At Osa Property Management, we often field questions about the tax benefits of living in Costa Rica. This tropical paradise offers more than just stunning beaches and lush rainforests.

Costa Rica’s unique tax system provides significant advantages for expats and retirees. In this post, we’ll explore the key tax benefits that make Costa Rica an attractive destination for those seeking a tax-friendly lifestyle abroad.

How Does Costa Rica’s Tax System Work?

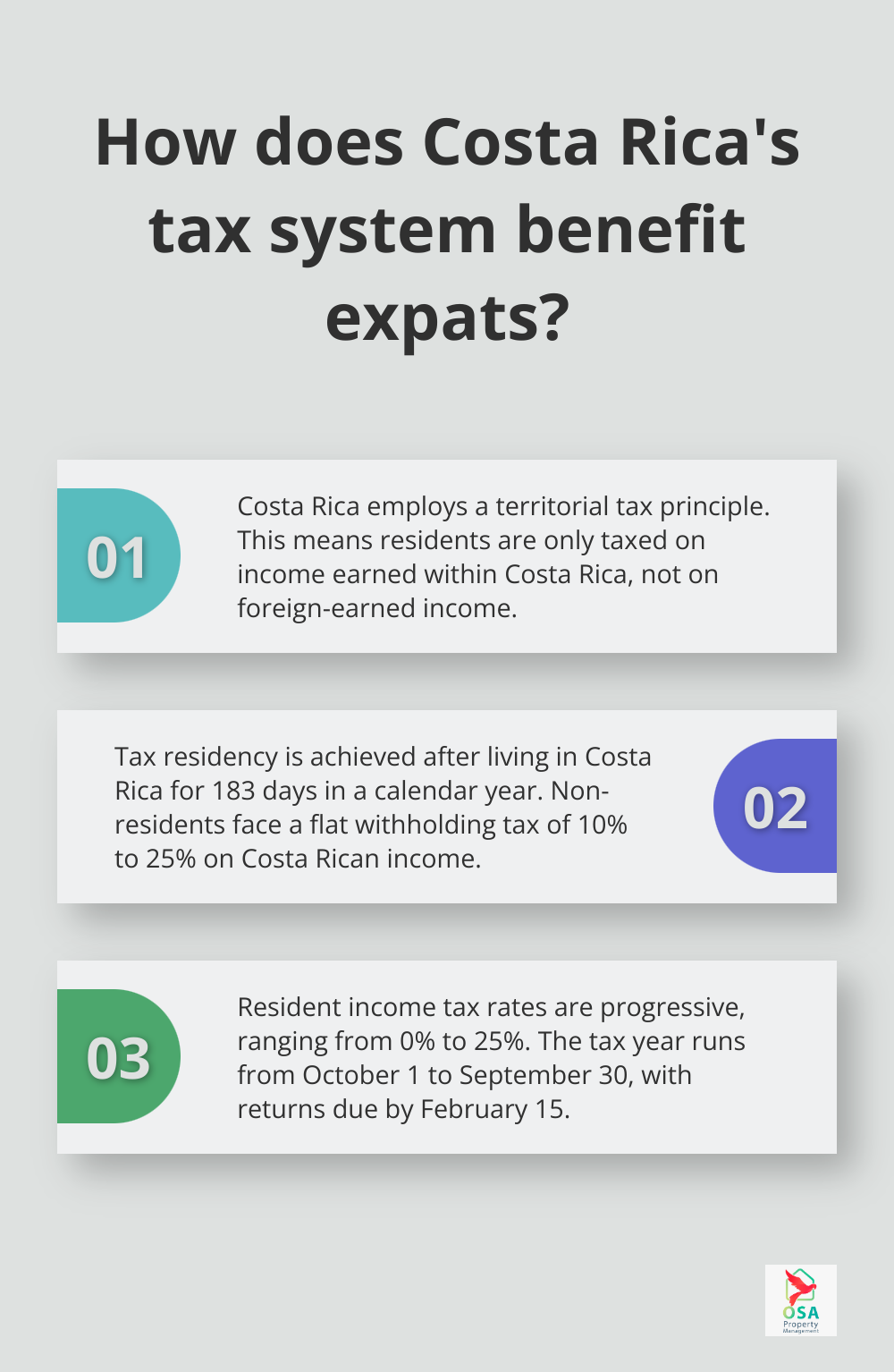

Costa Rica’s tax system attracts both residents and foreign investors with its unique territorial tax principle. This system only taxes income earned within Costa Rica, offering significant advantages for expats and retirees.

Resident vs Non-Resident Tax Status

Your tax obligations in Costa Rica depend on your residency status. Residents pay taxes only on their Costa Rican source income, while their foreign-earned income remains untaxed. Non-residents face a flat withholding tax on their Costa Rican income, typically ranging from 10% to 25% (depending on the income type).

To qualify as a tax resident, you must live in Costa Rica for more than 183 days in a calendar year. This status can lead to substantial tax savings, particularly for those with significant foreign income.

Key Government Agencies

The Dirección General de Tributación (DGT), under the Ministry of Finance, oversees taxation in Costa Rica. The DGT handles tax collection, audits, and policy implementation. Local municipalities manage property-related taxes.

The Caja Costarricense de Seguro Social (CCSS) manages mandatory social security contributions for employees and employers, funding the country’s healthcare system.

Tax Rates and Reporting

Costa Rica uses a progressive tax system for residents, with rates from 0% to 25% on employment income. The tax year runs from October 1 to September 30, with tax returns due by February 15 of the following year.

Costa Rica has implemented measures to improve tax collection and reduce evasion, including electronic invoicing systems and increased information sharing with other countries.

Recent Developments

In recent years, Costa Rica has made efforts to modernize its tax system. The country introduced a value-added tax (VAT) in 2019, replacing the previous general sales tax. This change aimed to broaden the tax base and increase revenue.

Additionally, Costa Rica has signed agreements with several countries to prevent double taxation and facilitate information exchange. These agreements (including one with the United States) help protect taxpayers from paying taxes twice on the same income.

Understanding these tax nuances proves essential for expats considering a move to Costa Rica. While the system offers many benefits, its complexity and potential for change require careful consideration. Professional guidance can help navigate this system effectively and maximize its advantages.

As we explore the specific income tax benefits for expats in the next section, you’ll gain a clearer picture of how Costa Rica’s tax system can work in your favor.

How Can Expats Benefit from Costa Rica’s Income Tax System?

Costa Rica’s income tax system offers several advantages for expats, making it an attractive destination for those seeking to optimize their tax situation. These benefits can significantly impact an expat’s financial well-being.

Tax-Free Foreign Income

One of the most appealing aspects of Costa Rica’s tax system for expats is the treatment of foreign-sourced income. Tax residents in Costa Rica don’t pay local taxes on income earned outside the country. This policy can lead to substantial savings, especially for retirees with pensions or investments abroad.

For example, if you receive a $50,000 annual pension from your home country, that income remains untaxed by Costa Rica. This contrasts sharply with many other countries that tax worldwide income, potentially saving you thousands of dollars each year.

Competitive Local Tax Rates

While foreign-sourced income is tax-free, you’ll still need to pay taxes on income earned within Costa Rica. However, the rates are often lower than what you might find in North America or Europe. The progressive tax system starts at 0% for the first portion of annual income and increases gradually.

These rates can result in significant savings. For instance, if you earn $50,000 from a local job or business in Costa Rica, your effective tax rate would be lower than in many developed countries, potentially leaving you with more disposable income.

Investment Incentives

Costa Rica also offers tax exemptions for certain types of investments, which can be particularly beneficial for expats looking to grow their wealth. Interest earned on investments in Costa Rican banks is generally tax-free for non-residents and taxed at a flat rate of 8% for residents (which is lower than many other countries).

Additionally, when a nonresident sells property located in Costa Rica to a local purchaser, the purchaser is required to withhold 2.5% of the transaction price. This can be advantageous for expats investing in Costa Rican property.

Simplified Tax Reporting

Costa Rica’s tax system also offers simplified reporting for many expats. If your only income is from foreign sources (which are not taxed in Costa Rica), you may not need to file a tax return at all. This can save time and reduce the complexity of your tax obligations.

Double Taxation Agreements

Costa Rica has signed agreements with several countries to prevent double taxation. These agreements (including one with the United States) help protect taxpayers from paying taxes twice on the same income. This can be particularly beneficial for expats who still have income sources or assets in their home countries.

It’s important to note that while these benefits can be substantial, tax laws can be complex and subject to change. Consulting with a local tax professional ensures you’re fully compliant and taking advantage of all available benefits. With proper planning and understanding of the system, expats can significantly optimize their tax situation in Costa Rica.

Now that we’ve explored the income tax benefits for expats, let’s examine other tax advantages that make Costa Rica an attractive destination for foreign residents.

What Tax Advantages Does Costa Rica Offer Beyond Income Tax?

Costa Rica’s tax system provides several advantages beyond income tax benefits, making it an attractive destination for expats and investors. These additional tax perks can significantly impact your financial planning and wealth preservation strategies.

Capital Gains Tax Exemptions

One of the most notable tax advantages in Costa Rica is the 15% CIT rate on the net amount of long-term capital gains, with some exceptions such as the sale of building land and similar assets. This rate is considerably lower than in many other countries.

However, frequent property transactions might be considered a business activity, potentially subjecting you to higher tax rates. To avoid this, limit your property sales to once every two years.

Property Tax Rates and Exemptions

Property taxes in Costa Rica are remarkably low compared to many other countries. The standard rate is just 0.25% of the registered property value. This means for a property valued at $200,000, your annual property tax would be only $500.

Costa Rica offers exemptions that can further reduce your property tax burden. For instance, if your property is your primary residence and its value is below approximately $230,000, you may qualify for a full exemption from property tax. This exemption can result in significant savings, especially for retirees or those on fixed incomes.

Luxury Home Tax Considerations

While Costa Rica generally offers favorable tax conditions, owners of high-value properties should know about the Luxury Home Tax (Impuesto Solidario). This tax applies to properties valued over approximately $230,000 and uses a progressive rate structure.

The rates for the Luxury Home Tax range from 0.25% to 0.55%, depending on the property value. While this may seem substantial, it’s still lower than luxury property taxes in many other countries.

To minimize this tax, ensure your property valuation is accurate and up-to-date. Overvaluation can lead to unnecessary tax liabilities. Consider consulting with a local real estate expert or tax professional to ensure your property is correctly assessed.

Tax Planning Strategies

To maximize these tax advantages, consider the following strategies:

- Time your property sales carefully to avoid being classified as a business activity.

- Keep detailed records of all property-related expenses, as these may be deductible.

- Stay informed about changes in tax laws and regulations, as they can impact your tax obligations.

- If you own multiple properties, consider designating one as your primary residence to take advantage of exemptions.

Professional Assistance

Navigating Costa Rica’s tax system can be complex, especially for expats. While the system offers many benefits, its intricacies require careful consideration. Professional guidance can help you navigate this system effectively and maximize its advantages. At Osa Property Management, we work with trusted tax professionals who specialize in expat taxation in Costa Rica.

Final Thoughts

Costa Rica’s tax system provides numerous advantages for expats seeking a tax-friendly lifestyle abroad. The tax benefits of living in Costa Rica include tax-free foreign-sourced income, lower local tax rates, and property tax advantages. These benefits create a favorable environment for expats to optimize their financial situation, but tax laws can change and proper planning remains essential.

Professional tax advice helps expats navigate the complexities of Costa Rica’s tax system. A qualified tax expert can assist in developing a comprehensive strategy tailored to specific situations, considering factors such as residency status, income sources, and investment activities. This expertise ensures compliance and maximizes available benefits for expats.

Osa Property Management works with trusted tax professionals who specialize in expat taxation in Costa Rica. Our team provides comprehensive services that include tax compliance assistance for property owners (based on our experience in property management across various regions in Costa Rica). We strive to support expats in enjoying a financially rewarding lifestyle in this beautiful country.