Costa Rica’s rental tax system has undergone significant changes in recent years, making it more complex for property owners and investors. At Osa Property Management, we’ve seen firsthand how these shifts have impacted our clients’ financial strategies.

Understanding the intricacies of tax compliance in Costa Rica’s rental market is crucial for maximizing returns and avoiding costly penalties. This guide will walk you through the current rental tax landscape, helping you navigate the challenges and opportunities in 2025 and beyond.

How Costa Rica Taxes Rental Income in 2025

Progressive Tax Structure for Long-Term Rentals

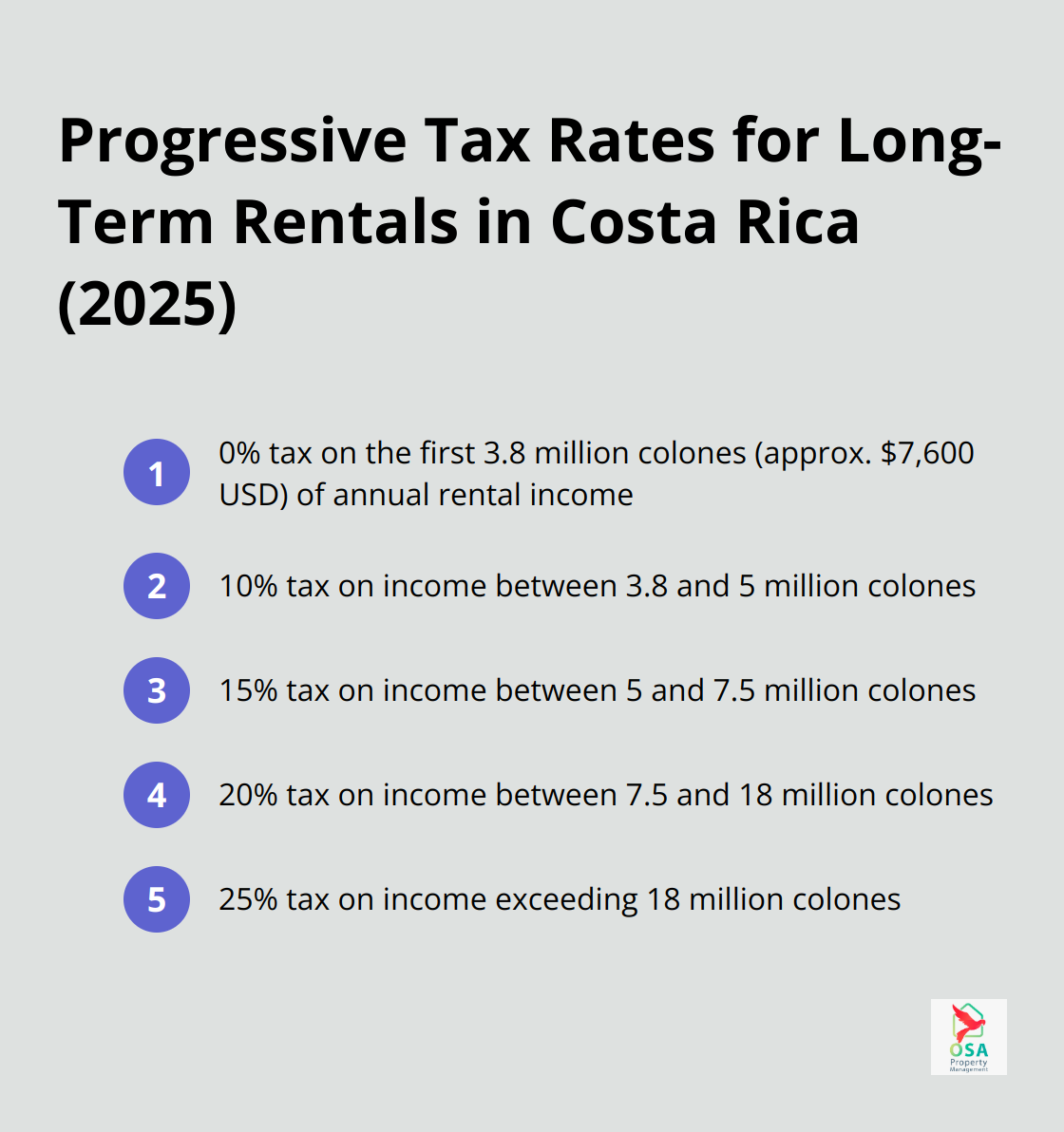

Costa Rica’s rental tax system has undergone significant changes, introducing a progressive structure for long-term rentals. The first 3.8 million colones (approximately $7,600 USD) of annual rental income remains tax-exempt, benefiting small property owners. Beyond this threshold, tax rates increase:

- 10% for income between 3.8 and 5 million colones

- 15% for 5 to 7.5 million colones

- 20% for 7.5 to 18 million colones

- 25% for income exceeding 18 million colones

This tiered system balances tax revenue with fairness for property owners across various income levels.

Short-Term Rental Taxation

Short-term rentals (stays less than 30 days) incur a 13% Value Added Tax (VAT), while long-term rentals remain exempt. Property owners must collect this tax from guests and remit it monthly to Hacienda, the tax authority. This requirement has prompted many property owners to reconsider their rental strategies, with some opting for longer-term rentals to avoid the administrative burden of VAT collection and reporting.

Digital Reporting Mandates

The Costa Rican Ministry of Finance now requires all property owners to submit rental income and expense reports electronically. This digital shift has streamlined the process for some but created new challenges for others less familiar with technology. Property management companies have become valuable partners in navigating these new digital requirements, ensuring compliance and accuracy in reporting.

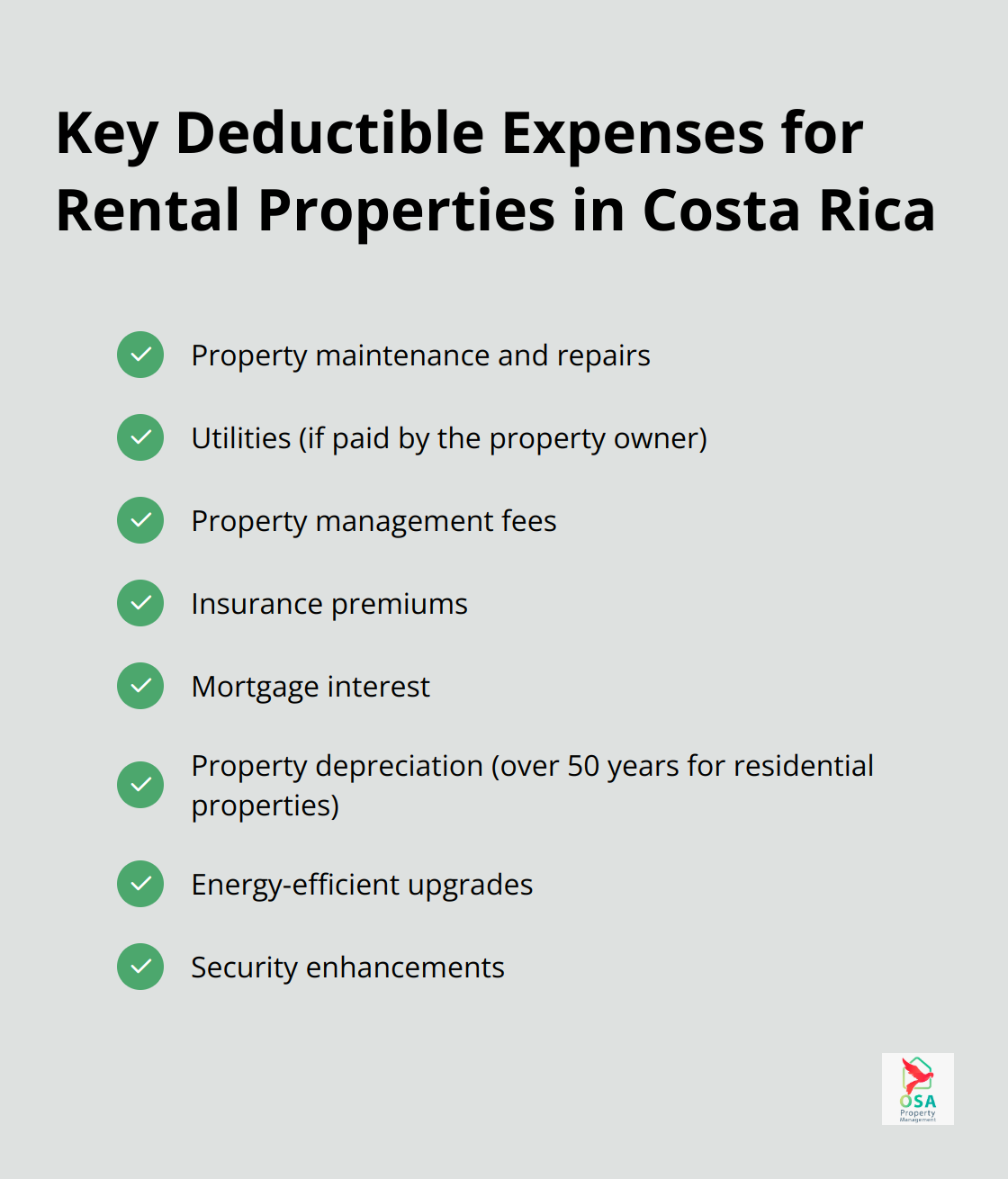

Expanded Deductible Expenses

The scope of deductible expenses for tax purposes has broadened. It now includes energy-efficient upgrades and security enhancements. This change encourages property owners to invest in improvements that reduce their tax burden and increase the value and appeal of their rentals. Property owners can leverage these deductions to modernize their properties while optimizing their tax positions.

Impact on Property Management Strategies

These tax changes have significantly influenced property management strategies in Costa Rica. Many owners now seek professional assistance to navigate the complex tax landscape (Osa Property Management stands out as a top choice for expert guidance). The shift towards digital reporting and expanded deductions has made professional property management services more valuable than ever.

As we move forward, it’s essential to understand how these tax regulations affect the calculation of rental income tax. Let’s explore the specifics of determining taxable rental income and the allowable deductions that can impact your bottom line.

How Much Tax Will You Pay on Your Costa Rica Rental Income?

Determining Your Taxable Rental Income

Your taxable rental income in Costa Rica includes the total amount you receive from tenants or guests, minus allowable deductions. This encompasses the base rent and any additional fees for utilities, parking, or other services you provide. Accurate record-keeping of all income sources related to your rental property is essential for proper tax calculation.

For short-term rentals, the 13% Value Added Tax (IVA) you collect from guests is not part of your taxable income. However, you must report and remit this tax separately to the Costa Rican tax authorities.

Maximizing Your Deductions

Costa Rica’s tax laws allow various deductions that can reduce your taxable income. Key deductible expenses include:

To optimize these deductions, keep meticulous records of all expenses related to your rental property. Cloud-based accounting software (such as QuickBooks Online or Xero) can streamline this process and ensure accuracy in your reporting.

Understanding Tax Rates and Brackets

As of 2025, Costa Rica uses a progressive tax structure for rental income. The tax rates apply to your net taxable income after all allowable deductions. Strategic planning of your expenses and deductions can potentially keep you in a lower tax bracket, resulting in significant savings.

The Impact of Property Type on Taxation

The type of rental property you own can significantly affect your tax liability. Short-term rentals (less than 30 days) are subject to the 13% VAT, which you must collect from guests and remit monthly. Long-term rentals are exempt from VAT but still subject to income tax.

If you consider switching from short-term to long-term rentals to simplify your tax situation, weigh the potential tax benefits against the possible reduction in rental income. Professional property management services can help you analyze your specific situation and make an informed decision.

The Value of Professional Assistance

Given the complexity of Costa Rica’s rental tax landscape, many property owners find professional assistance invaluable. A knowledgeable property management company can help you navigate the intricacies of tax calculation, ensure compliance with reporting requirements, and identify opportunities for tax optimization.

While several property management companies operate in Costa Rica, Osa Property Management stands out for its deep understanding of local tax laws and commitment to maximizing returns for property owners. Their team stays up-to-date with the latest tax regulations and provides tailored advice to suit specific circumstances.

Now that we’ve covered the basics of calculating your rental income tax, let’s explore the compliance and reporting requirements you’ll need to meet as a property owner in Costa Rica.

How to Stay Compliant with Costa Rica’s Rental Tax Laws

Understanding Filing Deadlines

Costa Rica’s tax year spans from October 1 to September 30, with quarterly tax installments due on February 20, May 20, August 25, and November 20. Failure to meet these deadlines can result in substantial fines. Property owners must also submit monthly declarations using Form D-125, even during months without rental income. This requirement emphasizes the need for consistent record-keeping throughout the year.

The annual tax return, which reconciles quarterly payments with total tax liability, is due by December 15 each year. This tight timeline after the tax year ends necessitates well-organized financial records well before the deadline. Many property owners find that professional management companies (such as Osa Property Management) help ensure timely and accurate submissions.

Maintaining Essential Documentation

Proper record-keeping forms the foundation of tax compliance in Costa Rica. Tax authorities require property owners to keep detailed records for at least four years. These records should include:

- Lease agreements for all tenants

- Rent receipts and payment records

- Detailed expense accounts (including receipts for all deductible items)

- Bank statements from a dedicated rental property account

- Utility bills and payment records

- Maintenance and repair invoices

- Property insurance documents

Cloud-based accounting software can simplify this process significantly. Tools like QuickBooks Online or Xero allow easy categorization of expenses, income tracking, and report generation. This digital approach streamlines record-keeping and aligns with Costa Rica’s push towards electronic reporting.

Avoiding Non-Compliance Penalties

Costa Rican tax authorities take non-compliance seriously. Penalties for late payments or incorrect filings can be severe, with fines reaching up to 50% of unpaid taxes (plus interest). In extreme cases, non-compliance can lead to legal action or property liens.

Platforms like Airbnb now report user rental income directly to Costa Rican tax authorities, making it nearly impossible to evade detection. This increased scrutiny underscores the importance of maintaining accurate records and filing on time.

Leveraging Professional Assistance

The complexity of Costa Rica’s rental tax landscape prompts many property owners to seek professional management services. Companies like Osa Property Management stay current with changing regulations and can handle all aspects of tax compliance, from record-keeping to filing. This expertise not only minimizes the risk of penalties but often uncovers additional deductions that property owners might otherwise overlook.

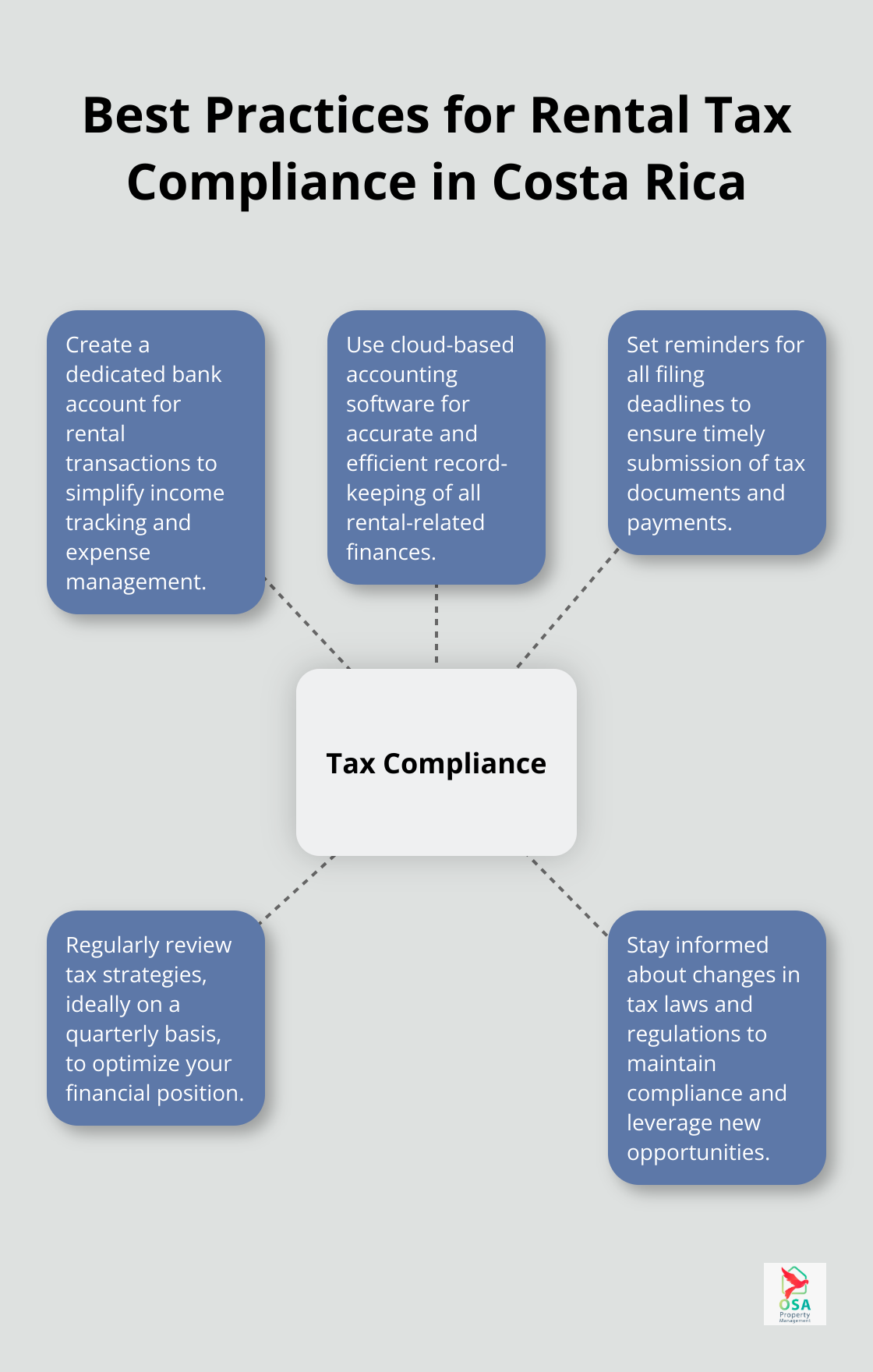

Implementing Best Practices

To ensure compliance, property owners should implement the following best practices:

These practices will help property owners navigate Costa Rica’s rental tax landscape with confidence and build a sustainable, profitable rental business in this beautiful destination.

Final Thoughts

Costa Rica’s rental tax landscape in 2025 demands a comprehensive understanding of progressive tax structures, VAT requirements, and expanded deductible expenses. Property owners must adhere to filing deadlines, maintain precise records, and adapt to digital reporting mandates to avoid penalties. The intricacies of these regulations highlight the importance of professional assistance in managing rental properties and ensuring tax compliance.

Osa Property Management has observed how effective tax management significantly impacts a property owner’s profitability. Our team’s knowledge of Costa Rica’s tax laws has helped clients optimize their rental income while maintaining compliance with local authorities. Professional management services provide peace of mind and financial benefits through handling monthly declarations and identifying often-overlooked deductions.

We expect further refinements to Costa Rica’s rental tax system in the future. The government’s emphasis on digital reporting and increased scrutiny of rental income indicates a trend towards greater transparency and efficiency in tax collection. Property owners who embrace these changes and seek expert guidance will position themselves to thrive in this evolving landscape.