Owning property in Costa Rica can be a rewarding investment, but it’s essential to understand the tax implications. At Osa Property Management, we’ve seen many property owners miss out on significant tax savings due to a lack of knowledge about local laws and deductions.

This guide will uncover hidden opportunities to reduce your tax burden and maximize your returns on Costa Rican real estate. We’ll explore the intricacies of the property tax system, legal deductions, and strategic approaches to optimize your tax position.

How Costa Rica’s Property Tax System Works

Property Tax Rates and Calculations

Costa Rica’s property tax system is straightforward but requires attention to detail. The standard property tax rate is 0.25% of the registered property value. This rate applies to most residential and commercial properties. The taxable value often falls below the market value, which can benefit property owners.

For instance, a property with a market value of $500,000 might have a registered value of $300,000. In this scenario, the annual property tax would amount to $750 (0.25% of $300,000), rather than $1,250 if based on the market value.

Luxury Home Tax

Costa Rica introduced a luxury home tax in 2009. This tax applies to properties valued over 133 million colones (approximately $230,000 as of February 2025). The tax is progressive, ranging from 0.25% to 0.55%, depending on the property’s value.

Owners of high-value properties should work with professionals to ensure accurate valuation and tax calculation. This step can help minimize unnecessary tax burdens and ensure compliance with local regulations.

Recent Changes in Tax Laws

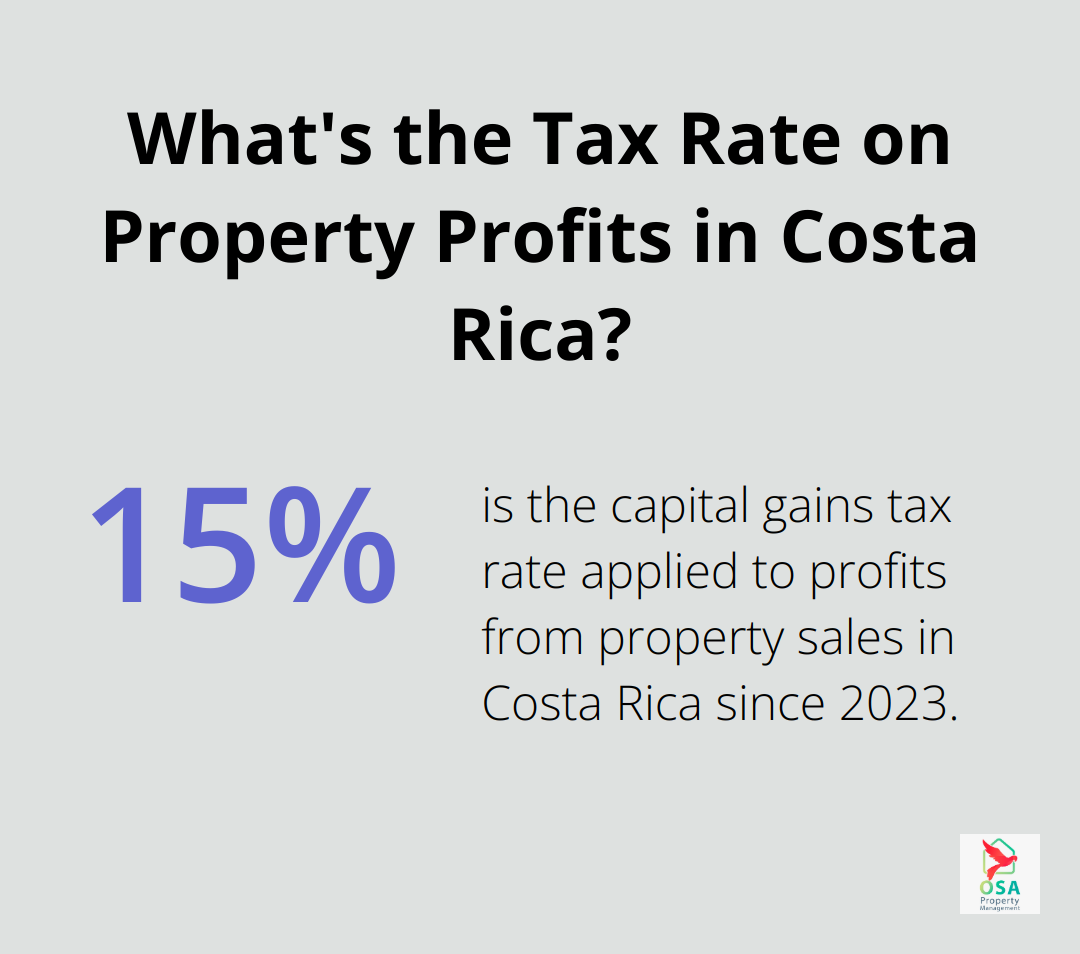

In 2023, Costa Rica implemented significant changes to its tax laws that affect property owners. A notable change was the introduction of a capital gains tax on property sales. Previously, profits from property sales were generally tax-free. Now, a 15% tax applies to gains from property sales (with some exceptions for primary residences).

This change highlights the importance of strategic planning when buying and selling property in Costa Rica. The timing of transactions and understanding of tax implications can significantly impact overall returns.

Property Use and Tax Implications

The use of a property can affect tax obligations. Rental properties may face additional taxes on rental income. However, they also offer opportunities for deductions that can offset these costs.

Commercial properties often incur higher tax rates and may be subject to additional municipal taxes. Understanding these distinctions is essential when considering property investments in Costa Rica.

The Role of Professional Management

Professional property management services (like those offered by Osa Property Management) can provide valuable assistance in navigating Costa Rica’s tax system. These services can help property owners stay compliant with local laws, maximize deductions, and optimize their tax positions.

As we move forward, we’ll explore legal tax deductions that can further reduce your tax burden and increase your returns on Costa Rican real estate. These strategies can make a significant difference in the profitability of your property investment.

How Property Owners Can Legally Reduce Their Tax Burden

Costa Rica offers several legal avenues for property owners to reduce their tax obligations. Understanding these deductions can significantly impact your bottom line and maximize the return on your real estate investment.

Maintenance and Repair Expense Deductions

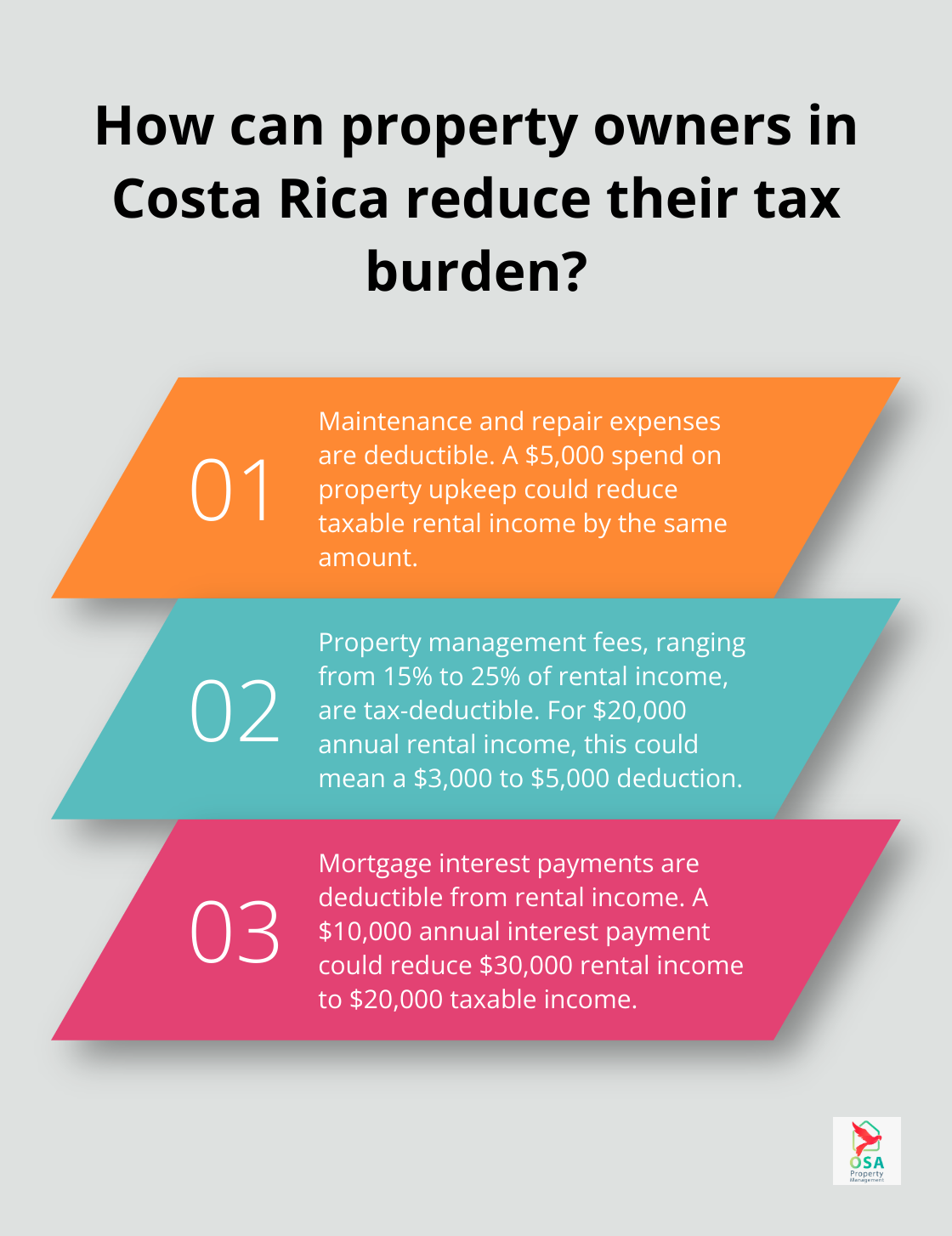

One of the most substantial tax benefits for property owners in Costa Rica is the ability to deduct maintenance and repair expenses. This includes costs for painting, plumbing repairs, electrical work, and general upkeep. It’s important to keep detailed records of all expenses, including receipts and invoices.

For example, if you spend $5,000 on property maintenance in a year, this could potentially reduce your taxable rental income by the same amount. Depending on your tax bracket, this could translate to significant savings.

Property Management Fee Deductions

Property management fees are another deductible expense that many owners overlook. If you use a professional service, the fees you pay are typically tax-deductible. This not only helps reduce your tax burden but also ensures your property is well-maintained and compliant with local regulations.

Property management fees can range from 15% to 25% of rental income. For a property generating $20,000 in annual rental income, management fees could result in a deduction of $3,000 to $5,000 from your taxable income.

Mortgage Interest Deductions

For property owners with mortgages, interest payments can be a significant tax deduction. Costa Rica allows property owners to deduct mortgage interest from their rental income. This deduction can substantially reduce your taxable income, especially in the early years of a mortgage when interest payments are highest.

Consider this scenario: You’re paying $10,000 in mortgage interest annually. If your rental income is $30,000, this deduction could reduce your taxable rental income to $20,000, potentially saving you thousands in taxes.

Depreciation Benefits for Rental Properties

Depreciation is an often-overlooked but powerful tax benefit for owners of rental properties in Costa Rica. The Costa Rican tax system allows you to deduct a portion of your property’s value each year to account for wear and tear. This non-cash expense can significantly reduce your taxable rental income.

To calculate the annual depreciation deduction, divide the building’s value (excluding land) by the appropriate number of years. For instance, a property valued at $200,000 might result in a $4,000 annual deduction from your taxable rental income, depending on the depreciation rate.

Professional Assistance for Tax Optimization

While these deductions can greatly reduce your tax burden, navigating Costa Rica’s tax system can be complex. Working with experienced professionals who understand local tax laws and regulations is important. Professional property management services can provide valuable assistance in optimizing your tax position and ensuring you take full advantage of all legal deductions available to you.

As we move forward, we’ll explore strategic approaches to maximize these tax savings and further optimize your property investment in Costa Rica.

How to Maximize Tax Savings for Your Costa Rica Property

Costa Rica offers numerous opportunities for property owners to reduce their tax burden and increase returns. This chapter explores effective strategies to optimize your tax position and maximize savings.

Meticulous Record-Keeping

Accurate and comprehensive record-keeping forms the foundation of effective tax management. Property owners should maintain detailed records of all income and expenses related to their property. This includes rental income, utility bills, maintenance costs, and property management fees. The use of digital tools or spreadsheets can help organize records, making it easier to track expenses and calculate deductions.

For example, when you spend $500 on a new water heater, keep the receipt and record the purchase date. This level of detail will prove invaluable when you file your taxes and claim deductions.

Strategic Timing of Income and Expenses

The timing of income and expenses can significantly impact your tax liability. If you approach the threshold for a higher tax bracket, consider deferring some rental income to the following year. Conversely, if you plan major renovations or repairs, it might benefit you to complete them before the end of the tax year to maximize your deductions.

Consider this scenario: if you plan to replace the roof of your rental property, doing so in December rather than January could allow you to claim the deduction a full year earlier, potentially reducing your current year’s tax burden.

Leveraging Tax-Free Thresholds

Costa Rica offers certain tax-free thresholds that property owners can leverage. As of 2025, a capital gain tax of 15% is imposed on profits from real estate sales, excluding primary residences. For properties purchased before July 1, 2019, different rules may apply.

Optimal Ownership Structure

The structure of your property ownership can have significant tax implications. For some property owners, creating a Costa Rican corporation to hold the property can offer tax advantages. Corporate ownership reduces personal accountability for property. A power of attorney can then be issued to purchase or sell property.

However, corporate ownership also comes with its own set of responsibilities and costs. It’s important to consult with a tax professional who understands both Costa Rican and your home country’s tax laws to determine the most advantageous structure for your situation.

Regular Tax Law Updates

Costa Rica’s tax laws change periodically, and staying informed about these changes is important for maximizing your tax savings. For example, the introduction of the capital gains tax in 2023 significantly impacted property sales strategies. When you stay up-to-date with tax law changes, you can adjust your property management and investment strategies accordingly.

Try to subscribe to reputable Costa Rican legal and financial newsletters or work with a property management company (such as Osa Property Management) that provides regular updates on relevant tax law changes.

Final Thoughts

Property taxes in Costa Rica offer numerous opportunities for tax savings. Property owners can reduce their tax burden through legal deductions, strategic timing, and optimal ownership structures. Professional assistance proves invaluable in navigating the complex tax landscape and staying informed about regulatory changes.

Osa Property Management specializes in helping property owners maximize their tax savings and investment returns. Their expertise covers marketing, renter relationships, tax compliance, and maintenance oversight. With 19 years of experience, they handle all aspects of property management in Costa Rica.

Professional property management services ensure you take advantage of all available tax savings opportunities. Osa Property Management’s knowledge of local tax laws and best practices can help you navigate the complexities of Costa Rican real estate ownership. Their services lead to increased returns and a more enjoyable investment experience.