At Osa Property Management, we understand the complexities of property ownership in Costa Rica for expats. Tax planning is a crucial aspect of managing your real estate investments in this beautiful country.

This guide will walk you through the intricacies of Costa Rica’s property tax system, provide effective strategies for minimizing your tax burden, and highlight common pitfalls to avoid. Whether you’re a seasoned property owner or considering your first purchase, our insights will help you navigate the Costa Rican tax landscape with confidence.

How Costa Rica’s Property Tax System Works

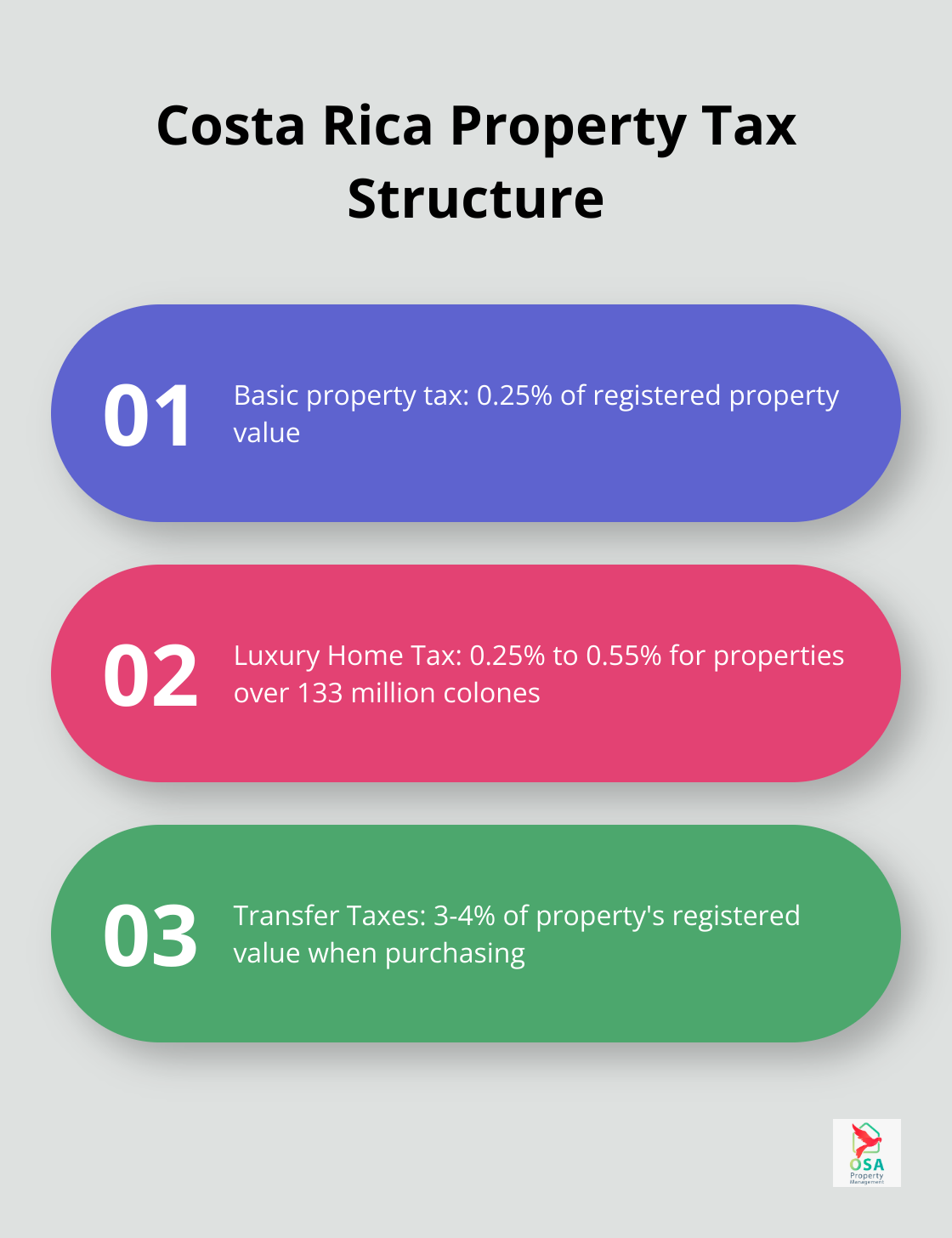

Basic Property Tax Structure

Costa Rica’s property tax system operates on a simple yet specific framework. The primary property tax, “impuesto sobre bienes inmuebles,” applies a flat rate of 0.25% to the property’s registered value. Local municipalities collect this tax annually, with payments due by March 31st each year.

Property Value Assessment Process

Municipalities assess property values every five years. These assessments often lag behind actual market values. Property owners have the right to declare a higher value (which can reduce capital gains taxes when selling) or appeal an assessment they believe is too high within 15 days of notification.

Additional Property-Related Taxes

Beyond the basic property tax, Costa Rica imposes other levies:

- Luxury Home Tax: Properties valued over 133 million colones (approximately $230,000 as of August 2024) incur an additional tax ranging from 0.25% to 0.55%.

- Transfer Taxes: When purchasing property, expect to pay transfer taxes and fees totaling 3-4% of the property’s registered value. This cost typically splits between buyer and seller (subject to negotiation).

Rental Income Taxation

For those who rent out their properties, Costa Rica applies progressive tax rates on rental income:

- First 3,804,000 colones of annual net rental income: Tax-exempt

- 3,804,001 to 5,706,000 colones: 10% tax rate

- Over 19,020,000 colones: 25% tax rate

Importance of Professional Assistance

The complexities of Costa Rica’s property tax system often challenge expat property owners. Many find value in professional property management services that handle tax compliance. These services ensure timely payments and help property owners avoid penalties while maximizing investment returns.

As we move forward, let’s explore effective tax planning strategies that can help expat property owners optimize their tax positions and make the most of their Costa Rican real estate investments.

Smart Tax Strategies for Expat Property Owners in Costa Rica

Maximize Tax Exemptions and Deductions

Costa Rica offers special tax regimes for certain sectors, such as free trade zones, where companies can benefit from reduced tax rates or exemptions. Property owners can deduct expenses related to maintenance, management fees, and depreciation from rental income. Meticulous record-keeping of all property-related expenses maximizes these deductions. Many property owners save thousands of dollars annually through proper documentation and claiming of these deductions.

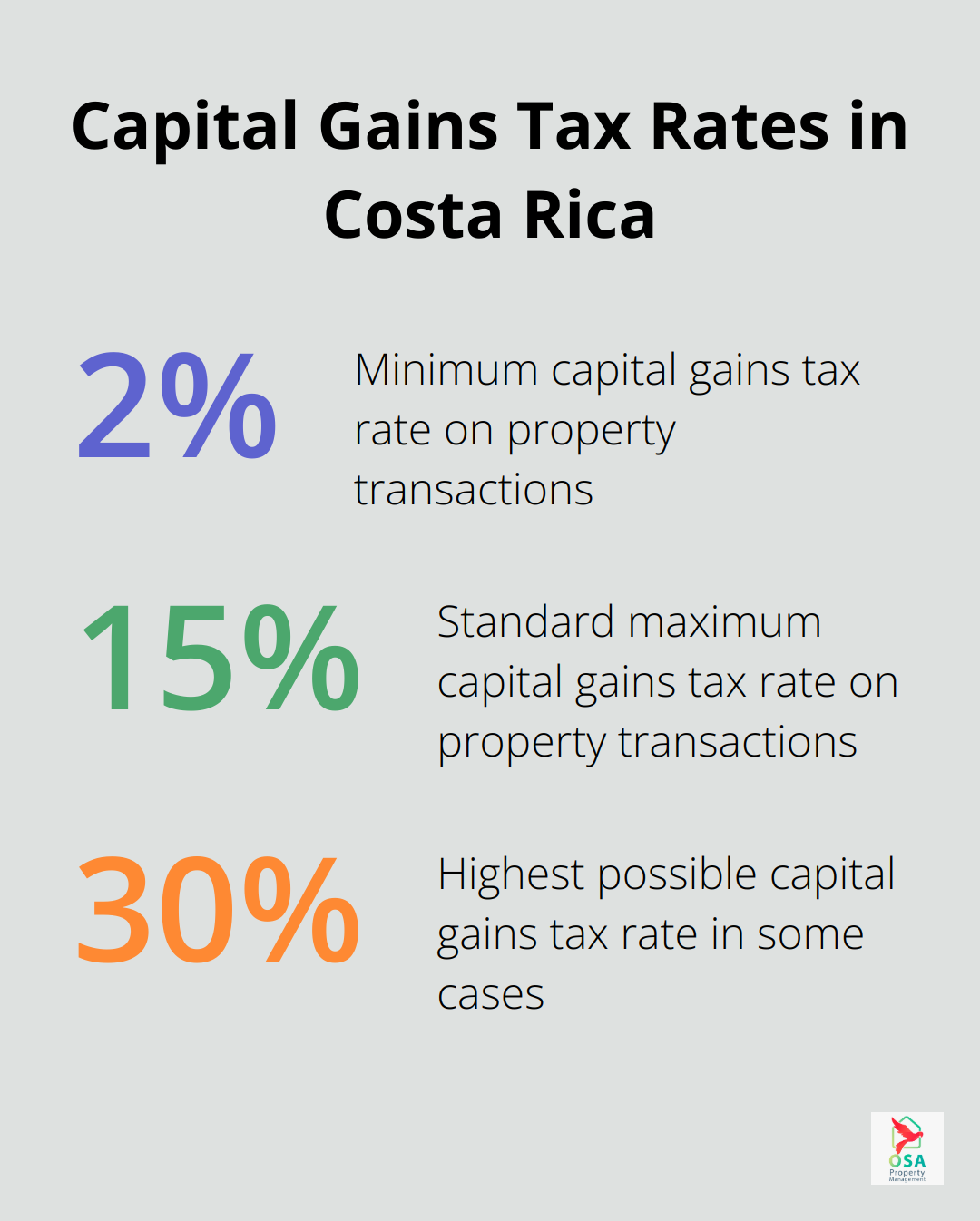

Time Property Transactions Strategically

The timing of property transactions in Costa Rica plays a critical role in tax optimization. Sellers should consider holding properties for at least three years. In Costa Rica, capital gains are taxed anywhere from 2.25% to 15%, and in some cases up to 30%. This tax applies when ownership of assets changes hands.

Buyers should note that property values undergo reassessment every five years. Purchasing a property shortly after a reassessment could result in lower property taxes for the next few years, as the assessed value often lags behind market value.

Choose Optimal Ownership Structures

The structure of property ownership can significantly impact tax implications. Many expats find benefits in owning property through a Costa Rican corporation. This structure offers advantages in liability protection and potentially smoother property transfers.

However, understanding the tax implications of corporate ownership remains essential. While it simplifies some aspects of property management, it may introduce additional reporting requirements and potential corporate taxes.

Some expats opt for trust structures, particularly useful for estate planning purposes. A well-structured trust can help minimize estate taxes and simplify property transfer to heirs.

No one-size-fits-all solution exists. The best ownership structure depends on individual circumstances, investment goals, and long-term plans. Consultation with a local tax professional determines the most advantageous structure for each unique situation.

Stay Informed and Seek Professional Advice

Tax laws in Costa Rica can change, and their complexity often challenges expat property owners. Many find value in professional property management services that handle tax compliance. These services ensure timely payments and help property owners avoid penalties while maximizing investment returns.

Osa Property Management stands out as a top choice for expats seeking expert guidance in navigating Costa Rica’s property tax landscape. With over 19 years of experience, their team provides comprehensive services, including tax compliance and customized management packages.

As we move forward, let’s explore common pitfalls that expat property owners should avoid to ensure smooth tax planning and compliance in Costa Rica.

Avoiding Tax Pitfalls for Expat Property Owners in Costa Rica

Misinterpreting Local Tax Regulations

Expat property owners often misinterpret Costa Rica’s tax regulations. The tax laws here differ significantly from other countries, which can lead to confusion and non-compliance. Many expats don’t know they must file an annual property tax declaration, even if their property value remains unchanged. This oversight can result in penalties and interest charges.

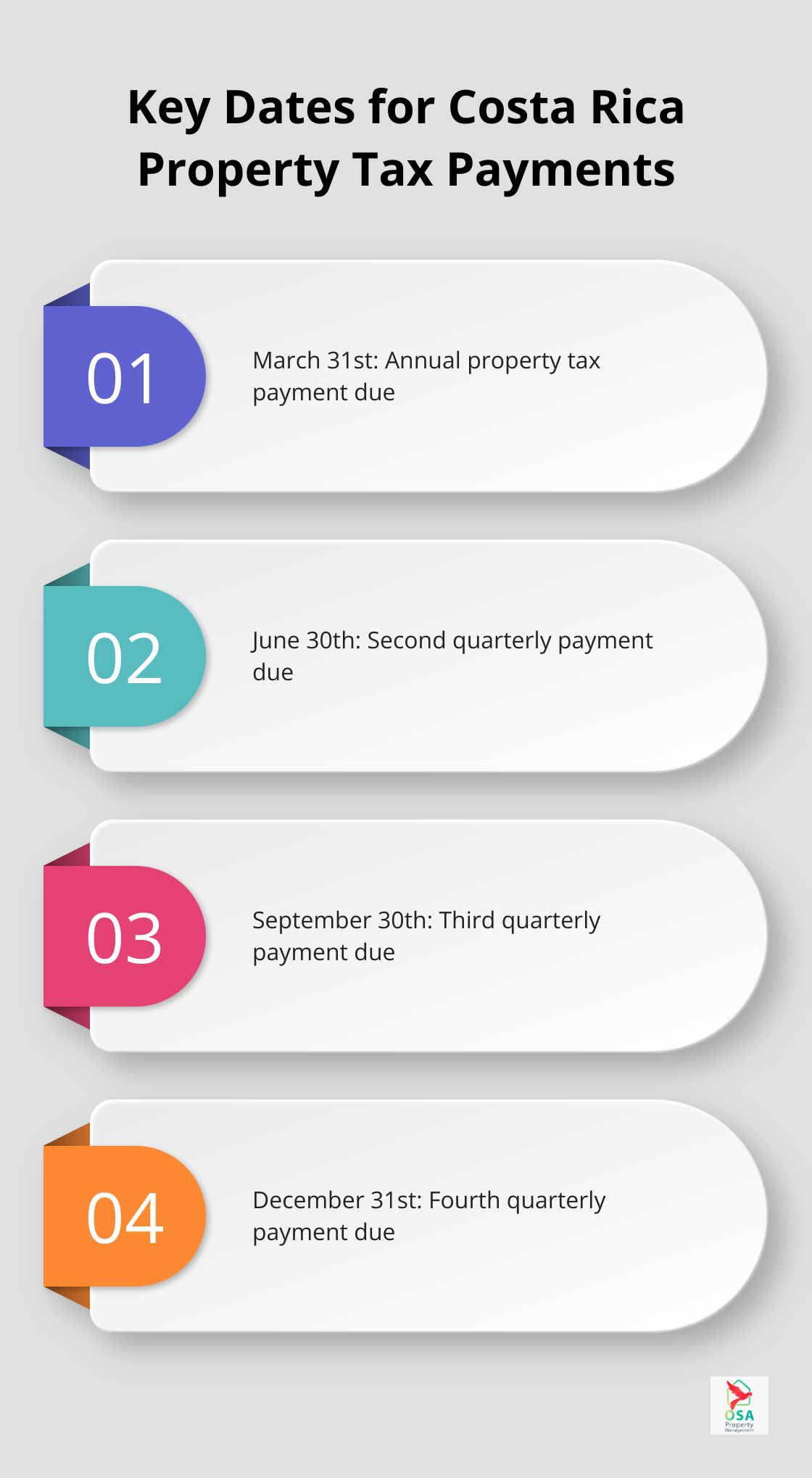

To prevent this issue, expats should familiarize themselves with Costa Rica’s tax calendar. Key dates include March 31st for annual property tax payments, with quarterly payments due on March 31st, June 30th, September 30th, and December 31st. Setting reminders for these dates will prevent late fees and ensure smooth compliance.

Neglecting Proper Property Registration

A critical mistake expats make is the failure to properly register their property for tax purposes. In Costa Rica, all properties must be registered with the National Registry and the local municipality. Neglecting this step can cause complications in property ownership and tax assessments.

Expats must ensure their property is correctly registered and all ownership details are current. This includes reporting any changes in property value or improvements made to the property. The Costa Rican Tax Administration states that failure to update property information can result in fines (up to 10 times the annual tax amount).

Underestimating Rental Income Obligations

Many expat property owners underestimate their tax obligations related to rental income. Costa Rica’s rental income tax system varies based on income type. Dividend and interest income are generally taxed at 15%, while most capital gains are taxed at 2.25%.

To navigate this complexity, expats should maintain detailed records of all rental income and related expenses. The use of property management software can help track these figures accurately. Expenses such as property maintenance, utilities, and management fees can be deducted from taxable rental income, potentially lowering the overall tax burden.

Overlooking Professional Assistance

Many expats try to handle their property tax matters independently, which can lead to costly mistakes. Professional assistance from local experts can provide valuable insights into the nuances of Costa Rica’s tax system and help avoid common pitfalls.

Osa Property Management offers expert guidance in navigating Costa Rica’s property tax landscape. With over 19 years of experience, their team provides comprehensive services, including tax compliance and customized management packages. This professional support can help expats save time, reduce stress, and potentially lower their tax liabilities through proper planning and execution.

Failing to Stay Informed About Tax Law Changes

Tax laws in Costa Rica can change, and staying informed about these changes is essential for compliance. Expats who don’t keep up with new regulations or amendments to existing laws may find themselves inadvertently non-compliant.

Try to regularly check official government sources or consult with local tax professionals to stay updated on any changes that might affect property ownership or rental income taxation. This proactive approach can help avoid unexpected tax liabilities or penalties due to outdated information.

Final Thoughts

Tax planning for Costa Rica property requires careful attention to local regulations and proactive management. Expat property owners must understand the basic tax structure, luxury home taxes, and rental income obligations to optimize their investments. The Costa Rican government updates tax laws periodically, which can significantly impact property owners’ financial outcomes.

Professional assistance proves invaluable for navigating Costa Rica’s complex tax landscape. Osa Property Management offers comprehensive services tailored to expat needs, including tax compliance and property management. Their team’s expertise can help minimize tax liabilities and provide peace of mind for property owners.

Successful tax planning in Costa Rica demands ongoing attention and expertise. Expat property owners who leverage professional support, maintain detailed records, and stay proactive in their approach will confidently navigate this landscape. This strategy ensures investments remain compliant and profitable in the long term.