As we approach 2025, Costa Rica’s tax landscape is set to undergo significant changes. At Osa Property Management, we’re closely monitoring these developments to keep our clients informed and prepared.

The proposed modifications to Costa Rica taxes 2025 will affect various areas, including income tax, VAT, and property taxes. These changes could have far-reaching implications for both residents and businesses operating in the country.

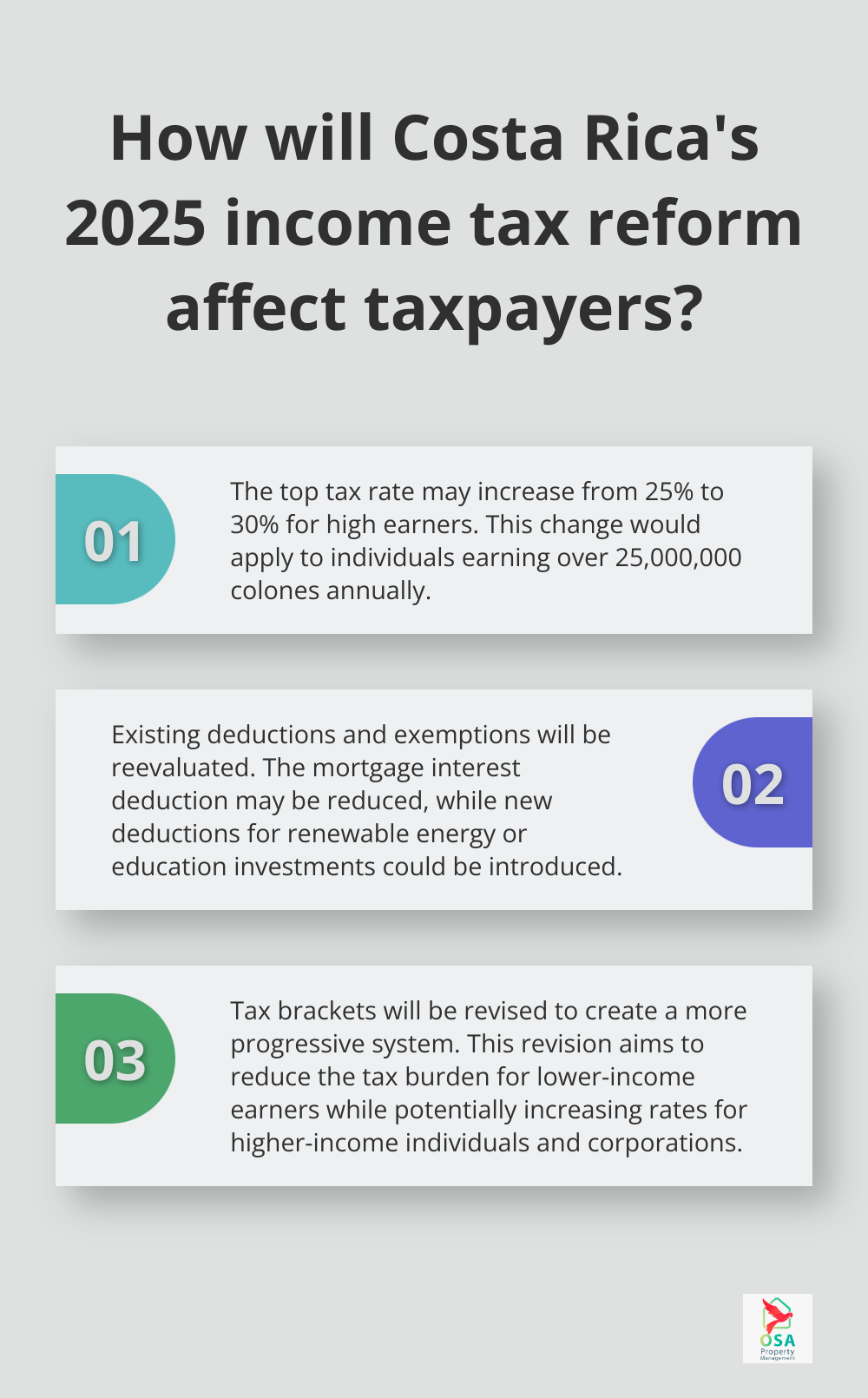

Income Tax Overhaul in Costa Rica

Costa Rica’s income tax system will undergo a significant transformation in 2025. The proposed changes aim to modernize the tax structure and address the country’s economic challenges.

Reshaping Tax Brackets

The government considers a revision of the current tax brackets to create a more progressive system. This revision could reduce the tax burden for lower-income earners, while higher-income individuals and corporations may face increased rates. For example, the current top rate of 25% for individuals earning over 18,683,000 colones annually might increase to 30% for those earning above 25,000,000 colones.

Deductions and Exemptions Under Scrutiny

A major focus of the proposed changes involves the reevaluation of existing deductions and exemptions. The government plans to simplify the tax code by eliminating certain deductions while potentially introducing new ones targeted at stimulating economic growth. For instance, officials discuss reducing the mortgage interest deduction but introducing new deductions for investments in renewable energy or education.

Impact on Individual Taxpayers

These changes will affect individual taxpayers significantly. The adjustments to tax brackets and deductions could result in substantial changes to take-home pay. Residents should review their financial planning strategies in light of these potential changes. (It’s advisable to consult with a tax professional to understand the personal implications of these reforms.)

Effects on Businesses

The proposed corporate tax modifications will impact profitability and investment decisions for businesses. Some sectors may benefit from new incentives, while others might face a heavier tax burden. Companies operating in Costa Rica should start preparing now by conducting thorough financial analyses and considering how these changes might affect their operations.

Property Owners and Real Estate Investments

Property owners should pay close attention to these tax reforms. The changes could affect rental income taxation and property-related deductions. (We at Osa Property Management recommend property owners initiate discussions with tax professionals to understand how these changes might affect their real estate investments.)

As we move forward, it’s essential to consider how these income tax changes will interact with other areas of taxation. The next section will explore potential updates to the Value Added Tax (VAT) system in Costa Rica.

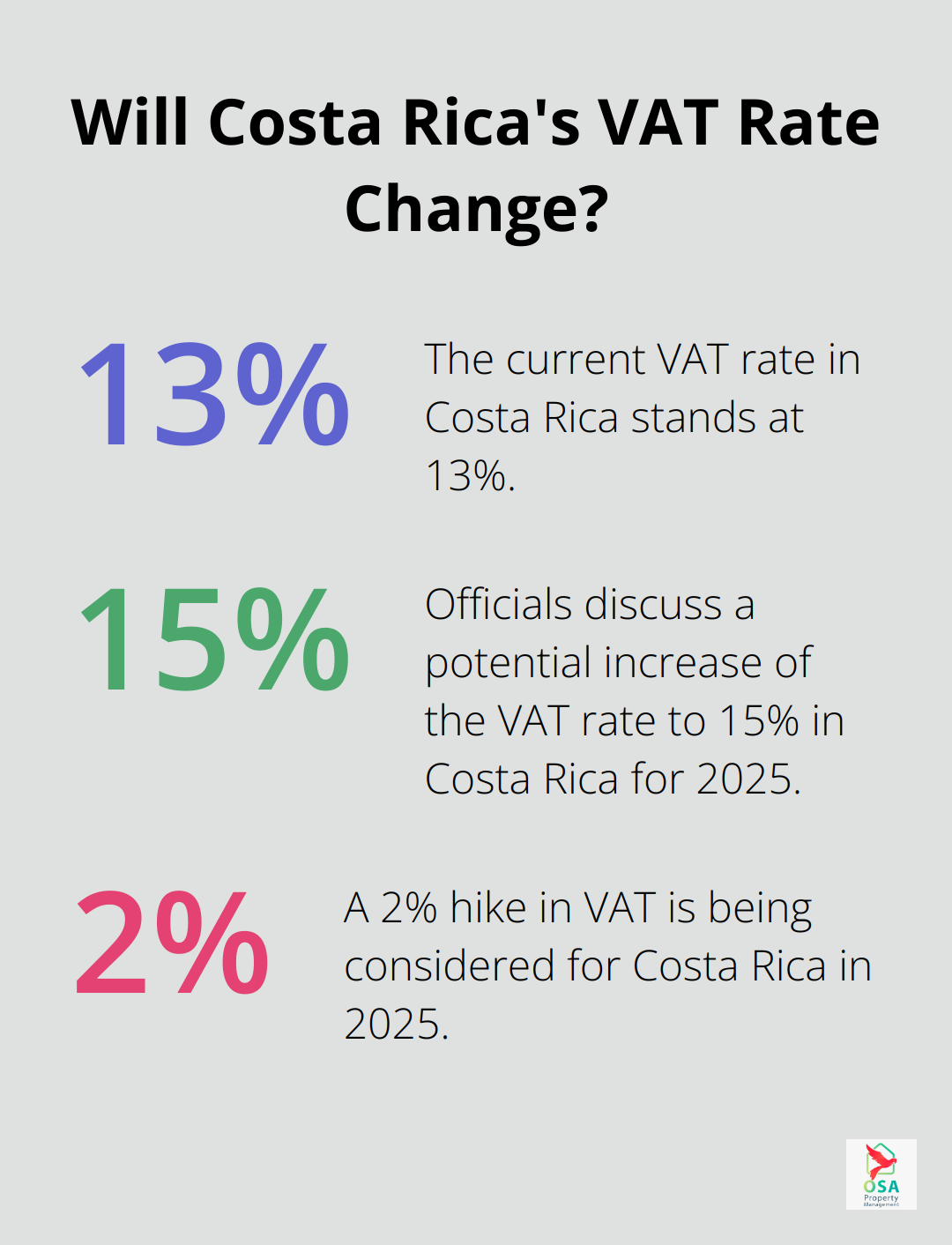

VAT Changes in Costa Rica for 2025

Adjustments to VAT Rates

Costa Rica’s Value Added Tax (VAT) system will undergo significant updates in 2025. The current VAT rate stands at 13%. However, officials discuss a potential increase to 15% in 2025. This 2% hike would align Costa Rica’s VAT more closely with other countries in the region. Businesses must adjust their pricing strategies and potentially absorb some of the increase to maintain competitiveness. It’s worth noting that such a VAT reform is unlikely to affect economic growth adversely.

Expanding the VAT Base

Costa Rica plans to broaden the scope of VAT-applicable goods and services. Previously exempt items (like certain food products and educational services) may become subject to VAT. This expansion aims to increase tax revenue and simplify the system. Businesses in these newly affected sectors should prepare for the administrative and financial impacts of collecting and remitting VAT.

Streamlining VAT Processes

The government will introduce measures to modernize VAT collection and reporting. A new digital platform for VAT declarations will launch, making it easier for businesses to comply with tax regulations. This system will require real-time reporting of transactions, reducing the potential for tax evasion and improving overall efficiency.

Impact on Property Owners and Renters

These VAT updates may affect rental prices and property management costs. Property owners should anticipate potential changes in their operational expenses and adjust their budgets accordingly. Renters might see slight increases in their rental costs as property managers adapt to the new tax landscape.

Preparing for VAT Changes

Businesses and individuals should start preparing for these VAT changes now. This preparation includes:

- Reviewing current pricing strategies

- Updating accounting systems to accommodate new VAT rates

- Training staff on new VAT collection and reporting procedures

- Consulting with tax professionals to understand specific impacts

As Costa Rica moves towards implementing these VAT changes, it’s important to consider how they will interact with other areas of taxation. The next section will explore the proposed changes to property taxes in Costa Rica, another critical area for property owners and investors to watch closely.

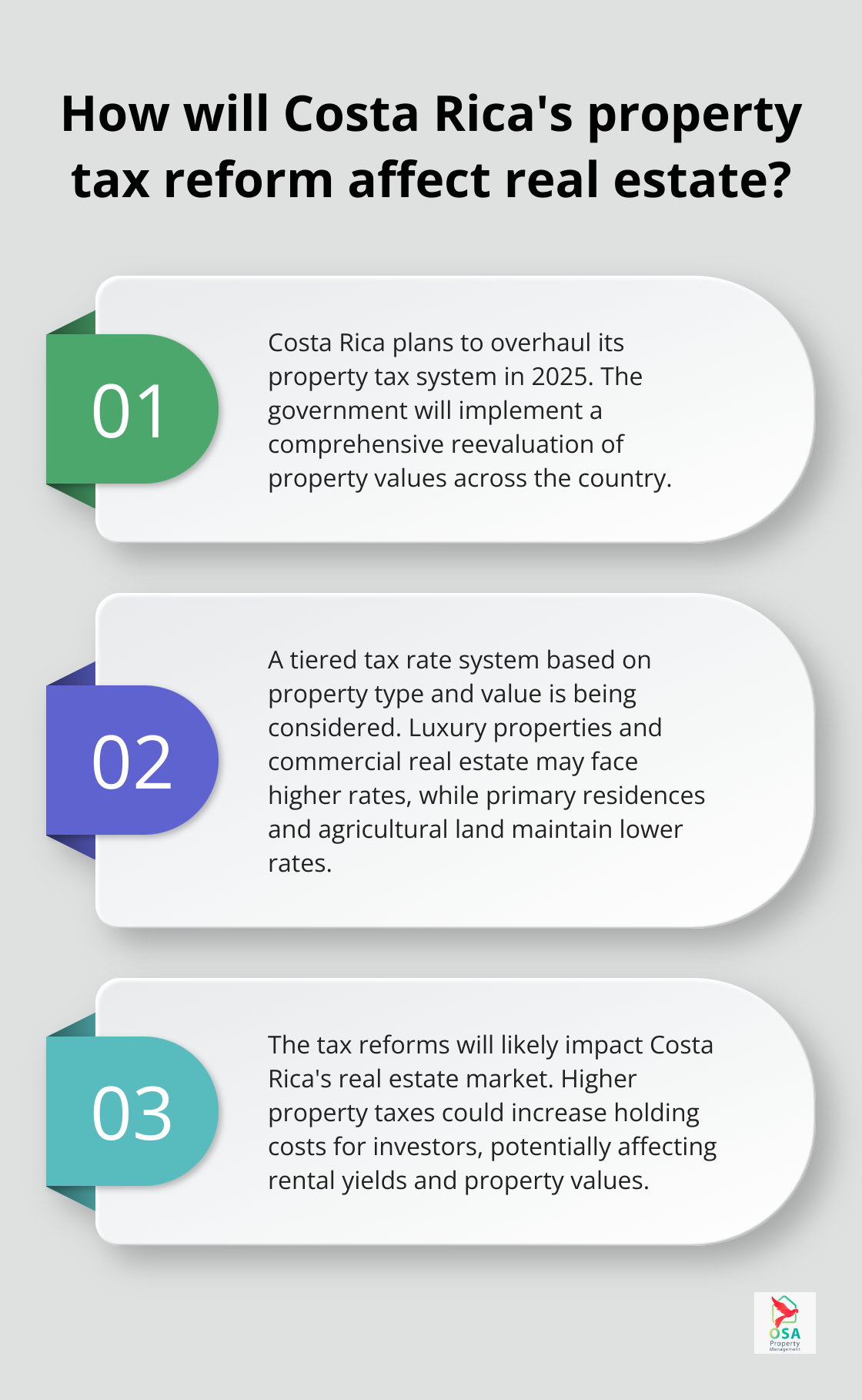

How Will Property Taxes Change in Costa Rica?

Reassessment of Property Values

Costa Rica plans to overhaul its property tax system in 2025. The government will implement a comprehensive reevaluation of property values across the country. This new system will replace outdated assessments with a more accurate valuation method. Many properties will likely see higher assessed values, especially in areas with significant development or appreciation.

Property owners should prepare for potential increases in their tax bills.

Tiered Tax Rates for Different Property Types

The Costa Rican government considers implementing a tiered tax rate system based on property type and value. This system could result in higher rates for luxury properties and commercial real estate, while maintaining lower rates for primary residences and agricultural land.

For example, a luxury beachfront villa in Manuel Antonio might see its tax rate increase from 0.25% to 0.55% of the assessed value. A family home in a less touristy area might remain at the lower rate. Real estate investors should factor these potential changes into their investment strategies and return calculations.

Impact on the Real Estate Market

These tax reforms will likely affect Costa Rica’s real estate market. Higher property taxes could lead to increased holding costs for investors, potentially impacting rental yields and property values. However, the additional revenue from these taxes could fund improvements in local infrastructure and services, potentially enhancing property values in the long term.

Those considering property purchases in Costa Rica must factor in these upcoming changes when making investment decisions. Long-term investors might find opportunities in areas slated for infrastructure improvements. Short-term investors should carefully consider the impact of higher taxes on their returns.

Preparing for the Changes

Property owners and investors should stay informed and proactive as these changes approach. They should:

- Review property assessments regularly

- Understand the new tax structure

- Work with local experts to navigate the changes

- Consider the long-term implications for their investments

(Osa Property Management offers expert guidance on these matters, helping property owners navigate the changing tax landscape effectively.)

Potential Benefits of Tax Reform

While increased taxes may seem daunting, this reform could bring benefits. Improved infrastructure and services funded by increased tax revenue could make Costa Rica an even more attractive destination for property investment. The modernized tax system could also lead to more equitable property valuations, ensuring fairness across different types of properties and locations.

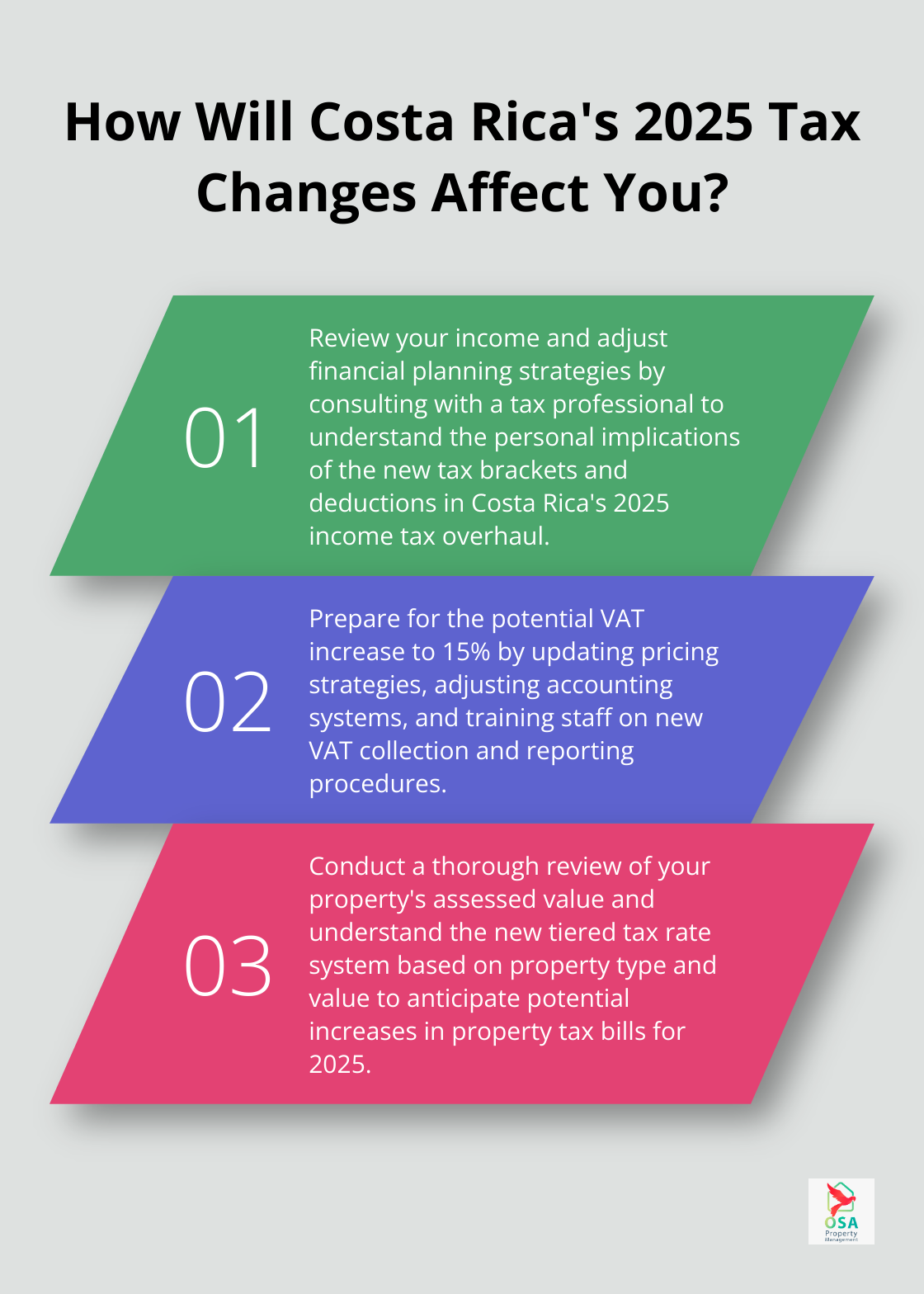

Final Thoughts

Costa Rica taxes 2025 will reshape the financial landscape for residents and businesses. The income tax overhaul, VAT expansion, and property tax reforms will affect take-home pay, consumer spending, and real estate investments. These changes aim to modernize the tax system, increase revenue, and promote economic growth in the country.

Residents and businesses must take proactive steps to navigate these changes successfully. We recommend reviewing financial planning strategies, consulting with tax professionals, and staying informed about the latest developments. Companies should update their systems and train staff to handle new tax requirements, while property owners should reassess their investment strategies.

Osa Property Management can help clients navigate these changes with our expert team. We offer comprehensive property management services, including tax compliance assistance (to ensure investments remain profitable and compliant with the new tax landscape). Our commitment to staying up-to-date with the latest tax regulations allows us to provide valuable insights for property owners and investors in Costa Rica.