Investing in Costa Rica’s property market can be lucrative, but it comes with unique tax considerations. At Osa Property Management, we understand the importance of strategic tax planning for maximizing returns on your Costa Rican real estate investments.

This guide will walk you through the intricacies of Costa Rica’s property tax system, offer tax-efficient strategies for investors, and provide insights on navigating tax compliance as a foreign property owner.

How Costa Rica’s Property Tax System Works

Standard Property Tax Rate

Costa Rica imposes a standard property tax rate of 0.25% on the registered property value. This tax, though modest, is fully deductible from taxable income, which provides a significant advantage for property owners.

National vs. Municipal Tax Collection

While the national government sets the property tax rate, municipalities collect these taxes. This system leads to variations in assessment and collection methods across different regions of Costa Rica. Some municipalities update property values more frequently than others.

Popular tourist areas like Jaco and Manuel Antonio often have municipalities that maintain vigilant property valuations and tax collection practices. These areas typically have higher property values and rely heavily on tourism-related revenue.

Recent Tax Law Changes

Costa Rica implemented several tax law changes in recent years that affect property owners. A notable update is the introduction of a capital gains tax in July 2019. This law imposes a capital gain tax of 15% on profits from real estate sales, excluding primary residences. For properties purchased before July 1, 2019, owners can choose to pay 2.25% of the total sale price instead of the 15% on capital gains. This option can result in substantial savings for appreciated properties.

Luxury Home Tax

High-value property owners must consider the luxury home tax (also known as the “solidarity tax”). This tax applies to properties valued above ₡148 million (approximately $260,000 as of January 2025). The rates range from 0.25% to 0.55%, depending on the property’s value. Investors in high-end properties must factor this additional tax into their financial planning, as it applies on top of the standard property tax.

Impact on Investment Decisions

These nuances in Costa Rica’s property tax system play a significant role in investment decisions. While the overall tax burden remains relatively low, local variations and recent changes can affect investment strategies. Investors who stay informed about these factors can optimize their tax strategies and avoid unexpected costs.

As we move forward, we will explore tax-efficient strategies that property investors can employ to maximize their returns in Costa Rica’s real estate market.

Maximizing Tax Benefits for Costa Rica Property Investments

At Osa Property Management, we understand the importance of strategic tax planning for Costa Rican real estate investments. This chapter explores key strategies to optimize your tax position:

Efficient Ownership Structures

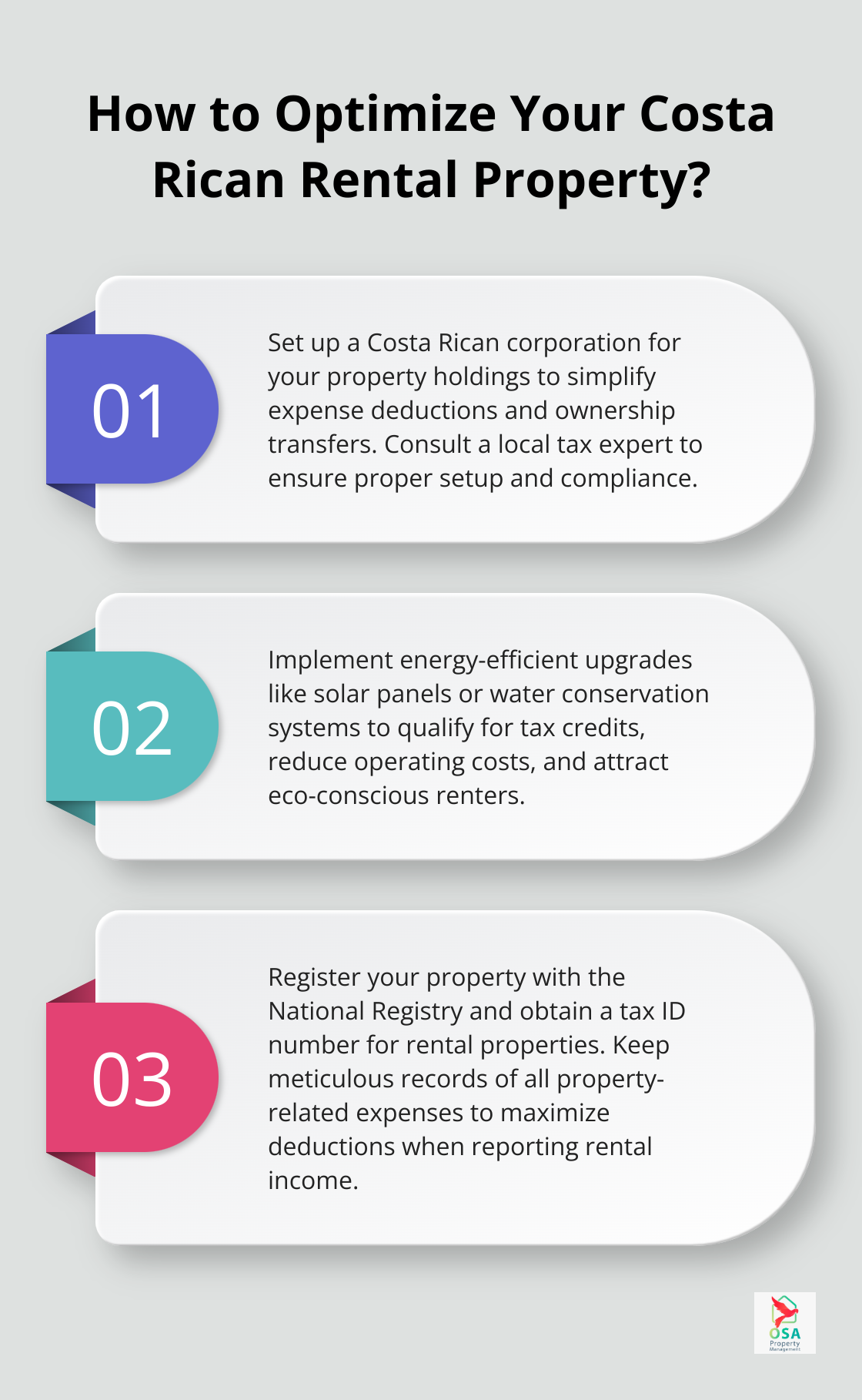

Establishing a Costa Rican corporation for property holdings can offer substantial tax benefits. Corporations generating Costa Rican–sourced income are generally subject to a 30% income tax, with lower rates for small companies. This structure allows for easier expense deductions and simplifies ownership transfers. However, it’s important to work with a local tax expert to set up the corporation correctly and ensure compliance with all regulations.

For properties generating rental income, consider separating ownership of the land and building. This approach can maximize depreciation benefits, as buildings typically depreciate faster than land. Allocating a higher percentage of the property value to the building increases your annual depreciation deduction.

Depreciation and Expense Deductions

Costa Rica’s tax code allows for depreciation deductions. The property tax ranges between 0.25% – 0.55% depending on the home’s value, and payment must be made by January 15th of each year to avoid penalties.

Don’t overlook other deductible expenses. Property management fees, maintenance costs, utilities, and travel expenses related to property management are all tax-deductible. Keep meticulous records of these expenses to maximize your deductions at tax time.

Mortgage interest is another significant deduction. If you’ve financed your property, you can deduct the full amount of interest paid each year. This applies to both primary residences and rental properties, providing a substantial tax benefit for leveraged investments.

Tax Incentives for Sustainable Improvements

Costa Rica’s commitment to sustainability extends to its tax policies. Property owners can qualify for tax credits by investing in energy-efficient upgrades. Installing solar panels, implementing water conservation systems, or using eco-friendly building materials can reduce your environmental impact and lower your tax burden.

These green investments often attract eco-conscious renters, potentially increasing your rental income while simultaneously reducing operating costs. It aligns with Costa Rica’s goal of carbon neutrality by 2050 (a target that has attracted global attention).

Professional Guidance

Tax laws in Costa Rica are subject to change, and interpretations can vary. While these strategies can significantly enhance your investment returns, it’s essential to consult with a local tax professional. They can ensure you’re making the most of available benefits while remaining fully compliant with Costa Rican law.

As we move forward, we’ll explore the specific tax compliance requirements for foreign investors in Costa Rica’s property market. Understanding these obligations is key to a successful and legally sound investment strategy.

Foreign Investors Tax Compliance Guide

Non-Resident Tax Obligations

Foreign investors must register their property with the National Registry to establish ownership and tax assessments. This process requires collaboration with a local attorney to ensure proper documentation. Non-residents face taxation only on income sourced within Costa Rica, which simplifies obligations for many foreign property owners.

Tax residency status changes if an investor spends more than 183 days, continuous or discontinuous, in Costa Rica during a single fiscal year. This shift subjects the individual to taxation on worldwide income. Investors should track their time in the country meticulously and consult a tax professional if approaching this threshold.

Reporting Rental Income

Property owners must register with local tax authorities and obtain a tax ID number for rental properties. Short-term rentals (less than 30 days) incur a 13% Value Added Tax (IVA), while long-term rentals enjoy exemption. This tax structure has prompted many investors to focus on long-term rental strategies for optimal tax efficiency.

Accurate record-keeping of all property-related expenses proves essential when reporting rental income. These expenses (including management fees, maintenance costs, utilities, and insurance premiums) reduce taxable income significantly.

Capital Gains Reporting

The 15% capital gains tax applies to profits from property sales in Costa Rica. Property owners who purchased before July 1, 2019, have the option to pay 2.25% of the total sale price instead. This alternative often benefits owners of appreciated properties.

Leveraging Local Expertise

Local tax professionals and property managers provide invaluable assistance to foreign investors. A knowledgeable local tax expert helps navigate the intricacies of Costa Rican tax law, identifies potential deductions, and ensures full compliance with all regulations.

Property management companies (such as Osa Property Management) play a vital role in maintaining tax compliance. These firms handle day-to-day operations, ensure proper record-keeping for tax purposes, and often maintain established relationships with local tax professionals. This comprehensive approach not only simplifies investment but also maximizes tax efficiency.

Staying Informed on Tax Changes

Costa Rica’s tax laws evolve periodically. Foreign investors must stay informed about these changes to adapt their strategies accordingly. Regular consultations with tax professionals and property management experts help investors remain compliant and optimize their tax positions in this dynamic environment.

Final Thoughts

Tax planning for Costa Rica property investments requires careful strategy and informed decision-making. Investors must understand property tax rates, recent law changes, and the differences between national and municipal tax collection. Foreign investors need to pay attention to their tax obligations, including proper registration and accurate reporting of rental income.

Professional property management services play a key role in successful tax planning for Costa Rica real estate investments. Osa Property Management offers comprehensive services that cover marketing, renter relationships, bill payment, accounting, and tax compliance. Their team’s expertise helps investors navigate local regulations and maintain meticulous records.

Successful property investment in Costa Rica depends on strategic tax planning and reliable local partnerships. Investors who seek expert guidance and use professional property management services can maximize their returns while complying with Costa Rican tax laws. This approach optimizes financial outcomes and provides peace of mind for Costa Rican real estate ventures.