Costa Rica’s vacation rental tax structure can be complex, especially for property owners unfamiliar with local regulations. At Osa Property Management, we’ve seen firsthand how these taxes impact our clients’ investments and operations.

This guide breaks down the key components of vacation taxes in Costa Rica, including recent changes for 2025. We’ll explore strategies for compliance and optimization to help you navigate this intricate system effectively.

How Costa Rica Taxes Vacation Rentals

Value Added Tax (VAT) on Short-Term Rentals

Costa Rica’s vacation rental tax system includes a 13% Value Added Tax (VAT) for short-term rentals lasting less than 30 days. Property owners must collect this tax from guests and remit it to the Costa Rican tax authority, Hacienda, monthly. For instance, a $1,000 weekly rental fee requires a total collection of $1,130, with $130 forwarded to Hacienda.

Property owners must submit monthly declarations, even for zero-income months, to maintain compliance. The Hacienda virtual portal streamlines this process by automating tax calculations based on input income and expenses.

Property Tax Obligations

Costa Rica imposes an annual property tax on the registered property value. However, high-value or “luxury” properties may incur additional solidarity taxes for social housing, which can significantly increase tax obligations.

For example, a $500,000 property typically incurs an annual tax. Classification as a luxury property could substantially increase this amount. Property owners should factor these costs into their overall investment strategy.

Income Tax for Rental Property Owners

Income tax on rental properties in Costa Rica follows a progressive system. As of 2025, the first 3.8 million colones (approximately $7,600 USD) of annual rental income remains tax-exempt. Beyond this threshold, tax rates range from 10% to 25%, depending on the income bracket.

Consider an annual rental income of 10 million colones (about $20,000 USD). The owner would pay no tax on the first 3.8 million, 10% on the next 1.2 million, and 15% on the remaining 5 million colones.

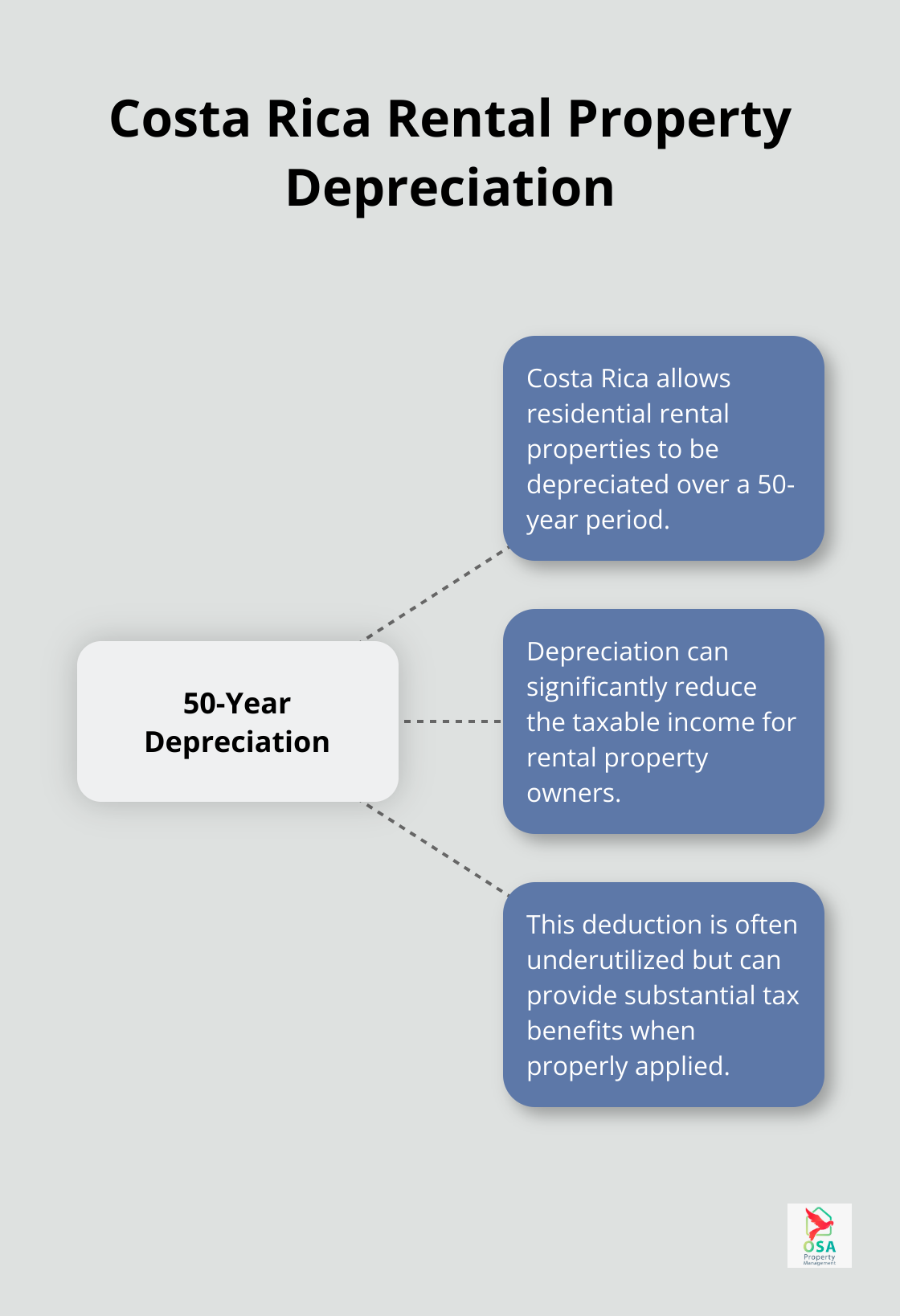

Costa Rica allows residential rental properties to depreciate over 50 years, providing significant tax deductions. Other deductible expenses include property maintenance, management fees, utilities, and insurance.

Navigating the Tax Landscape

The complex tax structure in Costa Rica can present challenges, especially for non-resident property owners. Many investors opt to work with professional property management services to ensure compliance and optimize their tax strategy. These services offer expertise in local tax regulations and maintain efficient record-keeping systems.

As we move forward, let’s explore the key changes in Costa Rica’s vacation rental taxation for 2025, which will further shape the landscape for property owners and investors.

What’s New for Costa Rica Vacation Rental Taxes in 2025?

Costa Rica’s tax landscape for vacation rentals continues to evolve. The year 2025 introduces significant changes that property owners must understand. These updates affect various aspects of taxation, from VAT to property assessments and income tax brackets.

VAT Rate Adjustments and New Exemptions

The Value Added Tax (VAT) rate for short-term rentals remains at 13% in 2025. However, the government has introduced new exemptions for certain types of eco-friendly accommodations. Properties that meet specific sustainability criteria (such as using renewable energy sources or implementing water conservation measures) may qualify for a reduced VAT rate. This change promotes sustainable tourism and incentivizes property owners to adopt environmentally friendly practices.

To benefit from this reduced rate, property owners must apply for certification through the Costa Rican Tourism Institute (ICT). The application process involves a thorough assessment of the property’s sustainability features and practices. The potential tax savings make it a worthwhile consideration for many vacation rental owners, despite the time-consuming certification process.

Modernized Property Tax Assessment Methods

Costa Rica has implemented a new digital property valuation system in 2025, which streamlines and standardizes property tax assessments. This system uses advanced algorithms and real-time market data to determine property values more accurately. As a result, some property owners may see changes in their tax obligations.

The new assessment method takes into account factors such as location, property size, amenities, and recent sales of comparable properties in the area. Property owners should prepare for potential adjustments to their tax bills and consider appealing assessments if they believe the valuation is inaccurate.

Income Tax Bracket Revisions for Rental Income

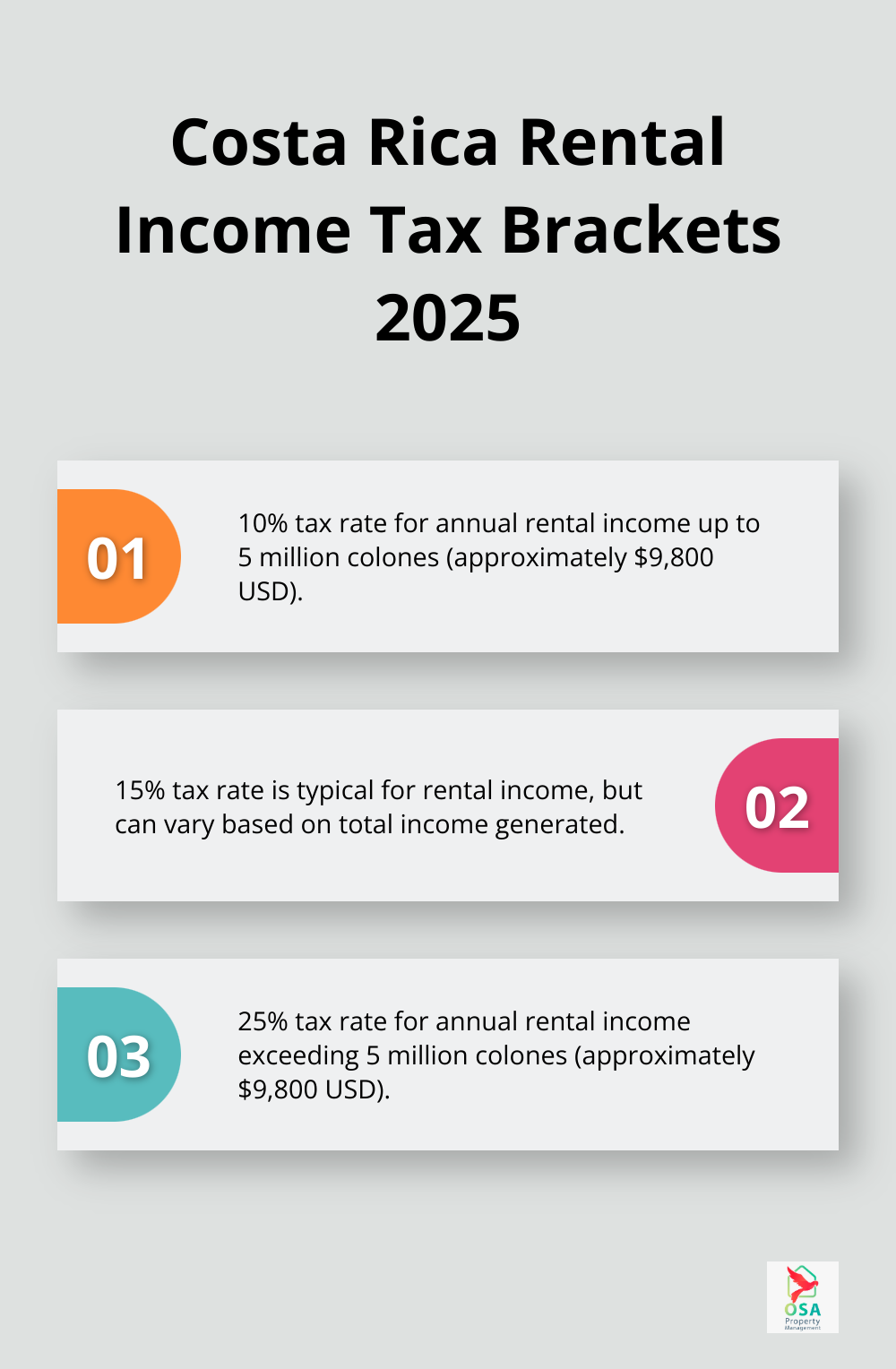

The Costa Rican government has revised the income tax brackets for rental income in 2025, aiming to create a more progressive tax structure. According to the 2025 guide, the tax rates now range from 10% for annual rental income up to 5 million colones (approximately $9,800 USD) to 25% for income exceeding this amount.

This change may result in different tax obligations for property owners depending on their income bracket. It’s important to note that the tax rate for rental income is typically 15%, but this can vary based on how much income you generate.

This new structure emphasizes the importance of accurate income reporting and strategic tax planning. Property owners should consider working with tax professionals or property management services to optimize their tax strategy and ensure compliance with these new regulations.

As we move forward, it becomes clear that understanding and adapting to these tax changes requires careful planning and expert guidance. The next section will explore strategies for tax compliance and optimization in light of these new regulations.

How to Optimize Your Costa Rica Vacation Rental Taxes

Implement a Robust Record-Keeping System

Accurate and organized documentation forms the foundation of tax compliance and optimization. We recommend the use of cloud-based accounting software (such as QuickBooks Online or Xero) to track all rental income and expenses. These platforms allow you to categorize transactions, generate reports, and store digital receipts, which simplifies tax filing preparation and potential audits.

Set up a separate bank account for your rental property to simplify the tracking of income and expenses. This separation aids in accurate reporting and helps identify potential tax deductions more easily.

Maximize Allowable Deductions

Costa Rica’s tax code offers several deductions for vacation rental owners. Common deductible expenses include property maintenance, management fees, utilities, insurance premiums, and mortgage interest. Don’t overlook less obvious deductions like travel expenses related to property management or the cost of furnishings for your rental.

One significant deduction often underutilized is depreciation. Costa Rica allows residential rental properties to be depreciated over 50 years, which can substantially reduce your taxable income.

Leverage Professional Expertise

While it’s possible to manage your taxes independently, working with local tax professionals can yield significant benefits. Costa Rican tax laws are complex and frequently updated. A local expert can help you navigate these changes, ensure compliance, and identify opportunities for tax optimization.

For example, a tax professional might advise on the optimal legal structure for your rental property. Depending on your situation, operating as a corporation rather than an individual could offer tax advantages and liability protection.

Regular Tax Strategy Reviews

Tax optimization requires an ongoing process. Conduct regular reviews of your tax strategy (ideally quarterly) to adapt to changing regulations and market conditions. This practice ensures you’re always in the best position to minimize your tax burden while maximizing your rental income.

Utilize Property Management Services

Professional property management services (like Osa Property Management) can provide valuable assistance in navigating Costa Rica’s complex tax landscape. These services often have established relationships with local tax professionals and can offer comprehensive support in managing your property’s finances and tax obligations.

Final Thoughts

Costa Rica’s vacation rental tax structure demands careful attention and strategic planning from property owners. The system includes Value Added Tax on short-term rentals, property tax obligations, and income tax for rental property owners. Recent changes in 2025 have introduced new exemptions, modernized assessment methods, and revised income tax brackets, making it essential for owners to stay informed and compliant.

Proper documentation, maximization of allowable deductions, and utilization of professional expertise are key elements in managing vacation taxes effectively. Many property owners, especially those residing outside Costa Rica, find it challenging to manage these complex tax obligations on their own. This challenge highlights the value of professional property management services in navigating Costa Rica’s tax landscape.

Osa Property Management offers comprehensive support for property owners, covering areas such as accounting, tax compliance, and property management across popular locations. Their team provides expert assistance to ensure vacation rentals remain compliant with local regulations while maximizing investment potential. Property owners can benefit from their customized service packages, which cover marketing, renter relationships, bill payment, and maintenance oversight.