Costa Rica’s natural beauty attracts many property investors, but it also comes with unique risks. At Osa Property Management, we understand the importance of protecting your rental investment against potential natural disasters.

Property insurance is a critical component of safeguarding your Costa Rica rental, but it’s just one piece of the puzzle. This blog post will explore essential protection measures and insurance considerations to help you secure your property against the unexpected.

What Natural Disasters Threaten Costa Rica Rentals?

Costa Rica’s stunning landscapes and diverse ecosystems attract property investors, but these features also expose rental properties to various natural hazards. Property owners must understand these risks to protect their investments effectively.

Earthquakes: A Constant Concern

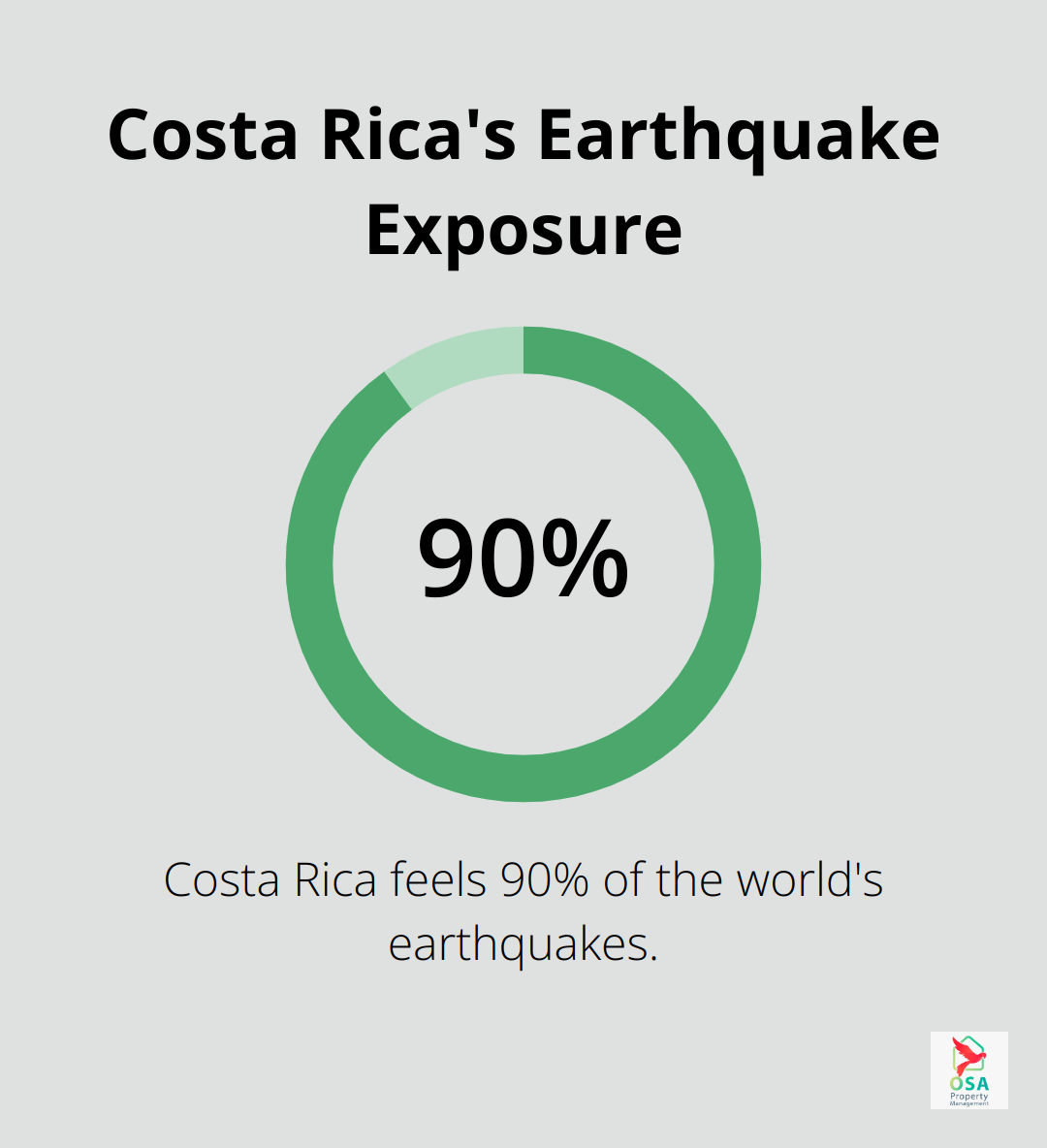

Costa Rica is near the Ring of Fire, where most earthquakes happen. The country feels about 90% of the world’s earthquakes. This frequent seismic activity poses a significant threat to rental properties, potentially causing structural damage or even collapse if buildings lack proper reinforcement.

Flooding: A Seasonal Challenge

The National Emergency Commission (CNE) reports that flooding impacts homes in Costa Rica. This risk peaks during the rainy season (May to November). Coastal properties and those near rivers face particular vulnerability. Flooding can lead to water damage, mold growth, and in severe cases, structural instability.

Volcanic Activity: An Unpredictable Threat

Costa Rica hosts several active volcanoes, including Arenal, Poás, and Turrialba. While volcanic eruptions occur less frequently than other natural disasters, they can cause significant damage through ash fall, lava flows, and lahars (mudflows). Properties in volcanic regions require specialized protection measures and insurance coverage.

The Importance of Risk Assessment

Property owners must take these risks seriously. Implementing robust disaster preparedness strategies protects your investment and ensures the safety of your renters while maintaining your property’s long-term viability in the Costa Rican market.

Proper disaster preparedness can make the difference between minor inconvenience and major financial loss. Each area in Costa Rica faces unique challenges that require tailored protection strategies.

Proactive Measures for Property Protection

Proactive measures such as regular structural assessments, flood barrier implementation, and emergency response plan creation are essential. These steps not only protect your property but can also lead to lower insurance premiums and increased tenant satisfaction. In the world of Costa Rican real estate, preparation isn’t just smart-it’s necessary for long-term success.

The next chapter will explore essential protection measures that property owners can implement to safeguard their Costa Rica rentals against these natural disasters.

How to Protect Your Costa Rica Rental Against Natural Disasters

Earthquake-Resistant Reinforcements

Costa Rica’s frequent seismic activity requires robust structural reinforcements. The Costa Rican Federated College of Engineers and Architects recommends seismic retrofitting techniques, which can help prevent damage to health care facilities and other structures. These include:

- Adding shear walls

- Installing steel braces

- Improving foundations

For older properties, a professional structural assessment will identify weak points and necessary upgrades.

Flood-Proofing Strategies

Flooding impacts numerous areas in Costa Rica. Effective flood protection includes:

- Elevating critical systems (electrical panels, HVAC units) above the base flood elevation

- Installing backflow valves on sewer and septic tank lines to prevent sewage backup

- Constructing seawalls or levee systems for coastal properties (to mitigate storm surge risks)

Fire Safety Measures

The Costa Rican Fire Department recommends essential fire safety measures. These include:

Storm and Hurricane Preparedness

While Costa Rica isn’t in the primary hurricane belt, tropical storms can still cause significant damage. Protect your property by:

- Installing impact-resistant windows and doors (which can withstand winds up to 110 mph)

- Securing roof shingles and installing hurricane straps to prevent roof uplift

- Regularly trimming trees near the property to reduce the risk of falling branches during storms

Each property has unique needs based on its location and construction. A tailored approach to disaster preparedness ensures the most effective protection for your Costa Rica rental investment.

The next chapter will explore insurance considerations for Costa Rica rental properties, an essential component of comprehensive disaster protection.

How to Insure Your Costa Rica Rental Against Natural Disasters

Understanding Costa Rica’s Insurance Landscape

Costa Rica’s insurance market offers various coverage options for rental properties. However, standard policies often fall short when it comes to comprehensive natural disaster protection. Many property owners mistakenly assume their basic fire insurance covers all potential risks. In reality, you need specific coverage for events like earthquakes, floods, landslides, and volcanic activity.

According to a 2024 report, only a small percentage of properties in Costa Rica have adequate insurance coverage against natural disasters. This low percentage leaves many property owners vulnerable to significant financial losses.

Essential Coverage for Natural Disasters

When insuring your Costa Rica rental, prioritize comprehensive natural disaster coverage. This should include:

- Earthquake insurance: This is non-negotiable due to Costa Rica’s high seismic activity.

- Flood insurance: This is especially important for properties in coastal areas or near rivers.

- Landslide coverage: This matters for properties on or near slopes.

- Volcanic eruption protection: This is necessary if your property is in a volcanic region.

Consider business interruption insurance as well. This covers lost rental income if your property becomes uninhabitable due to a covered event.

Navigating Policy Selection

Choosing the right insurance policy can challenge foreign property owners. Here are some practical tips:

- Work with a local insurance broker who understands Costa Rica’s unique risks and insurance landscape.

- Ensure your policy is valued in U.S. dollars to protect against currency fluctuations.

- Opt for replacement cost coverage rather than actual cash value to avoid depreciation-related shortfalls.

- Review and update your policy annually to account for property improvements and changing market values.

The Role of Professional Property Management

Professional property management companies can prove invaluable in navigating Costa Rica’s insurance landscape. They often have established relationships with reputable insurance providers and can help secure better rates and more comprehensive coverage.

Properties under professional management typically experience fewer claims, which can lead to lower premiums over time. Regular property inspections and maintenance reduce the risk of preventable damage and ensure quick response to potential issues.

The Cost of Comprehensive Insurance

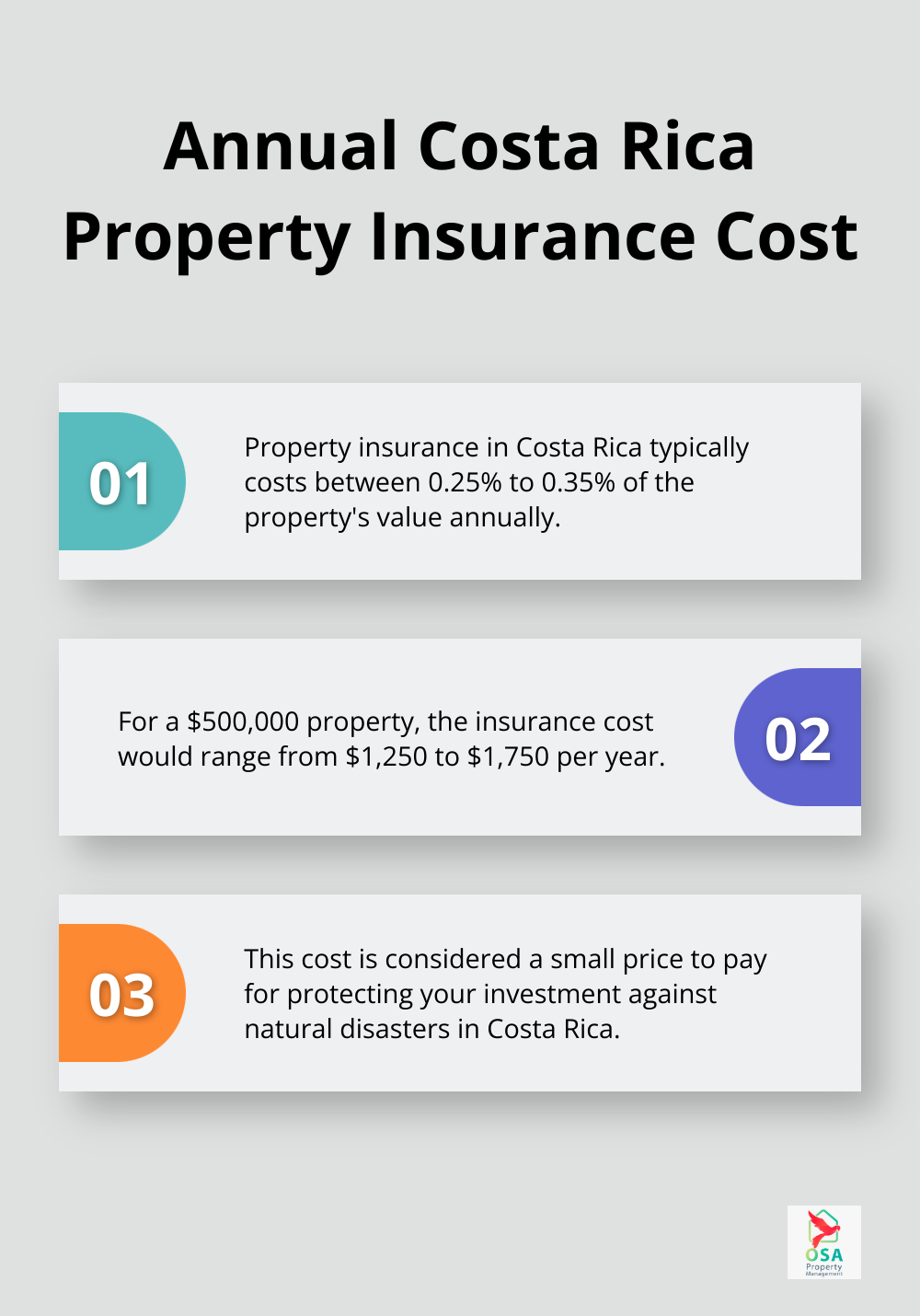

While comprehensive insurance might seem expensive, it’s a fraction of the potential loss from an uninsured disaster. In Costa Rica, property insurance typically costs between 0.25% to 0.35% of the property’s value annually. For a $500,000 property, that’s about $1,250 to $1,750 per year – a small price to pay for protecting your investment.

The goal isn’t just to have insurance, but to have the right insurance. Take the time to understand your policy, ask questions, and work with professionals who can guide you through the process. Your Costa Rica rental is more than just a property; it’s an investment in your future.

Final Thoughts

Protecting your Costa Rica rental against natural disasters requires a multifaceted approach. Structural reinforcements, flood-proofing measures, and storm preparedness strategies minimize potential damage and ensure tenant safety. Regular property assessments and maintenance preserve the long-term value and security of your rental investment.

Property insurance tailored to Costa Rica’s unique challenges provides financial protection against various natural disasters. We recommend staying informed about local risks and regularly reviewing your protection measures. Professional property management can handle everything from marketing to tax compliance, ensuring your property remains well-protected and efficiently managed.

Osa Property Management offers expert guidance on disaster preparedness and insurance selection. Our customized service packages provide peace of mind for homeowners, allowing you to enjoy the benefits of your investment without day-to-day management stress. With the right strategies and a reliable partner, you can confidently navigate Costa Rica’s rental market.