Navigating Costa Rica’s rental income tax system can be a daunting task for property owners. At Osa Property Management, we understand the challenges you face when it comes to tax reporting for your rental properties.

This step-by-step guide will simplify the process, helping you understand the intricacies of Costa Rica’s tax structure and avoid common pitfalls. We’ll walk you through the essential steps to ensure accurate and timely reporting of your rental income.

How Costa Rica Taxes Rental Income

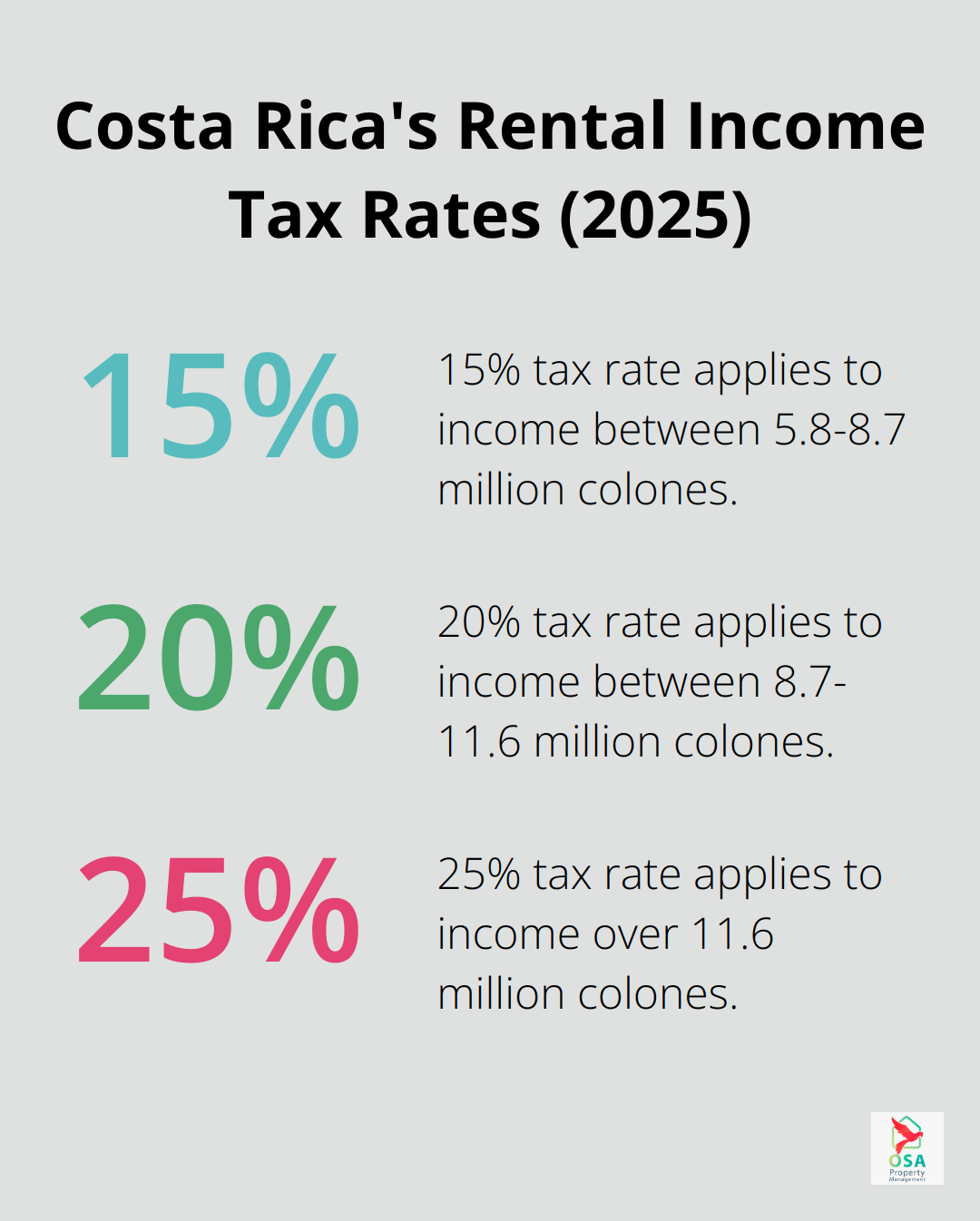

Tax Rates and Thresholds

Costa Rica’s rental income tax system is straightforward but requires attention to detail. As of 2025, the first 3.8 million colones (approximately $7,600 USD) of annual rental income is tax-exempt. This threshold provides a significant advantage for small-scale landlords. Income beyond this amount faces progressive tax rates, ranging from 10% to 25% for higher earnings.

Short-Term vs. Long-Term Rentals

The tax treatment differs based on rental duration. Short-term rentals (stays less than 30 days) incur a 13% Value Added Tax (VAT), while long-term rentals remain exempt. This distinction can significantly impact your tax liability and should factor into your rental strategy.

Reporting Requirements

Costa Rica’s tax year runs from October 1 to September 30, with four installment deadlines throughout the year. Property owners must file monthly declarations of gross income using Form D-125, even if no income was received. This requirement simplifies the annual tax return process but demands consistent record-keeping.

Deductible Expenses

Understanding deductible expenses is key to minimizing your tax liability. Common deductions include property management fees, maintenance costs, utilities, insurance premiums, and mortgage interest. It’s essential to maintain electronic receipts for all expenses to substantiate these deductions.

Increased Scrutiny

The Costa Rican tax authorities have increased scrutiny on rental properties, particularly those listed on platforms like Airbnb. This heightened attention underscores the importance of meticulous record-keeping and accurate reporting.

Professional property management services (like those offered by Osa Property Management) can handle these complex tasks, ensuring you never miss a deadline and maintain compliance with Costa Rican tax authorities. Their expertise can prove invaluable in navigating the intricacies of Costa Rica’s rental income tax system, allowing you to optimize your rental property’s financial performance while staying compliant with local laws.

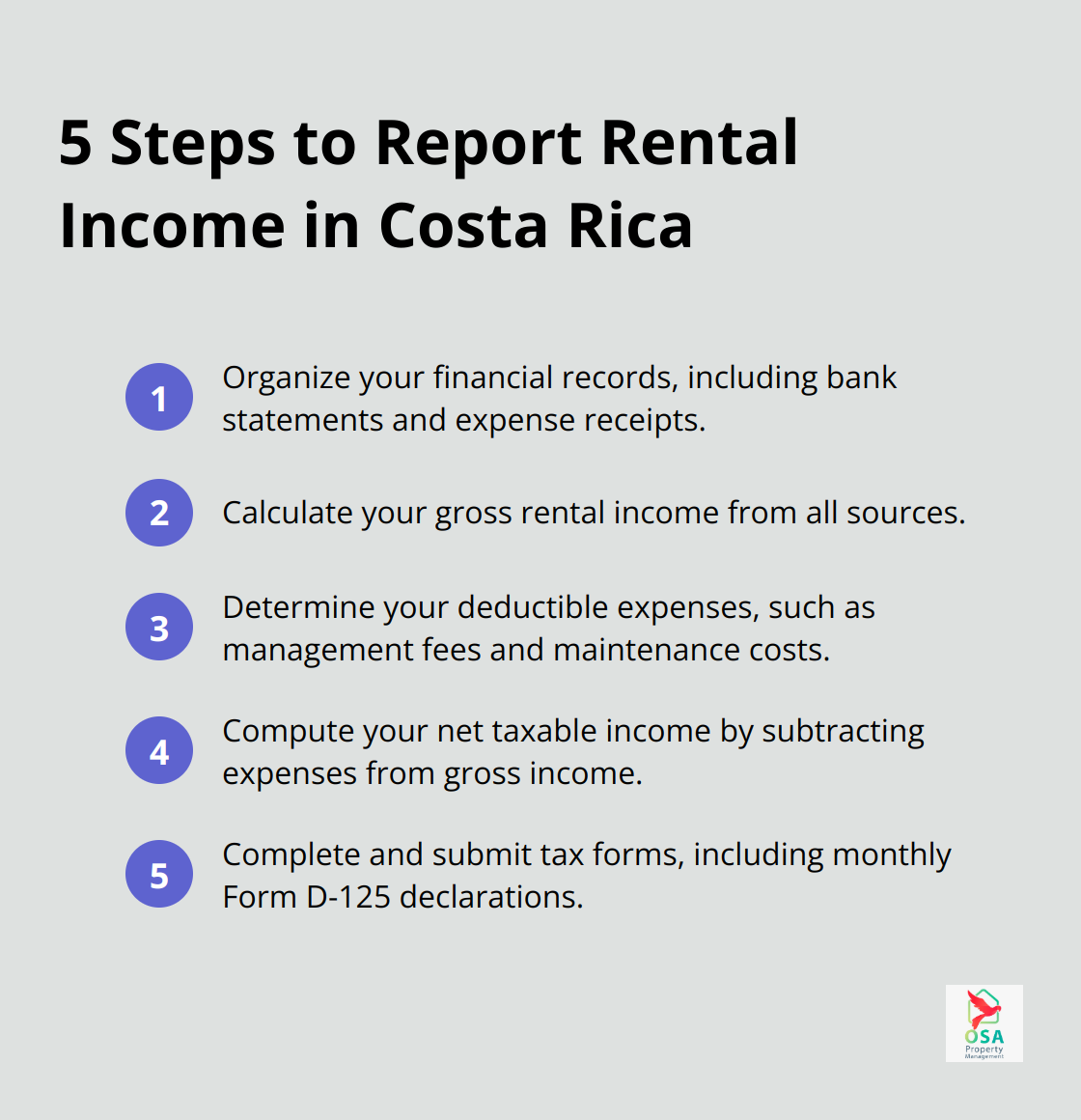

How to Report Your Rental Income in Costa Rica

Organize Your Financial Records

Start by collecting all relevant financial documents. This includes bank statements showing rental deposits, receipts for expenses, and records of property improvements. Create a digital filing system to store these documents securely. QuickBooks Online or Xero (two popular accounting software options) allow you to categorize expenses and generate reports easily.

Calculate Your Gross Rental Income

Add up all rent payments you’ve received during the tax year. Include any additional fees charged to tenants, such as cleaning fees or pet deposits. If you use a property management service, they should provide you with a detailed income statement. For short-term rentals, platforms like Airbnb often offer annual summaries that can help with this calculation.

Determine Your Deductible Expenses

This step minimizes your tax liability. Common deductible expenses include property management fees, maintenance costs, utilities, insurance premiums, and mortgage interest. In Costa Rica, you can also deduct expenses for energy-efficient upgrades and security enhancements. Keep in mind that personal expenses or costs related to periods when you use the property yourself are not deductible.

Compute Your Net Taxable Income

Subtract your total deductible expenses from your gross rental income to arrive at your net taxable income. The first 3.8 million colones of annual rental income is tax-exempt as of 2025. If your net income exceeds this threshold, you’ll need to calculate the tax owed based on the progressive rates.

Complete and Submit Your Tax Forms

The primary form for reporting rental income in Costa Rica is Form D-125, which you must file monthly. Property owners must submit monthly declarations of gross income using Form D-125. This can be completed online. You’re required to submit this form even if you didn’t receive any rental income in a particular month. For your annual tax return, you’ll need to consolidate these monthly reports. The Costa Rican tax authorities now require electronic submission of these forms through their digital reporting system.

While this process might seem complex, professional property management services can handle these tasks efficiently. They ensure you never miss a deadline and maintain compliance with Costa Rican tax laws. Their expertise proves invaluable in navigating the intricacies of Costa Rica’s rental income tax system. This allows you to focus on enjoying your property investment while avoiding common pitfalls in rental income reporting.

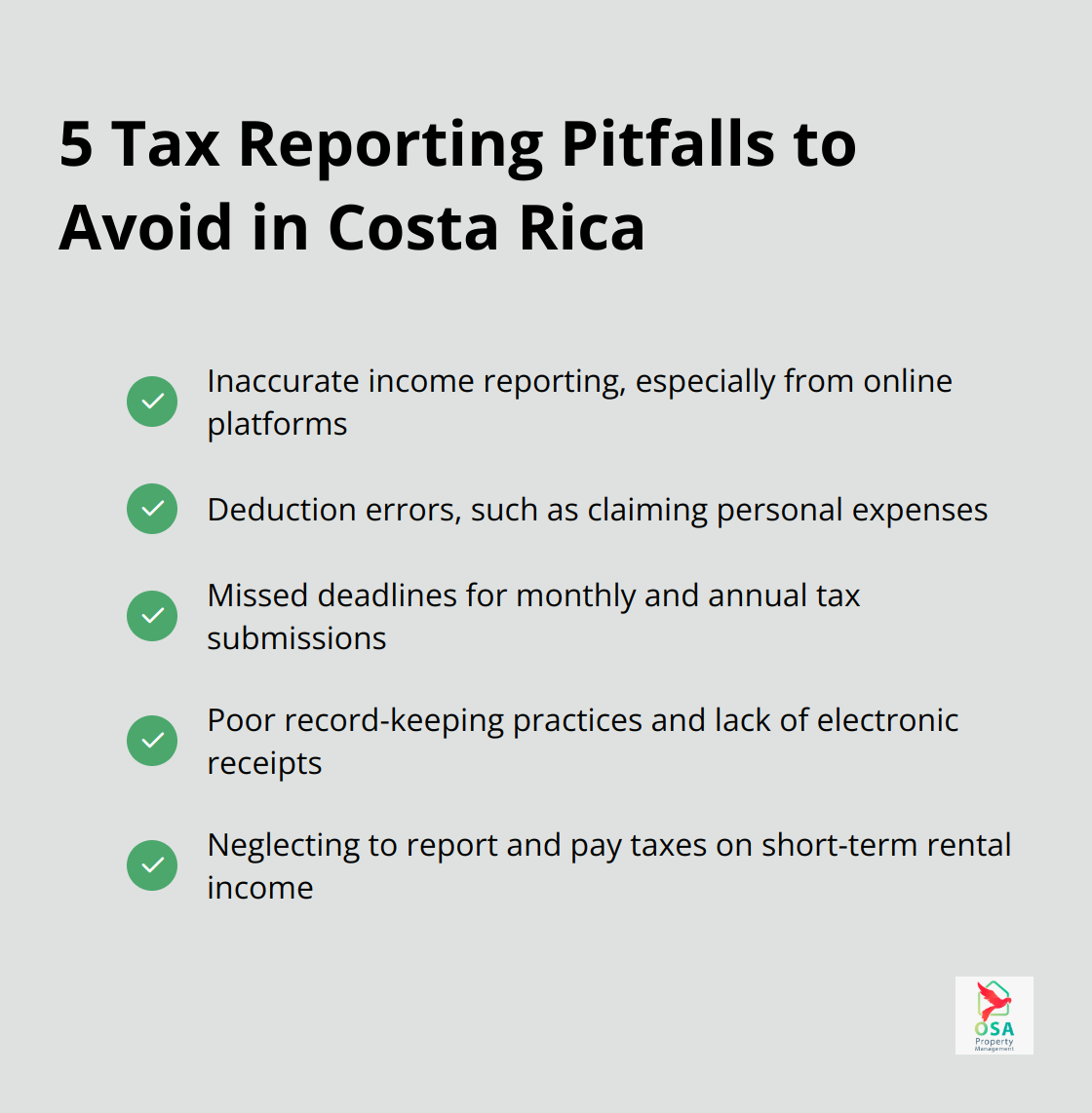

Avoiding Common Tax Reporting Pitfalls

Costa Rica’s rental income tax system demands vigilance and attention to detail. Property owners often make mistakes that lead to penalties or missed tax savings opportunities. This chapter highlights key areas where errors frequently occur and provides strategies to avoid them.

Accurate Income Reporting

Underreporting rental income stands as one of the most common mistakes. As a tax resident in Costa Rica, you must declare all income, regardless of its origin. The Costa Rican tax authority has intensified its scrutiny on rental properties, especially those listed on platforms like Airbnb. To prevent issues, maintain a comprehensive record of all income, including those from online booking platforms and direct bookings.

Deduction Accuracy

Claiming all eligible deductions is important, but overestimating expenses can trigger audits. Some property owners mistakenly include personal expenses or costs related to periods when they use the property themselves. Only expenses directly related to the rental activity qualify as deductible. Keep meticulous records and consult with a tax professional to ensure you claim the right deductions.

Timely Submissions

Costa Rica’s tax system operates on specific deadlines, and missing these results in penalties. Property owners must file monthly declarations using Form D-125, even if they received no income. The tax year runs from October 1 to September 30, with four installment deadlines throughout the year. Set up reminders or use property management software to track these important dates.

Record-Keeping Practices

Inaccurate record-keeping creates tax troubles. Costa Rican tax authorities require electronic receipts for all expenses to substantiate deductions. Invest in a digital filing system or accounting software (such as QuickBooks Online or Xero) to organize your financial documents. This simplifies tax reporting and provides a clear financial picture of your rental property’s performance.

Short-Term Rental Reporting

Many property owners neglect to report income from short-term rentals, especially those facilitated through platforms like Airbnb. However, these rentals incur a 13% Value Added Tax (VAT) on short-term rentals (less than 30 days). This tax was introduced in 2019 and significantly impacts vacation rentals. Failure to report and remit these taxes results in significant penalties. Keep detailed records of all short-term rental activity and ensure you collect and remit the appropriate taxes.

Final Thoughts

Costa Rica’s rental income tax system demands diligence, organization, and a thorough understanding of local regulations. Property owners must maintain detailed financial records, including income from all sources and expenses backed by electronic receipts. The tax year runs from October 1 to September 30, with four installment deadlines that require consistent attention.

Professional assistance proves invaluable for navigating the complexities of tax reporting in Costa Rica. Osa Property Management offers expert services tailored to handle these challenges. They manage everything from marketing and maintenance to accounting and tax compliance, allowing property owners to enjoy their investments without stress.

Property owners can confidently manage their rental income tax reporting in Costa Rica through meticulous record-keeping and professional support. This approach ensures adherence to local laws and optimizes the financial performance of rental properties. It allows investors to fully enjoy the benefits of their Costa Rican real estate investments.