At Osa Property Management, we know that accurate property valuation in Costa Rica is both an art and a science. The Costa Rican real estate market has its own unique characteristics, influenced by factors ranging from location to legal considerations.

In this post, we’ll reveal the secrets to mastering Costa Rica property valuation, helping you make informed decisions in this dynamic market.

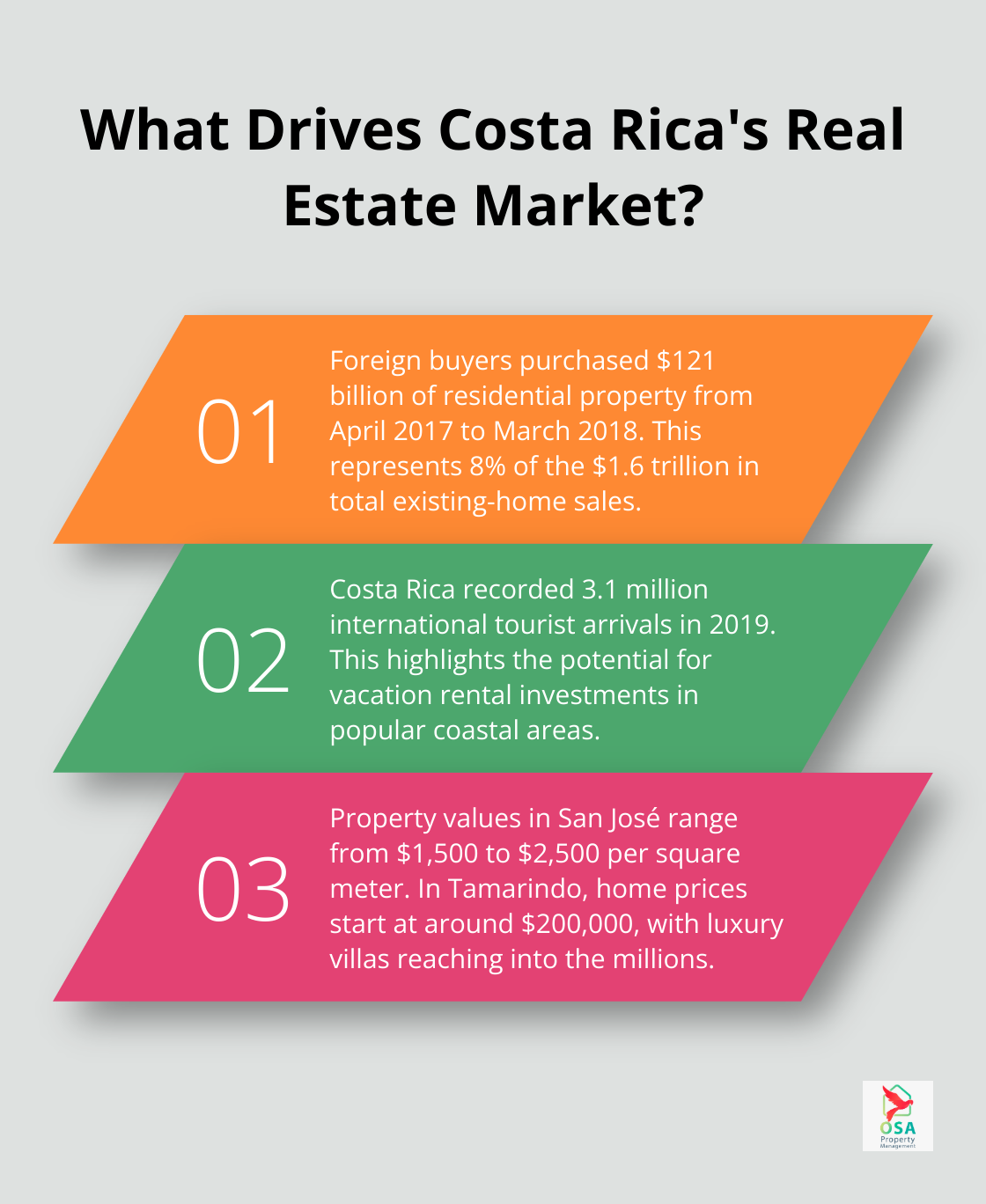

What Drives Costa Rica’s Real Estate Market?

Foreign Investment and Tourism Impact

Costa Rica’s real estate market thrives on foreign investment. Residential Real Estate foreign buyers purchased $121 billion of residential property during April 2017-March 2018, or eight percent of the $1.6 trillion in total existing-home sales. This surge in international buyers, primarily from North America and Europe, continues to fuel demand in popular coastal areas and retirement destinations.

Tourism also shapes property values significantly. Regions like Guanacaste and Puntarenas have experienced substantial growth due to their appeal to tourists and retirees. The Costa Rica Tourism Board recorded 3.1 million international arrivals in 2019, highlighting the potential for vacation rental investments.

Economic and Political Stability Factors

Costa Rica’s stable political climate and growing economy contribute to its real estate investment appeal. Costa Rica’s growth in the past two decades has been trade-driven. Agriculture has seen its sector’s saving rate decrease from an average 3.5% of GDP in 1976-77. This economic stability provides a solid foundation for property value appreciation.

Regional Valuation Differences

Property values vary significantly across Costa Rica’s diverse regions:

- Central Valley: Properties in San José command higher prices due to urban amenities and business opportunities. A typical apartment in San José costs between $1,500 to $2,500 per square meter.

- Coastal Areas: Guanacaste sees premium prices for beachfront properties. In Tamarindo, home prices start at around $200,000, with luxury villas reaching into the millions.

- Southern Zone: Emerging areas like Uvita and Ojochal offer more affordable options with strong potential for appreciation.

- Mountain Regions: Escazú and Santa Ana attract buyers seeking cooler climates and panoramic views. These areas have seen steady price increases, with luxury homes often exceeding $1 million.

Understanding these regional differences proves essential for accurate property valuation. Local knowledge and expertise (such as that provided by professional property management services) can offer precise valuations across Costa Rica’s diverse real estate landscape.

As we move forward, let’s explore the key factors that influence property valuation in Costa Rica, including location, property condition, and legal considerations.

What Drives Property Value in Costa Rica?

Costa Rica’s real estate market is experiencing remarkable growth, driven by a confluence of factors that make it an increasingly attractive destination. The most critical elements that impact accurate property valuation in this diverse market include:

Location: The Golden Rule of Real Estate

Location remains the primary driver of property value in Costa Rica. Beachfront properties in popular tourist destinations like Tamarindo or Manuel Antonio command premium prices. In contrast, similar properties in less developed areas might sell for lower prices.

Proximity to amenities also plays a significant role. Properties near international schools, hospitals, and shopping centers in areas like Escazú or Santa Ana can see higher values than those in more remote locations.

Property Condition and Age: The Value of Upkeep

The condition and age of a property significantly impact its value. In Costa Rica’s tropical climate, regular maintenance is essential. A well-maintained older property can often command a higher price than a newer, poorly maintained one.

Land Characteristics: Size and Usability Matter

While land size is important, topography and usability are equally important in Costa Rica. A large plot of steep, unusable land might be less valuable than a smaller, flat lot with ocean views.

Legal Status and Zoning: Navigating the Regulatory Landscape

Understanding the legal status and zoning regulations of a property is vital for accurate valuation. Properties within the Maritime Zone (first 200 meters from the high tide line) have different ownership structures and can significantly impact value.

Zoning regulations also play a vital role. A property zoned for commercial use in a prime location could be worth substantially more than a residential-only property nearby.

These nuanced factors highlight the complexity of property valuation in Costa Rica. The next section will explore the various methods used to determine accurate property values in this unique market.

How We Value Properties in Costa Rica

At Osa Property Management, we use a multi-faceted approach to property valuation in Costa Rica. We combine local expertise with proven methodologies to ensure accurate assessments that reflect the unique characteristics of the Costa Rican real estate market.

Comparative Market Analysis: The Gold Standard

The most reliable method for property valuation in Costa Rica is comparative market analysis (CMA). This approach involves analyzing recent sales of similar properties in the same area. However, in Costa Rica, this method presents unique challenges.

Costa Rica lacks a centralized Multiple Listing Service (MLS), which makes it difficult to access comprehensive, up-to-date sales data. To overcome this hurdle, we leverage our extensive network of local real estate professionals and our proprietary database of transactions.

We typically examine properties sold within the last 6-12 months, adjusting for differences in features, location, and condition. For instance, we might compare a 3-bedroom villa in Tamarindo to similar properties, with adjustments for factors like ocean views, pool size, or proximity to amenities.

Income Approach: Evaluating Rental Potential

For investment properties, particularly in popular tourist areas (like Manuel Antonio or Jaco), we utilize the income approach. This method estimates a property’s value based on its potential rental income.

We analyze local rental rates, occupancy rates, and operating expenses to calculate the property’s net operating income (NOI). Rental property investment strategies in Costa Rica can vary, and it’s important to work with experienced real estate agents to understand the market.

Rental yields in Costa Rica can vary significantly. Prime locations in Guanacaste might see yields of 6-8%, while more remote areas could offer higher returns of 10-12% due to lower property costs.

Cost Approach: New Construction Insights

For newly built properties or those undergoing significant renovations, we consider the cost approach. This method estimates value by calculating the cost to rebuild the property from scratch, plus the value of the land.

In Costa Rica, construction costs can vary widely depending on location and quality. As of 2025, basic construction costs range from $600 to $800 per square meter, while luxury builds can exceed $1,500 per square meter. We factor in these costs, along with land values, to provide a comprehensive valuation.

Local Market Knowledge: The Valuation Advantage

While these methodologies provide a solid foundation, the key to accurate property valuation in Costa Rica lies in local market knowledge. Experienced real estate professionals bring years of experience in the Costa Rican real estate market.

They understand the nuances that can significantly impact property values. For instance, properties in Uvita with ocean views can command premiums of 30-50% over similar properties without views. They’re also aware of upcoming infrastructure projects, like the expansion of Route 27, which could boost property values in certain areas.

A deep understanding of local regulations, such as the Maritime Zone restrictions or the intricacies of concession properties, allows for accurate factoring of these elements into valuations.

Final Thoughts

Costa Rica property valuation requires a deep understanding of the country’s unique real estate landscape. Numerous factors influence property values, including foreign investment, tourism impact, and regional differences. Location remains paramount, with beachfront properties and those near urban amenities commanding premium prices.

Professional expertise proves indispensable to navigate this complex market. At Osa Property Management, we combine proven valuation methods with extensive local knowledge to provide accurate and comprehensive property assessments. Our approach integrates comparative market analysis, income evaluation for rental properties, and cost considerations for new constructions.

For property owners and investors seeking reliable valuations and expert management services in Costa Rica, Osa Property Management offers unparalleled expertise. We provide comprehensive property management solutions, encompassing marketing, renter relationships, bill payment, accounting, and tax compliance (ensuring your property investment remains in capable hands).