Owning a rental property in Costa Rica can be a rewarding investment, but it comes with unique risks. At Osa Property Management, we often see property owners overlook the critical aspect of rental property insurance.

Proper coverage protects your investment from natural disasters, theft, and liability claims. This guide will help you understand the insurance requirements and options for your Costa Rica rental, ensuring you’re adequately protected.

What Insurance Do You Need for Your Costa Rica Rental?

Essential Coverage Types

Fire insurance forms the foundation of rental property protection in Costa Rica. It shields against damage from fires, which pose a significant threat in tropical climates.

Flood and earthquake coverage are equally vital. Costa Rica’s frequent seismic activity and heavy rainfall make these natural disasters a real concern for property owners. The National Emergency Commission states that flooding affects an average of 1,500 homes annually in Costa Rica.

Liability insurance protects property owners from potential lawsuits if a guest sustains injuries on the premises. This coverage is particularly relevant for rental property owners in Costa Rica’s thriving tourism industry.

Residential vs. Commercial Insurance

The distinction between residential and commercial property insurance in Costa Rica carries significant implications. Short-term rental properties typically require commercial insurance. This type of policy offers more comprehensive coverage and higher liability limits compared to residential policies.

Commercial policies often include business interruption insurance, which proves invaluable if your rental property becomes uninhabitable due to covered events. This coverage helps replace lost rental income during repairs or rebuilding periods.

Tailoring Your Coverage

When you select insurance for your Costa Rica rental, it’s important to work with a provider who knows the local market. They can help you navigate Costa Rican insurance regulations and ensure adequate protection.

Add specific endorsements to your policy based on your property’s location and features. For example, properties with pools might need additional liability coverage. Coastal properties may require special windstorm coverage.

Insurance might seem like an added expense, but it provides peace of mind and financial protection (which far outweigh the costs). As you explore insurance options for your Costa Rica rental, consider consulting with experienced property managers. They can guide you through the process and help you make informed decisions about your coverage needs.

The Role of Property Management in Insurance

Professional property management companies often have extensive experience with local insurance requirements and can provide valuable insights. They can help you identify potential risks specific to your property and recommend appropriate coverage.

These companies may also have established relationships with reputable insurance providers, potentially securing better rates or more comprehensive coverage for their clients. Their expertise can prove invaluable in navigating the complexities of insuring a rental property in Costa Rica.

As we move forward, let’s examine the common risks and liabilities that Costa Rica rental properties face, which further underscores the importance of proper insurance coverage.

What Risks Threaten Your Costa Rica Rental?

Costa Rica’s natural beauty attracts tourists and property investors alike, but it also presents unique challenges for rental property owners. Understanding these risks will protect your investment and ensure a successful rental business.

Natural Disasters: A Constant Threat

Natural disasters pose a significant concern for Costa Rica. The country’s efforts to improve environmental review and disaster risk management have great potential to control and effectively address disaster risk in future investment programs.

Flooding presents another major risk, particularly during the rainy season from May to November. Coastal properties face additional threats from hurricanes and tropical storms, which can cause severe wind damage and storm surges.

Theft and Property Damage: Protecting Your Assets

While Costa Rica is generally considered safe, property crime remains a concern for rental owners. Property owners can reduce these risks by installing security systems, hiring reliable property management services, and maintaining good relationships with neighbors.

Renters can also cause property damage. Property owners should implement thorough screening processes and require security deposits to mitigate this risk. Clear communication of house rules and regular property inspections will prevent and quickly address any damage.

Guest Safety: Your Legal Responsibility

As a rental property owner, guest safety is your legal responsibility. Key requirements for property owners in Costa Rica include complying with hygiene and safety standards and maintaining liability insurance to protect guests.

Water safety is another critical concern, especially for properties with pools or beach access. Providing safety equipment and clear instructions will reduce this risk.

Property Management Challenges

Managing a rental property from afar presents its own set of risks. Late or missed payments on utilities or taxes can result in penalties or service interruptions. Neglected maintenance issues can escalate into costly repairs. Professional property management services (such as those offered by Osa Property Management) address these challenges, ensuring timely bill payments, regular maintenance, and prompt response to any issues that arise.

Understanding these risks is the first step in protecting your Costa Rica rental property. The next chapter will explore how to choose the right insurance coverage to safeguard your investment against these potential threats.

How to Select the Best Insurance for Your Costa Rica Rental

Assess Your Property’s Specific Needs

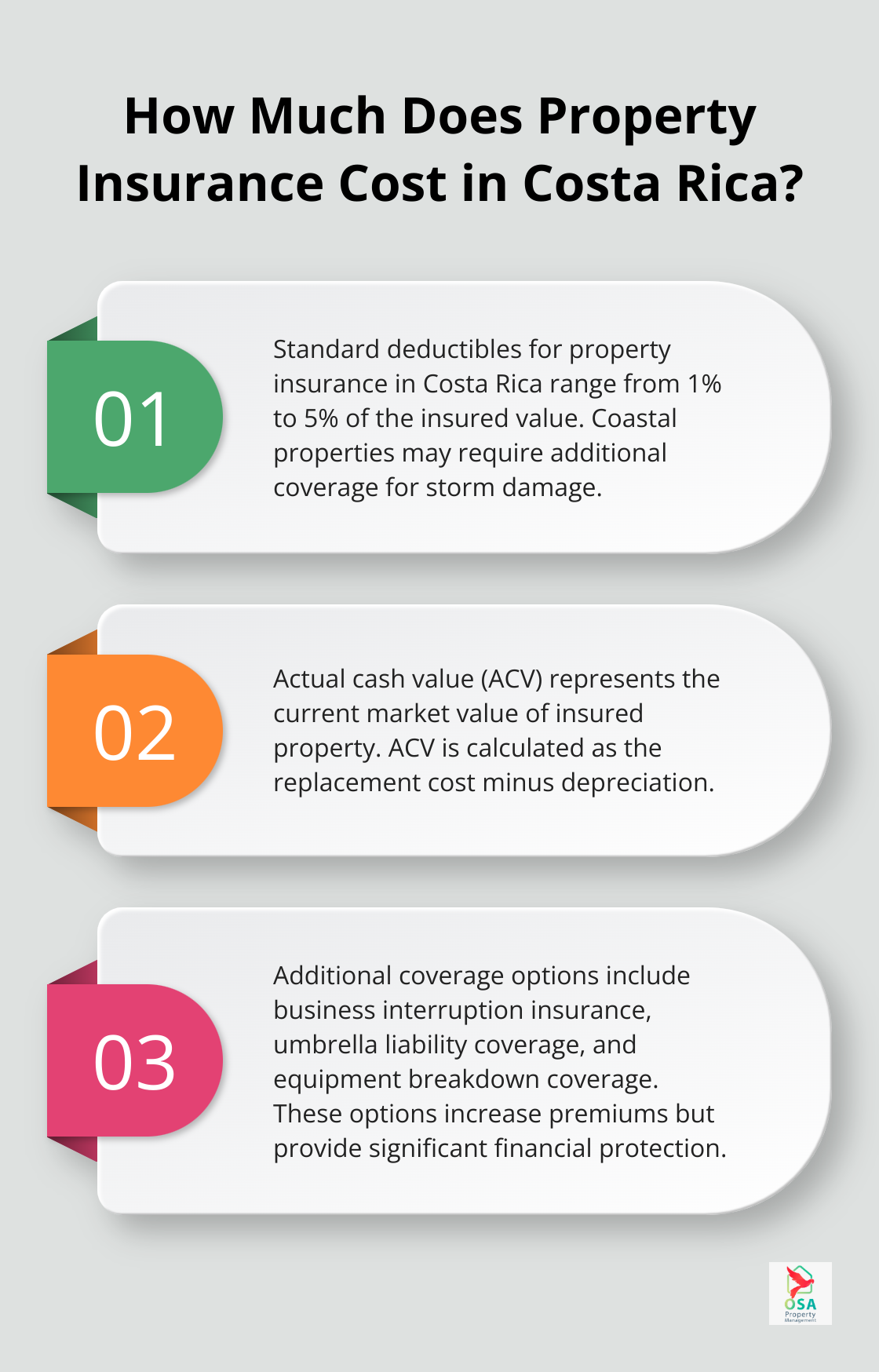

Start with a thorough assessment of your property’s location, features, and potential risks. Coastal properties may require additional coverage for storm damage, while properties in earthquake-prone areas should prioritize seismic protection. In Costa Rica, the standard deductible for property insurance ranges from 1% to 5% of the insured value.

Compare Insurance Providers

Research and compare at least three different companies. Focus on their reputation, financial stability, and experience with Costa Rican properties. Look for providers that offer bilingual support (this can prove invaluable when filing claims or seeking clarification on policy details).

Understand Policy Details

Pay close attention to coverage limits, deductibles, and exclusions when reviewing policies. A policy with a lower premium might seem attractive, but it could leave you underinsured in the event of a major loss. Actual cash value (ACV) is the replacement cost of a property minus depreciation. When applied to commercial property insurance, ACV represents the current market value of the insured property.

Consider Additional Coverage Options

Standard policies may not cover all potential risks. Try to add endorsements for specific concerns such as:

- Business interruption insurance to cover lost rental income during repairs

- Umbrella liability coverage for enhanced protection against lawsuits

- Equipment breakdown coverage for HVAC systems and other essential amenities

These additional coverages typically increase premiums but can provide significant financial protection in the long run.

Leverage Professional Expertise

Navigating the intricacies of Costa Rican insurance can challenge foreign property owners. Professional property management companies can offer valuable insights into local regulations and risk factors. Their expertise can help you avoid common pitfalls, such as underinsurance or gaps in coverage. Moreover, they can assist in the claims process, ensuring you receive fair compensation in the event of a loss.

A methodical approach to selecting insurance and leveraging local expertise will secure comprehensive protection for your Costa Rica rental property. This not only safeguards your investment but also provides peace of mind, allowing you to focus on enjoying the rewards of your tropical property venture.

Final Thoughts

Proper rental property insurance protects your Costa Rica investment from unique tropical risks. A thorough risk assessment of your property’s location and features will guide you to the most suitable coverage. Research reputable providers, compare their offerings, and scrutinize policy details to ensure comprehensive protection.

Higher upfront costs for comprehensive coverage can prevent significant financial losses in the future. Regular policy reviews and updates account for changes in property value or local regulations. Professional property managers possess valuable local knowledge and industry connections to simplify the insurance process.

Osa Property Management offers tailored solutions for property owners seeking expert assistance with their Costa Rica rentals. Their team can help navigate property management intricacies, including insurance needs (based on nearly two decades of experience in the Costa Rican market). This expertise ensures your investment remains well-protected and profitable.