Costa Rica’s rental tax landscape has undergone significant changes in 2025, presenting new challenges for property owners. At Osa Property Management, we’ve seen firsthand how these updates have impacted our clients’ tax obligations.

Understanding and navigating these complex regulations is essential for maintaining tax compliance and maximizing rental income. This guide will provide you with the latest information on Costa Rica’s rental tax structure, compliance requirements, and strategies for optimization.

How Costa Rica Taxes Rental Income in 2025

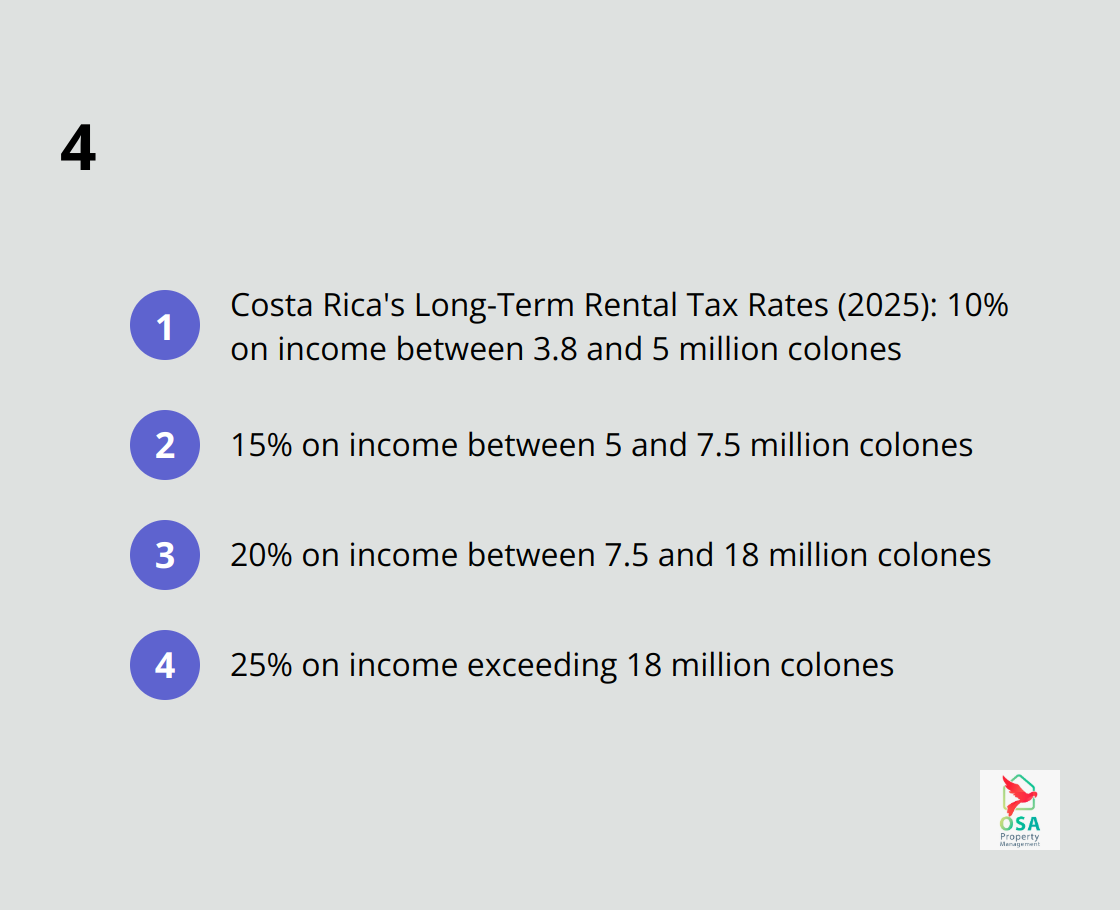

Long-Term Rental Tax Rates

Costa Rica’s rental tax structure has evolved significantly in 2025, affecting both short-term and long-term property rentals. For rentals exceeding 30 days, Costa Rica uses a progressive tax system. The first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt. Beyond this threshold, tax rates increase:

- 10% on income between 3.8 and 5 million colones

- 15% on income between 5 and 7.5 million colones

- 20% on income between 7.5 and 18 million colones

- 25% on income exceeding 18 million colones

These rates apply to taxable income after allowable deductions (e.g., property maintenance, management fees, and depreciation).

Short-Term Rental Taxation

Short-term rentals (stays less than 30 days) incur a 13% Value Added Tax (VAT), while long-term rentals remain exempt. Property owners must collect this tax from guests and remit it monthly to Costa Rican tax authorities. This requirement necessitates careful pricing strategies to maintain competitiveness while ensuring compliance.

Key Tax Law Updates for 2025

Costa Rica has introduced several important changes to rental tax laws:

- Digital Reporting System: All property owners now must submit rental income and expense reports electronically through the Ministry of Finance’s online platform.

- Expanded deductions: The list of deductible expenses now includes energy-efficient upgrades and security enhancements.

- Stricter enforcement: Non-compliance penalties have increased (fines can reach up to 50% of unpaid taxes plus interest).

- Platform reporting: Digital platforms like Airbnb must report user rental income directly to Costa Rican tax authorities.

These changes highlight the need for accurate record-keeping and timely reporting. Property owners should consider cloud-based accounting software to streamline financial management and ensure compliance with new regulations.

Impact on Property Values

Properties with clear tax compliance histories often sell faster and at higher prices in competitive markets like Jaco and Manuel Antonio. This trend underscores the long-term benefits of maintaining proper tax records beyond penalty avoidance.

As we move forward, understanding the intricacies of Costa Rica’s rental tax landscape becomes increasingly important. The next section will explore the specific compliance requirements that property owners must meet to stay on the right side of these new regulations.

How to Meet Costa Rica’s Rental Tax Compliance Requirements

Costa Rica’s rental tax compliance requirements have become more stringent in 2025, demanding meticulous attention from property owners. To avoid hefty penalties and ensure smooth operations, property owners must understand and follow these requirements precisely.

Registering Your Rental Property

The first step in compliance is to register your rental property with Costa Rica’s tax authorities. This process involves obtaining a tax identification number (NIT) from the Ministry of Finance. Non-resident property owners must appoint a local representative. This representative will act on your behalf for tax-related matters.

Essential Documentation and Record-Keeping

Proper documentation forms the backbone of tax compliance. Costa Rican tax law now requires property owners to maintain detailed records for at least four years. These records should include:

- Lease agreements for all tenants

- Rent receipts and invoices

- Expense receipts for property maintenance, utilities, and improvements

- Bank statements showing rental income and related expenses

Property owners should use a separate bank account for their rental property to simplify tracking and reporting. Cloud-based accounting software (such as QuickBooks Online or Xero) can streamline this process, making it easier to generate reports and meet compliance requirements.

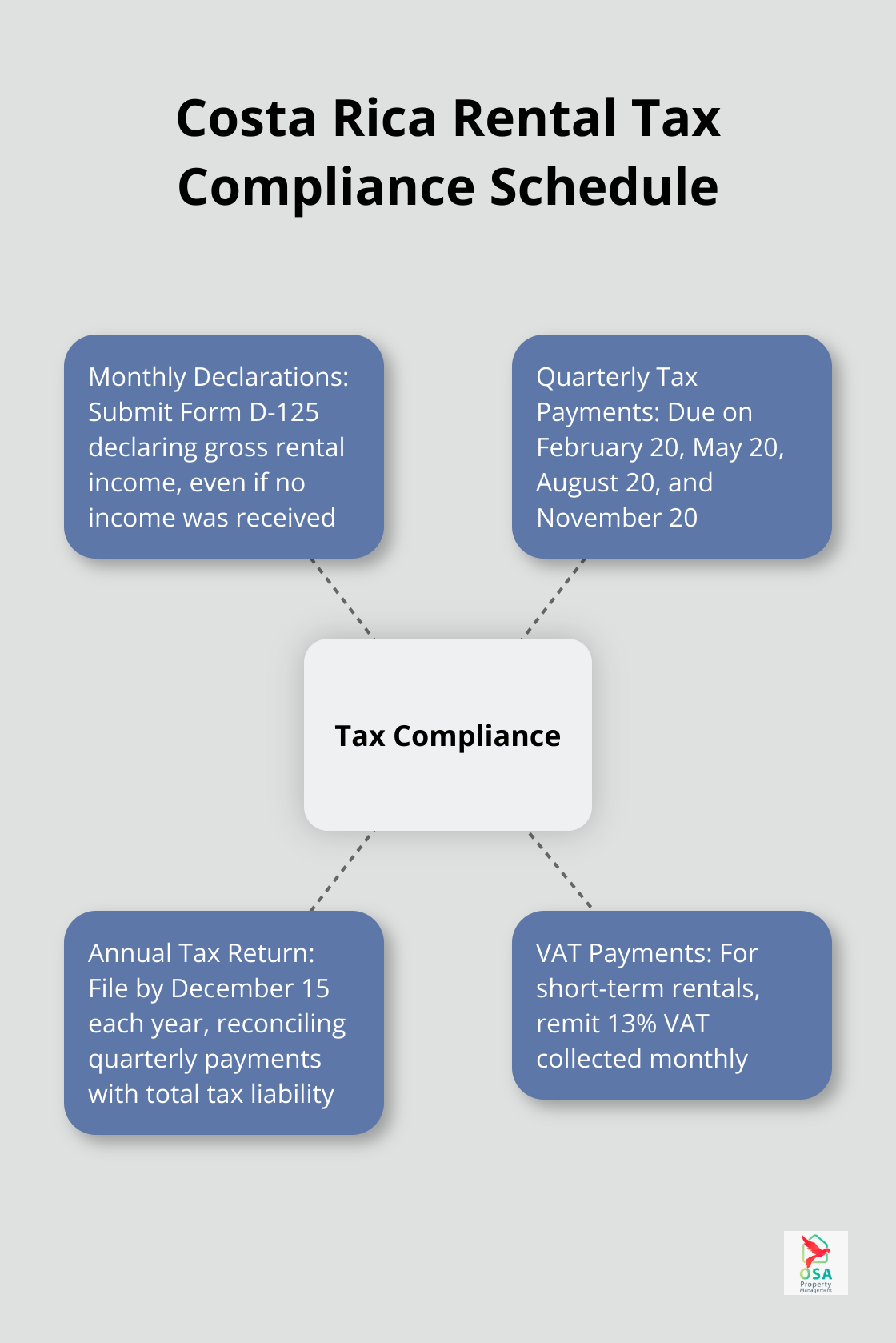

Tax Declaration and Payment Schedule

Understanding the frequency and deadlines for tax declarations and payments is critical. Here’s what property owners need to know:

- Monthly Declarations: Property owners must submit Form D-125 monthly, declaring gross rental income. This applies even if no income was received that month.

- Quarterly Tax Payments: The Costa Rican tax year runs from October 1 to September 30. Quarterly tax installments are due on February 20, May 20, August 20, and November 20.

- Annual Tax Return: An annual tax return must be filed by December 15 each year, reconciling your quarterly payments with your total tax liability.

- VAT Payments: For short-term rentals, the 13% VAT collected must be remitted monthly.

Missing these deadlines can result in penalties, so it’s important to set up reminders or work with a property management company to ensure timely submissions.

Professional Assistance

Navigating these compliance requirements can be complex, especially for foreign property owners unfamiliar with Costa Rica’s tax system. Professional assistance from experienced property managers or local tax advisors can provide invaluable support in ensuring full compliance and peace of mind.

Companies like Osa Property Management offer comprehensive services to help property owners navigate Costa Rica’s rental tax landscape. With their extensive experience and local expertise, they can handle all aspects of tax compliance, from registration to monthly declarations and annual returns.

The next section will explore strategies for optimizing your rental income tax situation, including legal deductions and the benefits of professional property management services.

How to Optimize Your Rental Tax Situation in Costa Rica

Maximize Legal Deductions

Costa Rica’s rental tax system allows property owners to reduce their taxable rental income through various deductions. To take full advantage of these deductions, keep detailed records of all property-related expenses. Consider investments in energy-efficient systems or security upgrades, which not only qualify for tax credits but also increase your property’s appeal to potential renters.

Choose Your Rental Strategy Wisely

The tax implications for short-term and long-term rentals differ significantly. This distinction can impact your overall profitability and tax liability.

Some property owners find benefits in transitioning from short-term to long-term rentals, which can simplify tax compliance. However, this decision requires a thorough analysis of your specific situation, including factors like location, property type, and target market.

Engage Professional Property Management Services

A reputable property management company can transform your tax optimization strategy. These professionals possess in-depth knowledge of Costa Rica’s tax laws and ensure you take advantage of all available deductions while maintaining full compliance.

Professional property managers handle monthly declarations, quarterly payments, and annual returns, which reduces the risk of costly errors or missed deadlines. They also provide valuable insights on tax-efficient property improvements and rental strategies.

Implement Effective Accounting Practices

Proper accounting plays a key role in tax optimization and compliance. Invest in cloud-based accounting software (such as QuickBooks Online or Xero) to streamline your financial management. These tools help you track income and expenses in real-time, generate accurate reports for tax filings, and provide valuable insights for financial planning.

Set up a separate bank account for your rental property to simplify tracking and reporting. This practice not only aids in tax compliance but also provides a clear financial picture of your rental property’s performance.

Seek Expert Advice and Stay Informed

Costa Rica’s tax laws evolve continuously. Stay informed about changes by attending local real estate seminars, joining online forums, and regularly consulting with tax professionals. A local Certified Public Accountant (CPA) can provide tailored advice on tax optimization strategies and help you navigate complex scenarios (like double taxation treaties for international property owners).

While these strategies can help optimize your tax situation, approach tax planning ethically and in full compliance with Costa Rican law. Always consult with qualified professionals to ensure your tax optimization efforts align with current regulations and your specific circumstances.

Final Thoughts

Costa Rica’s rental tax landscape in 2025 demands diligence, knowledge, and strategic planning from property owners. The progressive tax rates, VAT implications, and stringent compliance requirements highlight the system’s complexity. Property owners must stay informed about recent changes, including digital reporting mandates and expanded deductible expenses.

Tax compliance enhances property marketability and value, beyond just meeting legal obligations. Proper record-keeping, timely declarations, and accurate payments help avoid penalties and maintain good standing with Costa Rican tax authorities. Professional assistance proves invaluable in managing rental property taxes effectively.

Osa Property Management offers expert services to help property owners navigate these complexities. Their team can handle everything from marketing and maintenance to tax compliance and accounting, providing peace of mind for property owners. A proactive approach to rental property tax compliance will lead to success in Costa Rica’s real estate market.