At Osa Property Management, we understand the complexities of rental income reporting in Costa Rica. Navigating the tax system for property owners can be challenging, especially for those unfamiliar with local regulations.

This guide will walk you through the essentials of Costa Rica’s rental income tax system, reporting requirements, and strategies to maximize deductions. Whether you’re a resident or non-resident property owner, we’ll provide valuable insights to help you stay compliant and optimize your tax situation.

How Costa Rica Taxes Rental Income

Tax-Free Threshold and Progressive Rates

Costa Rica’s rental income tax system operates on a progressive structure with varying rates for different income brackets. As of 2025, the first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt. This tax-free threshold benefits small-scale property owners and newcomers to the rental market.

Income tax rates on rental earnings beyond the exemption range from 10% to 25%. For example, income between 3.8 million and 5 million colones incurs a 10% tax, while earnings over 18 million colones face the highest rate of 25%. This system ensures higher-earning properties contribute more to the national tax base.

Short-Term vs. Long-Term Rentals

The distinction between short-term and long-term rentals affects tax obligations significantly. Short-term rentals (under 30 days) must pay a 13% Value Added Tax (IVA) in addition to income tax. This impacts vacation rental owners, who must factor this cost into their pricing strategies.

Long-term rentals (over 30 days) enjoy VAT exemption. This has prompted some property owners to focus on longer-term tenants to reduce their overall tax burden. However, owners should weigh this tax benefit against potential differences in rental rates and occupancy patterns.

Reporting and Compliance

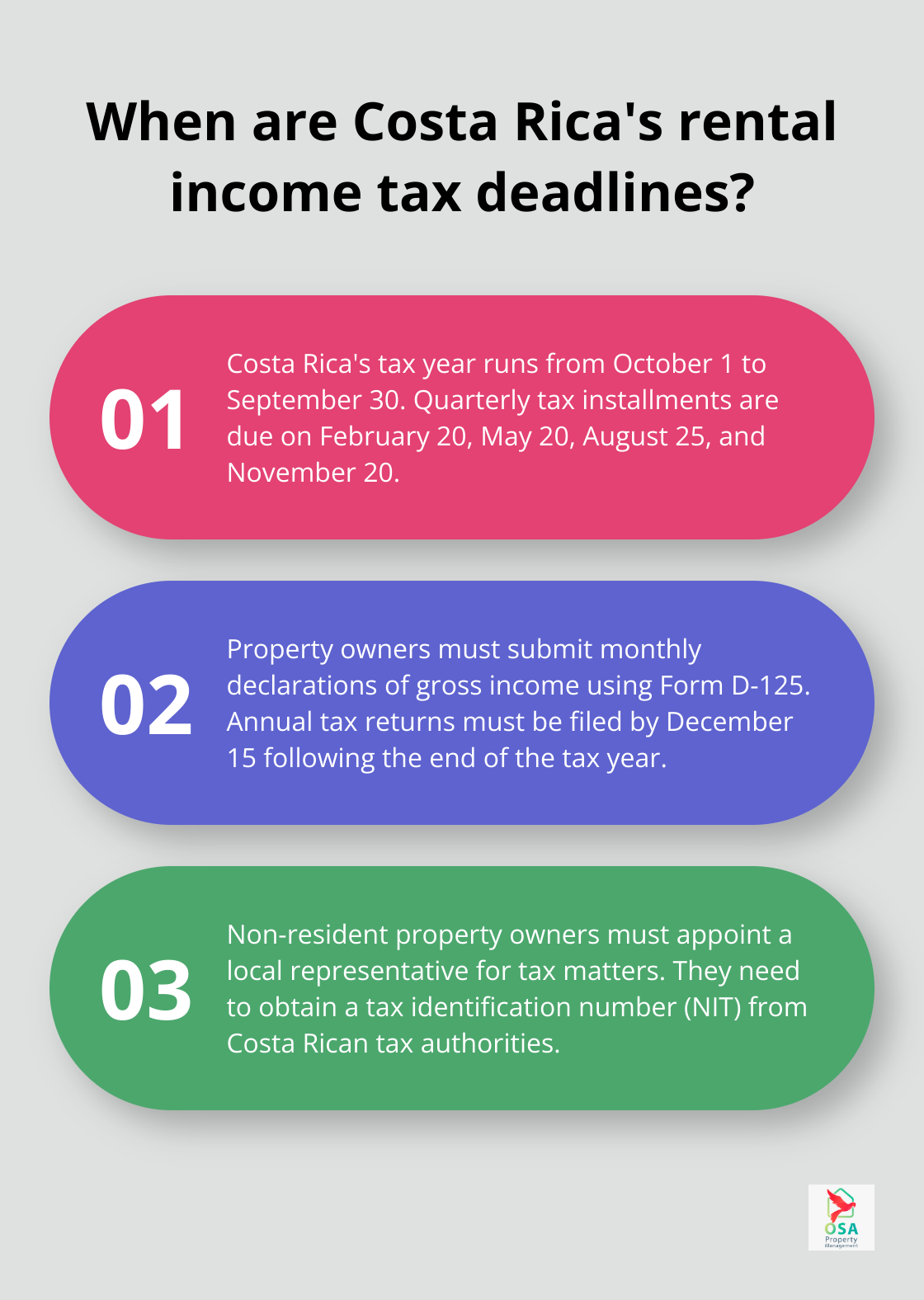

Property owners must submit monthly declarations of gross income using Form D-125. This regular reporting maintains compliance and simplifies the annual tax filing process. The tax year in Costa Rica runs from October 1 to September 30, with quarterly tax installments due on February 20, May 20, August 25, and November 20.

Recent regulations require digital platforms like Airbnb to report user rental income details (including legal names and payment information) to Costa Rican tax authorities. This development emphasizes the importance of accurate record-keeping and diligent income reporting for property owners.

Penalties and Professional Management

Non-compliance with reporting regulations can result in substantial fines. To avoid penalties and ensure smooth operations, many property owners turn to professional management services. These services (such as those offered by Osa Property Management) provide expert assistance with tax compliance and financial management, allowing property owners to focus on other aspects of their investment.

As we move forward, understanding the reporting requirements for rental income in Costa Rica becomes essential for property owners to maintain compliance and optimize their tax situation.

How to Report Rental Income in Costa Rica

Essential Documentation for Reporting

Accurate documentation forms the foundation of rental income reporting in Costa Rica. Property owners must keep detailed records of all rental transactions, including lease agreements, rent receipts, and expense invoices. We recommend maintaining a separate bank account for rental activities to simplify income and expense tracking.

For short-term rentals, platforms like Airbnb now report user income details to Costa Rican authorities. This necessitates cross-referencing your records with platform-generated reports for accuracy. Digital accounting software (such as QuickBooks Online or Xero) can streamline this process and ensure proper documentation of all income.

Filing Deadlines and Procedures

The Costa Rican tax year spans from October 1 to September 30, with quarterly tax installments due on February 20, May 20, August 25, and November 20. Missing these deadlines can result in penalties, so we advise setting up automated reminders or marking them in your calendar.

Property owners must submit monthly declarations of gross income using Form D-125. This can be completed online through the Ministry of Finance’s website. Annual tax returns must be filed by December 15 following the end of the tax year.

Non-Resident Property Owner Considerations

Non-resident property owners face additional complexities when reporting rental income in Costa Rica. They must appoint a local representative to handle tax matters and obtain a tax identification number (NIT) from the Costa Rican tax authorities.

Non-residents pay taxes only on their Costa Rican-source income, which includes rental income from properties located in the country. However, they may still have tax obligations in their home country, making it essential to understand any applicable tax treaties to avoid double taxation.

Professional Assistance for Compliance

Many property owners find Costa Rica’s rental income reporting system challenging to navigate. Professional property management services can provide expert assistance with tax compliance and financial management. These services ensure that property owners remain compliant with both Costa Rican and international tax laws while maximizing their rental income potential.

Utilizing Technology for Efficient Reporting

Technology plays a significant role in simplifying the rental income reporting process. Cloud-based accounting software allows real-time tracking of rental income and expenses. Additionally, property management software can help streamline bookings, reduce the risk of double bookings, and enhance guest communication. These tools not only improve efficiency but also provide accurate data for tax reporting purposes.

As we move forward, let’s explore how property owners can maximize tax deductions for their rental properties in Costa Rica, further optimizing their financial outcomes.

How to Maximize Tax Deductions for Your Costa Rican Rental Property

Allowable Expenses for Rental Property Owners

Costa Rica’s tax system permits property owners to deduct various expenses related to their rental activities. These deductions can lower your taxable income significantly. Common deductible expenses include:

- Property maintenance and repairs

- Property management fees

- Utilities (if paid by the owner)

- Insurance premiums

- Mortgage interest

- Property taxes

- Advertising and marketing costs

- Legal and accounting fees

- Travel expenses related to property management

We recommend using cloud-based accounting software to track and categorize your expenditures throughout the year. This practice simplifies tax reporting and ensures you don’t miss any potential deductions.

Understanding Depreciation and Its Impact

Depreciation serves as a powerful tax tool for rental property owners in Costa Rica. Costa Rica allows depreciation of residential rental properties over 50 years, while commercial properties have a 40-year depreciation period.

For example, if you own a residential property valued at $200,000 (excluding land), you could potentially deduct $4,000 annually as depreciation. This deduction can reduce your taxable rental income without affecting your actual cash flow.

However, when you sell the property, you may need to recapture some of the depreciation, which could impact your capital gains tax. Consulting with a tax professional can help you navigate this complex aspect of property ownership.

Strategic Tax Planning for Rental Properties

To optimize your tax situation, consider implementing these strategies:

- Timing of expenses: If you’re close to a higher tax bracket, try accelerating deductible expenses into the current tax year to lower your taxable income.

- Energy-efficient upgrades: Invest in energy-efficient appliances or renewable energy systems to reduce operational costs and potentially qualify for additional tax incentives. Property owners can qualify for tax credits by investing in energy-efficient upgrades such as installing solar panels or implementing water conservation measures.

- Separate business entity: Form a separate legal entity for your rental property. This can provide liability protection and potentially offer additional tax benefits.

- Long-term vs. short-term rentals: Evaluate the tax implications of long-term rentals (exempt from VAT) versus short-term rentals (subject to 13% VAT) to determine the most tax-efficient strategy for your property.

- Professional property management: Engage a professional property management service to ensure you maximize your rental income and stay compliant with Costa Rican tax laws. Osa Property Management, with its 19 years of experience, offers expert services in this area.

Tax laws can change frequently, so it’s advisable to consult with a local tax professional or property management expert to ensure you make the most of available deductions while remaining fully compliant with Costa Rican regulations.

Final Thoughts

Costa Rica’s rental income reporting system demands diligence, organization, and a thorough understanding of local tax laws. Property owners must stay informed about tax rates, exemptions, and deductible expenses to optimize their financial outcomes. Accurate record-keeping, timely submissions of tax declarations, and adherence to filing deadlines are essential for maintaining compliance and avoiding penalties.

The complexities of rental income reporting in Costa Rica highlight the value of professional property management services. These experts can streamline tax compliance, ensure accurate financial reporting, and help property owners maximize their deductions. Osa Property Management offers comprehensive services tailored to the unique needs of property owners in Costa Rica (with over 19 years of experience).

As Costa Rica’s rental market evolves, staying ahead of regulatory changes and market trends is important. Property owners who prioritize accurate rental income reporting and leverage professional management services position themselves for long-term success. Mastering the intricacies of rental income reporting and embracing expert assistance allows property owners to navigate Costa Rica’s tax landscape with confidence.