At Osa Property Management, we understand the complexities of managing rental properties and their tax implications. Navigating the world of tax advice for rental property owners can be challenging, but it’s crucial for maximizing your investment returns.

This guide will walk you through essential tax strategies, from understanding rental income and expenses to maximizing deductions and maintaining proper records. We’ll provide practical tips to help you optimize your tax position and stay compliant with current regulations.

What Counts as Rental Income and Expenses?

Comprehensive Rental Income Sources

Rental income extends beyond monthly rent checks. Property owners often overlook additional taxable income sources. These include advance rent payments, lease cancellation fees, and expenses tenants pay on your behalf.

Security deposits often cause confusion. If you return the full deposit to your tenant, it’s not income. However, any portion kept due to lease violations becomes taxable. If a tenant pays for a repair that’s your responsibility, and you deduct it from their rent, you must still report the full rent as income.

Deductible Expenses: A Broader Scope

Numerous expenses can offset your rental income. Property taxes and mortgage interest are significant deductions. Operating costs (utilities, insurance, and property management fees) are fully deductible. Don’t overlook advertising expenses for tenant acquisition or legal fees for lease drafting.

Travel costs related to your rental property can accumulate quickly. For properties in Costa Rica managed from abroad, you can deduct airfare, car rentals, and even a portion of meals during property visits. Maintain meticulous records of these expenses for tax purposes.

Navigating Repairs vs. Improvements

One of the most challenging aspects of rental property taxes is distinguishing between repairs and improvements. Repairs are fully deductible in the year they occur, while improvements must be depreciated over time.

A repair maintains your property’s current condition (e.g., fixing a leaky faucet or repainting a room). An improvement adds value or extends the property’s life (e.g., installing a new roof or upgrading the HVAC system).

Many property owners in areas like Jaco or Manuel Antonio often misclassify these expenses. Understanding the difference is essential, as it can significantly impact your tax liability. When uncertain, consult with a tax professional familiar with Costa Rican property laws to ensure correct expense categorization.

The Importance of Proper Classification

Proper classification of income and expenses is vital for accurate tax reporting and maximizing deductions. Misclassification can lead to legal consequences, including potential felony charges for tax evasion. Keep detailed records of all transactions related to your rental property.

Consider using property management software to track income and expenses efficiently. This can help you categorize items correctly and provide a clear financial picture of your rental business.

As we move forward, we’ll explore strategies to maximize tax deductions for your rental properties, including depreciation and home office deductions.

How to Maximize Tax Deductions for Rental Properties

Leveraging Depreciation

Depreciation offers a powerful tool to reduce your taxable income. The IRS allows you to deduct the cost of your rental property over its useful life, typically 27.5 years for residential properties using the straight line method. You can use Table 2-2d in IRS Publication 527 to find your depreciation percentage.

For instance, if you purchased a rental property, you would calculate the depreciation based on the recovery period and the appropriate table in the IRS publication.

Major improvements require separate depreciation. A new roof or HVAC system depreciates over its own useful life, often 27.5 years for residential rental property improvements.

Home Office Deductions

If you manage your rental properties from home, you might qualify for home office deductions. The IRS permits deductions for the portion of your home used exclusively for your rental business.

Two methods exist to calculate this deduction:

- Simplified Method: Deduct $5 per square foot of your home office (up to 300 square feet).

- Regular Method: Calculate the percentage of your home used for business and apply that to your home expenses.

For example, if your home office occupies 10% of your home’s total area, you can deduct 10% of your mortgage interest, property taxes, utilities, and maintenance costs.

Maximizing Travel Expense Deductions

Travel expenses related to your rental property qualify for full deduction. This applies particularly to those who manage properties in Costa Rica from abroad. Keep detailed records of all travel costs, including:

- Airfare and ground transportation

- Lodging expenses

- 50% of meal costs during your trip

Local travel also qualifies for deductions. Use the standard mileage rate or actual expenses method to deduct costs for using your personal vehicle for rental-related activities.

To support these deductions under IRS scrutiny, maintain a log that details the purpose of each trip and its relation to your rental business.

Strategic Timing of Expenses

The timing of your expenses can impact your tax liability. If you use the cash method of accounting, consider paying some of next year’s expenses in December to increase your current year deductions. This could include prepaying property taxes or insurance premiums.

Exercise caution not to trigger the alternative minimum tax (AMT) by concentrating too many deductions in one year. A tax professional can help you find the right balance for your situation.

Professional Services Deduction

Professional services related to your rental business qualify for full deduction. This includes fees paid to property managers, accountants, lawyers, and other professionals. If you use a CPA or computer software to prepare your tax return, these expenses can also be deducted.

As we move forward, we’ll explore the essential aspects of record keeping and reporting requirements for rental property owners. These practices will help you maintain accurate financial records and comply with tax regulations.

Mastering Record Keeping for Rental Properties

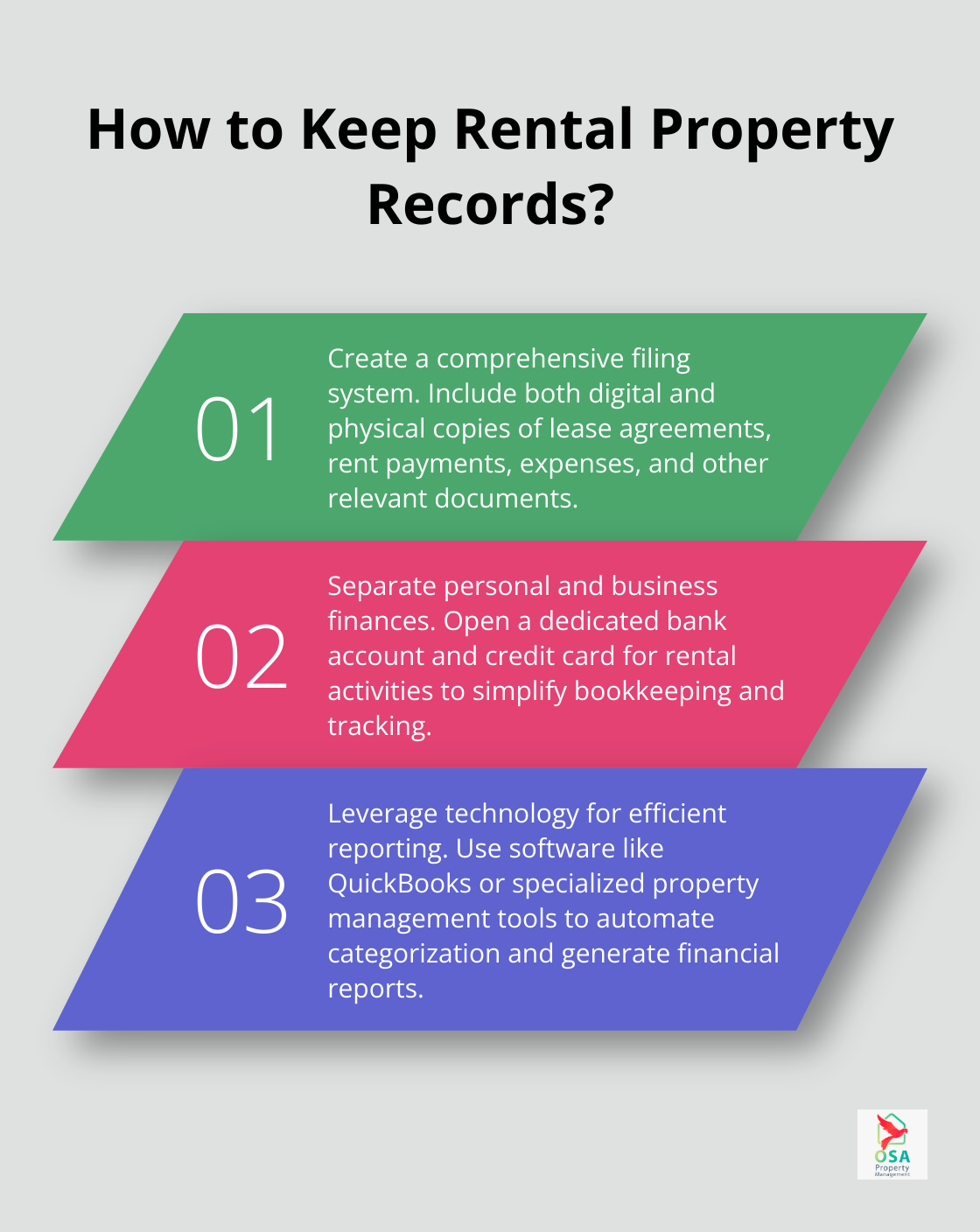

Creating a Robust Filing System

Establish a comprehensive filing system for your rental property management. Include both digital and physical copies of all relevant documents. Key items to maintain:

- Lease agreements

- Rent payment records

- Expense receipts

- Bank statements

- Property tax bills

- Insurance policies

- Correspondence with tenants

- Maintenance and repair records

Use cloud-based storage solutions for digital files to ensure easy access and protect against physical damage or loss. For physical documents, invest in a fireproof safe or consider a safety deposit box for crucial papers.

Separating Personal and Business Finances

Many rental property owners make the mistake of commingling personal and business funds. This can lead to tax complications and make it difficult to track your rental property’s true financial performance.

Open a separate bank account for your rental business. Use this account exclusively for rental income deposits and expense payments. This separation simplifies bookkeeping and provides a clear financial picture of your rental activities.

Use a dedicated credit card for rental-related purchases. This further streamlines expense tracking and can offer rewards or cashback on business spending.

Leveraging Technology for Efficient Reporting

Numerous software options can streamline your record keeping and reporting processes. QuickBooks and Xero are popular choices for general accounting, while specialized property management software like Buildium or AppFolio offer features tailored to landlords.

These tools can automatically categorize expenses, generate financial reports, and even assist with tax preparation. Many also integrate with bank accounts and credit cards, reducing manual data entry and the risk of errors.

For Costa Rican properties, ensure your chosen software can handle multiple currencies if you’re managing finances across borders. This is particularly important for accurate reporting of rental income and expenses on both U.S. and Costa Rican tax returns.

Importance of Meticulous Record Keeping

Meticulous record keeping helps you monitor the progress of your rental property, prepare financial statements, and identify the source of receipts. It’s about gaining insights into your property’s performance, identifying areas for improvement, and making informed decisions about your rental business.

Try to update your records regularly (at least monthly) to maintain accuracy and avoid last-minute scrambles during tax season. This practice will also help you spot trends or issues in your rental business more quickly.

Professional Assistance

Consider engaging a professional bookkeeper or accountant familiar with rental property management (especially for properties in Costa Rica). Hiring a CPA can provide guidance to improve your financial health, ensure compliance, and navigate complex tax laws.

While this may seem like an additional expense, the potential tax savings and peace of mind often outweigh the cost. If you’re managing multiple properties or find yourself overwhelmed with paperwork, professional assistance can be invaluable.

Final Thoughts

Tax advice for rental property owners requires diligence, organization, and strategic planning. Property owners must understand rental income, maximize deductions, and maintain meticulous records to optimize their tax position. Tax laws evolve constantly, especially in dynamic markets like Costa Rica, so staying informed about regulatory changes is essential for making sound decisions.

Every rental property situation is unique, particularly in international markets. The complexities of managing properties often demand specialized knowledge. We at Osa Property Management recommend consulting with a tax professional who understands both local and international tax laws.

Effective tax management is an ongoing process that requires proactivity and accurate record-keeping. You can turn tax season into an opportunity to refine your rental property strategy and maximize returns (with the right approach). Focus on growing your investment portfolio while confidently managing your rental property taxes.