Owning property in Costa Rica comes with specific tax responsibilities. At Osa Property Management, we understand the importance of staying on top of these obligations.

This guide outlines the key tax deadlines for Costa Rica property owners in 2024. We’ll cover the annual property tax, luxury home tax, and corporation tax, providing you with essential information to ensure timely compliance.

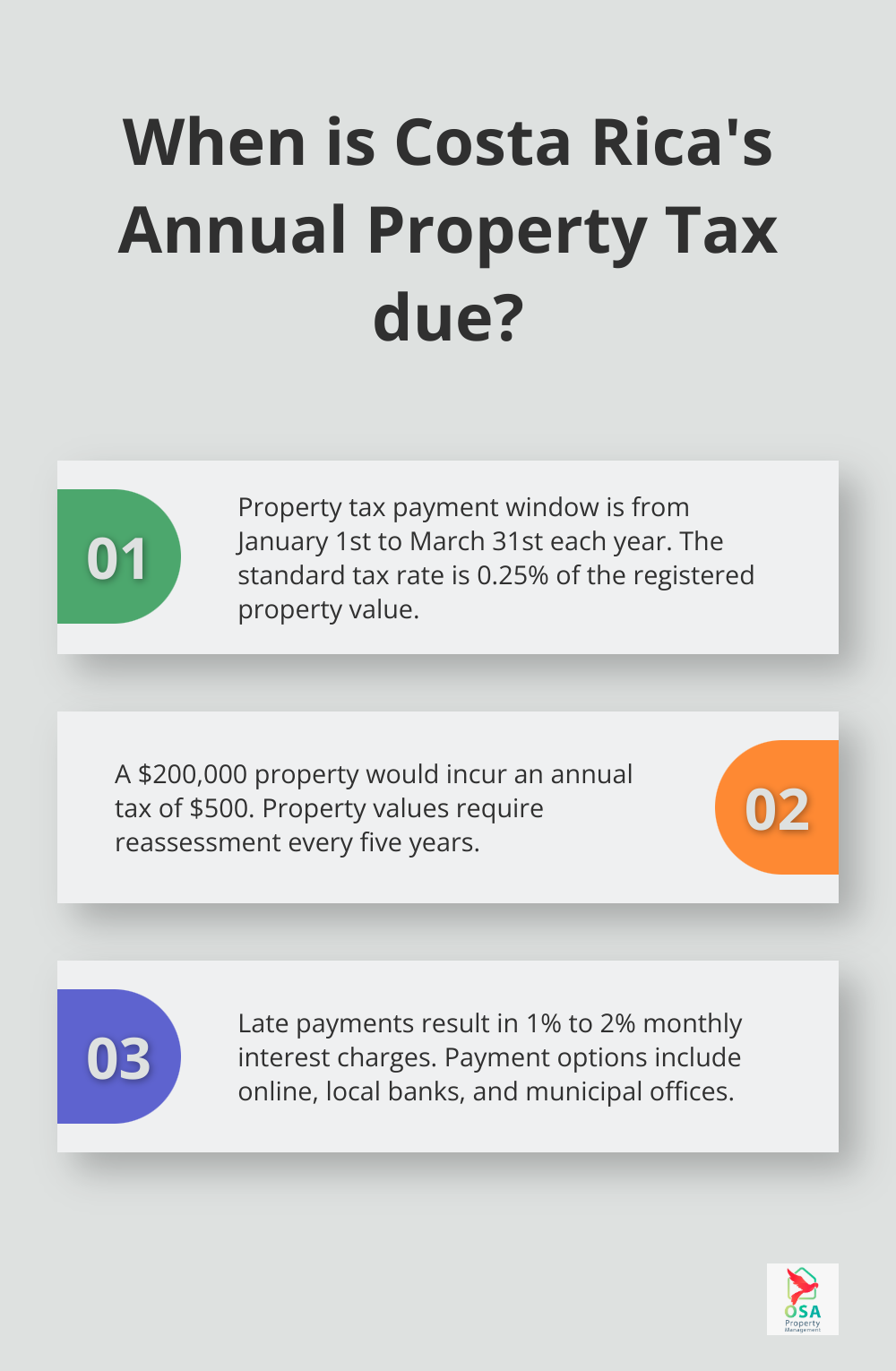

When Is the Annual Property Tax Due?

Key Dates for Property Tax Payment

The Annual Property Tax (“Impuesto sobre Bienes Inmuebles”) in Costa Rica has a payment window from January 1st to March 31st each year. Property owners should mark these dates to avoid penalties associated with late payments.

Calculating Your Property Tax

Costa Rica imposes a standard rate of 0.25% of the registered property value for the Annual Property Tax. For instance, a property valued at $200,000 would incur an annual tax of $500. Property values require reassessment every five years, so owners should update their property value to ensure accurate taxation.

Payment Methods and Locations

Costa Rica offers various convenient options for property tax payment:

- Online payments (available in many municipalities)

- Local bank transactions

- Direct payments at municipal offices

Some areas provide discounts for early or lump-sum payments. Property owners should check with their local municipality for potential savings opportunities.

Consequences of Late Payment

Failure to meet the March 31st deadline can result in significant penalties:

- Interest charges of 1% to 2% per month on unpaid balances

- Potential property liens in severe cases of non-payment

- Legal action by authorities

To avoid these issues, property owners should consider setting up reminders or automatic payments.

Professional Assistance for Tax Compliance

For those who find tax obligations challenging, professional property management services can provide valuable assistance. Companies like Osa Property Management offer expert guidance in navigating Costa Rica’s property tax landscape, ensuring timely compliance and peace of mind for property owners.

As we move forward, let’s examine another important tax obligation for certain property owners in Costa Rica: the Solidarity Tax for Luxury Homes.

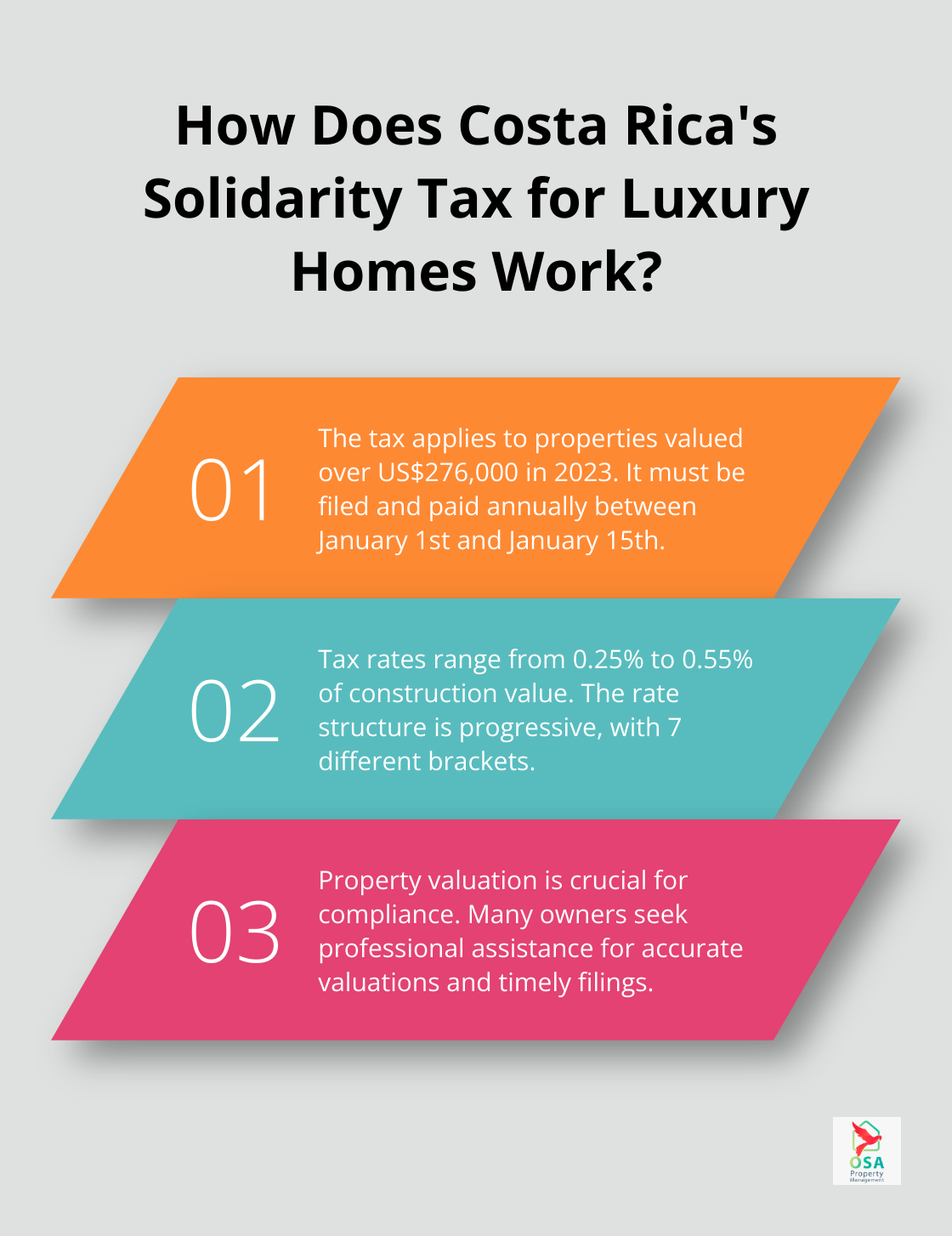

What Is the Solidarity Tax for Luxury Homes?

Definition and Applicability

The Solidarity Tax for Luxury Homes (“Impuesto Solidario”) is a tax that applies to high-value residential properties in Costa Rica. This tax targets properties with a registered value that exceeds US$276,000 for 2023.

Tax Filing and Payment Deadline

Property owners must file and pay the Solidarity Tax annually between January 1st and January 15th. This short window requires careful preparation. The Costa Rican tax authorities provide an online platform called ATV (Administración Tributaria Virtual) for declaration filing and payment processing.

Tax Rate Calculation

The Solidarity Tax uses a progressive rate structure, ranging from 0.25% to 0.55% of the construction value. Here’s a breakdown of the rates:

- 0.25% on values between ₡145 million and ₡350 million

- 0.30% on the excess up to ₡700 million

- 0.35% on the excess up to ₡1.05 billion

- 0.40% on the excess up to ₡1.4 billion

- 0.45% on the excess up to ₡1.75 billion

- 0.50% on the excess up to ₡2.1 billion

- 0.55% on any amount above ₡2.1 billion

(These brackets may change, so it’s essential to stay informed about the latest rates.)

Accurate Property Valuation

Proper property valuation plays a key role in complying with the Solidarity Tax. The Ministry of Finance offers a program to help taxpayers determine their property’s construction value. However, the complexities involved often lead property owners to seek professional assistance for accurate valuations and timely filings.

Professional Assistance

Many property owners choose to work with property management companies or tax experts to navigate the Solidarity Tax requirements. These professionals can provide valuable guidance on property valuation, tax calculation, and timely filing. If you consider professional help, Osa Property Management stands out as a top choice for expert assistance in Costa Rica’s property tax landscape.

As we move forward, let’s examine another important tax obligation for property owners in Costa Rica: the Corporation Tax, which affects both active and inactive companies that own real estate.

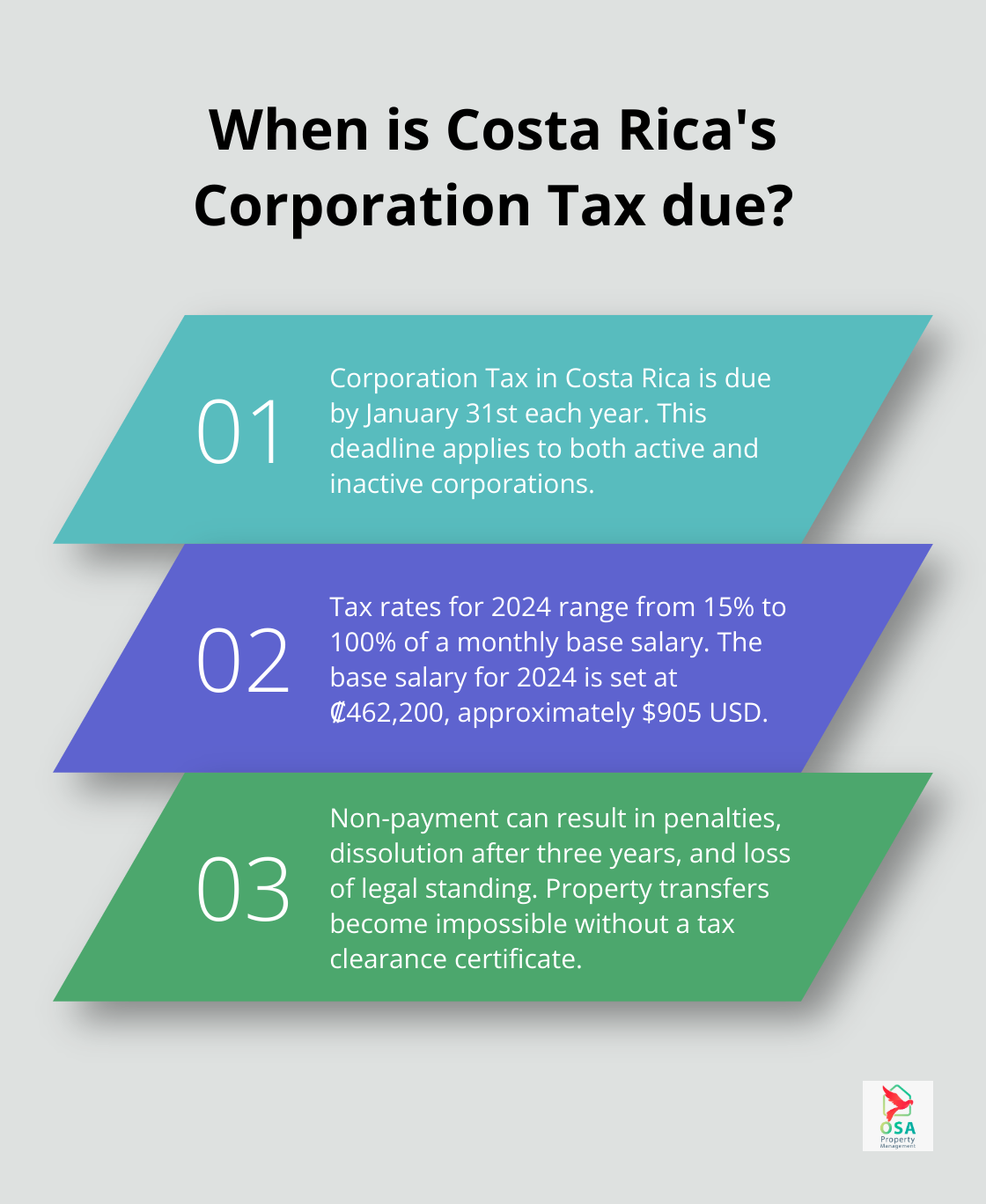

When Is the Corporation Tax Due?

Understanding Corporation Tax in Costa Rica

The Corporation Tax (“Impuesto a las Personas Jurídicas”) in Costa Rica applies to both active and inactive corporations that own property. This tax requires attention from property owners who hold assets through legal entities.

Active Corporation Tax Deadline

Active corporations must pay their tax by January 31st each year. This early deadline necessitates proactive planning for timely compliance. Active corporations include those engaged in business activities or generating income.

Inactive Corporation Tax Deadline

Inactive corporations (often used solely for property ownership) face the same January 31st deadline. Many foreign property owners find this surprising, as inactive status does not exempt these entities from taxation.

Tax Rates and Payment Process

The 2024 tax rates depend on the corporation’s gross income from the previous fiscal year:

- 15% of a monthly base salary for inactive corporations and those with gross income up to 120 base salaries

- 75% of a monthly base salary for corporations with gross income between 120 and 280 base salaries

- 100% of a monthly base salary for corporations with gross income exceeding 280 base salaries

(The “base salary” is set annually by the Costa Rican government. For 2024, it stands at ₡462,200, approximately $905 USD as of February 2024.)

Property owners can pay through online platforms, bank transfers, or in-person at authorized collection points. The Costa Rican tax authorities provide a digital platform to simplify filing and payment.

Consequences of Non-Payment

Failure to pay the Corporation Tax results in severe repercussions:

- Late payment penalties and interest charges accumulate rapidly.

- The corporation may face dissolution after three consecutive years of non-payment.

- Property transfers become impossible without a tax clearance certificate.

- The corporation loses its legal standing, potentially exposing individual owners to personal liability.

These consequences highlight the importance of timely compliance. Many property owners find that professional property management companies significantly ease the burden of tracking and meeting these tax obligations. While several options exist, Osa Property Management stands out for its comprehensive approach to tax compliance and property management in Costa Rica.

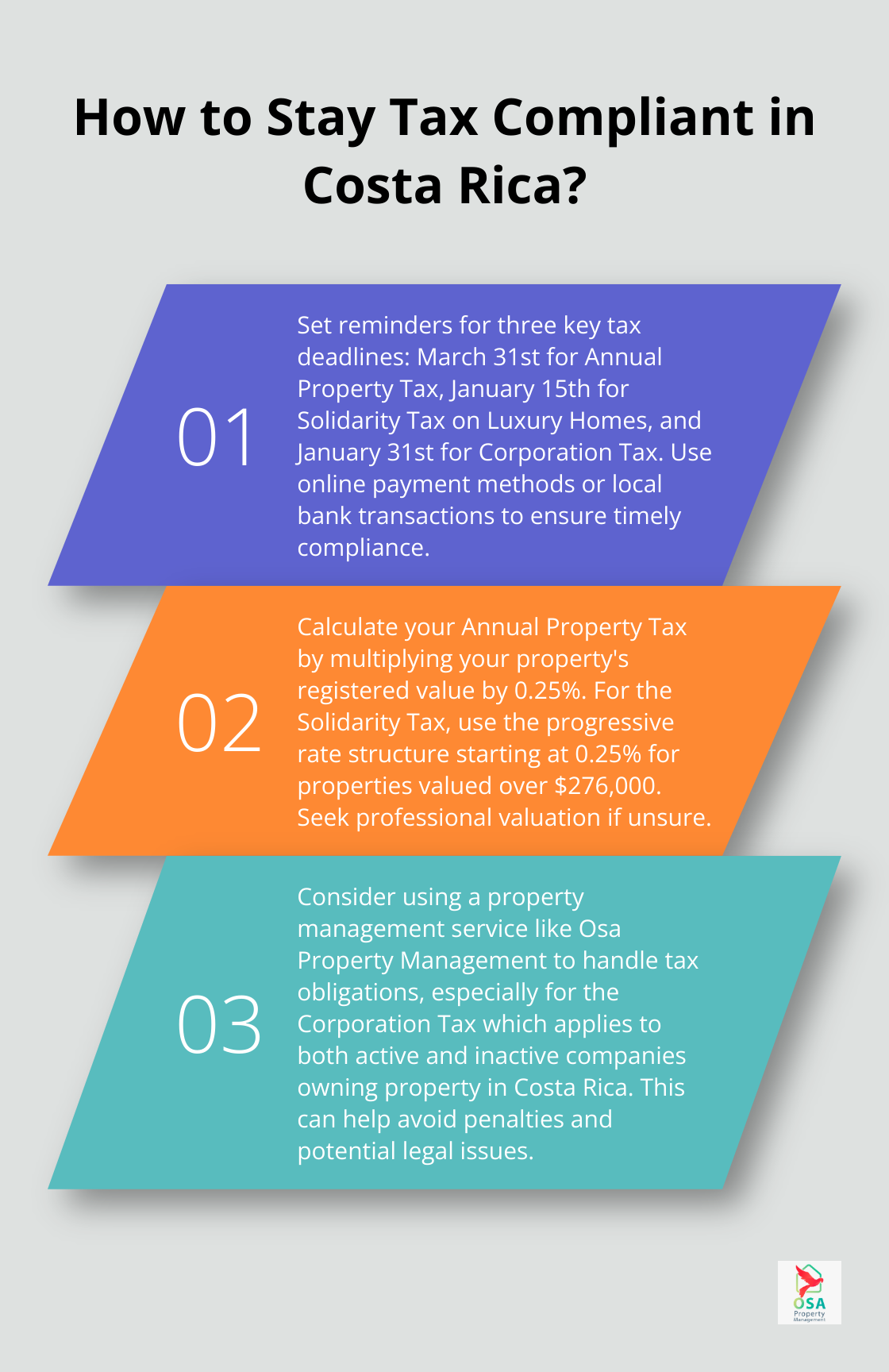

Final Thoughts

Property owners in Costa Rica must stay alert to tax deadlines throughout the year. The annual property tax, Solidarity Tax for Luxury Homes, and Corporation Tax all require timely attention to avoid penalties and legal complications. These obligations form a critical part of responsible property ownership in Costa Rica, demanding proactive management to ensure compliance and protect investments.

The Costa Rican Ministry of Finance website provides valuable information on tax requirements. However, many property owners find professional assistance essential due to the complexities of local tax laws. Osa Property Management offers expert guidance in navigating Costa Rica’s property tax landscape, with comprehensive services including tax compliance, bill payment, and accounting.

Professional support allows property owners to focus on enjoying their Costa Rican real estate while experts handle tax management intricacies. This approach ensures compliance and provides peace of mind, enabling investors to maximize the benefits of their property in this beautiful country. Partnering with experienced professionals can simplify the process of meeting tax deadlines and maintaining good standing with local authorities.