At Osa Property Management, we know that owning a rental property in Costa Rica can be a lucrative investment. However, many property owners overlook the potential for significant tax savings.

This blog post will guide you through the intricacies of Costa Rica’s property tax system and reveal strategies to maximize your deductions. We’ll explore how to reduce your tax burden and make the most of your rental investment in this tropical paradise.

How Costa Rica’s Property Tax System Works

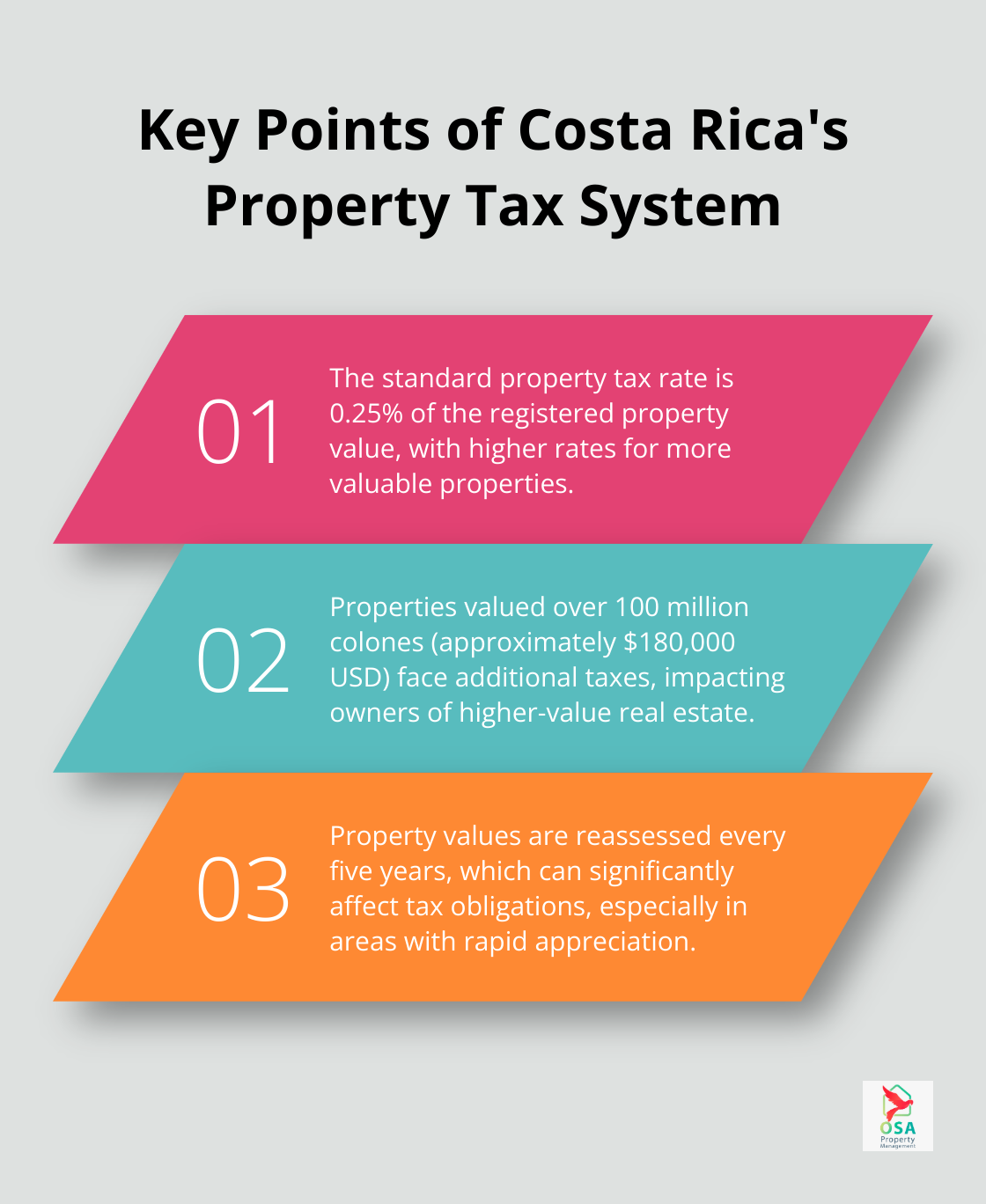

Property Tax Rates and Calculations

Costa Rica employs a progressive tax structure that varies based on property value and ownership status. The standard property tax rate is 0.25% of the registered property value. However, this rate increases for higher-valued properties. Properties valued over 100 million colones (approximately $180,000 USD) face additional taxes.

Property values undergo reassessment every five years. This reassessment can significantly impact tax obligations, especially in areas experiencing rapid appreciation. In popular tourist destinations like Manuel Antonio or Jaco, property values often increase substantially between assessments.

Resident vs. Non-Resident Property Owners

A key difference between resident and non-resident property owners lies in the luxury home tax. This tax applies to properties valued at 150 million colones (about $270,000 USD) or more. Non-resident owners of luxury properties face a higher tax rate, starting at 0.25% and increasing to 0.55% for the most valuable properties.

Residents can benefit from certain exemptions and deductions unavailable to non-residents. For example, residents may qualify for a homestead exemption on their primary residence, potentially reducing their taxable property value.

Recent Tax Law Changes

In 2019, Costa Rica implemented significant changes to its tax laws, affecting rental property owners. The most notable change was the introduction of a capital gains tax on real estate sales. Under the new law, property sales are subject to a 15% capital gains tax on the profit. However, properties acquired before July 1, 2019, are exempt from this tax if sold within the first two years of the law’s implementation.

Another important change affects rental income. Short-term rentals (generally under 30 days) are subject to an added 13% Value Added Tax (VAT). This tax is in addition to the income tax on rental earnings, which ranges from 10% to 25% depending on the amount of income generated.

Staying Informed and Compliant

These changes underscore the importance of staying informed about Costa Rica’s evolving tax landscape. Property owners should regularly review their tax obligations and seek professional advice to ensure compliance and optimize their tax strategies.

Understanding Costa Rica’s property tax system lays the foundation for maximizing your rental property investment. The next section will explore specific strategies for maximizing deductions and reducing your overall tax burden.

How to Maximize Deductions for Your Costa Rica Rental Property

Allowable Maintenance and Repair Expenses

Costa Rica’s tax laws permit property owners to deduct a wide range of maintenance and repair costs. This includes expenses for fixing leaky roofs, repainting walls, and other necessary upkeep. It’s important to differentiate between repairs and improvements. Repairs are fully deductible in the year they occur, while improvements must be depreciated over time.

For instance, replacing a broken air conditioning unit counts as a repair, but upgrading to a more energy-efficient system is an improvement. Maintain detailed records of all expenses (including receipts and invoices) to claim deductions and protect yourself in case of an audit.

Depreciation Benefits for Rental Properties

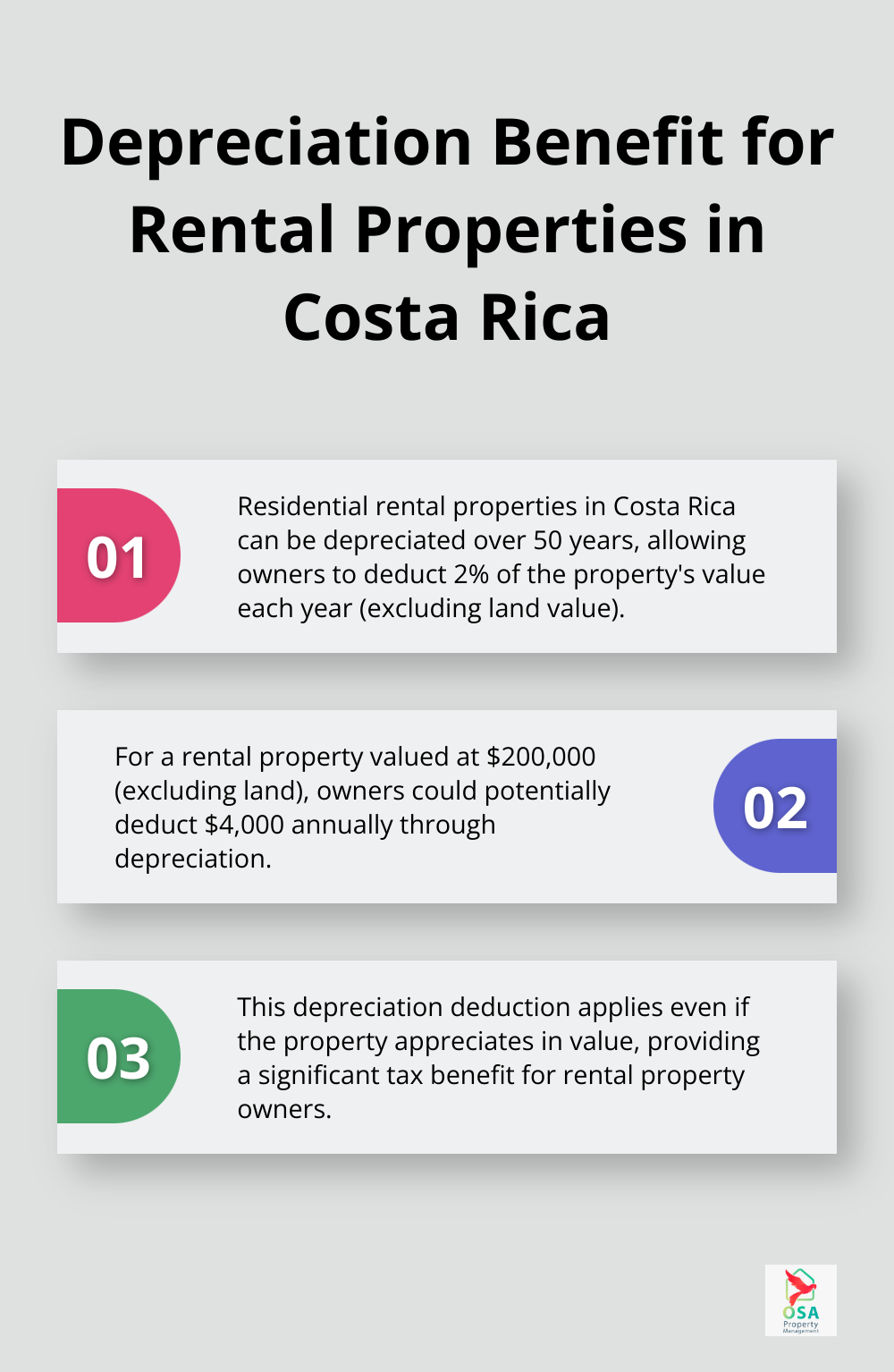

Depreciation serves as a powerful tool to reduce your taxable income. In Costa Rica, residential rental properties can be depreciated over 50 years. This allows you to deduct 2% of the property’s value each year (excluding the land value).

For example, if you own a rental property valued at $200,000 (excluding land), you could potentially deduct $4,000 annually. This deduction applies even if your property appreciates in value.

Deducting Property Management Fees

Property management fees are fully deductible, which adds value to professional management services. These fees not only ensure your property remains well-maintained and occupied but also provide a significant tax benefit.

Insurance Cost Deductions

Insurance premiums are deductible expenses for rental properties in Costa Rica. This category includes property insurance, liability insurance, and even rental income insurance. These expenses can accumulate quickly, so claim every eligible cost.

Professional Tax Advice

Tax laws can be complex and change frequently. While we strive to provide accurate information, it’s always best to consult with a tax professional familiar with Costa Rica’s tax laws. They can help you navigate the intricacies of the tax code and ensure you maximize your deductions while remaining compliant.

Now that we’ve covered how to maximize deductions, let’s explore strategies to further reduce your tax burden and optimize your rental property investment.

How to Slash Your Costa Rica Rental Property Taxes

Optimal Ownership Structures

The structure of your rental property ownership can significantly impact your tax obligations. Many property owners find success by establishing a Costa Rican corporation to hold their rental properties. This approach offers several advantages:

- Limited liability protection

- Easier transfer of ownership

- Potential for lower tax rates on rental income

One of the key benefits of owning property under a corporation is the ability to optimize tax benefits. By structuring property ownership through a corporation, you may be able to take advantage of various tax strategies and deductions.

Eco-Friendly Improvements for Tax Benefits

Costa Rica offers attractive tax incentives for eco-friendly property improvements. These incentives align with the country’s commitment to environmental sustainability and can provide significant tax savings for property owners.

Some eco-friendly improvements that may qualify for tax benefits include:

Property owners can qualify for tax credits by investing in energy-efficient upgrades. Installing solar panels, implementing water conservation measures, and other eco-friendly improvements can lead to potential tax benefits.

Strategic Timing of Income and Expenses

The timing of your income and expenses can have a substantial impact on your tax liability. Consider these tactics:

- Accelerate expenses: If you anticipate a high-income year, make necessary repairs or improvements before year-end to offset your taxable income.

- Defer income: If possible, delay receiving rental payments until the next tax year if you expect to be in a lower tax bracket.

- Bunch deductions: Group deductible expenses into a single tax year to maximize their impact.

- Plan major improvements: Schedule significant renovations during slower rental periods to minimize lost income while maximizing deductions.

Professional Tax Advice

Tax laws can change frequently and prove complex. While we try to provide accurate information, you should consult with a tax professional familiar with Costa Rica’s tax laws. They can help you navigate the intricacies of the tax code and ensure you maximize your deductions while remaining compliant.

Staying Informed on Tax Law Changes

Costa Rica’s tax landscape evolves regularly. Property owners should review their tax obligations and seek professional advice to ensure compliance and optimize their tax strategies. Recent changes (such as the introduction of a capital gains tax on real estate sales and VAT on short-term rentals) underscore the importance of staying informed.

These strategies can help you reduce your tax burden significantly, allowing you to reinvest more of your rental income into your property or expand your investment portfolio in Costa Rica’s real estate market. However, you must implement them carefully and in compliance with Costa Rica’s tax laws.

Final Thoughts

Costa Rica’s rental property taxes present challenges, but also opportunities for significant tax savings. Property owners who understand the tax system, maximize deductions, and implement strategic planning can reduce their tax burden substantially. Professional tax advice proves invaluable in navigating complex and changing tax laws, ensuring compliance, and uncovering additional tax-saving opportunities.

Osa Property Management can help you optimize your rental property investment in Costa Rica. Our team of experts assists with property management, tax compliance, and financial optimization. We ensure your property remains well-maintained, effectively marketed, and financially sound, allowing you to enjoy your investment with peace of mind.

The potential for tax savings in Costa Rica’s rental market remains high. A proactive approach to tax planning, coupled with expert guidance, can unlock the full potential of your rental property investment. Staying informed and adaptable will help you maintain and increase your property’s profitability as Costa Rica’s tax landscape evolves.