Owning a rental property in Costa Rica can be a rewarding investment, but it comes with important tax responsibilities. At Osa Property Management, we understand the complexities of tax compliance for rental properties in this beautiful country.

Navigating the Costa Rican tax system requires knowledge of various obligations, from income tax on rental earnings to property taxes and Value Added Tax (VAT). This guide will help you understand your tax duties and provide strategies for effective compliance, ensuring your investment remains both profitable and legally sound.

Costa Rica’s Rental Property Tax Landscape

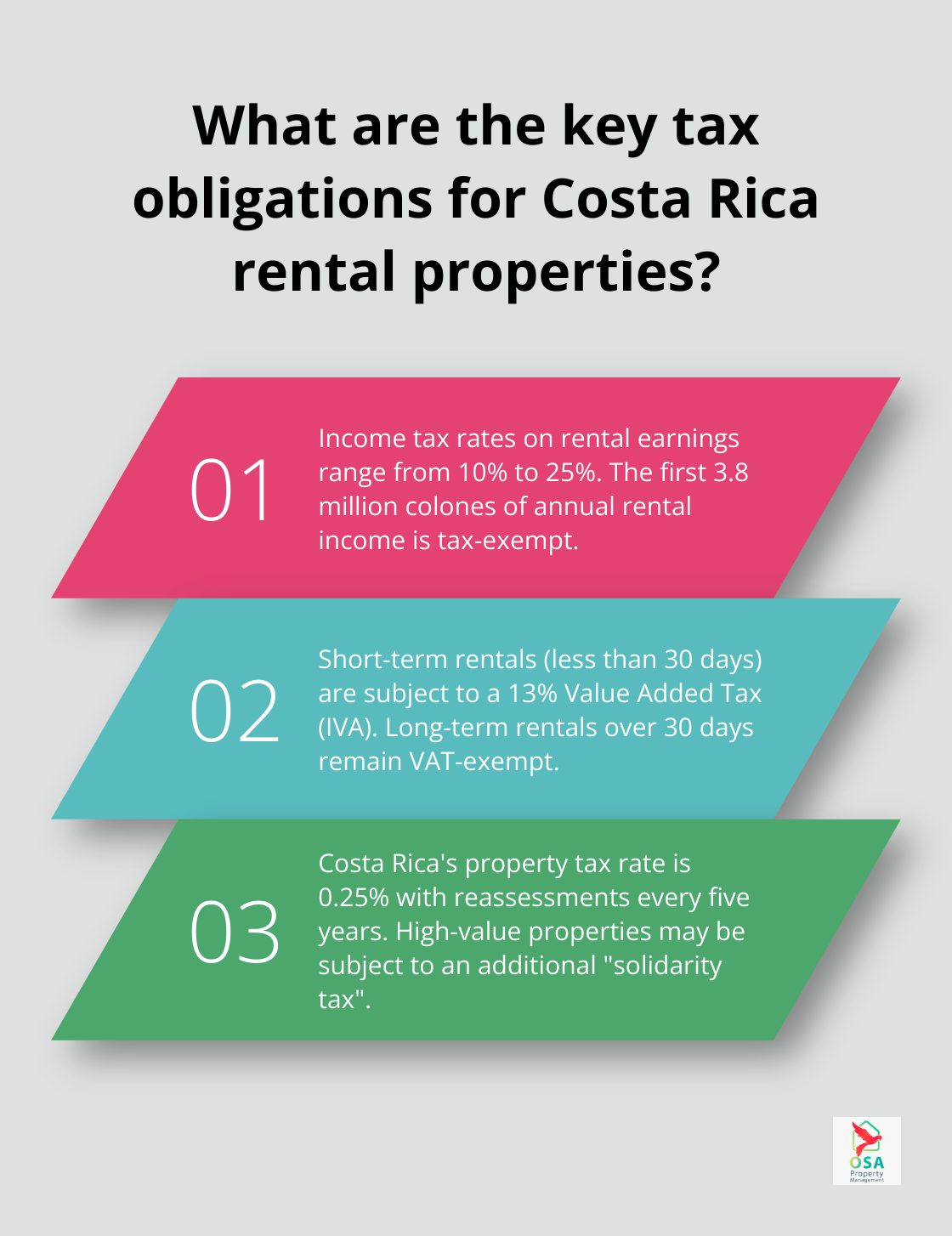

Income Tax on Rental Earnings

Costa Rica’s tax system for rental properties requires property owners to navigate a complex web of obligations. The cornerstone of rental property taxation is income tax. As of 2025, rental income follows a progressive tax rate structure. The first 3.8 million colones (approximately $7,600 USD) of annual rental income remains tax-exempt. Beyond this threshold, rates range from 10% to 25%, depending on the total income. Property owners must keep detailed records of all rental transactions to report their earnings accurately.

Value Added Tax (VAT) Implementation

Costa Rica introduced a Value Added Tax (IVA) of 13% on short-term rentals (less than 30 days) in 2019. This tax significantly impacts vacation rental owners, particularly in popular tourist destinations. Long-term rentals remain exempt from VAT, which has prompted some property owners to shift their rental strategies. Many owners now transition to long-term leases to reduce this tax burden.

Property Tax and Additional Levies

Property tax in Costa Rica stands at a relatively low 0.25% of the registered property value. However, property owners should be aware of additional taxes such as the “solidarity tax” (also known as luxury tax). This tax applies to properties exceeding certain construction value thresholds (approximately $233,900 as of 2023). Mandatory property assessments occur every five years to ensure accurate valuations and prevent penalties.

Reporting Requirements and Deadlines

Costa Rica’s tax authorities require regular reporting from rental property owners. Monthly declarations of gross income (Form D-125) are mandatory to avoid complications during annual returns. The tax year runs from October 1 to September 30, with quarterly installments due by February 20, May 20, August 25, and November 20. Failure to meet these deadlines can result in penalties and interest charges.

Recent Changes in Tax Regulations

The Costa Rican government has recently implemented new regulations to track and tax income earned through digital platforms like Airbnb. These platforms must now report comprehensive data about users earning rental income to the tax authorities. The new regulations require full legal names and other identifying details of sellers, as well as payment details including amounts. Non-compliance can lead to significant fines, emphasizing the need for property owners to stay informed and adapt their tax strategies accordingly.

The dynamic nature of Costa Rica’s tax landscape for rental properties demands vigilant attention from property owners. Professional assistance can prove invaluable in navigating these complexities effectively. In the next section, we will explore key strategies for maintaining effective tax compliance in this ever-changing environment.

Essential Tax Obligations for Costa Rica Rental Properties

Income Tax on Rental Earnings

Income tax on rental earnings is a primary obligation for property owners in Costa Rica. The progressive tax rate structure exempts the first 3.8 million colones of annual rental income. Beyond this threshold, rates range from 10% to 25%. Accurate reporting of earnings requires meticulous record-keeping. Property owners should use digital accounting software to track all rental transactions, including income and expenses. This practice simplifies tax reporting and provides valuable insights into the property’s financial performance.

VAT Requirements for Short-Term Rentals

The 13% Value Added Tax (IVA) on short-term rentals (less than 30 days) significantly impacts vacation rental owners. To manage this tax effectively, implement a clear pricing strategy that factors in the VAT. Communicate transparently with guests about the tax implications on their bookings. Those primarily offering short-term rentals should explore options to offset the VAT impact, such as adjusting rates or services. Alternatively, a shift to long-term rentals (over 30 days) can provide tax advantages, as these remain VAT-exempt.

Property Tax and Additional Assessments

Costa Rica’s property tax rate of 0.25% is relatively low, but staying current with payments and reassessments is important. Property valuations occur every five years, and non-compliance can result in penalties. Set up automatic reminders for tax due dates and budget for potential increases in property value. Be aware of the “solidarity tax” for high-value properties. If your property’s construction value exceeds the threshold (approximately $233,900 as of 2023), factor this additional tax into your financial planning.

Reporting Requirements and Deadlines

Adherence to reporting requirements prevents complications and penalties. Monthly declarations of gross income via Form D-125 are mandatory. Mark your calendar for the quarterly tax installment due dates: February 20, May 20, August 25, and November 20. Consider setting up a dedicated bank account for rental income to simplify tracking and ensure funds availability for tax payments. Those managing multiple properties or complex financial situations should engage with a local tax professional for valuable guidance and timely compliance with all reporting obligations.

Navigating Digital Platform Regulations

Recent regulations require digital platforms like Airbnb to report comprehensive data about users earning rental income to tax authorities. These platforms must provide full legal names and other identifying details of sellers, as well as payment information. Non-compliance can lead to significant fines, emphasizing the need for property owners to stay informed and adapt their tax strategies. Property owners using these platforms should maintain detailed records of all transactions and consider professional assistance to ensure full compliance with these new requirements.

As tax obligations for rental properties in Costa Rica continue to evolve, property owners must stay vigilant and adaptable. The next section will explore effective strategies for maintaining tax compliance in this dynamic environment.

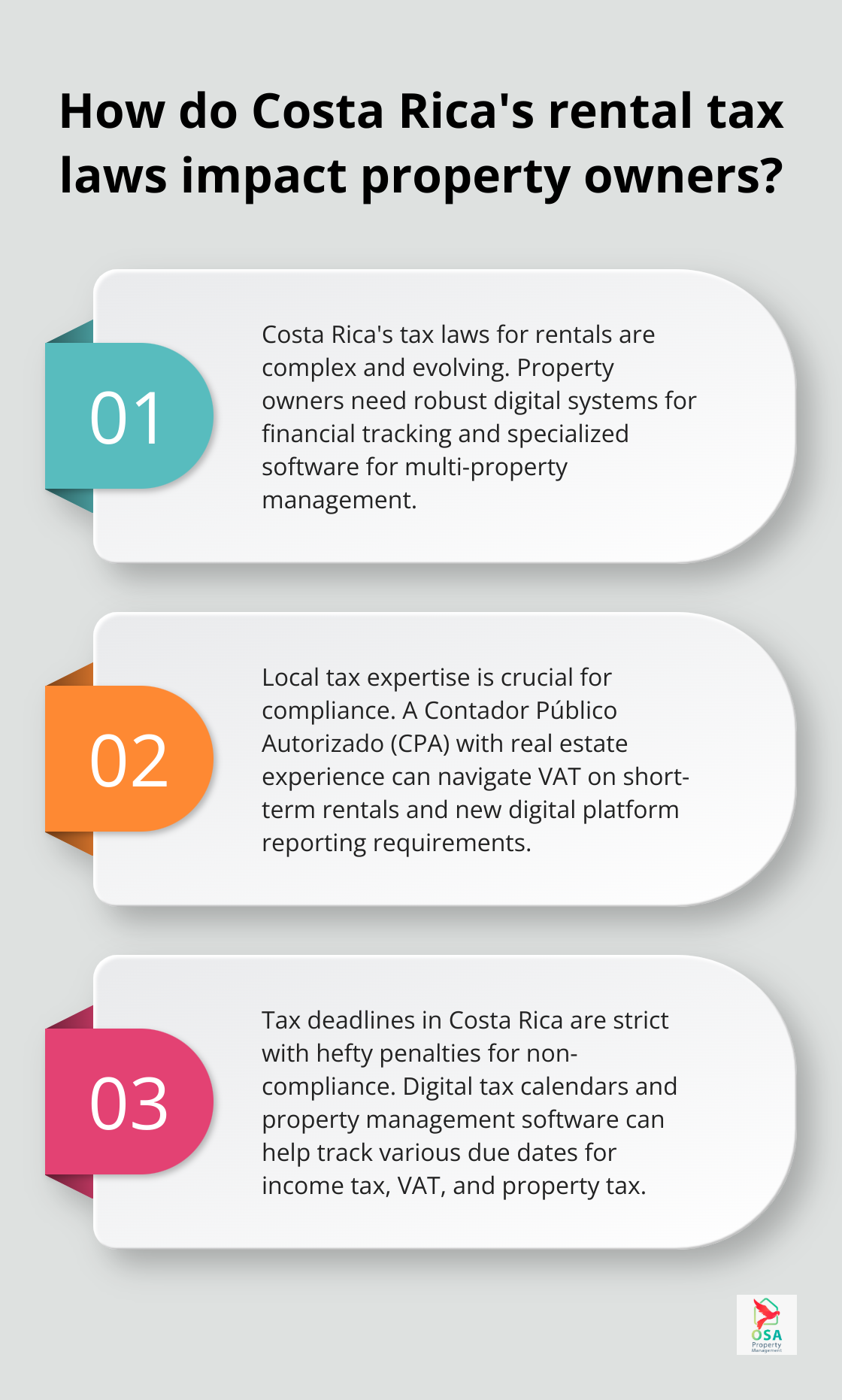

Mastering Tax Compliance for Costa Rica Rentals

Embrace Digital Record-Keeping

Modern property owners need robust digital systems to track every financial aspect of their rentals. QuickBooks Online and Xero offer features tailored to rental property management. These platforms allow you to categorize expenses, generate financial reports, and integrate with bank accounts for real-time updates.

For those managing multiple properties, specialized software like Buildium or AppFolio can transform operations. These tools handle accounting and offer features such as tenant screening and maintenance request tracking (streamlining your entire operation).

Leverage Local Tax Expertise

Costa Rica’s tax laws are complex and constantly evolving. Partnering with a local tax professional is essential. Look for a Contador Público Autorizado (CPA) with experience in real estate. If you’re renting out your property short-term, it’s essential to understand the local tax regulations to ensure compliance and avoid any issues.

The cost of professional tax services often results in significant savings and peace of mind. A skilled CPA can help you navigate the intricacies of VAT on short-term rentals, ensure compliance with new digital platform reporting requirements, and optimize your tax strategy based on your specific situation.

Automate Your Tax Calendar

Tax deadlines in Costa Rica are strict, and missing them can result in hefty penalties. Set up a digital tax calendar with reminders for monthly, quarterly, and annual filings. Tools like Google Calendar or Microsoft Outlook can sync across devices, ensuring you never miss a deadline.

Many property management software platforms offer built-in tax reminder features. These can be particularly useful for tracking the various due dates for income tax installments, VAT payments, and property tax assessments.

Utilize Property Management Services

Professional property management services can significantly simplify tax compliance. These services often include comprehensive financial management, ensuring all necessary records are maintained and tax obligations are met on time. Osa Property Management stands out as a top choice in this field, offering expert assistance with tax compliance as part of their comprehensive property management package.

Stay Informed on Tax Law Changes

Costa Rica’s tax landscape for rental properties continues to evolve. Try to stay updated on any changes that might affect your tax obligations. Subscribe to reputable newsletters, attend local real estate seminars, and maintain regular communication with your tax professional to stay ahead of any new regulations or requirements.

Final Thoughts

Tax compliance for rental properties in Costa Rica demands vigilance, knowledge, and proactive management. Property owners must address income tax obligations, VAT requirements, property taxes, and evolving reporting regulations. Digital platform reporting adds complexity to the system, necessitating a thorough understanding of the tax landscape.

Effective strategies streamline the tax compliance process. Digital record-keeping tools, local tax expertise, and automated tax calendars prove essential for success in Costa Rica’s rental market. Property owners should stay informed about tax law changes to adapt their strategies accordingly.

Professional property management services offer valuable solutions for navigating Costa Rica’s tax landscape. Osa Property Management provides comprehensive services to handle marketing, renter relationships, accounting, and tax compliance. Their expertise helps property owners optimize their investments while ensuring adherence to tax obligations.