At Osa Property Management, we’ve seen countless property owners in Costa Rica wonder if their investment is reaching its full potential.

Property valuation in this tropical paradise can be tricky, with unique factors influencing market prices.

This blog post will guide you through the signs of an undervalued property and provide practical steps to determine its true worth.

Whether you’re a seasoned investor or a first-time buyer, understanding your property’s value is key to making informed decisions in Costa Rica’s dynamic real estate market.

What Drives Costa Rica’s Property Market?

Location: The Prime Factor

In Costa Rica, location determines value. Beachfront properties in Guanacaste command premium prices, with apartments reaching $2,896 per square meter. Urban centers like San José have experienced significant growth, with apartment prices increasing by 12.08% year-on-year to $2,343 per square meter in 2023 (according to encuentra24.com).

Economic Influences

Costa Rica’s economy has proven resilient, with a real GDP growth of 5.1% in 2023. This stability strengthens the property market. Inflation took a surprising turn, plummeting from 7.9% at the end of 2022 to -1.8% by the end of 2023 (as reported by the International Monetary Fund). This shift impacts property values and investment strategies.

Tourism and Foreign Investment Impact

Tourism drives property values, especially in coastal areas. The influx of visitors has sparked a surge in short-term rentals, with Limón and Guanacaste reporting higher rates of unoccupied housing. This trend creates opportunities for investors in the vacation rental market.

Foreign investment, particularly from North America and Europe, consistently influences Costa Rica’s property market. The country’s “Pura Vida” lifestyle and relatively affordable living costs (compared to many Western countries) continue to attract retirees and digital nomads.

Recent Market Trends

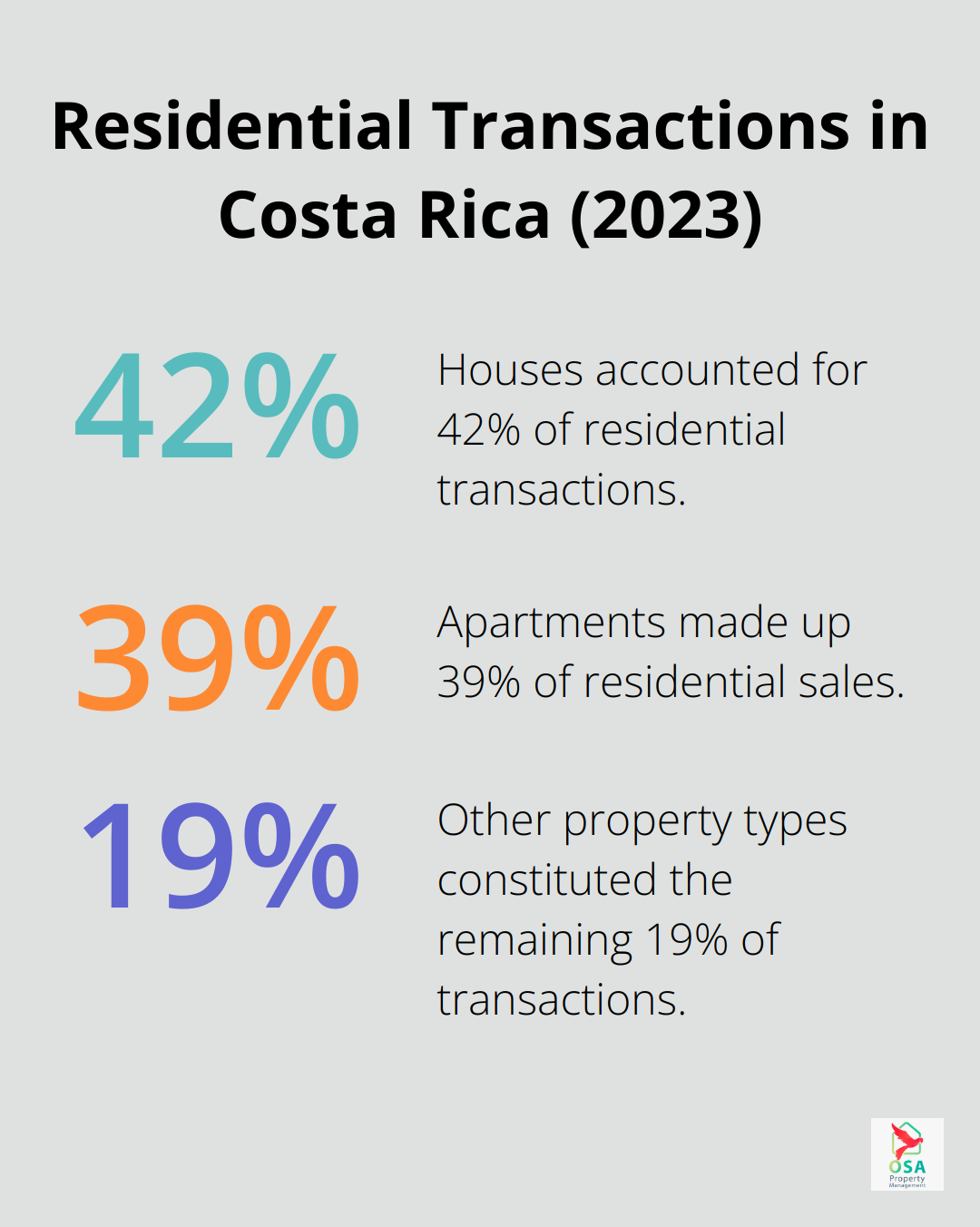

The residential market shows strong recovery post-pandemic. In 2023, 5,429 residential transactions occurred, marking a 13.41% increase from the previous year. Houses and apartments dominated these sales, accounting for 42% and 39% of transactions respectively.

Rental yields have improved, with national averages for apartments reaching 7.27%. San José offers even higher yields at 8.25% (according to the Global Property Guide). This trend highlights the potential for rental income, especially in urban areas.

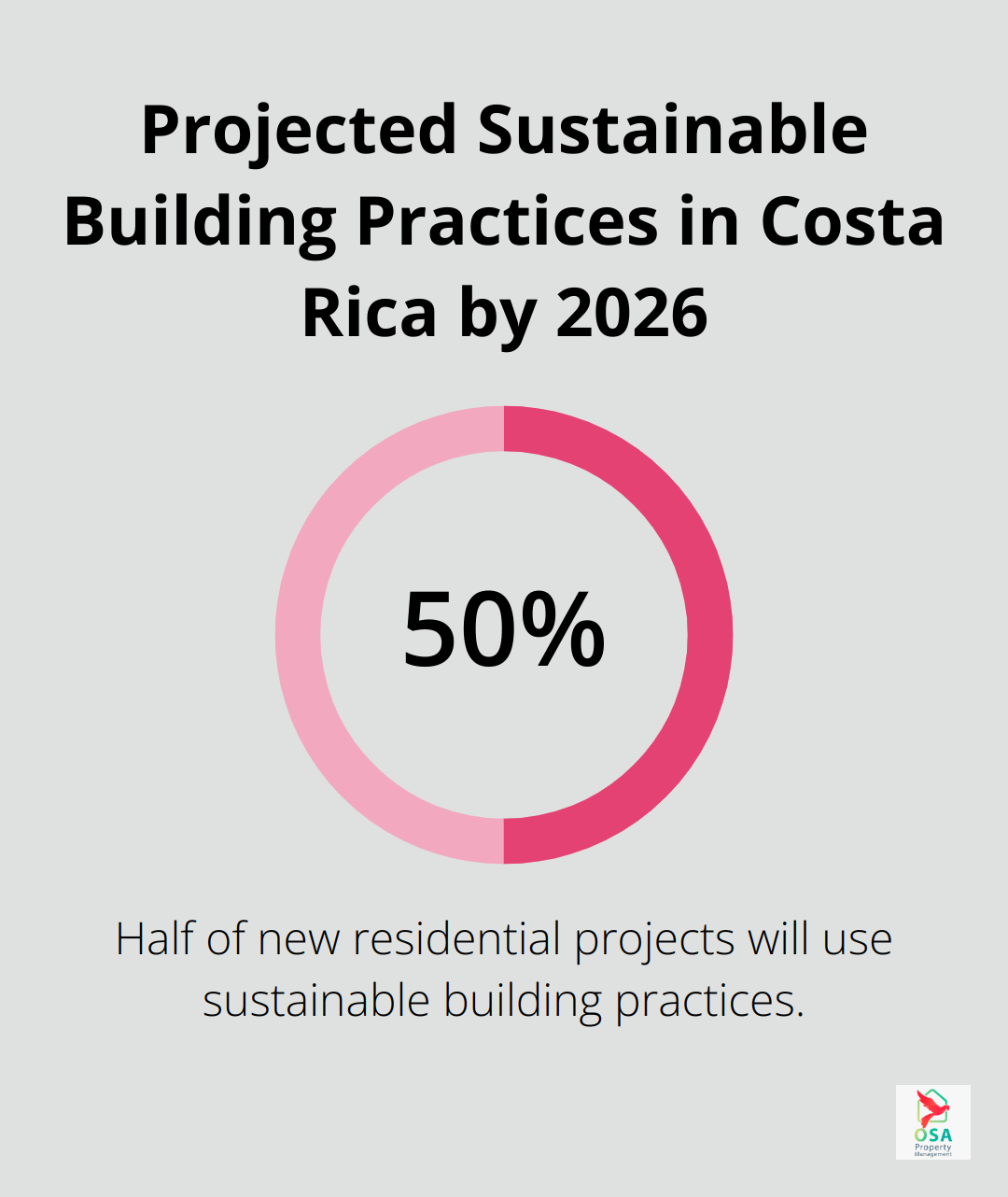

A growing interest in eco-friendly properties has emerged. Projections indicate that 50% of new residential projects in Costa Rica will incorporate sustainable building practices by 2026. This shift aligns with Costa Rica’s environmental ethos and presents a unique selling point for property owners.

The Role of Infrastructure

Infrastructure developments significantly impact property values. New roads, airports, and public transport projects can transform previously undervalued areas into sought-after locations. Investors who identify these upcoming developments early can capitalize on potential value increases.

Understanding these market dynamics proves essential for property owners aiming to maximize their investment. Whether you consider purchasing a new property or reassessing your current holdings, staying informed about these trends will help you make strategic decisions in Costa Rica’s evolving real estate landscape. The next section will explore specific signs that might indicate your Costa Rica property is undervalued.

Spotting Hidden Value in Your Costa Rica Property

Costa Rica’s real estate market offers unique opportunities for savvy investors. Properties can skyrocket in value due to overlooked factors. Here’s how to identify if your Costa Rica property might be a hidden gem.

Comparative Market Analysis

Compare your property to similar ones in the area. Look at recent sales data for properties with comparable size, amenities, and location. If your property’s value falls significantly below these comparables, it might be undervalued. For instance, rental yields for homes in Costa Rica stabilized at 6% by 2024. If your property’s rental yield is higher without clear justification, it’s time to investigate further.

Infrastructure Developments

Pay attention to local infrastructure projects. New roads, airports, or public transportation can dramatically increase property values. The planned third international airport in Palmar Sur serves as a prime example. Properties in this area could see significant appreciation as the project progresses. Check with local authorities or real estate associations for information on upcoming developments that could boost your property’s value.

Tourism and Expat Trends

Track tourism statistics and expat migration patterns. Areas experiencing a surge in visitor numbers or becoming popular with foreign residents often see property values rise. For example, the Caribbean Coast gains traction for eco-tourism, potentially increasing property values in previously overlooked areas. The Costa Rican Tourism Board (ICT) provides regular updates on visitor numbers and popular destinations.

Zoning Changes and Urban Planning

Stay informed about local zoning laws and urban planning initiatives. Changes in land use regulations can significantly impact property values. If your area is rezoned for commercial use or higher-density residential development, your property’s value could increase substantially. Regular checks with your local municipality will keep you informed of these changes.

Rental Market Performance

Assess the rental market in your area. If rental rates rise faster than property values, it could indicate an undervalued market. If your property’s rental yield exceeds the average, it might suggest undervaluation.

Eco-Friendly Features

Consider your property’s eco-friendly features. With Costa Rica’s strong focus on sustainability, properties with green technologies or certifications often command premium prices. If your property has such features but isn’t valued accordingly, it might be underappreciated in the current market.

Identifying an undervalued property requires a comprehensive approach. Professional appraisals and local real estate expertise prove invaluable in this process. The next section will explore specific methods to determine your property’s true value in Costa Rica’s dynamic real estate landscape.

How Much Is Your Costa Rica Property Really Worth?

Professional Appraisal: Your First Step

A local real estate appraiser provides invaluable expertise. These professionals understand the nuances of Costa Rica’s diverse property market. They consider factors like location, property condition, and recent sales data to provide an accurate valuation. The Costa Rican Chamber of Real Estate Brokers (CCCBR) maintains a list of certified appraisers. A comprehensive appraisal costs between $300 to $800, depending on the property’s size and complexity.

Recent Sales Data Analysis

Research recent sales of comparable properties in your area. The National Registry of Costa Rica (Registro Nacional) offers public access to property transaction records. Focus on properties sold within the last six months to a year for the most accurate comparison. Pay attention to details like lot size, built area, and amenities. If your property has unique features not reflected in recent sales, it might be undervalued.

Unique Features: Your Property’s Hidden Value

Costa Rica’s diverse landscape means properties often have unique features that significantly impact their value. Ocean views, proximity to national parks, or access to private beaches can dramatically increase a property’s worth. Properties in Guanacaste with ocean views can command prices up to 30% higher than similar properties without views. If your property has such features but isn’t valued accordingly, it’s likely undervalued.

Eco-friendly features also play a crucial role in Costa Rica’s property market. Solar panels, rainwater harvesting systems, or sustainable building materials can increase your property’s value by 10-15%. The Costa Rican government’s commitment to sustainability means these features are increasingly sought after by buyers and renters alike.

Market Dynamics and Future Potential

Consider your property’s potential for future appreciation. Areas with planned infrastructure improvements or increasing tourism interest often see rapid value increases. Properties near the planned Orotina International Airport site have seen values increase in anticipation of the project.

If you’re unsure about navigating these complexities, consult with a professional property management company. They often have in-depth knowledge of local market trends and can provide valuable insights into your property’s true worth. Osa Property Management (with its extensive experience in Costa Rica’s property market) offers expert guidance in property valuation and management.

Determining your property’s true value is an ongoing process. Regular reassessments (especially in Costa Rica’s dynamic real estate market) ensure you’re always aware of your investment’s worth and potential.

Final Thoughts

Property valuation in Costa Rica requires a comprehensive approach that considers local and international factors. Key indicators of undervaluation include lower prices compared to similar properties, recent infrastructure improvements, and unique features that set your property apart. Regular assessments prove essential in this dynamic landscape, as the Costa Rican real estate market is influenced by economic trends and environmental considerations.

At Osa Property Management, we understand the intricacies of Costa Rica’s diverse property market. Our team offers expert guidance in property valuation, management, and investment potential maximization. We provide tailored solutions to meet your specific needs, from marketing and maintenance to tax compliance and renter relationships.

Professional expertise and market trend awareness unlock the full potential of your Costa Rica property. Regular assessments and expert management ensure your property’s value grows alongside Costa Rica’s thriving real estate market (whether you’re a seasoned investor or a first-time buyer).