance for Costa Rica Properties

Costa Rica is near the Ring of Fire, where most earthquakes happen. The country feels about 90% of the world’s earthquakes. This underscores the need for robust earthquake coverage in property insurance policies.

The country’s tropical climate also presents risks. Heavy rainfall, particularly during the May to November wet season, can lead to flooding that affects properties. According to figures from CNE, flooding and heavy rain has damaged 1,585 houses, 18 schools, 23 roads, 11 bridges, 7 dams and 3 aqueducts. This highlights the importance of including flood insurance in your property protection plan.

Common Misconceptions About Property Insurance

Many property owners incorrectly assume that basic fire insurance provides sufficient protection. This misconception leaves properties vulnerable to other significant risks. Another widespread belief is that property insurance in Costa Rica is prohibitively expensive. In reality, the average cost for comprehensive coverage is about 0.25% of the property’s value per year-a small price for substantial protection.

Expatriate property owners often mistakenly think their home country’s insurance will cover their Costa Rica property. This assumption rarely holds true. Local insurance is essential not only for proper coverage but also for compliance with Costa Rican regulations.

Real-World Impact of Proper Insurance

During the 2017 tropical storm Nate, insured properties in the Dominical area received prompt compensation for flood damage. In contrast, uninsured properties faced significant out-of-pocket expenses. This event demonstrated the real-world value of comprehensive property insurance in Costa Rica.

Understanding these aspects of property insurance forms the foundation for protecting your investment in Costa Rica. The next step involves evaluating specific factors that influence your insurance needs and costs, which we’ll explore in the following section on key considerations for insuring your Costa Rica property.

What Factors Affect Your Costa Rica Property Insurance?

Location-Specific Risks

The geographical location of your property in Costa Rica significantly impacts your insurance needs and costs. Coastal properties face higher risks of flooding and storm damage. The Intertropical Convergence Zone is still very active over Costa Rica, causing rains from the early hours of Sunday in the Central and South Pacific.

Properties in mountainous regions are more susceptible to landslides. Urban properties in cities like San José face different risks, with theft as a primary concern.

Property Value and Construction

Your property’s value and construction materials significantly influence insurance premiums. Properties built with reinforced concrete and adhering to strict building codes typically qualify for lower premiums due to their increased resilience to natural disasters.

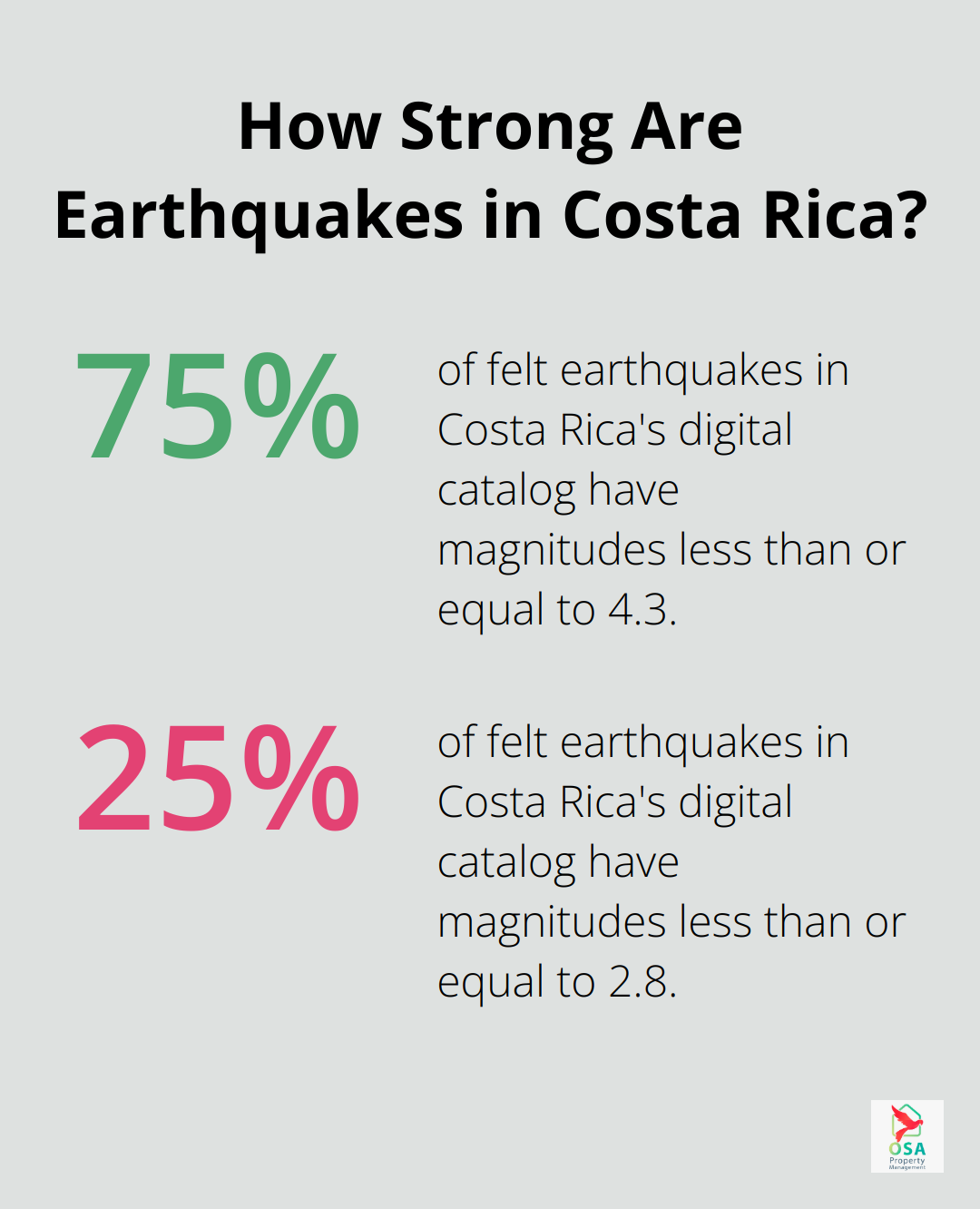

Recent data shows that of the felt earthquakes in the catalog, 75% have magnitudes less than or equal to 4.3, while 25% have magnitudes less than or equal to 2.8.

Coverage Limits and Deductibles

Selecting the right coverage limits and deductibles requires a balance between adequate protection and affordable premiums. Higher deductibles generally lead to lower premiums but increase your out-of-pocket expenses in the event of a claim.

In Costa Rica, the standard deductible for property insurance ranges from 1% to 5% of the insured value. Opting for a 5% deductible instead of 1% can reduce your annual premium by up to 25% (according to data from major insurers like INS and Oceanica).

It’s essential to ensure your coverage limits accurately reflect your property’s value. Underinsuring your property to save on premiums can lead to significant financial losses if you need to make a claim.

Climate and Natural Disasters

Costa Rica’s tropical climate and geological position present unique risks that affect insurance considerations. The country experiences frequent earthquakes due to its location near the Ring of Fire. This proximity necessitates robust earthquake coverage in property insurance policies.

Heavy rainfall, particularly during the May to November wet season, can lead to flooding that affects properties.

Understanding these factors helps property owners make informed decisions about their insurance needs. The next section will explore how professional property management services can assist in navigating these complexities and securing the most appropriate coverage for your Costa Rica property.

How We Safeguard Your Costa Rica Property

Expertise in Costa Rica’s Insurance Landscape

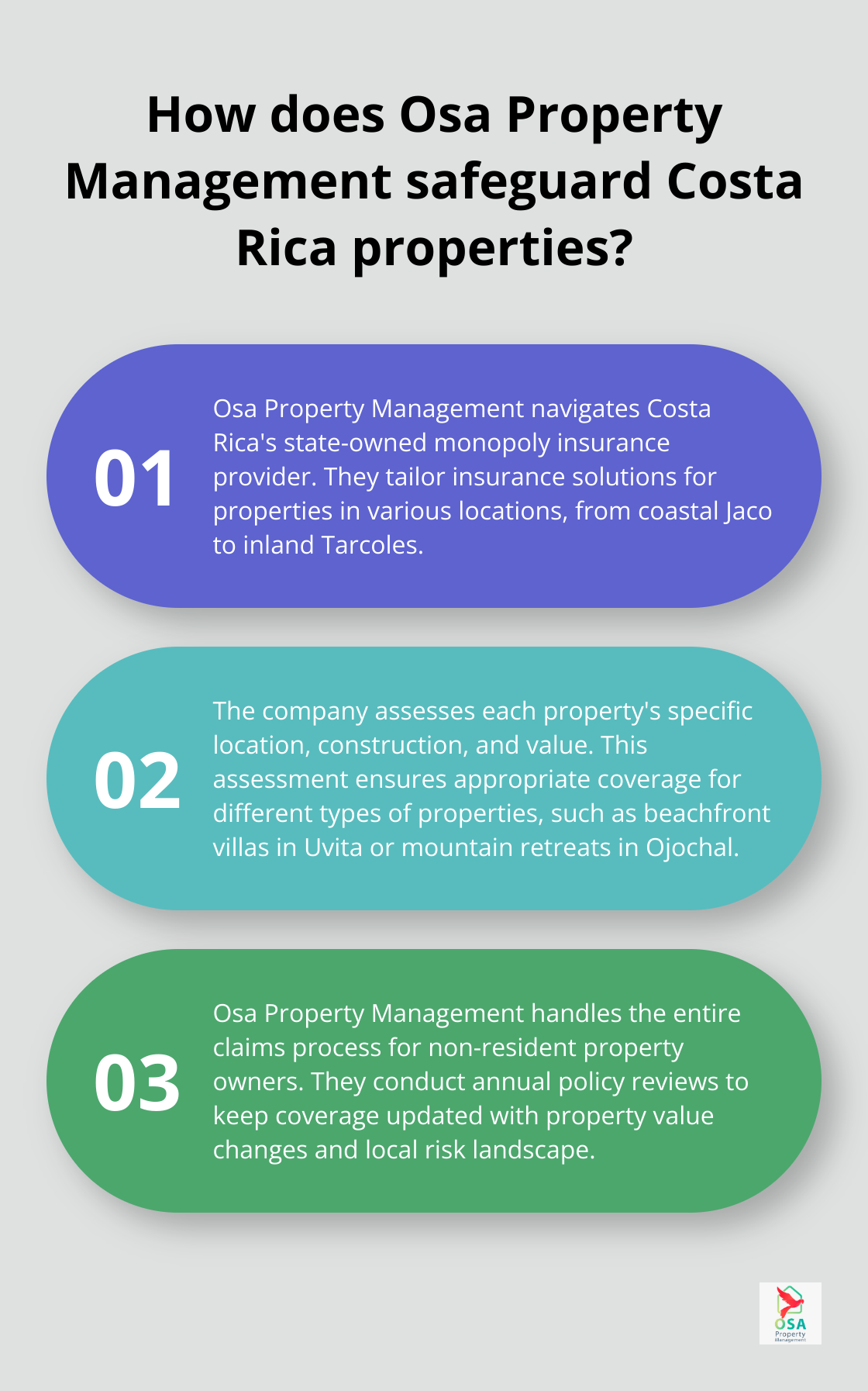

At Osa Property Management, we have experience in Costa Rica’s unique insurance market, which is characterized by a state-owned monopoly provider. This expertise allows us to navigate the complexities of insuring properties in this unique environment, from coastal areas like Jaco and Manuel Antonio to inland regions such as Tarcoles.

Tailored Insurance Solutions

We recognize that each property in Costa Rica faces distinct risks. A beachfront villa in Uvita requires different insurance coverage compared to a mountain retreat in Ojochal. Our team assesses your property’s specific location, construction, and value to recommend the most appropriate insurance coverage.

Managing Claims and Renewals

Insurance claims can present challenges in Costa Rica, especially for non-resident property owners. Our bilingual team acts as your advocate, handling the entire claims process from initial filing to final settlement.

We proactively review your policy annually when it comes to renewals. This ensures your coverage keeps pace with any changes in your property’s value or the local risk landscape.

Leveraging Local Partnerships

Our established relationships with Costa Rican insurers allow us to access competitive rates and coverage options. We work closely with reputable companies, negotiating on your behalf to secure the best possible terms.

These partnerships also mean we often receive early information about new insurance products or changes in the market. This knowledge directly benefits our clients, ensuring your property always has the most up-to-date and comprehensive protection available in Costa Rica.

Final Thoughts

Property insurance in Costa Rica protects your investment against unique risks associated with the country’s geography and climate. Comprehensive coverage shields you from significant financial losses due to earthquakes, floods, theft, and liability concerns. Osa Property Management can help you navigate the complexities of Costa Rican property insurance with their extensive experience and local expertise.

To ensure adequate protection, assess your property’s specific risks based on its location and construction. Work with a professional to accurately value your property and its contents for appropriate coverage limits. Review your policy regularly, especially after renovations or changes in the property’s use or value.

The cost of adequate property insurance is minimal compared to potential losses without it. You can enjoy your Costa Rica property with confidence by taking these steps and leveraging professional expertise. Don’t leave your piece of paradise vulnerable – invest in comprehensive property insurance today.