At Osa Property Management, we understand that navigating the tax landscape of rental property ownership can be complex. The tax advantages of owning a rental property are numerous and can significantly impact your financial success as a real estate investor.

In this post, we’ll break down the key tax benefits available to rental property owners, including depreciation, deductible expenses, and the powerful 1031 exchange strategy. Whether you’re a seasoned investor or just starting out, understanding these tax advantages can help you maximize your returns and build long-term wealth through real estate.

How Depreciation Benefits Rental Property Owners

Understanding Depreciation in Real Estate

Depreciation serves as a powerful tax tool for rental property owners. It allows investors to reduce their taxable income significantly from rental properties.

In real estate, depreciation is a tax deduction that enables property owners to recover their investment cost over time. The Internal Revenue Service (IRS) acknowledges that buildings and their components deteriorate, thus allowing this deduction to offset ownership expenses.

For residential rental properties, the IRS sets the depreciation period at 27.5 years. This means property owners can deduct a portion of their property’s value annually for nearly three decades, which substantially lowers taxable rental income.

Calculating Depreciation for Your Rental Property

To calculate depreciation, you must determine your property’s basis (typically its purchase price plus certain closing costs and improvements). Since land value isn’t depreciable, you need to separate it from the building value.

For instance, if you purchased a rental property for $300,000 and the land is valued at $50,000, your depreciable basis is $250,000. Divide this by 27.5 years, and you can deduct about $9,090 annually from your taxable rental income.

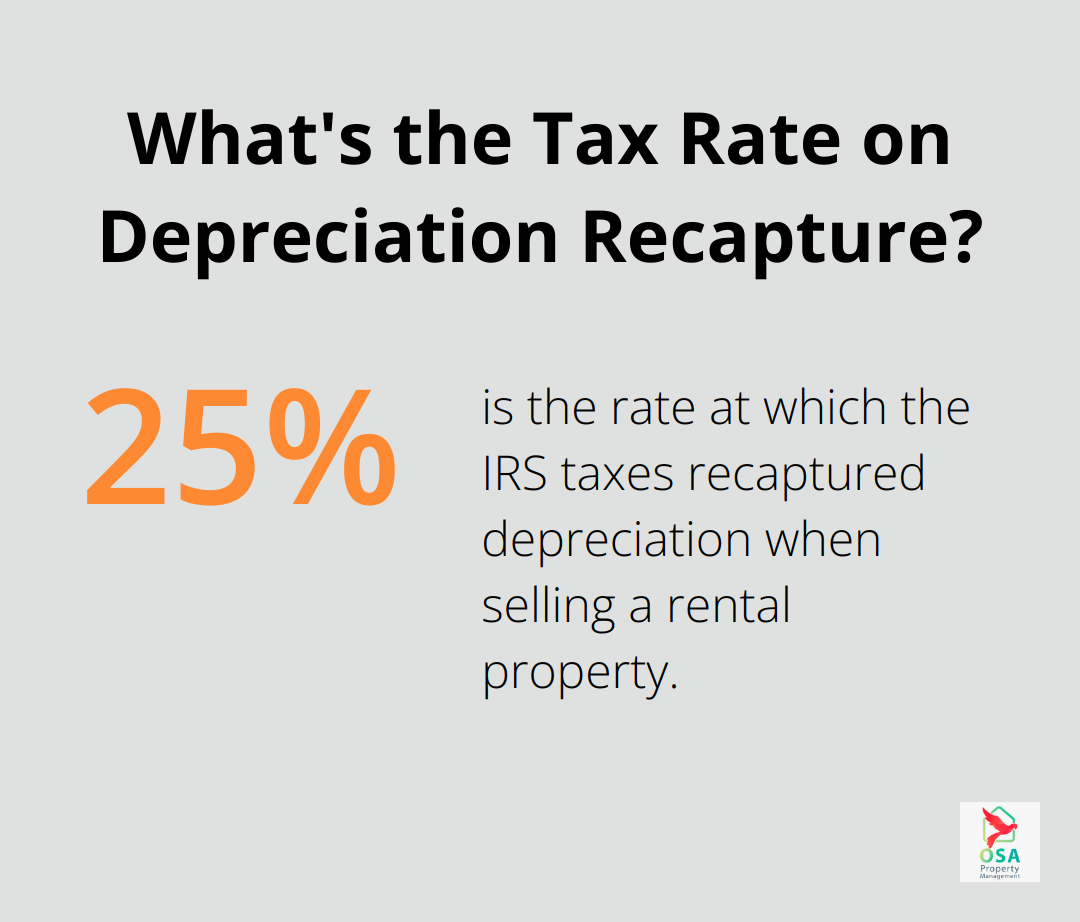

The Impact of Depreciation Recapture

While depreciation offers substantial tax benefits, it’s important to understand depreciation recapture. When you sell a rental property, the IRS will “recapture” the depreciation you’ve claimed over the years, taxing it at a rate of 25%.

This doesn’t negate the benefits of depreciation (you still receive a valuable tax deferral). However, you should factor this future tax liability into your long-term investment strategy.

Strategies to Maximize Depreciation Benefits

To optimize your depreciation benefits:

- Maintain meticulous records of all capital improvements. You can add these to your property’s basis, which increases your annual depreciation deduction.

- Consider a cost segregation study. This can identify components of your property that depreciate faster than 27.5 years, potentially front-loading your tax benefits.

- Plan your exit strategy. If you’re considering selling, consult with a tax professional about strategies to minimize depreciation recapture, such as a 1031 exchange.

The Role of Professional Guidance

Depreciation is a complex but powerful tool in real estate investing. While property management companies like Osa Property Management focus on delivering top-notch services, they often recommend clients work with qualified tax professionals. These experts can help optimize investment strategies and ensure compliance with all relevant tax laws.

As we move forward, let’s explore another significant tax advantage for rental property owners: deductible expenses. These deductions can further reduce your taxable income and boost your overall returns.

What Expenses Can Rental Property Owners Deduct?

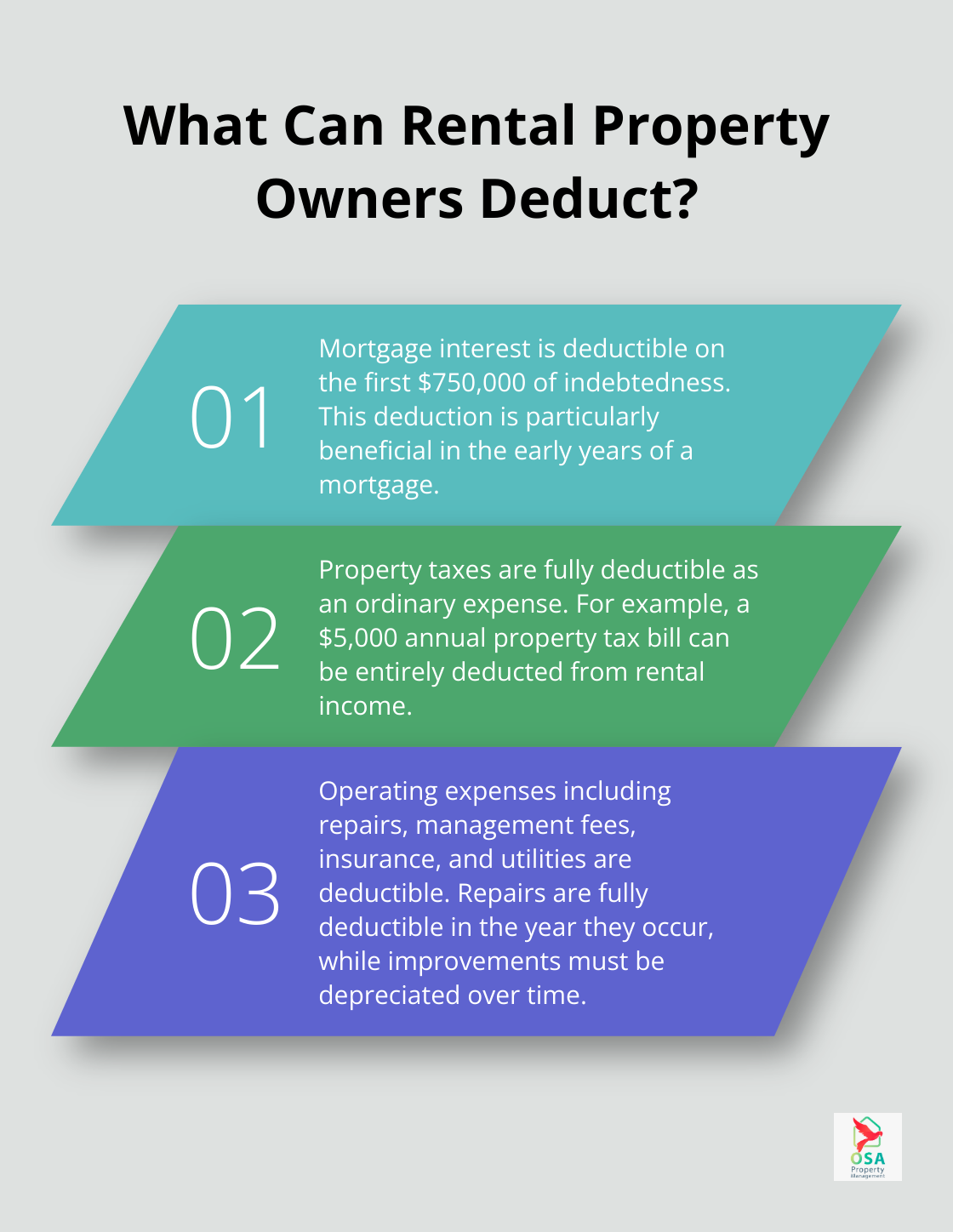

Mortgage Interest: A Major Tax Benefit

Rental property owners can reduce their tax burden significantly by deducting mortgage interest. The Internal Revenue Service (IRS) allows deductions for home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. This benefit proves particularly advantageous in the early years of a mortgage when a larger portion of payments goes towards interest.

Property Taxes: Another Significant Deduction

Property taxes offer another major expense deduction for rental property owners. You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property.

In areas with high property taxes, this deduction can provide substantial value. If your annual property tax bill amounts to $5,000, you can deduct this entire sum from your rental income.

Operating Expenses: The Day-to-Day Costs of Property Ownership

Operating expenses cover a wide range of costs associated with managing and maintaining your rental property. These include:

- Repairs and maintenance (e.g., fixing a leaky faucet, repainting the exterior)

- Property management fees

- Insurance premiums

- Utilities

- Legal and professional fees (attorneys, accountants, etc.)

It’s important to distinguish between repairs and improvements. Repairs (expenses that keep your property in good operating condition) are fully deductible in the year they occur. Improvements (which add value to the property or extend its life) must be depreciated over time.

Travel Expenses: Often Overlooked but Valuable

Don’t overlook travel expenses related to your rental property. If you travel for management or maintenance purposes, you can deduct these costs:

- Mileage or actual expenses for driving

- Airfare for flights to your property

- Lodging costs for overnight stays

- 50% of meal expenses during these trips

To claim these deductions, maintain detailed records of your trips, including the purpose of each visit and receipts for all expenses.

The Importance of Record-Keeping

The key to maximizing tax benefits lies in maintaining accurate and comprehensive records of all rental property expenses. While property management companies can assist with many aspects of rental property ownership, consulting with a tax professional ensures you take full advantage of all available deductions and comply with tax laws.

As we move forward, let’s explore another powerful tax strategy for rental property owners: the 1031 exchange. This method allows investors to defer capital gains taxes and potentially grow their real estate portfolio more rapidly.

How a 1031 Exchange Works

The Basics of a 1031 Exchange

A 1031 Exchange is a tax strategy that allows real estate investors to defer capital gains taxes when they sell an investment property and reinvest the proceeds into a new property. This IRS-approved method can significantly boost the growth potential of a real estate portfolio.

At its core, a 1031 exchange involves swapping one investment property for another of “like-kind.” The term “like-kind” is broader than many investors realize. For example, an investor can exchange a single-family rental home for a multi-unit apartment building or even raw land.

The primary benefit? Investors can defer paying capital gains taxes on the sale of their property, which potentially allows them to invest more capital into a new (and possibly more valuable) property. This can lead to faster wealth accumulation over time.

Rules and Timelines

1031 exchanges offer substantial benefits, but they come with strict rules. Investors must identify potential replacement properties within 45 days of selling their relinquished property. They then have 180 days total to close on one of those identified properties.

These timelines are non-negotiable. Missing them can result in disqualification of the exchange and immediate tax liability. This is why working with a qualified intermediary is important. They hold the funds and ensure compliance with IRS regulations.

Common Pitfalls to Avoid

One frequent mistake is attempting to access the proceeds from the property sale. In a 1031 exchange, investors can’t touch the money – it must go directly to the qualified intermediary. Another pitfall is failing to reinvest all the proceeds. Any cash received (known as “boot”) will be taxable.

It’s also vital to ensure both properties involved in the exchange are held for investment or business purposes. Personal residences don’t qualify for a 1031 exchange.

The Role of Professional Guidance

While property management companies focus on providing top-notch services, they often recommend clients work with tax professionals and qualified intermediaries to navigate the complexities of 1031 exchanges successfully. These experts can help optimize investment strategies and ensure compliance with all relevant tax laws.

Long-Term Benefits

A well-executed 1031 exchange can transform investment strategies. It allows investors to defer taxes and potentially acquire more valuable properties over time. This can lead to a larger, more diverse real estate portfolio and increased potential for long-term wealth generation.

Final Thoughts

The tax advantages of owning a rental property offer significant opportunities for real estate investors. Depreciation, deductible expenses, and 1031 exchanges can reduce taxable income and defer capital gains. These benefits allow investors to potentially grow their portfolios more rapidly and accumulate wealth over time.

Proper record-keeping and professional advice play a vital role in maximizing tax benefits and ensuring compliance with IRS regulations. Detailed records of all expenses, improvements, and transactions related to rental properties are essential. Working with qualified tax professionals can help navigate the complexities of real estate investing and optimize tax strategies.

At Osa Property Management, we understand the intricacies of rental property ownership in Costa Rica. Our team’s expertise in managing properties, combined with strategic tax planning, can help maximize returns on real estate investments. We recommend our clients work with qualified tax professionals to make the most of these valuable tax advantages.