Owning a rental property in Costa Rica can be a rewarding investment, but navigating the tax landscape can be challenging. At Osa Property Management, we understand the complexities of tax reporting for Costa Rican rental properties.

This guide will walk you through the essential steps to simplify your tax obligations, ensuring compliance and peace of mind. We’ll cover everything from understanding the local tax system to implementing efficient reporting strategies.

What Taxes Apply to Your Costa Rica Rental Property?

Income Tax on Rental Earnings

Costa Rica’s tax system for rental properties involves a progressive rate structure. As of 2025, the first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt. Beyond this threshold, rates range from 10% to 25%, depending on total income. Property owners must file monthly declarations of gross income using Form D-125, which prevents complications during the annual tax return process.

Value-Added Tax (VAT) for Short-Term Rentals

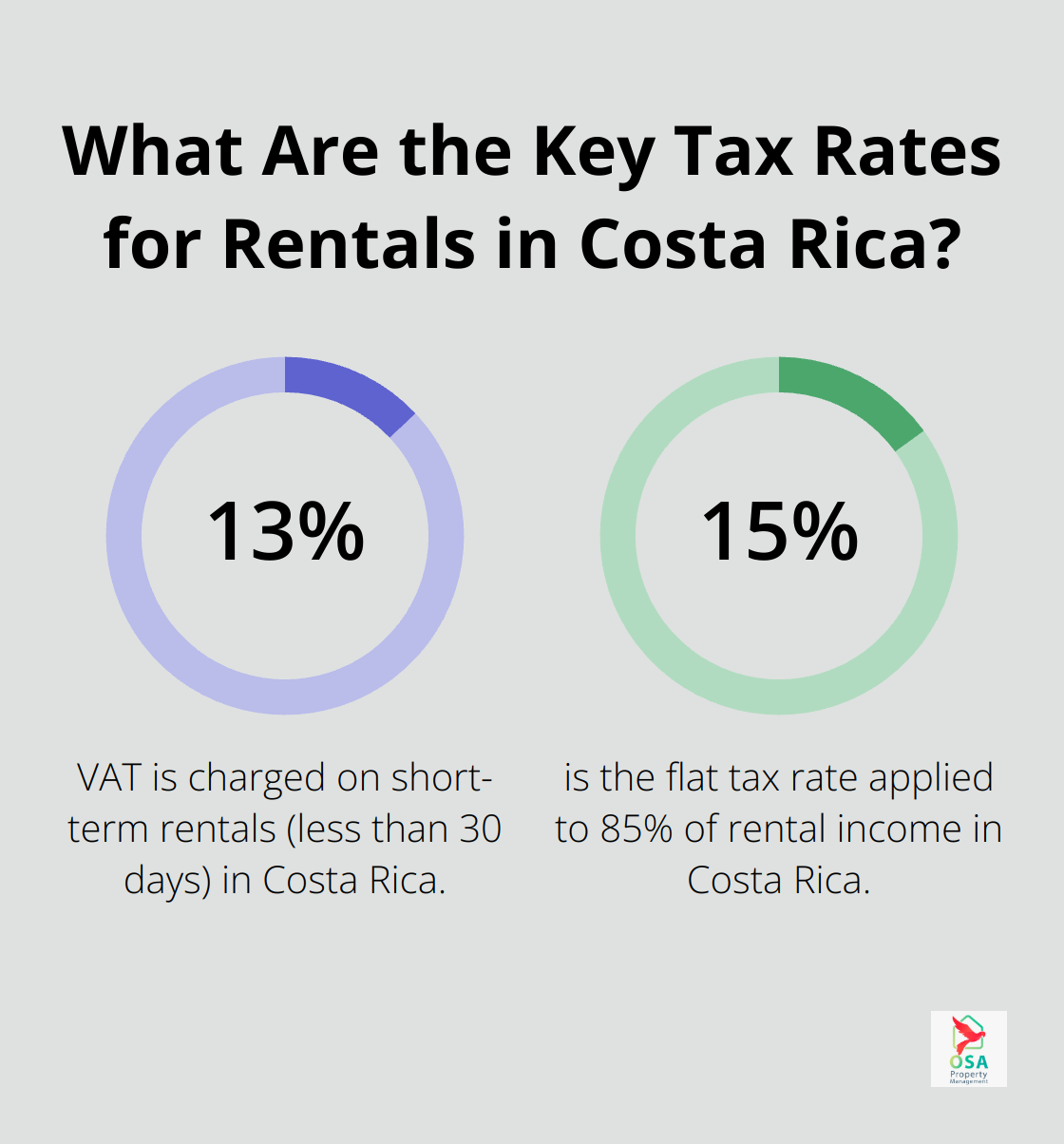

Short-term rentals (less than 30 days) require a 13% VAT charge and remittance. This tax, implemented in 2019, applies to all short-term rental income. Long-term rentals (over 30 days) remain exempt from VAT, which property owners should consider when deciding on their rental strategy.

Property Tax and Additional Considerations

Costa Rica imposes a tax on rental income. The remaining 85% of rental income is taxed at a flat rate of 15%. Some call this the 15/15 tax because you deduct 15% of rental income and pay 15% on the rest. Properties exceeding a construction value of approximately $233,900 face an additional “solidarity tax” (also known as luxury tax). Property owners should stay informed about these thresholds, as they may change.

The Costa Rican tax year runs from October 1 to September 30, with quarterly installment deadlines on February 20, May 20, August 25, and November 20. Missing these deadlines results in penalties and interest charges, so marking these dates in your calendar is essential.

Streamlining Your Tax Compliance

To simplify your tax reporting process, try using digital accounting software like QuickBooks Online or Xero. These tools track rental income and expenses accurately, facilitating compliance with Costa Rica’s tax requirements.

Engaging a local tax professional or CPA provides invaluable guidance. They navigate the complexities of Costa Rica’s tax landscape and ensure you take advantage of all available deductions and exemptions.

Professional Property Management Support

Professional property management services (like those offered by Osa Property Management) can assist with maintaining necessary records, ensuring timely filings, and staying informed about changes in tax regulations. This comprehensive approach optimizes tax compliance and overall financial management for your rental property.

As we move forward, let’s explore the essential documentation you’ll need for accurate tax reporting in Costa Rica.

Essential Documentation for Accurate Tax Reporting

Rental Income Records

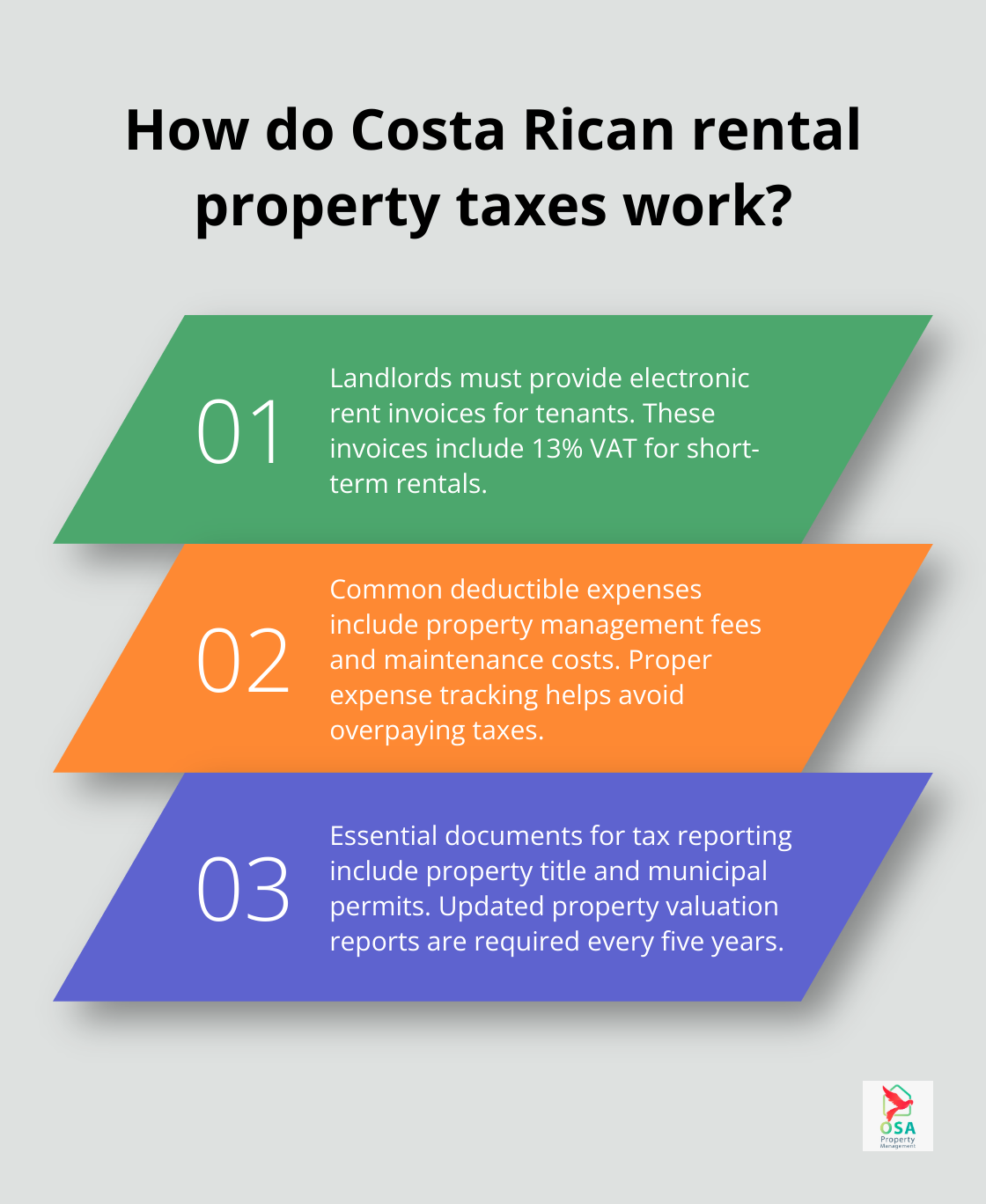

Accurate tax reporting for your Costa Rica rental property depends on meticulous record-keeping. Soon, landlords have to give tenants an electronic rent invoice (factura electrónica). This invoice includes the 13% VAT for short-term rentals. These invoices serve as your primary proof of income and are essential for accurate tax reporting.

Property management software can generate and store these invoices automatically, ensuring you don’t miss a transaction. This system also categorizes rentals by duration, which simplifies the process of distinguishing between short-term (VAT-applicable) and long-term rentals.

Expense Tracking

Thorough expense tracking helps you avoid overpaying taxes. Common deductible expenses for rental properties in Costa Rica include:

- Property management fees

- Maintenance and repair costs

- Utilities (if paid by the owner)

- Insurance premiums

- Property taxes

- Mortgage interest

Keep the corresponding factura electrónica for each expense. These digital receipts are vital for claiming deductions and reducing your taxable income. Categorize all expenses meticulously to maximize your deductions come tax time.

Property-Related Documents

Several property-related documents are important for tax reporting and overall compliance:

- Property title and registration documents

- Municipal permits for rental activities

- Insurance policies

- Mortgage statements (if applicable)

- Property valuation reports (updated every five years)

These documents support your property ownership claims and validate certain expenses. They’re also necessary for calculating the solidarity tax, which applies to high-value properties.

Staying organized with these documents streamlines your tax reporting process and protects you in case of an audit. While managing this paperwork can overwhelm you, professional property management services can significantly ease this burden. Osa Property Management offers comprehensive services that cover marketing, renter relationships, bill payment, accounting, and tax compliance.

The Costa Rican tax authorities have increased scrutiny on rental properties, especially those listed on platforms like Airbnb. Proper documentation is your best defense against potential audits and penalties.

Now that you understand the essential documentation for tax reporting, let’s explore strategies to streamline your tax reporting process and make compliance easier.

How to Streamline Tax Reporting for Your Costa Rica Rental Property

Implement Digital Accounting Systems

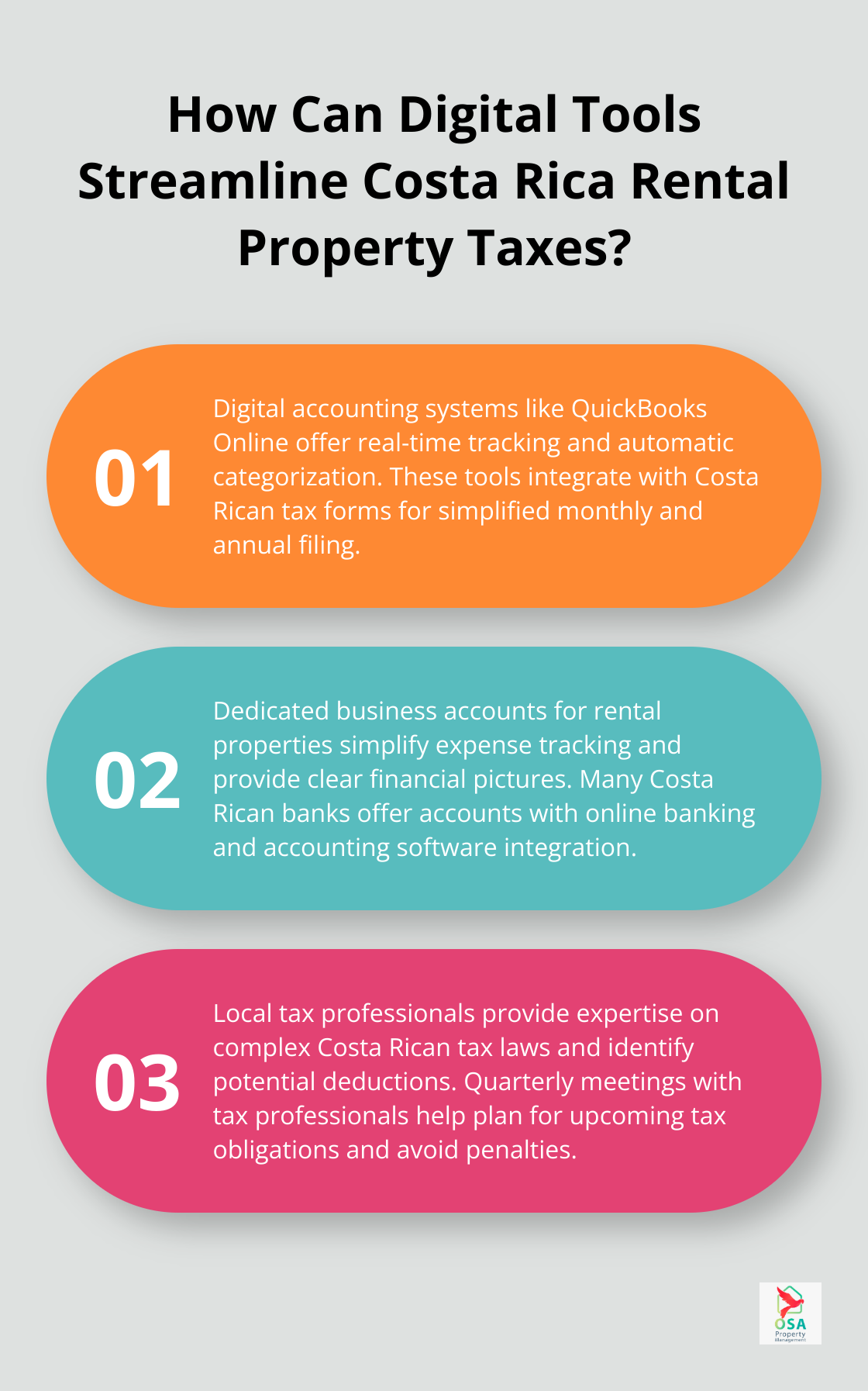

Digital accounting systems transform tax reporting for property owners. Software like QuickBooks Online or Xero offers real-time income and expense tracking, automatic categorization, and easy financial report generation. These tools integrate with Costa Rican tax forms, which simplifies the monthly and annual filing process.

QuickBooks Online allows you to set up recurring transactions for regular expenses (such as property management fees or utilities). This feature ensures you don’t miss any deductions. Its bank feed feature automatically imports transactions, which reduces manual data entry and potential errors.

Set Up a Dedicated Business Account

A dedicated bank account for your rental property transactions is essential. This separation simplifies expense tracking and provides a clear financial picture for tax purposes.

Many Costa Rican banks offer business accounts tailored for property owners. These accounts often include features like online banking and integration with accounting software, which further streamlines your financial management.

Work with Local Tax Professionals

Local tax professionals provide invaluable expertise. Costa Rican tax laws are complex and change frequently. A knowledgeable accountant or tax lawyer can provide up-to-date advice, ensure compliance, and identify potential deductions you might overlook.

A local tax professional can guide you through the nuances of the rental tax system, which helps you accurately calculate your tax liability. They can also assist with proper expense documentation, which ensures you maximize your deductions within Costa Rican tax law.

Try to schedule quarterly meetings with your tax professional to review your financial position and plan for upcoming tax obligations. This proactive approach helps you avoid last-minute scrambles and potential penalties.

Utilize Property Management Services

Professional property management services (like those offered by Osa Property Management) can significantly simplify tax reporting. These services maintain necessary records, ensure timely filings, and stay informed about changes in tax regulations. This comprehensive approach optimizes tax compliance and overall financial management for your rental property.

Final Thoughts

Tax reporting for Costa Rica rental properties presents challenges, but property owners can simplify the process with the right approach. Understanding applicable taxes, maintaining detailed records, and implementing efficient strategies ensure compliance with Costa Rican tax laws. Digital accounting systems, separate business accounts, and collaboration with local tax professionals streamline the reporting process and provide valuable financial insights.

Professional support can alleviate the complexities of tax obligations for property owners. Osa Property Management offers expert services tailored to Costa Rican rental properties, handling everything from marketing to tax compliance. Their team’s 19 years of experience enables property owners to enjoy their investment without the stress of managing complex tax requirements.

Successful property ownership in Costa Rica requires diligent financial management and tax compliance (beyond beautiful views and satisfied guests). Property owners who implement effective strategies and consider professional support can navigate the tax landscape with confidence. This approach allows them to focus on maximizing the potential of their Costa Rican property investment.