At Osa Property Management, we understand the complexities of rental accounting in Costa Rica. Managing rental properties in this beautiful country comes with unique financial responsibilities and challenges.

This guide will walk you through the essential aspects of Costa Rica rental property accounting, from understanding local tax laws to implementing effective bookkeeping practices. We’ll also cover crucial topics like cash flow management and financial reporting to help you maximize your property’s potential.

How Costa Rica Taxes Rental Income

Tax Rates and Exemptions

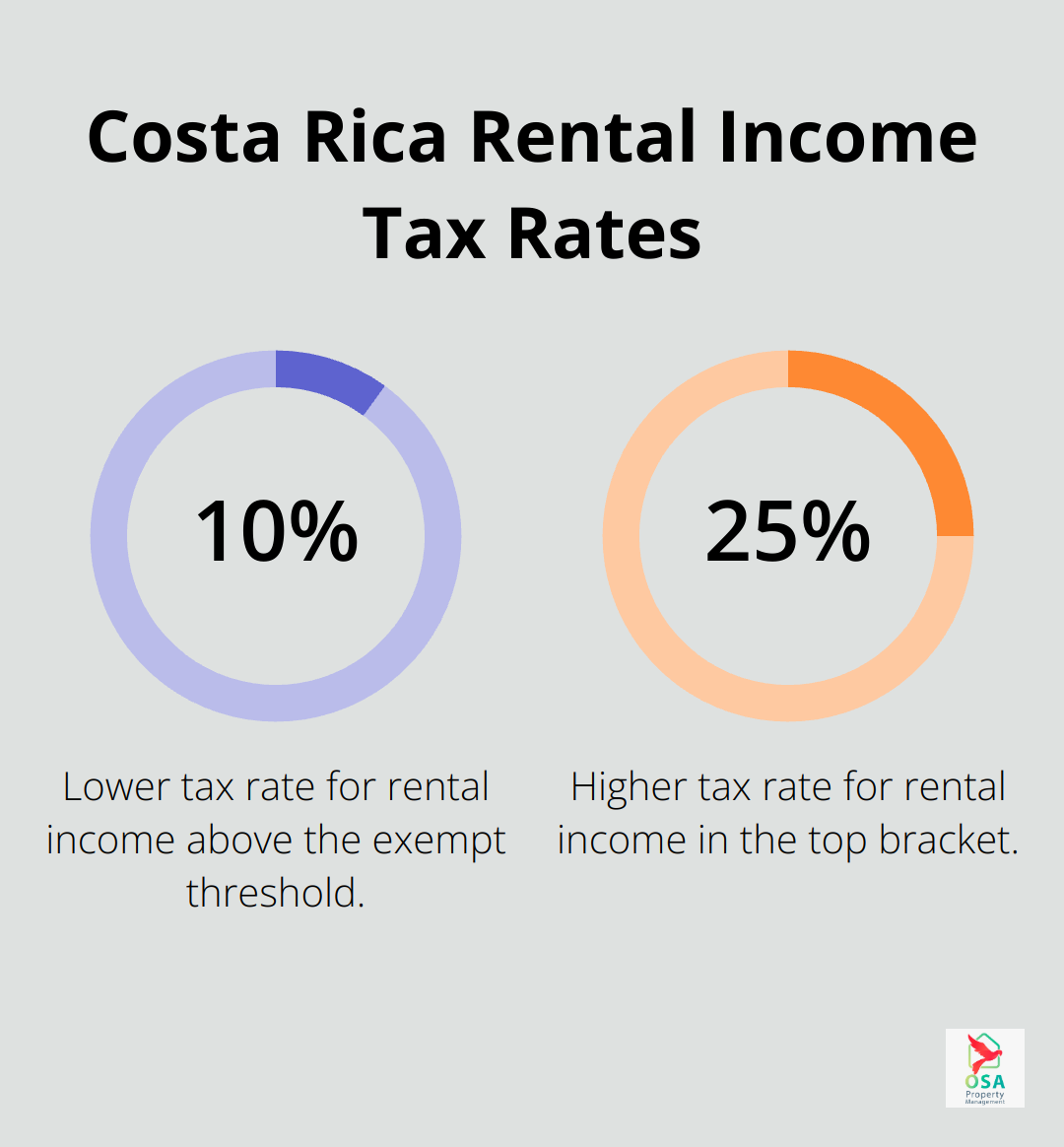

Costa Rica’s rental income tax system offers unique benefits and challenges for property owners. The first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt, which benefits small-scale property owners. Income tax rates on rental earnings beyond this threshold range from 10% to 25%, following a progressive tax structure.

Short-term rentals (less than 30 days) now face a 13% tax, while long-term rentals remain exempt. This distinction can impact your pricing strategy and overall profitability.

Deductible Expenses

Property owners can reduce their tax burden by deducting various expenses from their rental income. These include:

- Property maintenance

- Management fees

- Utilities

- Insurance

- Advertising costs

Costa Rica allows the depreciation of residential rental properties over 50 years, providing a substantial tax deduction opportunity. Strategic timing of these expenses can lower your taxable income, especially near tax bracket thresholds.

Reporting Requirements and Deadlines

Compliance with Costa Rica’s tax reporting requirements is essential. Property owners must submit monthly declarations of gross income using Form D-125. The Costa Rican tax year runs from October 1 to September 30, with quarterly tax installments due on February 20, May 20, August 25, and November 20.

Recent regulations require digital platforms (like Airbnb) to report user rental income details to Costa Rican tax authorities. This change emphasizes the importance of accurate record-keeping. Maintain detailed documentation, including lease agreements and rent receipts, for proper rental income reporting.

Cloud-based accounting software can help track income, manage expenses, and ensure proper documentation, simplifying tax preparation.

Additional Requirements for Non-Residents

Non-resident property owners must appoint a local representative and obtain a tax identification number (NIT) to manage tax matters effectively. This step helps maintain compliance and avoid potential penalties.

As we move forward, let’s explore the essential bookkeeping practices that will help you stay organized and compliant with Costa Rica’s rental property accounting requirements.

How to Set Up Effective Bookkeeping for Your Costa Rica Rental Property

Proper bookkeeping forms the foundation of successful rental property management in Costa Rica. Organized financial records can significantly impact the success of your property investment. This chapter will explore the essential practices to keep your Costa Rica rental property finances in order.

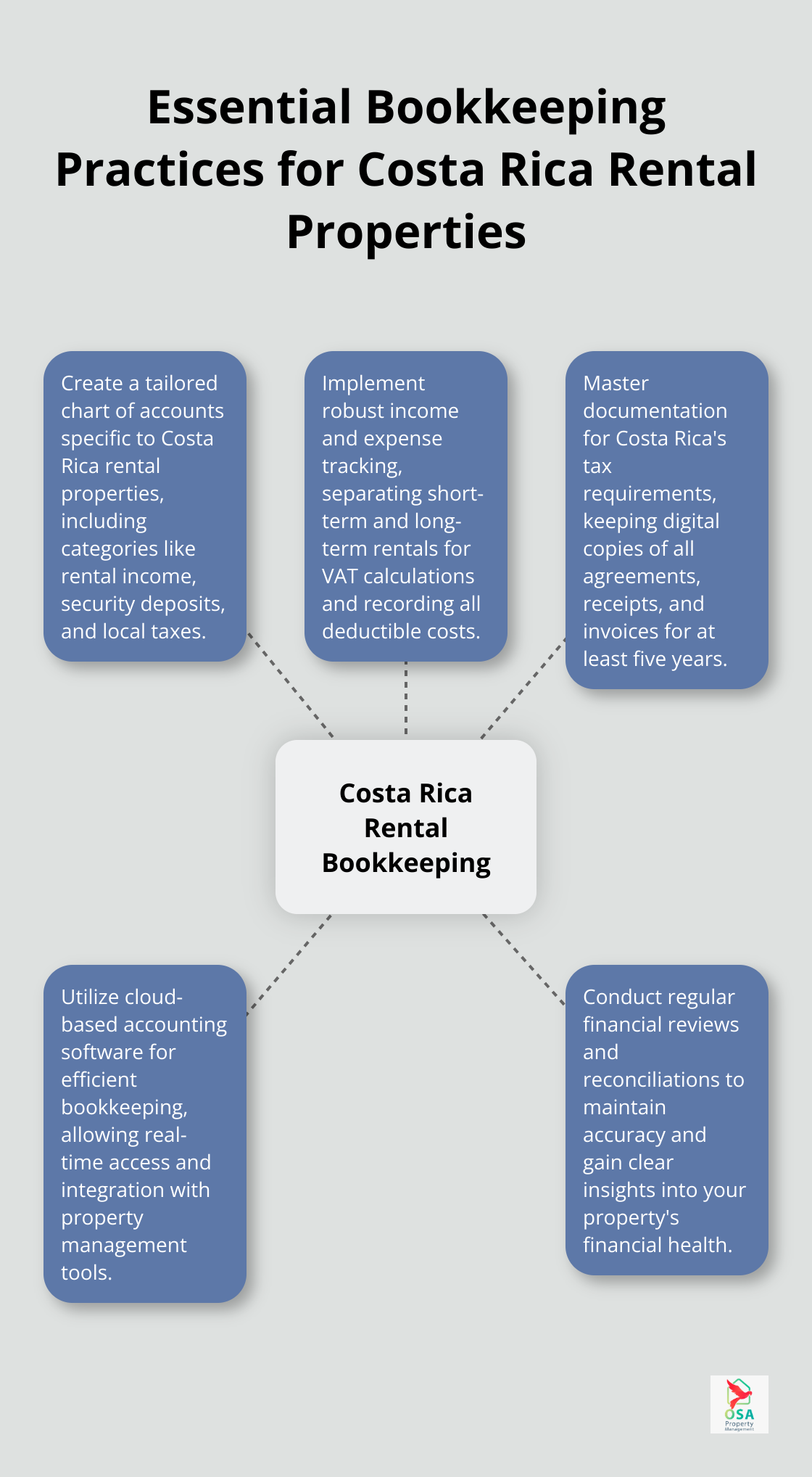

Create a Tailored Chart of Accounts

Set up a chart of accounts specifically for your Costa Rica rental property. This financial organizational tool should include categories such as rental income, security deposits, maintenance expenses, property taxes, and insurance. Tailor your chart to reflect the unique aspects of Costa Rican property management (e.g., the 13% Value Added Tax for short-term rentals lasting less than 30 days).

Implement Robust Income and Expense Tracking

Accurate tracking of income and expenses ensures tax compliance and financial health. Use cloud-based accounting software that allows for real-time updates and easy categorization. Separate your rental income into short-term and long-term categories to simplify VAT calculations. On the expense side, meticulously record all deductible costs, including property management fees, utilities, and maintenance expenses.

Master Documentation for Costa Rica’s Tax Requirements

In Costa Rica’s tax landscape, proper documentation protects you against potential audits. Keep digital copies of all lease agreements, rent receipts, and expense invoices. For each transaction, note the date, amount, and purpose. This level of detail not only satisfies tax authorities but also provides valuable insights for property performance analysis.

Costa Rican law requires you to retain these records for at least five years. Organize your documents to align with your monthly D-125 form submissions and quarterly tax installments. This organization will save time and reduce stress when you file your annual tax return.

Utilize Technology for Efficient Bookkeeping

Embrace technology to streamline your bookkeeping processes. Cloud-based accounting software offers real-time access to your financial data from anywhere. These platforms often integrate with property management software, allowing for seamless data flow and reducing manual data entry errors.

Regular Financial Review and Reconciliation

Schedule regular reviews of your financial records. Monthly reconciliations help identify discrepancies early and ensure all transactions are properly recorded. This practice not only maintains the accuracy of your books but also provides a clear picture of your property’s financial health.

As you establish these robust bookkeeping practices, you’ll create a solid foundation for your Costa Rica rental property’s financial management. This level of organization ensures compliance and provides the clarity needed to make informed decisions about your investment. In the next chapter, we’ll explore how to effectively manage cash flow and generate insightful financial reports for your Costa Rica rental property.

How to Optimize Cash Flow and Financial Reporting for Your Costa Rica Rental

Create a Comprehensive Budget

Develop a detailed budget for your rental property. Include all expected income sources (rent and additional fees) and anticipated expenses (property taxes, maintenance costs). Account for Costa Rica-specific expenses like the luxury home tax for properties valued over $250,000.

Consider seasonal fluctuations, especially in popular tourist areas like Tamarindo or Manuel Antonio. Your occupancy rates and income will likely vary between the high season (December to April) and the low season.

Generate Insightful Financial Statements

Produce monthly and annual financial statements to gain a clear picture of your property’s performance. These should include:

Use these statements to track your property’s financial health over time.

Analyze Financial Data

Regular analysis of your financial reports is essential. Look for trends in your data, such as changes in occupancy rates or increases in specific expense categories. Use this information to make informed decisions about your property.

If you notice rising electricity costs, consider investing in energy-efficient upgrades. This can reduce your expenses and may qualify you for additional tax incentives in Costa Rica.

Monitor your rental yield closely. If it falls below the average for Costa Rica, investigate why and take corrective action. This might involve adjusting your pricing strategy or investing in property improvements to attract more renters.

Manage Tax Liabilities

Keep a close eye on your tax liabilities. Costa Rica’s tax year runs from October 1 to September 30, with quarterly installments due throughout the year. Proper financial planning will help you meet these obligations without cash flow issues.

Consider Professional Help

While DIY accounting might seem cost-effective, mistakes can be costly. Partner with a reputable property management company (such as Osa Property Management). Their expertise in Costa Rica’s rental market and tax laws can help you navigate financial complexities, optimize your returns, and ensure compliance with local regulations.

Final Thoughts

Rental accounting in Costa Rica requires a thorough understanding of local tax laws and effective financial management practices. Property owners must accurately report rental income, document expenses, and submit tax declarations on time to avoid penalties. Proper accounting practices provide clear insights into property performance, enabling informed decisions about pricing, maintenance, and investments.

Sound financial management enhances property value and marketability in Costa Rica’s dynamic real estate landscape. Well-maintained financial records can attract potential buyers or investors, giving property owners a significant advantage. Effective accounting is not just about numbers; it creates a sustainable and profitable investment in this beautiful country.

Osa Property Management offers expert services tailored to Costa Rica’s rental market. Their extensive experience and local knowledge can help streamline accounting processes, ensure tax compliance, and optimize property financial performance. Property owners who prioritize sound accounting practices and stay informed about local regulations position their Costa Rica rental properties for long-term success.